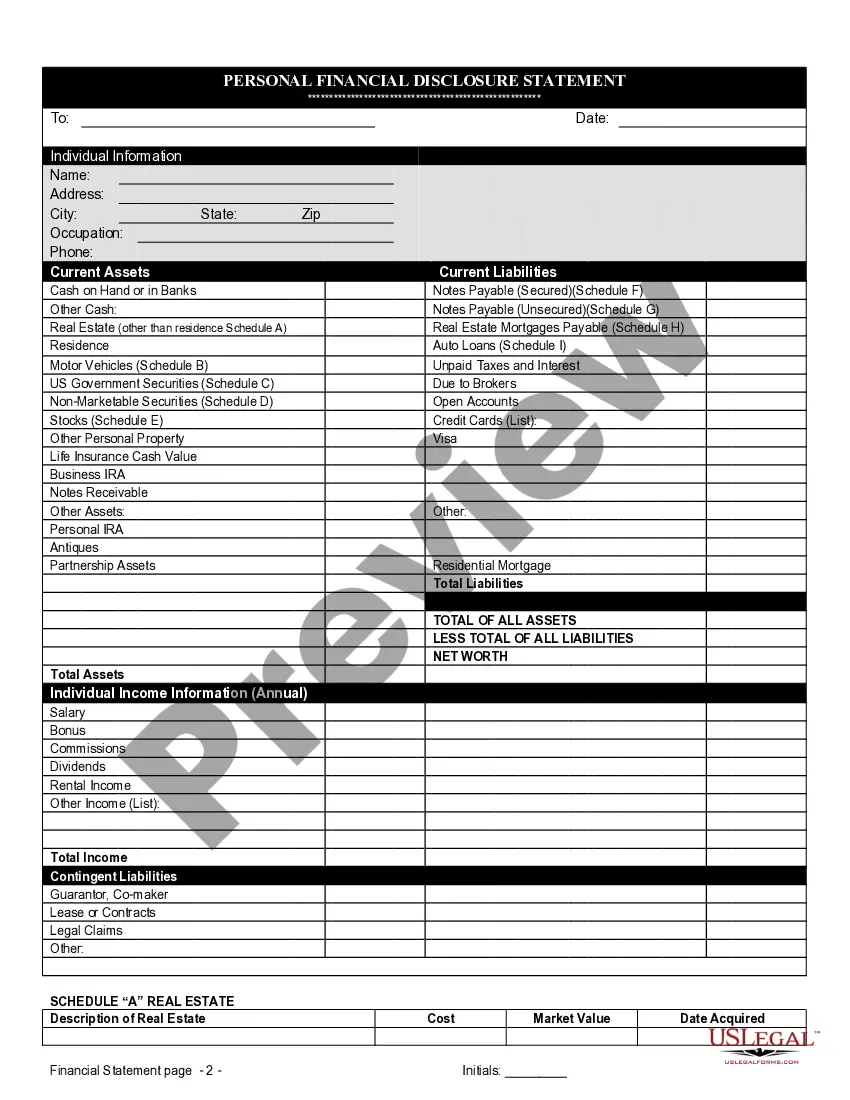

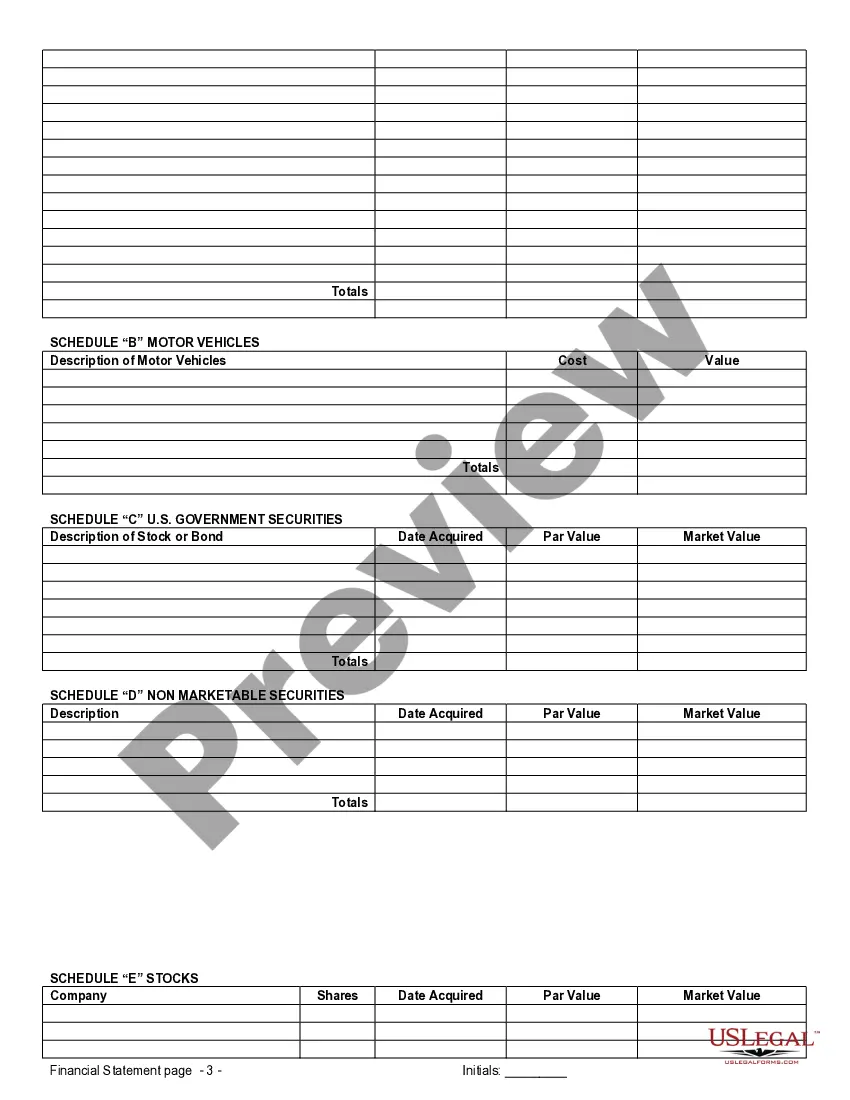

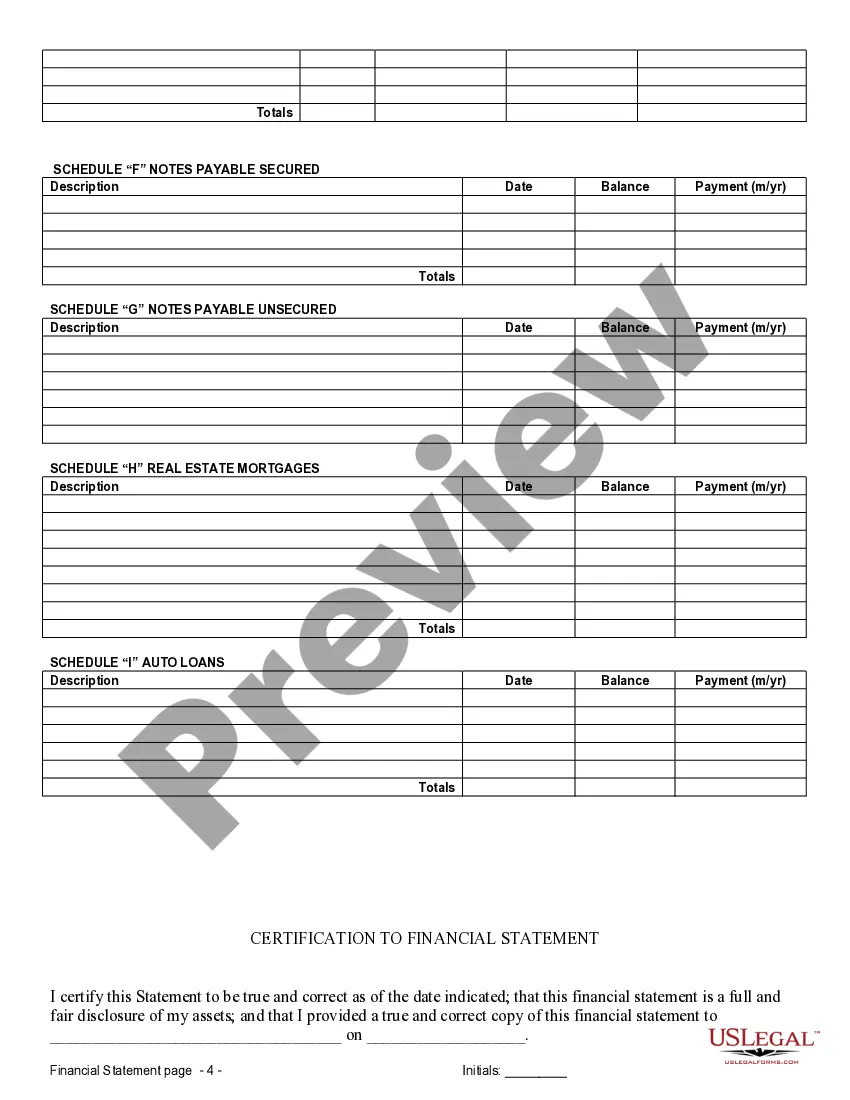

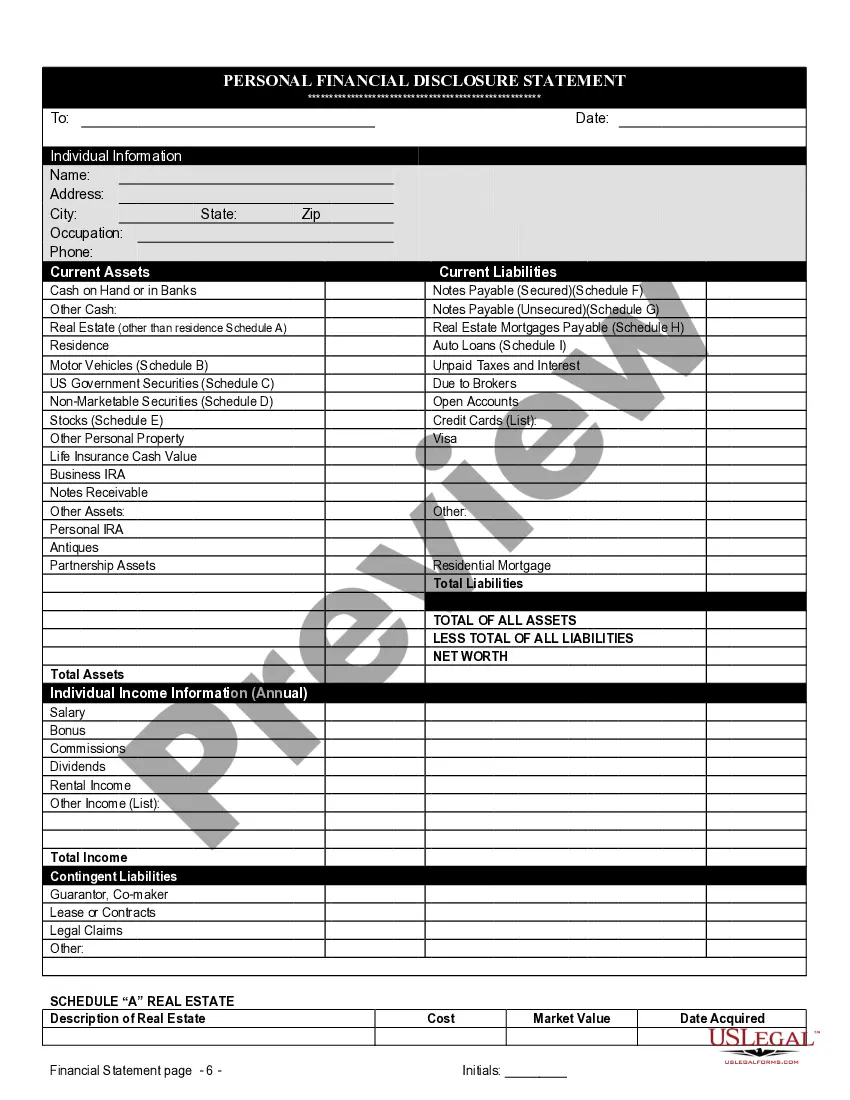

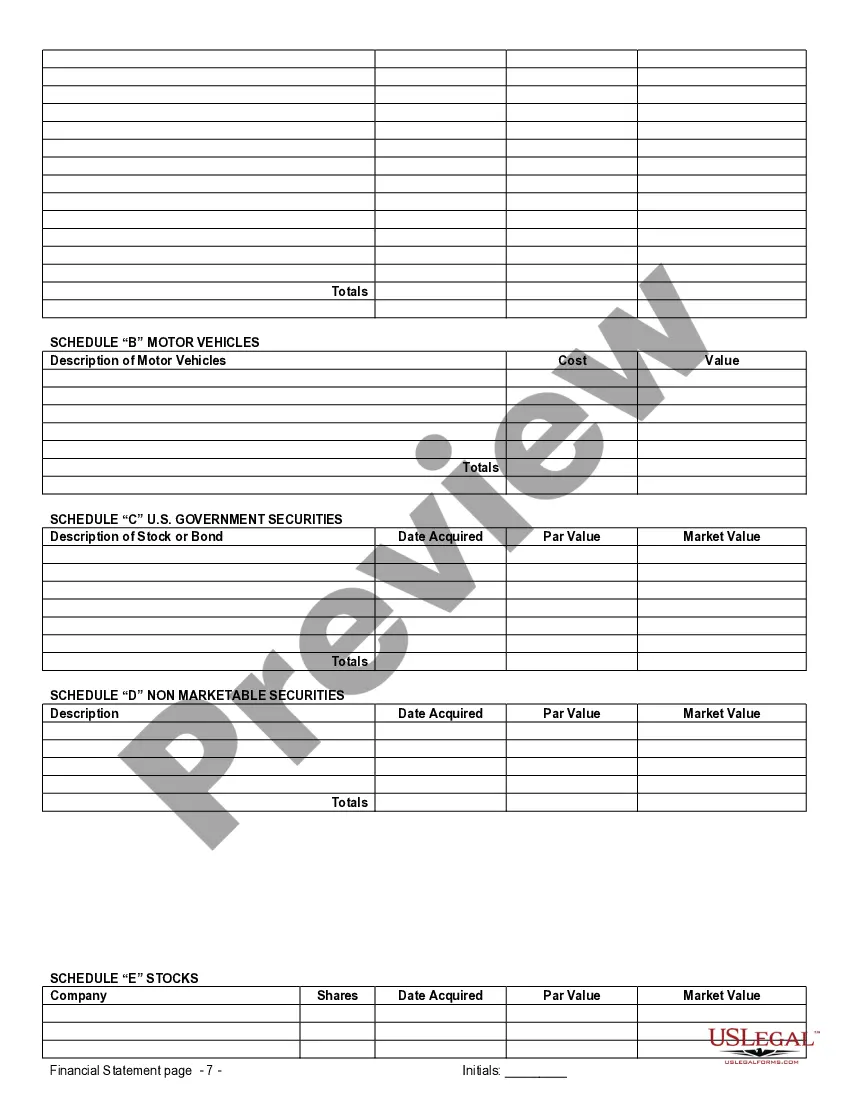

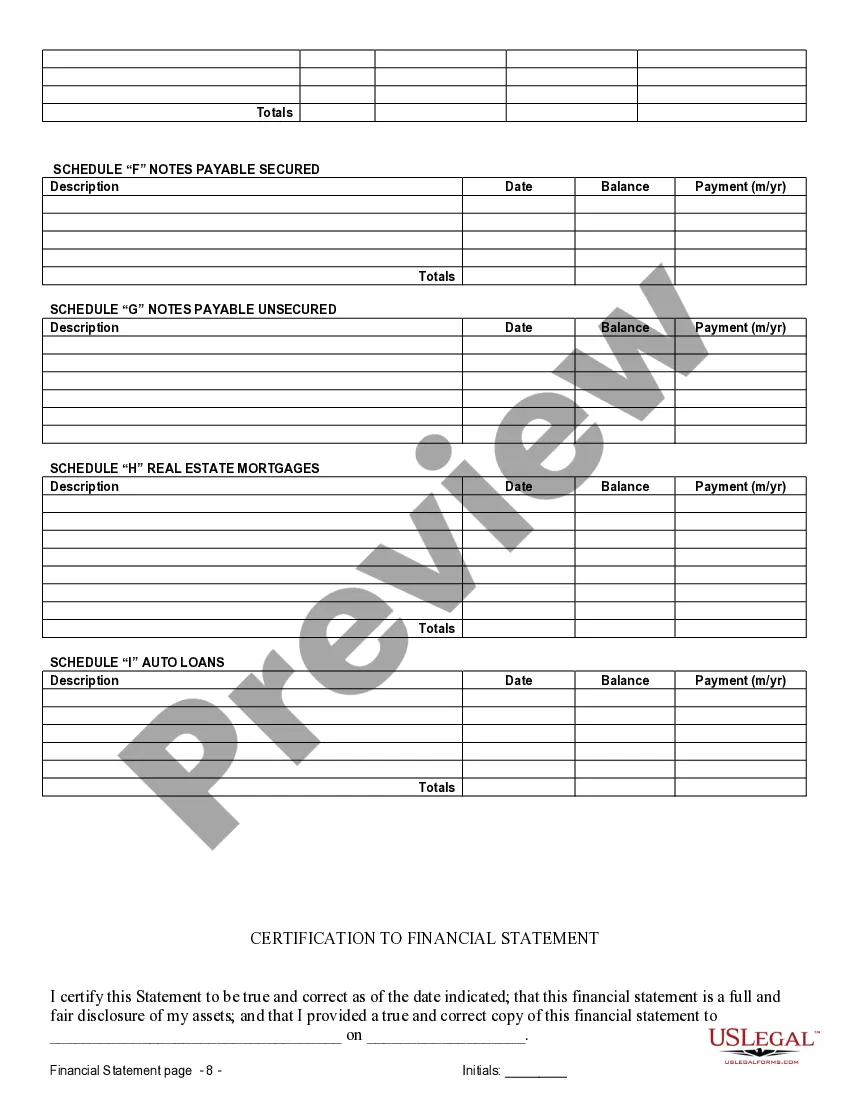

Raleigh, North Carolina Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview In Raleigh, North Carolina, financial statements play a crucial role in the context of prenuptial or premarital agreements. These statements provide a clear and transparent record of each party's financial standing, ensuring both parties have a complete understanding of their assets, liabilities, and financial obligations before entering into a marital union. Raleigh, North Carolina offers various types of financial statements that can be utilized exclusively for prenuptial or premarital agreements. These statements serve as a fundamental document outlining the financial aspects and expectations within the agreement. Here are the different types of financial statements commonly used: 1. Income Statements: Income statements encompass detailed information regarding each party's income sources, including employment earnings, investments, rental properties, or business profits. These statements provide an overview of current income levels as well as any anticipated changes or fluctuations in the future. 