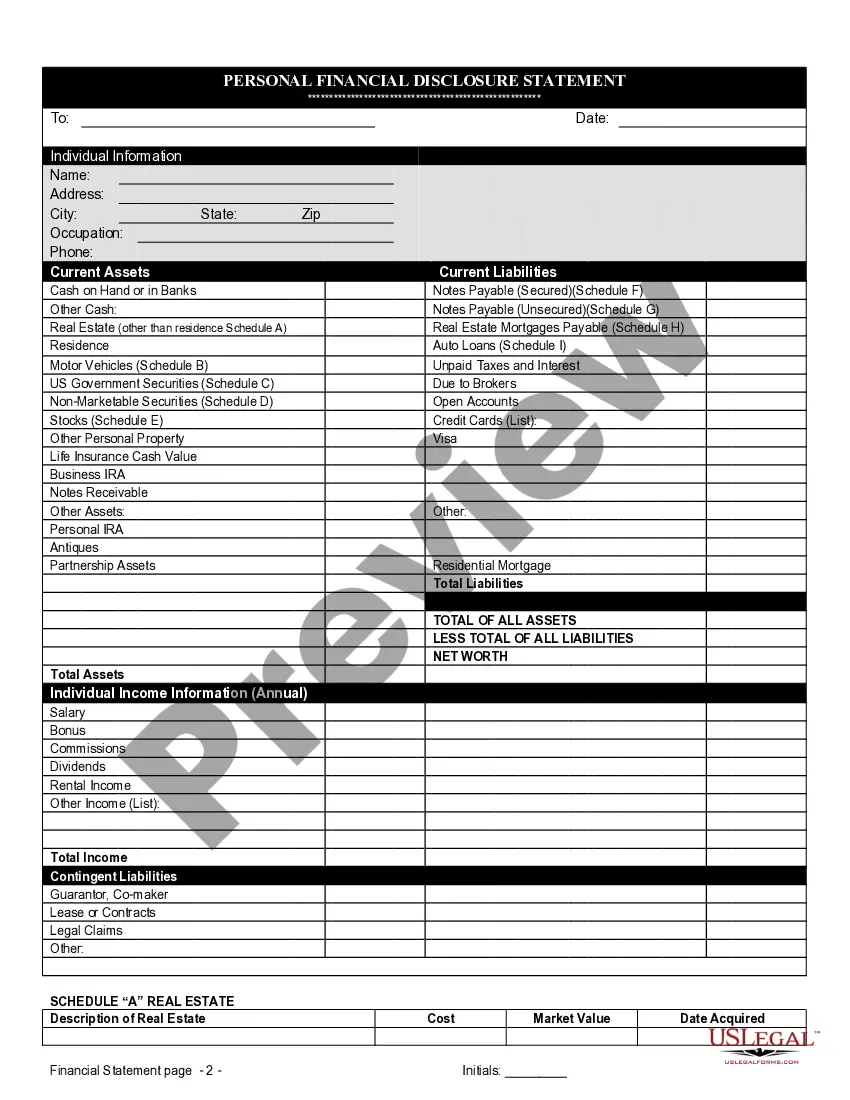

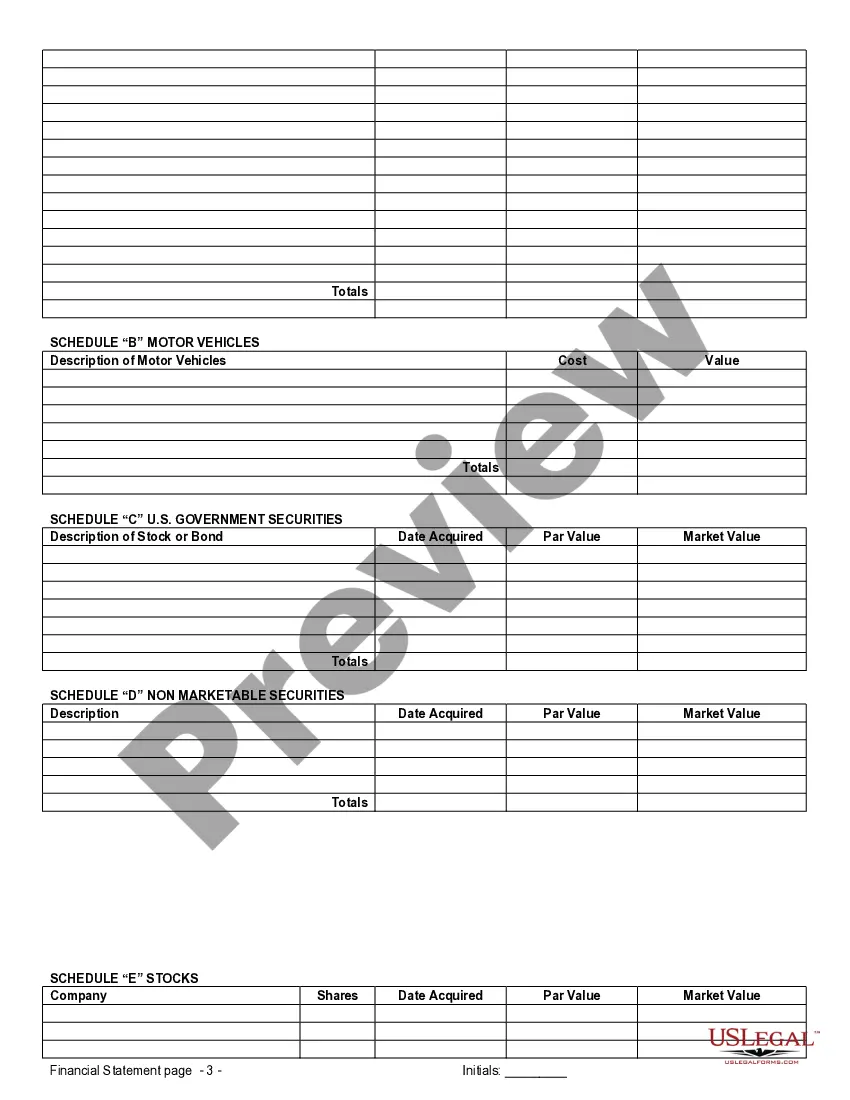

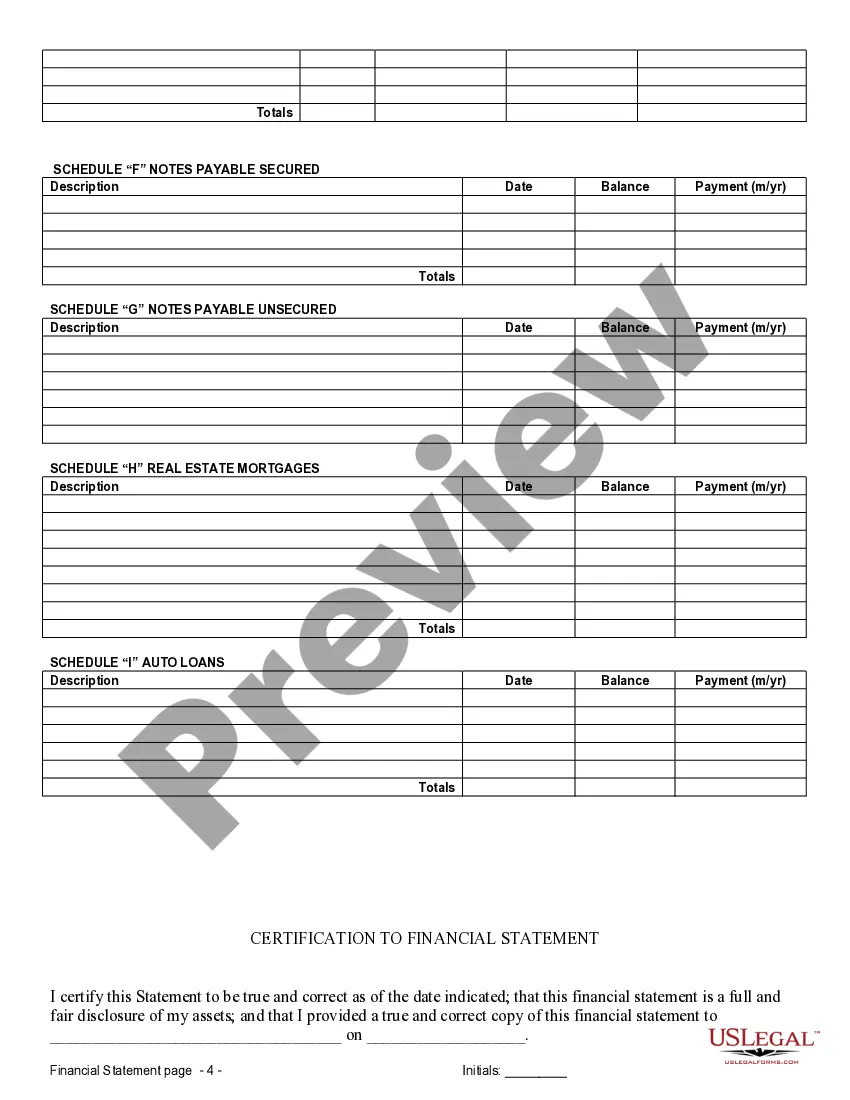

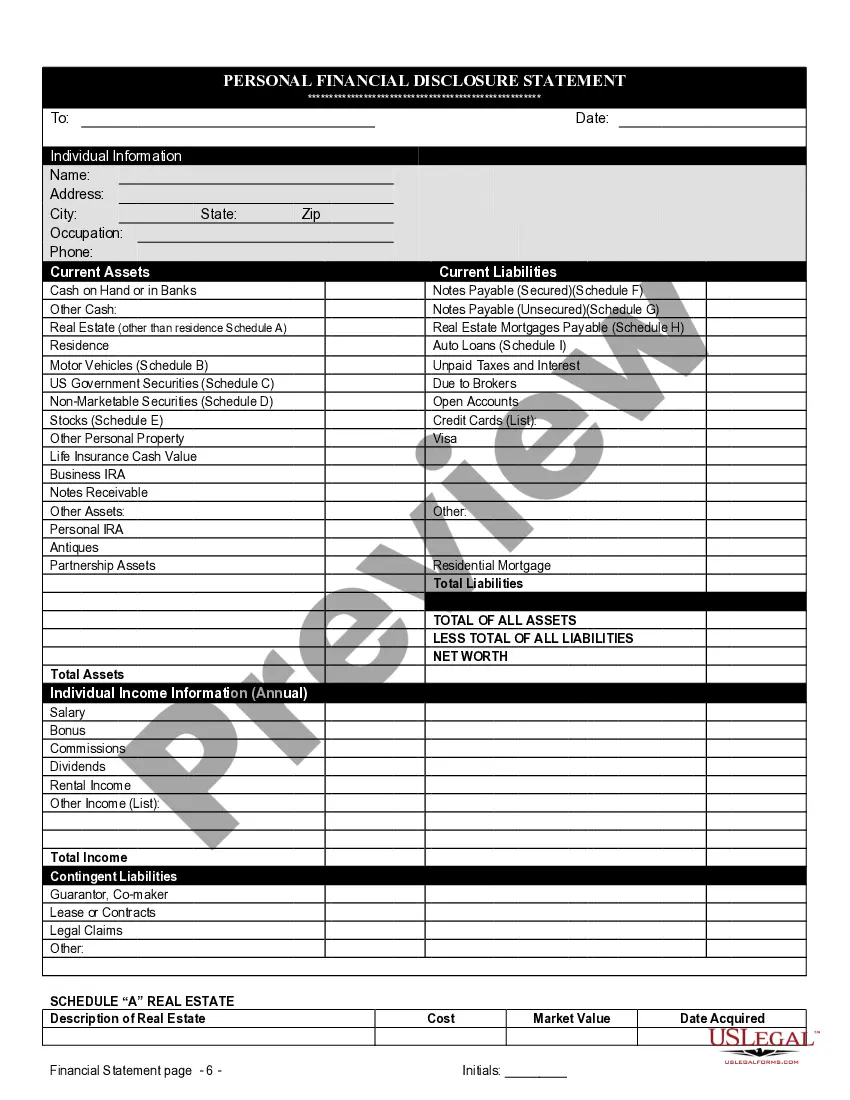

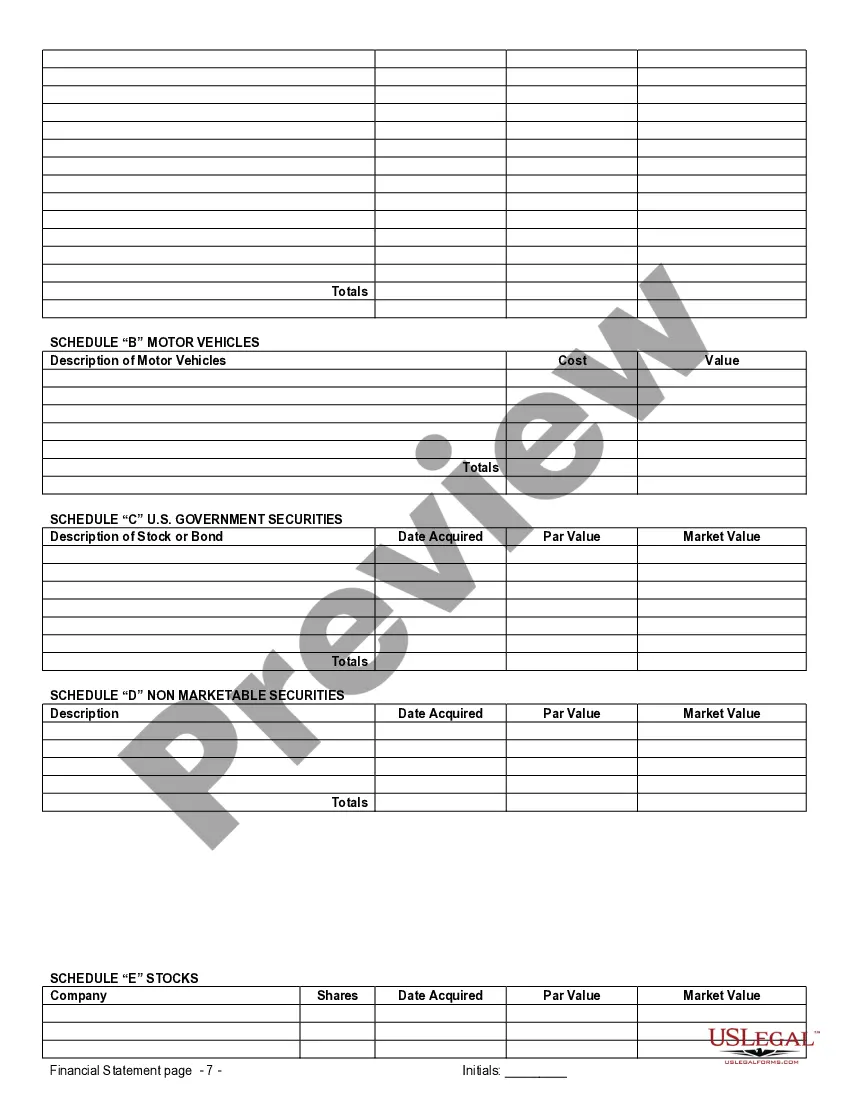

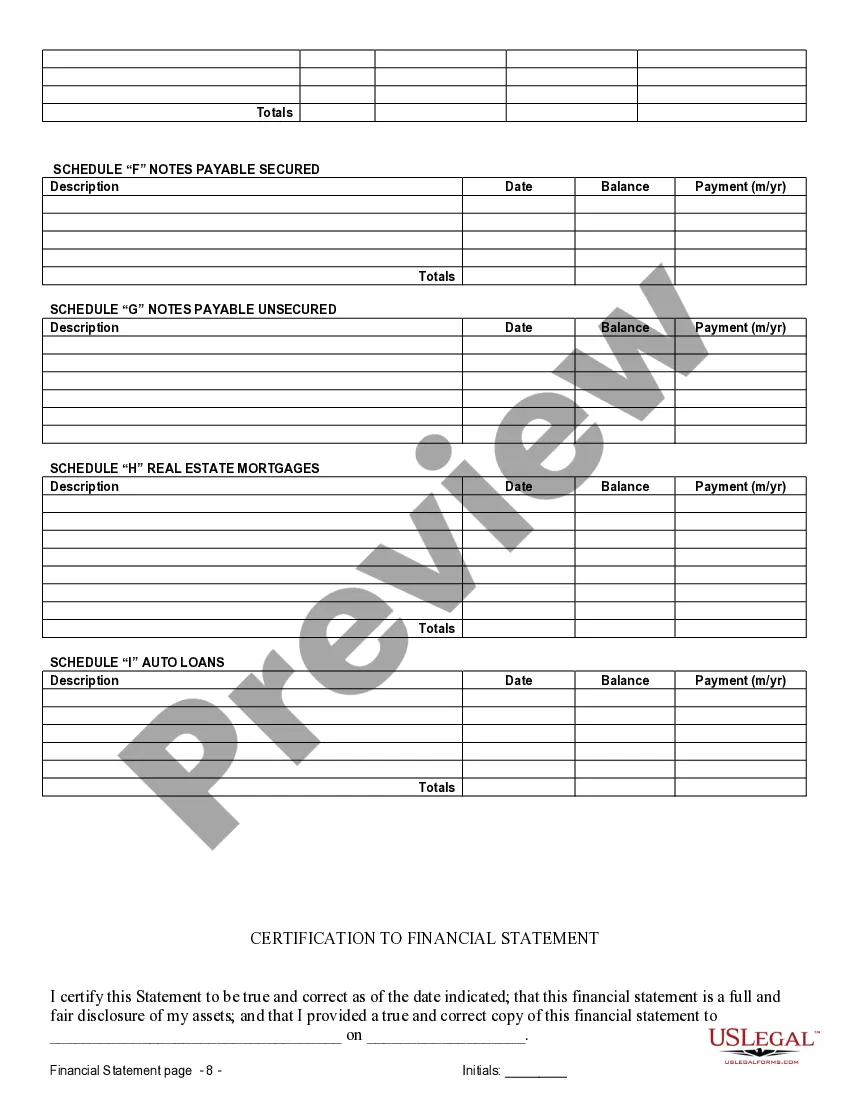

In High Point, North Carolina, financial statements play a crucial role when it comes to prenuptial or premarital agreements. These statements provide a comprehensive overview of each party's financial standing, assets, liabilities, income, and expenses, ensuring transparency and protecting the interests of both individuals involved. Here are the different types of High Point North Carolina Financial Statements typically used in connection with prenuptial or premarital agreements: 1. Personal Financial Statement: This statement includes details about an individual's personal finances, such as bank accounts, investments, retirement