Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to disclaim and renounce their right to inherit property from a life insurance or annuity contract in the city of Fayetteville, North Carolina. This can be done for various reasons, such as avoiding potential tax implications, managing estate planning, or simply not wanting to take ownership of the property. By renouncing and disclaiming the property, the individual essentially refuses to accept the benefits or any legal obligations associated with the life insurance or annuity contract. Instead, the property will pass on to the next eligible beneficiary or follow the provisions set forth in the contract or state law. There are two main types of Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract: 1. Irrevocable Renunciation and Disclaimer: This type of renunciation and disclaimer is permanent and cannot be reversed or revoked once it is made. Individuals who opt for this type of renunciation relinquish any claim or interest in the property, and it cannot be passed on to them at a later date. 2. Revocable Renunciation and Disclaimer: Unlike the irrevocable type, this renunciation and disclaimer can be revoked or canceled at a later time if the individual wishes to accept the property. However, it is essential to consult with legal professionals before opting for this type, as some conditions and time limitations may apply. Keywords: Fayetteville North Carolina, Renunciation, Disclaimer, Property, Life Insurance, Annuity Contract, legal process, inherit, tax implications, estate planning, ownership, benefits, obligations, eligible beneficiary, provisions, irrevocable, revocable, permanent, legal professionals.

Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Fayetteville North Carolina Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

We consistently strive to reduce or evade legal repercussions when navigating intricate legal or financial situations.

To achieve this, we enroll in attorney services that are often very expensive.

Nevertheless, not all legal issues are equally complicated.

Many of them can be managed independently.

