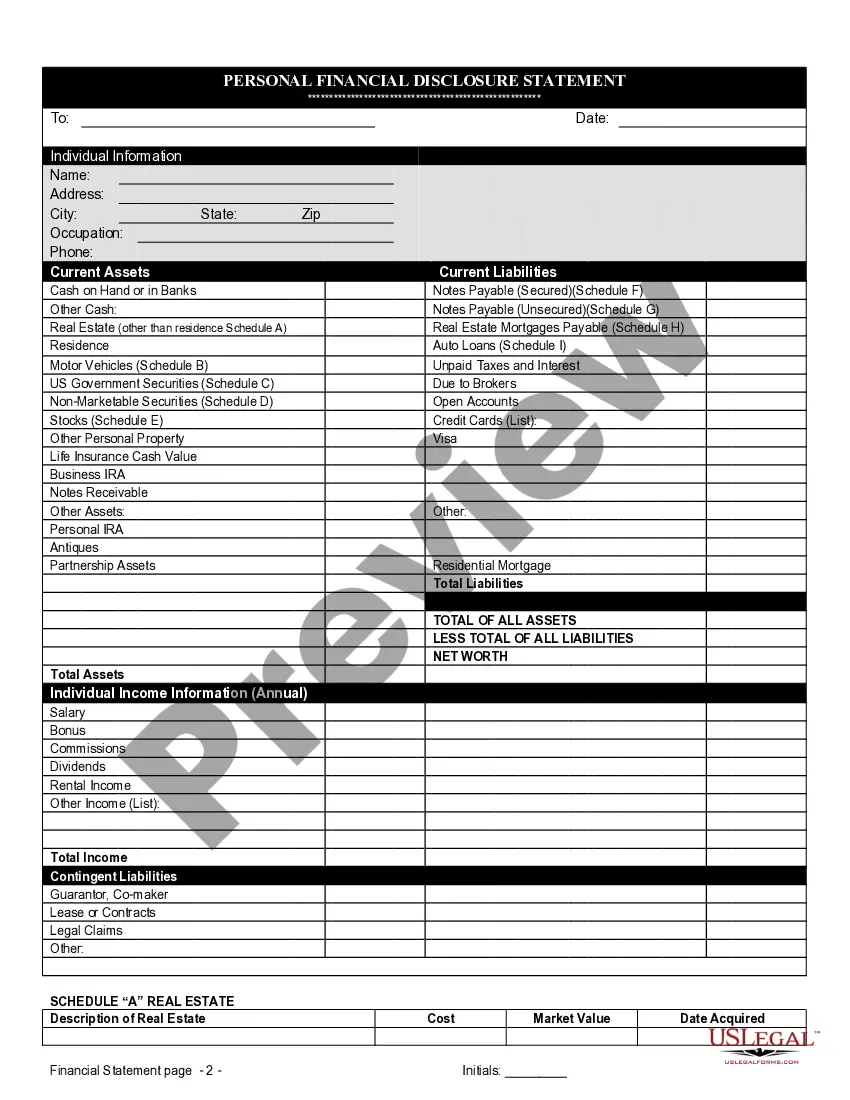

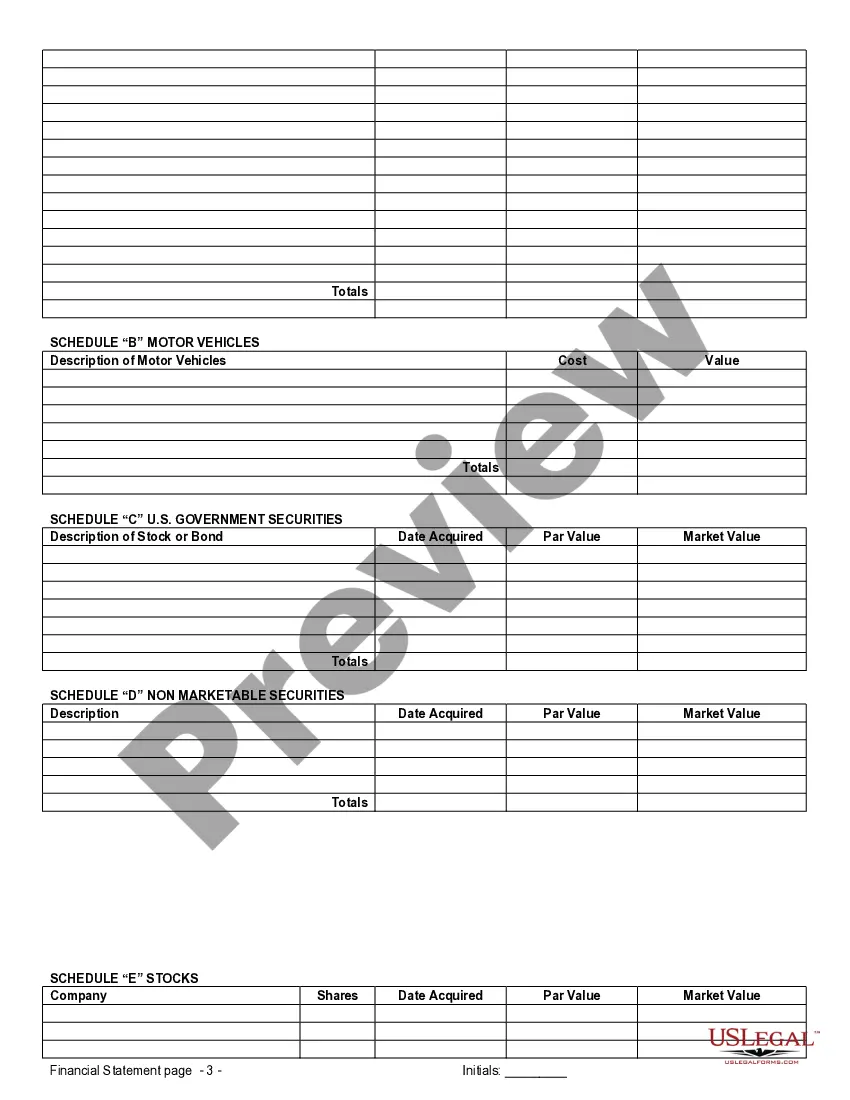

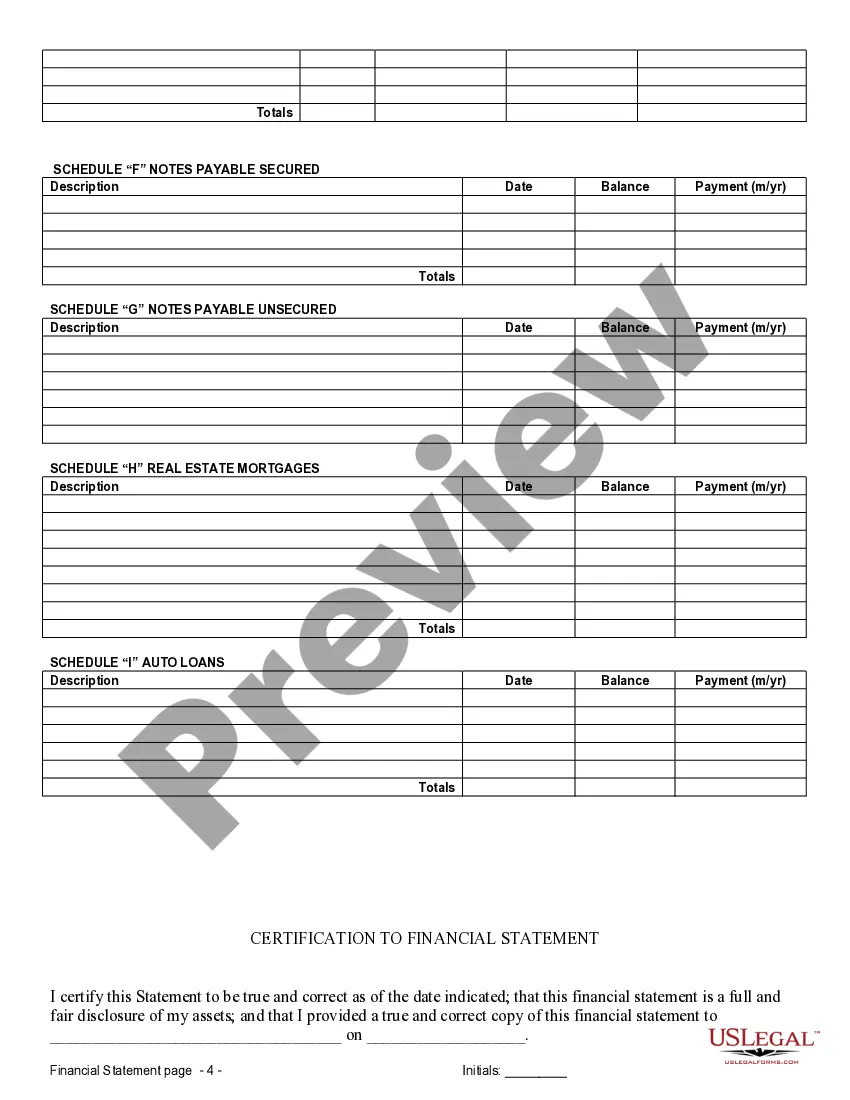

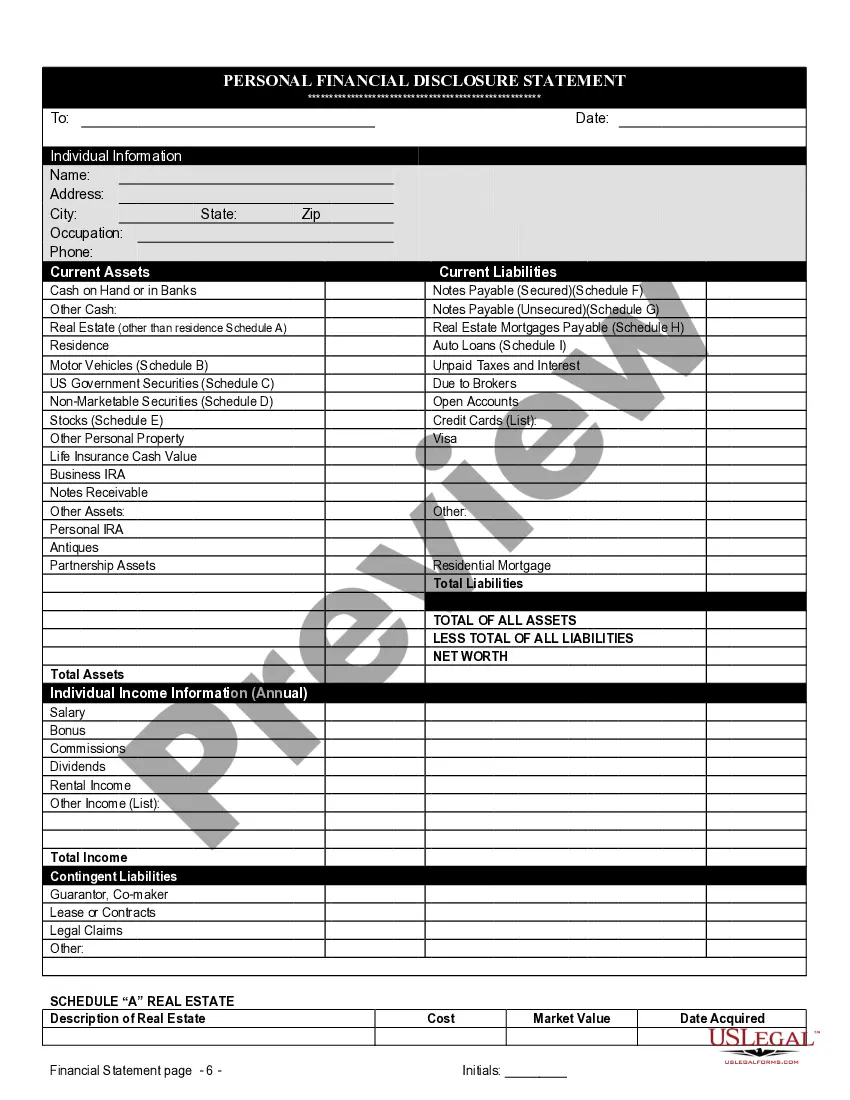

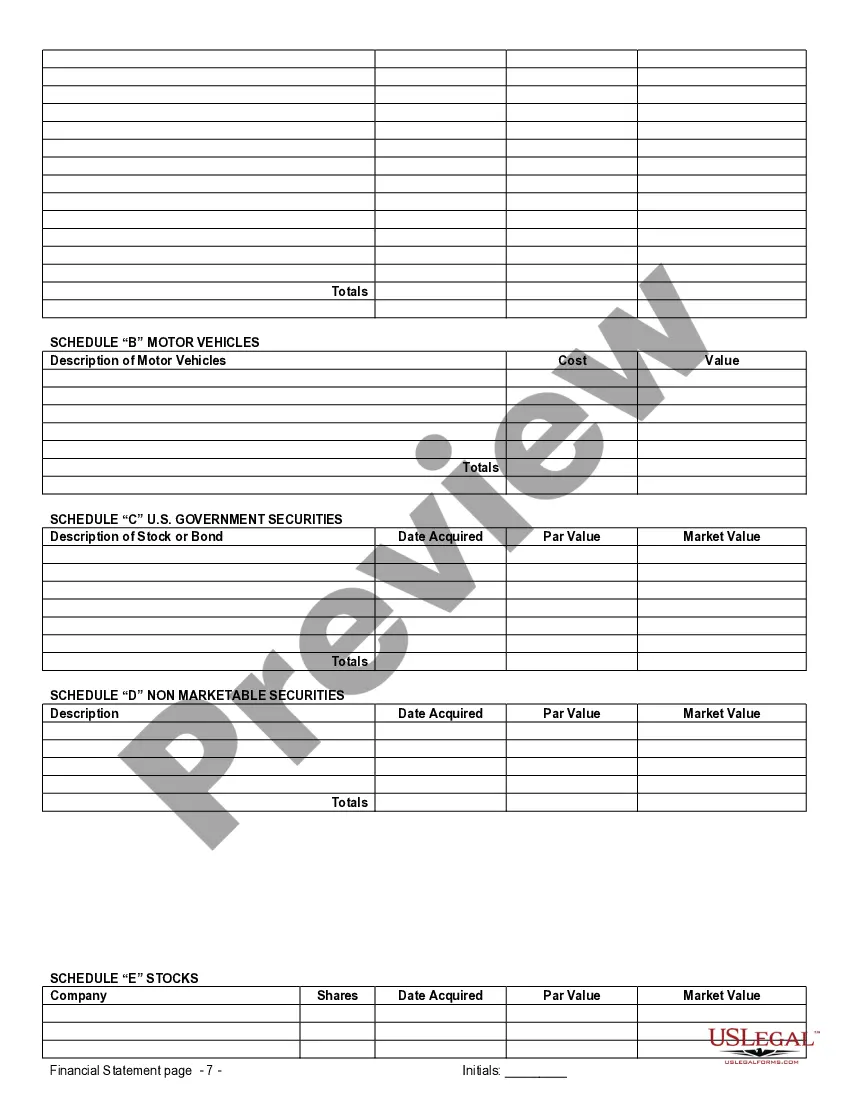

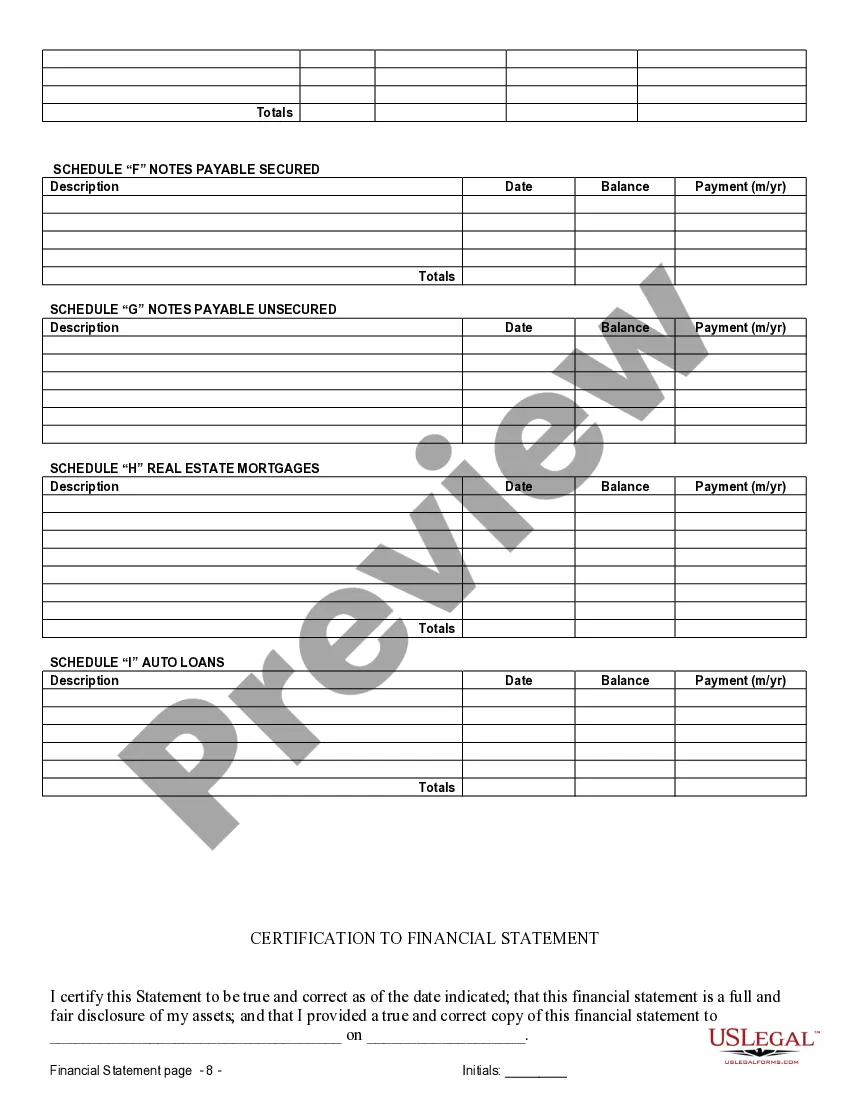

In Wilmington, North Carolina, financial statements play a vital role in prenuptial or premarital agreements. These statements provide a clear picture of each prospective spouse's financial situation before entering into marriage, ensuring transparency and protecting both parties' interests. Here are some important points to consider regarding Wilmington North Carolina financial statements in connection with prenuptial or premarital agreements: 1. Comprehensive Disclosure: Wilmington financial statements for prenuptial agreements require full disclosure of each party's assets, liabilities, income, and expenses. These statements aim to clarify the financial status and help determine the division of assets or potential spousal support in case of divorce or separation. 