plans, real estate properties, debts, and any other assets or liabilities. It provides an overall picture of their financial worth. 2. Income Statement: An income statement outlines an individual's income and expenses. It includes details of salary, bonuses, dividends, rental income, and other sources of income. Additionally, it may highlight monthly expenses, such as rent/mortgage payments, utilities, insurance, and other living costs. This statement helps determine the financial capacity of each party and their contribution towards the marriage. 3. Asset Statement: The asset statement focuses solely on the assets owned by an individual. It encompasses various categories, such as cash and cash equivalents, investments (stocks, bonds, mutual funds), real estate, vehicles, jewelry, and any other valuable possessions. This statement provides a clear understanding of the asset ownership and value. 4. Liability Statement: On the other hand, the liability statement captures an individual's debts and financial obligations. It includes mortgage loans, car loans, student loans, credit card debts, and any other outstanding liabilities. This statement ensures that both parties are aware of any potential financial burdens or obligations. 5. Tax Returns: Tax returns for the past few years are often included in the financial statements. These documents provide a comprehensive record of income, deductions, and any tax liabilities. It helps in evaluating each party's tax history and potential future tax obligations. 6. Business Financial Statements: If either party owns a business or holds partnership shares, business financial statements may be necessary in connection with prenuptial or premarital agreements. These statements include balance sheets, income statements, and cash flow statements, giving a clear understanding of the business's financial health. 7. Retirement Account Statements: Individuals with retirement accounts, such as 401(k), IRAs, or pensions, may need to provide statements related to these accounts. These statements show the current balances and contributions made, helping to determine each party's entitlement in case of divorce or separation. 8. Additional Supporting Documents: Alongside the financial statements, it is common for individuals to include additional supporting documents. These may include property deeds, car titles, loan agreements, insurance policies, and other relevant paperwork for a comprehensive understanding of their financial affairs. In High Point, North Carolina, these various types of financial statements are used together to create a detailed and thorough representation of each party's financial position. They provide a strong foundation for developing a fair and legally binding prenuptial or premarital agreement, protecting the rights and interests of both individuals involved.

High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out High Point North Carolina Financial Statements Only In Connection With Prenuptial Premarital Agreement?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney solutions that, as a rule, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re new to the website! You can create your account within minutes.

- Make sure to check if the High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the High Point North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the document in any available file format.

For over 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!