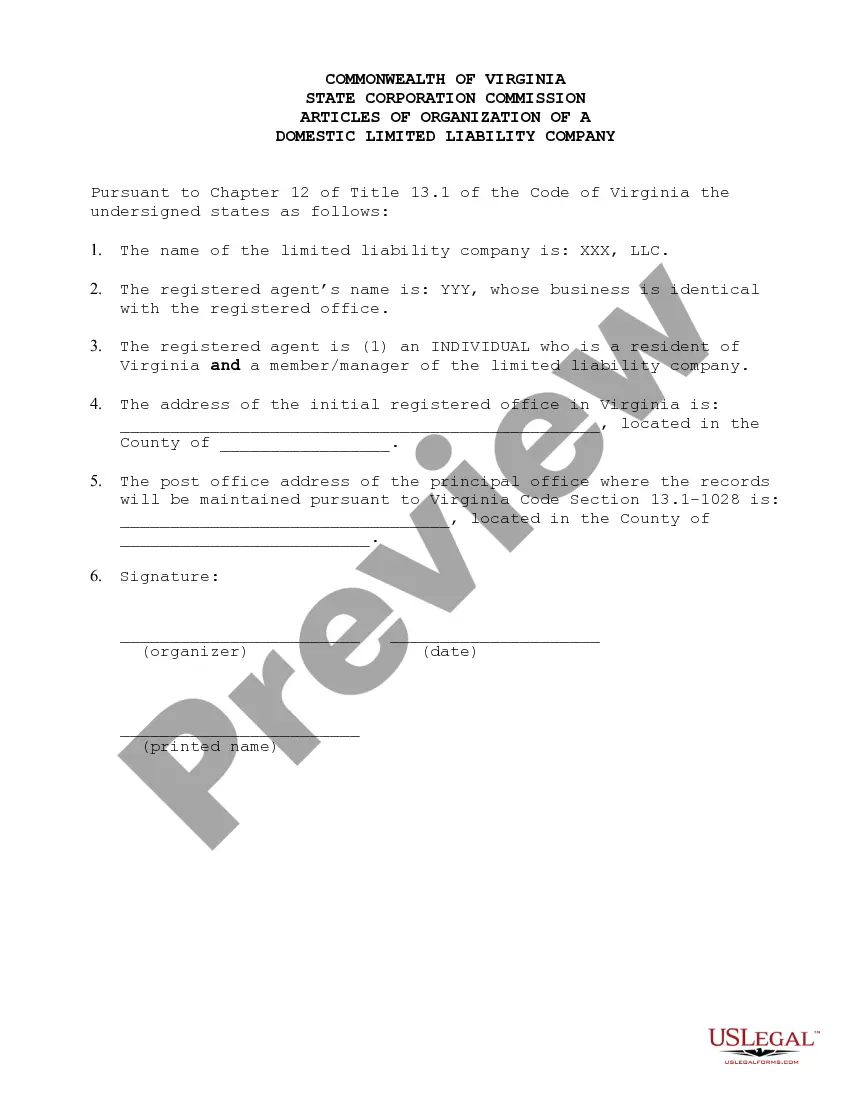

Utilize US Legal Forms whenever you need to obtain and download the Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract or any other document quickly and securely.

- US Legal Forms is an online collection of current DIY legal documents encompassing everything from wills and powers of attorney to corporate articles and dissolution petitions.

- Our library allows you to take control of your issues without resorting to a lawyer's services.

- We provide access to legal document templates that aren’t always available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

The statute of renunciation in North Carolina sets forth the time limits and conditions under which a person can refuse an inheritance. Generally, you have nine months to renounce any property or benefit after the decedent's death. This statute is particularly relevant in the context of Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contracts.

To officially disclaim an inheritance in North Carolina, you need to prepare and submit a written statement to the estate's executor or administrator. This statement must include your name, a description of the property you are disclaiming, and a declaration of your intention to disclaim. For clarity and legal certainty, utilizing resources like US Legal Forms can guide you through the Fayetteville North Carolina Renunciation and Disclaimer of Property process.

In North Carolina, a spouse does not automatically inherit everything from their partner. If there are surviving children, a spouse typically inherits one-third of the estate, whereas children inherit the remainder. Understanding these laws can help you navigate issues related to the Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

To disclaim an inheritance in North Carolina, you must file a written disclaimer with the appropriate clerk of court within nine months of the decedent's death. This disclaimer should clearly express your intent to reject the inheritance. Using platforms like US Legal Forms can simplify this process and ensure compliance with the Fayetteville North Carolina Renunciation and Disclaimer of Property requirements.

The law of renunciation allows individuals to refuse or disclaim any interest in property that they may have received. In Fayetteville, North Carolina, this process ensures that the renouncing party does not assume any legal obligations associated with that property. Understanding the implications of renunciation is crucial, especially in matters involving Life Insurance or Annuity Contracts.

In North Carolina, the statute of limitations for recovering personal property is generally three years. This time frame begins when the property owner discovers the loss or dispossession of their property. If you are dealing with issues related to the Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, it's essential to act promptly to protect your rights.

To disclaim part of an inheritance in North Carolina, you must provide a written disclaimer. This document should state your intention to decline the inheritance clearly and must be signed and dated. It's important to complete this process within nine months of the inheritance being transferred to maintain eligibility for the Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Using a reliable platform like USLegalForms can simplify this process and ensure compliance with local laws.

In North Carolina, inheritance laws govern how property is passed on after death. If a person dies without a will, the state laws dictate distribution among relatives. This process can be influenced by factors like marital status and the existence of children. If you seek to address property from life insurance or annuity contracts, understanding Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is essential to ensure your interests are protected.

If you refuse your inheritance through the Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, that property will typically pass to the next beneficiary in line. This means that those assets do not become part of your estate. Refusing an inheritance can have both financial and personal implications, so it's wise to fully understand the process. Platforms like US Legal Forms can help you navigate this decision effectively.

North Carolina does not impose an inheritance tax, so you do not need a tax waiver for inherited property. However, understanding the implications of disclaimed inheritances is crucial. By following the Fayetteville North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract process, you can manage how assets are distributed without the tax burden. For clearer instructions, consider accessing resources through US Legal Forms.