2. Types of Financial Statements: Depending on the complexity of their finances, individuals may need different types of financial statements when creating a prenuptial agreement. These include personal balance sheets, income statements, cash flow statements, and tax returns. 3. Personal Balance Sheets: Personal balance sheets in Wilmington financial statements offer an overview of each party's assets, such as real estate, savings accounts, investments, and personal properties. It also lists liabilities like mortgages, loans, credit card debts, and other outstanding obligations. 4. Income Statements: Income statements highlight the earning capacity of each party and provide details about their sources of income, such as salaries, self-employment earnings, investments, and other revenue streams. They also outline any financial obligations or support payments the party may be subject to. 5. Cash Flow Statements: Cash flow statements demonstrate the inflow and outflow of funds with regard to expenses and lifestyle maintenance. These statements give a clearer understanding of spending habits, savings capacity, and overall financial management skills. 6. Tax Returns: Wilmington financial statements for prenuptial agreements should include recent tax returns to validate income and to ensure the accuracy of the financial information disclosed. Tax returns provide a complete picture of the party's financial situation minus any inconsistencies or discrepancies. 7. Professional Assistance: Creating accurate and comprehensive financial statements for prenuptial agreements can be complex and critical. Seeking the help of a qualified financial advisor or family lawyer is crucial to ensure compliance with North Carolina laws and to guarantee the completeness and accuracy of the statements. In conclusion, Wilmington North Carolina financial statements in connection with prenuptial or premarital agreements provide a transparent and fair assessment of each party's financial status before marriage. These statements offer protection, clarification, and assistance in determining asset division and potential support obligations—ensuring both parties have a clear understanding of their financial rights and responsibilities throughout the marriage journey.

Wilmington North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

State:

North Carolina

City:

Wilmington

Control #:

NC-00590-D

Format:

Word;

Rich Text

