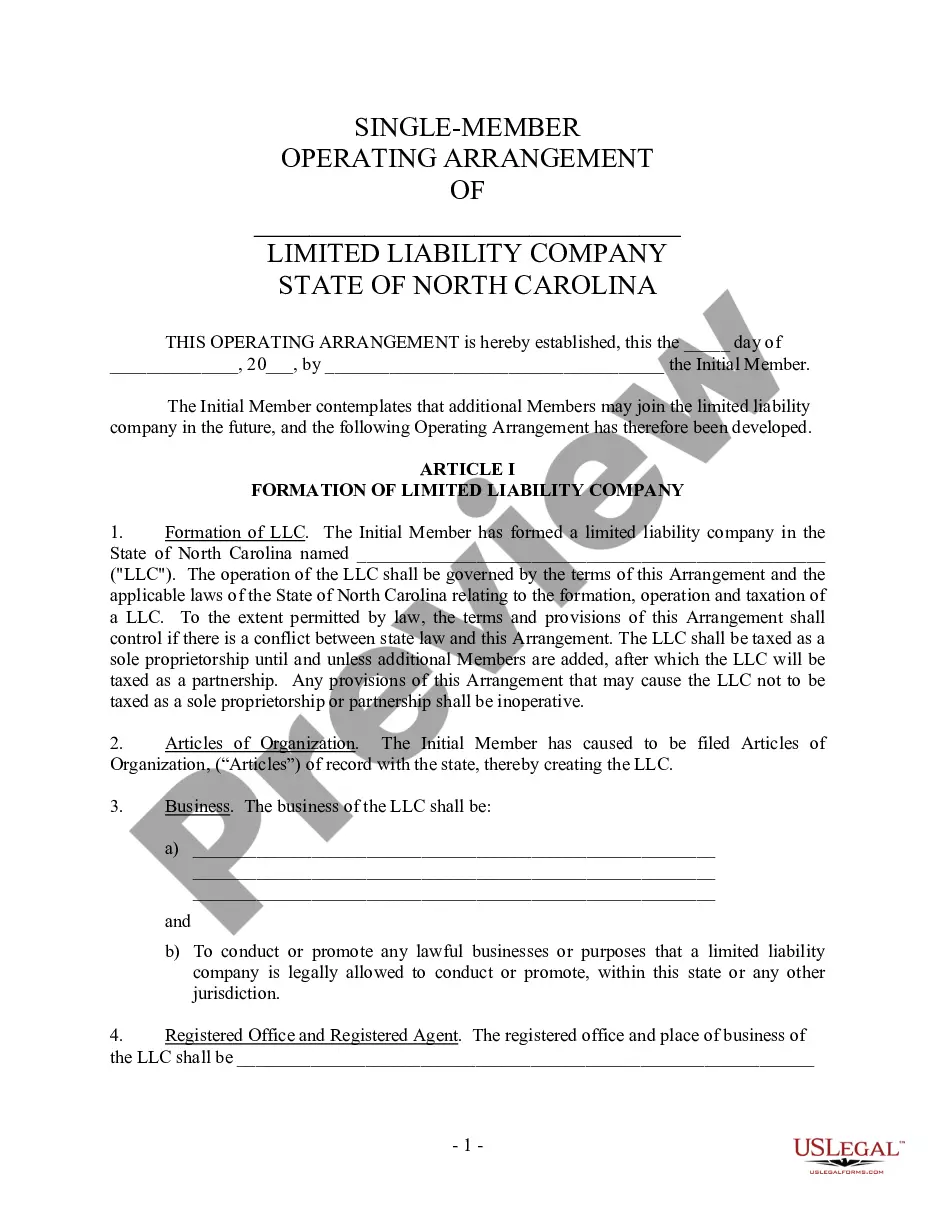

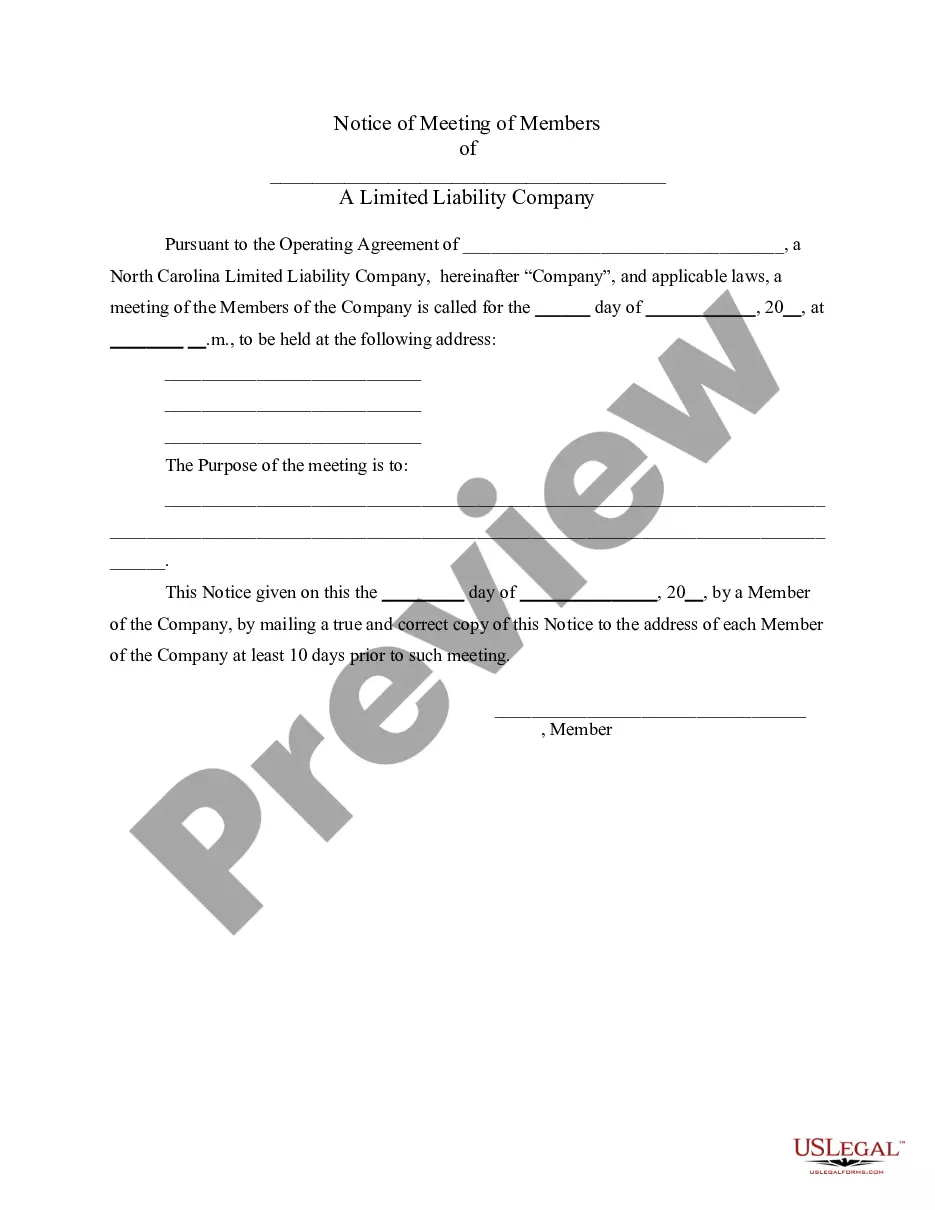

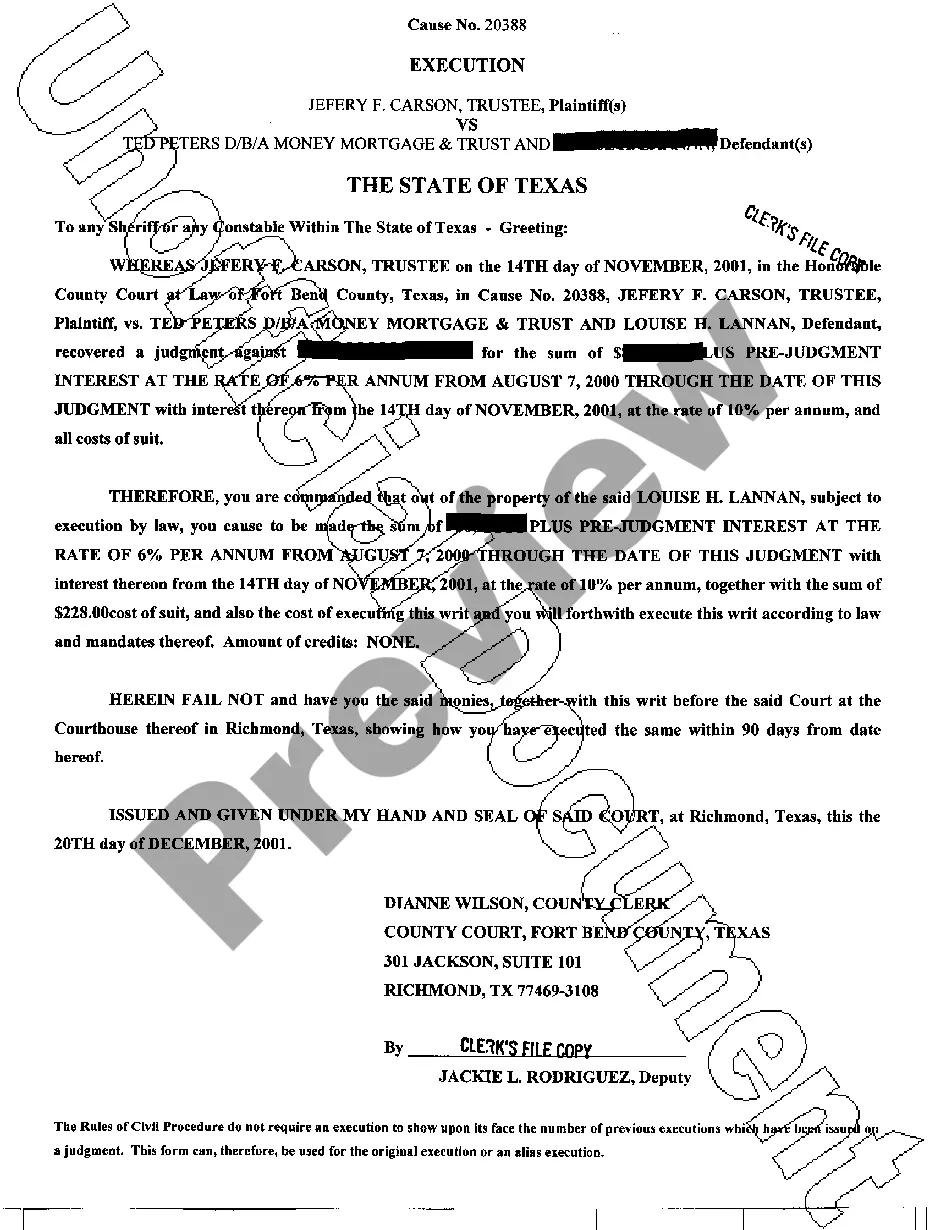

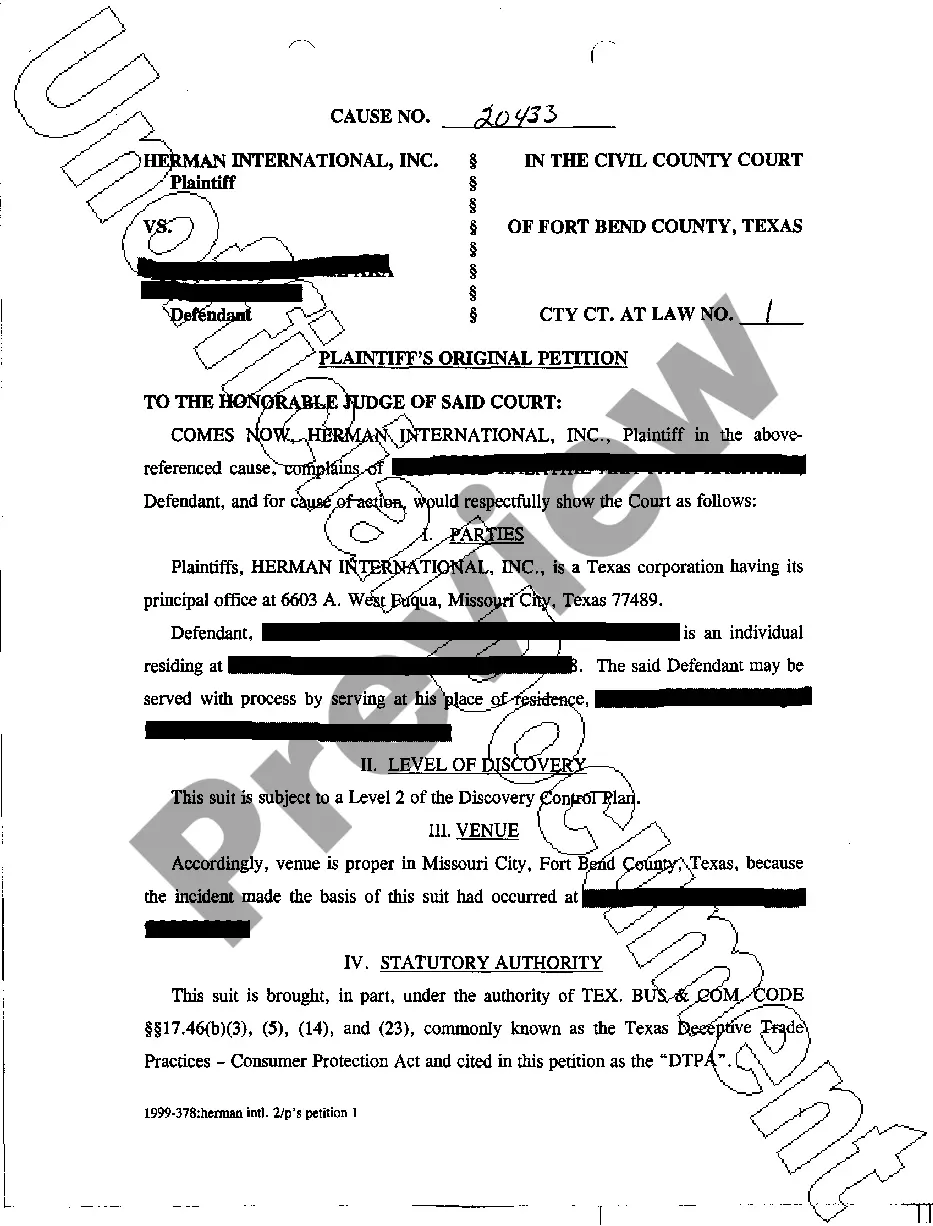

A Charlotte North Carolina Limited Liability Company (LLC) Operating Agreement is a legally binding document that outlines how an LLC is to be operated and managed in the state of North Carolina. It serves as a contract between the LLC members, detailing their rights, responsibilities, and contributions to the company. The Operating Agreement typically includes important information such as the LLC's name and address, the purpose of the business, the roles and responsibilities of each member, the ownership percentages, and the