The Articles of Incorporation for a Domestic Nonprofit Corporation in Charlotte, North Carolina are legal documents that must be filed with the North Carolina Secretary of State's office in order to establish and register a nonprofit organization within the state. These articles serve as the foundation and initial guidelines for the corporation's operations, structure, and purpose. The articles typically contain the following key elements: 1. Name of the Corporation: The articles must include the chosen name for the nonprofit corporation, which should comply with the North Carolina naming requirements. 2. Registered Agent: The articles must specify the name and physical address of the registered agent, who will act as the official point of contact for legal matters on behalf of the corporation. 3. Principal Office: The principal office address should be provided where the corporation's main business operations and administration will be conducted. 4. Purpose of the Corporation: The articles should clearly state the nonprofit corporation's charitable, educational, religious, scientific, or other objectives or purposes. The purpose statement should align with the requirements outlined in the North Carolina Nonprofit Corporation Act. 5. Duration: The articles should indicate whether the corporation will operate perpetually or for a specified period of time. 6. Membership and Voting Rights: If the nonprofit corporation will have members, the articles may include provisions about membership eligibility, voting rights, and governance structure. 7. Initial Board of Directors: The names and addresses of the initial board of directors should be listed in the articles. Nonprofit corporations in North Carolina typically require a minimum of three directors. 8. Dissolution Provisions: The articles may outline the procedures for the corporation's dissolution, including the distribution of remaining assets to other tax-exempt organizations. 9. Incorporated: The name and address of the incorporated, who is responsible for filing the articles with the Secretary of State, should be included. It is important to note that nonprofit corporations in Charlotte, North Carolina may have different types of articles of incorporation depending on their specific aims and requirements. For example, organizations seeking tax-exempt status under Internal Revenue Code Section 501(c)(3) may need to include additional provisions regarding compliance with federal tax laws and restrictions on political lobbying activities. However, the general content outlined above serves as a foundation for most nonprofit corporations. To obtain the specific articles of incorporation forms and guidelines for Charlotte, North Carolina, individuals can visit the North Carolina Secretary of State's website or reach out to their office for accurate, up-to-date information.

Charlotte North Carolina Articles of Incorporation for Domestic Nonprofit Corporation