Instant download

Description

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

In Wilmington, North Carolina, financial statements play a vital role in prenuptial or premarital agreements. These statements provide a clear picture of each prospective spouse's financial situation before entering into marriage, ensuring transparency and protecting both parties' interests. Here are some important points to consider regarding Wilmington North Carolina financial statements in connection with prenuptial or premarital agreements: 1. Comprehensive Disclosure: Wilmington financial statements for prenuptial agreements require full disclosure of each party's assets, liabilities, income, and expenses. These statements aim to clarify the financial status and help determine the division of assets or potential spousal support in case of divorce or separation. 2. Types of Financial Statements: Depending on the complexity of their finances, individuals may need different types of financial statements when creating a prenuptial agreement. These include personal balance sheets, income statements, cash flow statements, and tax returns. 3. Personal Balance Sheets: Personal balance sheets in Wilmington financial statements offer an overview of each party's assets, such as real estate, savings accounts, investments, and personal properties. It also lists liabilities like mortgages, loans, credit card debts, and other outstanding obligations. 4. Income Statements: Income statements highlight the earning capacity of each party and provide details about their sources of income, such as salaries, self-employment earnings, investments, and other revenue streams. They also outline any financial obligations or support payments the party may be subject to. 5. Cash Flow Statements: Cash flow statements demonstrate the inflow and outflow of funds with regard to expenses and lifestyle maintenance. These statements give a clearer understanding of spending habits, savings capacity, and overall financial management skills. 6. Tax Returns: Wilmington financial statements for prenuptial agreements should include recent tax returns to validate income and to ensure the accuracy of the financial information disclosed. Tax returns provide a complete picture of the party's financial situation minus any inconsistencies or discrepancies. 7. Professional Assistance: Creating accurate and comprehensive financial statements for prenuptial agreements can be complex and critical. Seeking the help of a qualified financial advisor or family lawyer is crucial to ensure compliance with North Carolina laws and to guarantee the completeness and accuracy of the statements. In conclusion, Wilmington North Carolina financial statements in connection with prenuptial or premarital agreements provide a transparent and fair assessment of each party's financial status before marriage. These statements offer protection, clarification, and assistance in determining asset division and potential support obligations—ensuring both parties have a clear understanding of their financial rights and responsibilities throughout the marriage journey.

Free preview

How to fill out Wilmington North Carolina Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you’ve already used our service before, log in to your account and download the Wilmington North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Wilmington North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!