2. Asset Statements: Asset statements focus on documenting all the assets each party owns before marriage. Assets may include real estate properties, vehicles, stocks, bonds, retirement accounts, businesses, and valuable personal possessions. Detailed descriptions, estimated values, and the ownership structure of these assets are usually included in these statements. 3. Liability Statements: Liability statements outline any existing debts, outstanding loans, or financial obligations that either party may possess. This component of the financial statements ensures that both parties are aware of any debt burdens, including student loans, mortgages, credit card debts, or other financial liabilities. It safeguards each party's financial interests and helps establish a fair distribution of liabilities in case of a divorce or separation. 4. Expense Statements: Expense statements detail the anticipated living expenses and financial obligations that each party expects to incur during the marriage. These may include monthly bills, mortgage or rent payments, insurance premiums, healthcare expenses, and projected costs for children if applicable. Expense statements aid in understanding the financial responsibilities both parties bring into the marriage and can help set a realistic budget. 5. Tax Statements: Tax statements focus on providing an overview of each party's tax return history and anticipated tax liabilities. They include past tax returns, tax forms, and relevant supporting documentation. This aspect of the financial statements ensures transparency regarding potential tax obligations that may impact the couple's finances during the marriage. It is essential to note that Raleigh, North Carolina financial statements in connection with prenuptial or premarital agreements should be prepared professionally and accurately. Each party may be required to work with a qualified financial advisor or an attorney well-versed in family law to ensure compliance with state laws and regulations. By utilizing these comprehensive financial statements, couples in Raleigh, North Carolina can establish a solid foundation for their prenuptial or premarital agreements. These statements promote transparency, facilitate open communication about financial matters, and can ultimately protect each party's interests in the event of a divorce or separation.