Description

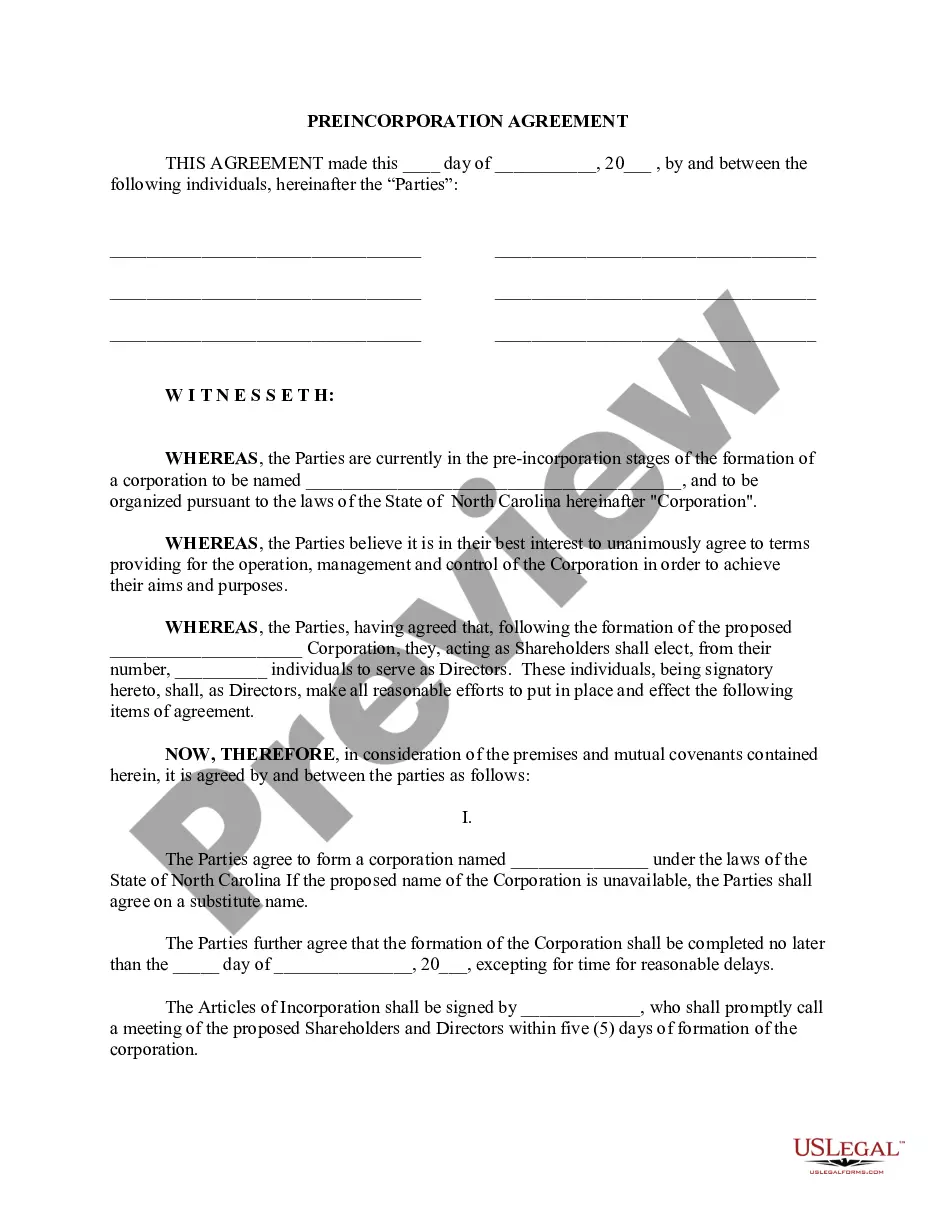

How to fill out Charlotte North Carolina Articles Of Incorporation For Domestic Nonprofit Corporation?

If you are in search of a legitimate form template, it’s exceptionally challenging to discover a more user-friendly platform than the US Legal Forms site – one of the largest collections available online.

With this collection, you can access thousands of document examples for corporate and personal use categorized by types and states, or keywords.

Utilizing our premium search functionality, locating the latest Charlotte North Carolina Articles of Incorporation for Domestic Nonprofit Corporation is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the form. Specify the format and store it on your device. Edit the form. Fill out, modify, print, and sign the downloaded Charlotte North Carolina Articles of Incorporation for Domestic Nonprofit Corporation.

- Furthermore, the accuracy of each document is verified by a team of qualified attorneys who routinely review the templates on our platform and refresh them according to the current state and county requirements.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Charlotte North Carolina Articles of Incorporation for Domestic Nonprofit Corporation is to Log In to your user account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the guidelines outlined below.

- Ensure you have accessed the sample you require. Examine its details and utilize the Preview feature (if available) to review its contents. If it doesn’t fulfill your requirements, use the Search box at the top of the page to find the needed document.

- Verify your choice. Click the Buy now button. Afterward, select your desired subscription plan and provide details to create an account.