initial capital contributions made by each member. It also establishes the decision-making process, voting rights, and procedures for adding or removing members. Additionally, the Operating Agreement may address how profits and losses will be distributed among members, how the LLC will be dissolved or liquidated if necessary, and any restrictions on transferring ownership interests. There may be different types or variations of the Charlotte North Carolina LLC Operating Agreement depending on the needs and preferences of the LLC members. These variations could include single-member LLC operating agreements, where a single individual owns the LLC, and multi-member LLC operating agreements, where multiple individuals or entities hold ownership interests. The specific provisions within the operating agreement may differ depending on the specific requirements and circumstances of each LLC. Furthermore, operating agreements can also be customized to include additional provisions that address specific issues or concerns of the LLC members, such as non-compete clauses, dispute resolution procedures, or managerial authority. Overall, a Charlotte North Carolina LLC Operating Agreement serves as a crucial document that establishes the legal framework for the operation and management of an LLC. It provides clarity, protection, and guidance to the members involved in the LLC's business activities, ensuring smooth operations and minimizing potential conflicts.

Charlotte North Carolina Limited Liability Company LLC Operating Agreement

Description

How to fill out Charlotte North Carolina Limited Liability Company LLC Operating Agreement?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Charlotte North Carolina Limited Liability Company LLC Operating Agreement gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, obtaining the Charlotte North Carolina Limited Liability Company LLC Operating Agreement takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Charlotte North Carolina Limited Liability Company LLC Operating Agreement. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!