Greensboro North Carolina Limited Liability Company LLC Formation Package

Description

How to fill out Greensboro North Carolina Limited Liability Company LLC Formation Package?

Utilize the US Legal Forms and gain immediate access to any sample form you desire.

Our user-friendly site, featuring an extensive collection of templates, streamlines the process of locating and acquiring nearly any document template you require.

You can save, complete, and authenticate the Greensboro North Carolina Limited Liability Company LLC Formation Package in just a few minutes rather than spending hours browsing the internet for the correct template.

Using our repository is an excellent method to enhance the security of your document submission.

Access the page with the form you require. Ensure that it is the form you were looking for: check its title and description, and utilize the Preview function if available.

Initiate the saving process. Choose Buy Now and select your preferred pricing plan. Then, create an account and complete your purchase using a credit card or PayPal.

- Our experienced attorneys frequently examine all documents to ensure that the forms are suitable for a specific state and adhere to the latest laws and regulations.

- How can you acquire the Greensboro North Carolina Limited Liability Company LLC Formation Package.

- If you already possess an account, just Log In to your profile. The Download button will be visible on all the samples you browse.

- Additionally, you can retrieve all previously saved documents from the My documents section.

- If you do not yet have an account, follow the steps outlined below.

Form popularity

FAQ

Determining a reasonable salary for an LLC depends on various factors, including the nature of your business and the market rates for similar positions. When you utilize the Greensboro North Carolina Limited Liability Company LLC Formation Package, you can create a solid compensation strategy that aligns with your earnings and keeps your finances in check. Aim for a salary that reflects your contributions while ensuring compliance with IRS guidelines.

The minimum income for an LLC is not set by law; rather, it often depends on your business goals and state regulations. With the Greensboro North Carolina Limited Liability Company LLC Formation Package, you can set your income targets based on your business model and operational feasibility. It's crucial to ensure that your LLC generates enough revenue to cover your expenses and key financial commitments.

Filling out a limited liability company operating agreement is essential for establishing your LLC structure. Start by identifying the members and their respective ownership percentages. Next, outline the management structure, including how decisions are made and how profits are distributed. Our Greensboro North Carolina Limited Liability Company LLC Formation Package provides guidance and templates to simplify this process, ensuring your agreement meets legal requirements.

Yes, you can start a single-member LLC in North Carolina. This structure allows you to enjoy the liability protection of an LLC while maintaining complete control over your business. The Greensboro North Carolina Limited Liability Company LLC Formation Package is an excellent resource for individuals wanting to set up an LLC on their own, providing templates and guidance tailored for solo entrepreneurs. Don't hesitate to leverage this package to ensure a smooth formation process.

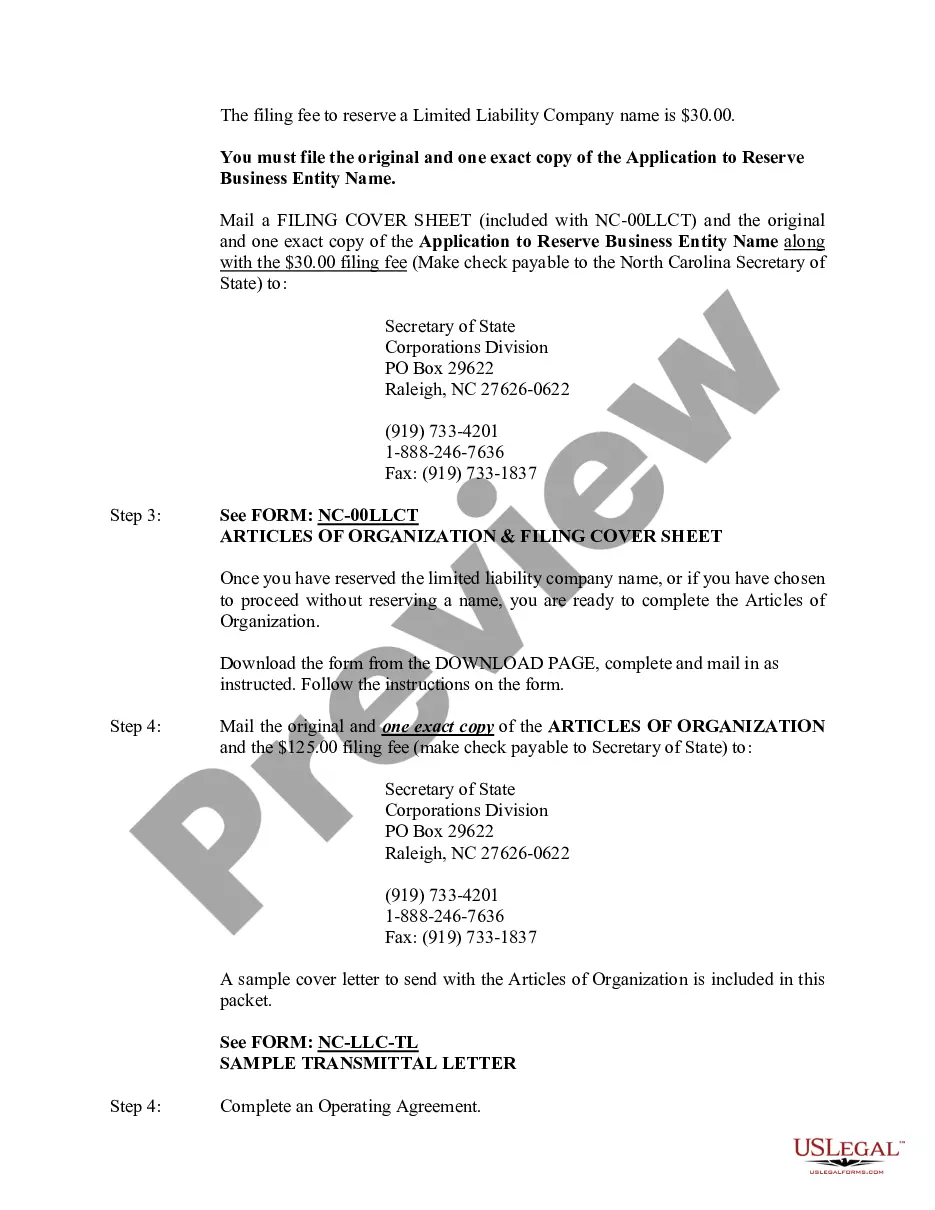

To file an LLC in North Carolina on your own, you must complete the Articles of Organization and submit it to the Secretary of State. It's important to ensure your chosen name is not already in use and complies with state guidelines. Using the Greensboro North Carolina Limited Liability Company LLC Formation Package can streamline this process, providing you with essential templates and instructions for filing accurately. Finally, monitor the status of your submission to confirm that your LLC is officially established.

Starting your own LLC in North Carolina involves a few key steps. First, select a unique name for your LLC that meets state requirements. Then, you will need to file the necessary formation documents with the North Carolina Secretary of State, and you can use a comprehensive package like the Greensboro North Carolina Limited Liability Company LLC Formation Package to simplify the process. Lastly, obtain any required licenses and permits to operate legally.

To form your LLC, you must submit to the state articles of organization, also called a certificate of organization (or certificate of formation in some states). You can generally download the appropriate form from the secretary of state website.

The formation of an LLC broadly requires filing the ?articles of organization? which is a document including basic information like business name, address, members. The filing is done with the Secretary of State for most states and has an associated filing fee.

The annual report must be filed each year by April 15 except that new LLCs don't need to file a report until the first year after they're created. The filing fee is $200.

The main cost of forming a limited liability company (LLC) is the state filing fee. This fee ranges between $40 and $500, depending on your state.