Form popularity

FAQ

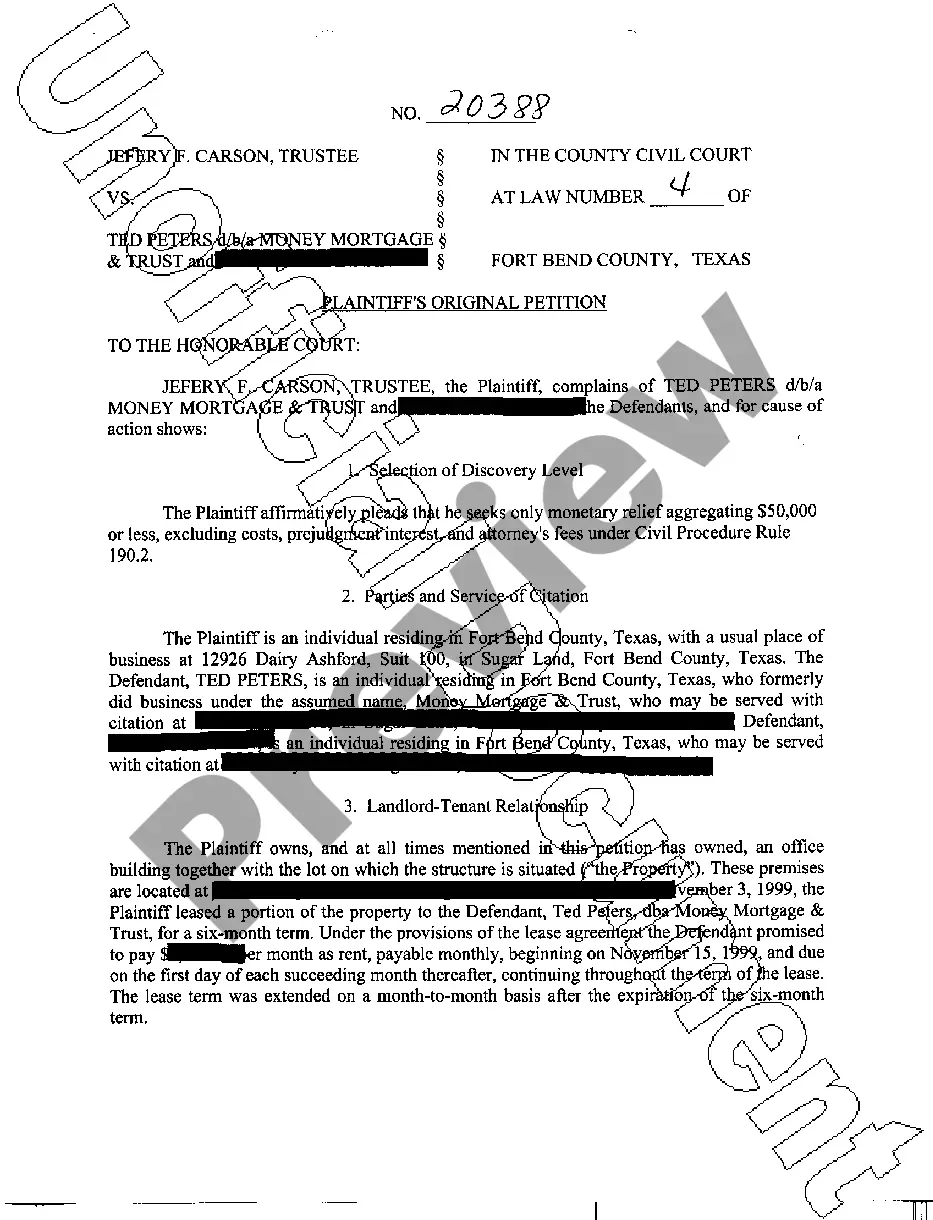

How To Start A Nonprofit In North Carolina Choose your NC nonprofit filing option. File the NC nonprofit articles of incorporation. Get a Federal EIN from the IRS. Adopt your nonprofit's bylaws. Apply for federal and/or state tax exemptions. Register for required state licenses. Open a bank account for your NC nonprofit.

How many board members are required for a nonprofit in California? The state of California requires a minimum of one board member for each organization. It is recommended that your organization have at least three since the IRS will most likely not give 501(c)(3) status to an organization with less.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email, phone, in person, or online, but we recommend online. Online processing is immediate and costs $15 plus $1 per page.

You can find information on any corporation or business entity in North Carolina or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email, phone, in person, or online, but we recommend online. Online processing is immediate and costs $15 plus $1 per page.

Board of Directors. North Carolina law requires only one board member, but best practices recommend that you have at least five; a minimum of seven is preferable. As you recruit board members, make sure they are aware of their roles and responsibilities.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length. What is important to remember is that board service terms aren't intended to be perpetual, and are typically one to five years.

Under North Carolina law, only one board member is required, but it is good practice to have at least 5-7 board members. The bylaws should also specify the names, functions, and powers of board committees. Sometimes the bylaws will contain (or repeat) the provisions on indemnification of board members and officers.

How to Start a Nonprofit in North Carolina Name Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.