Raleigh, North Carolina Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview In Raleigh, North Carolina, financial statements play a crucial role in the context of prenuptial or premarital agreements. These statements provide a clear and transparent record of each party's financial standing, ensuring both parties have a complete understanding of their assets, liabilities, and financial obligations before entering into a marital union. Raleigh, North Carolina offers various types of financial statements that can be utilized exclusively for prenuptial or premarital agreements. These statements serve as a fundamental document outlining the financial aspects and expectations within the agreement. Here are the different types of financial statements commonly used: 1. Income Statements: Income statements encompass detailed information regarding each party's income sources, including employment earnings, investments, rental properties, or business profits. These statements provide an overview of current income levels as well as any anticipated changes or fluctuations in the future. 2. Asset Statements: Asset statements focus on documenting all the assets each party owns before marriage. Assets may include real estate properties, vehicles, stocks, bonds, retirement accounts, businesses, and valuable personal possessions. Detailed descriptions, estimated values, and the ownership structure of these assets are usually included in these statements. 3. Liability Statements: Liability statements outline any existing debts, outstanding loans, or financial obligations that either party may possess. This component of the financial statements ensures that both parties are aware of any debt burdens, including student loans, mortgages, credit card debts, or other financial liabilities. It safeguards each party's financial interests and helps establish a fair distribution of liabilities in case of a divorce or separation. 4. Expense Statements: Expense statements detail the anticipated living expenses and financial obligations that each party expects to incur during the marriage. These may include monthly bills, mortgage or rent payments, insurance premiums, healthcare expenses, and projected costs for children if applicable. Expense statements aid in understanding the financial responsibilities both parties bring into the marriage and can help set a realistic budget. 5. Tax Statements: Tax statements focus on providing an overview of each party's tax return history and anticipated tax liabilities. They include past tax returns, tax forms, and relevant supporting documentation. This aspect of the financial statements ensures transparency regarding potential tax obligations that may impact the couple's finances during the marriage. It is essential to note that Raleigh, North Carolina financial statements in connection with prenuptial or premarital agreements should be prepared professionally and accurately. Each party may be required to work with a qualified financial advisor or an attorney well-versed in family law to ensure compliance with state laws and regulations. By utilizing these comprehensive financial statements, couples in Raleigh, North Carolina can establish a solid foundation for their prenuptial or premarital agreements. These statements promote transparency, facilitate open communication about financial matters, and can ultimately protect each party's interests in the event of a divorce or separation.