High Point North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to waive their rights to property received from a life insurance policy or annuity contract. In High Point, North Carolina, individuals have the option to renounce or disclaim any property they would otherwise be entitled to receive from a life insurance policy or annuity contract. This process typically occurs when a beneficiary decides that they do not wish to accept the property due to personal reasons or financial implications. By renouncing or disclaiming the property, the individual forfeits any rights or claims to it. There are various circumstances in which individuals may choose to employ the renunciation or disclaimer process. Some possible situations include: 1. Financial Planning: Individuals may renounce or disclaim property to manage their assets strategically. This could be to avoid potential taxes, maintain eligibility for government assistance programs, or to distribute assets among beneficiaries more equitably. 2. Estate Planning: Renunciation or disclaimer of property can be utilized as part of an overall estate plan to ensure that assets are distributed according to the individual's wishes. This can be particularly useful when attempting to minimize tax burdens or provide for the needs of specific beneficiaries. 3. Personal Reasons: An individual may choose to renounce or disclaim property due to personal beliefs, values, or preferences. This could include not wishing to benefit from a life insurance policy or annuity contract due to a moral objection to the nature of the insurance industry. It is important to note that the process of renunciation or disclaimer must adhere to the laws and regulations set forth in North Carolina. Failure to comply with the necessary legal requirements could result in unintended consequences, such as the property being distributed as if the renunciation or disclaimer never occurred. In High Point, North Carolina, there are no specific different types of renunciation or disclaimer processes for life insurance or annuity contracts. The general process involves formally declaring the intention to renounce or disclaim the property in written form, which must be accepted and acknowledged by the relevant parties involved, such as the insurance company or the estate executor. Overall, the High Point North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract provides individuals with the option to relinquish property received from life insurance policies or annuity contracts under specific legal conditions. It is a valuable tool for those seeking to manage their assets, plan their estates, or adhere to personal principles.

High Point North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

State:

North Carolina

City:

High Point

Control #:

NC-01-03

Format:

Word

Instant download

Description

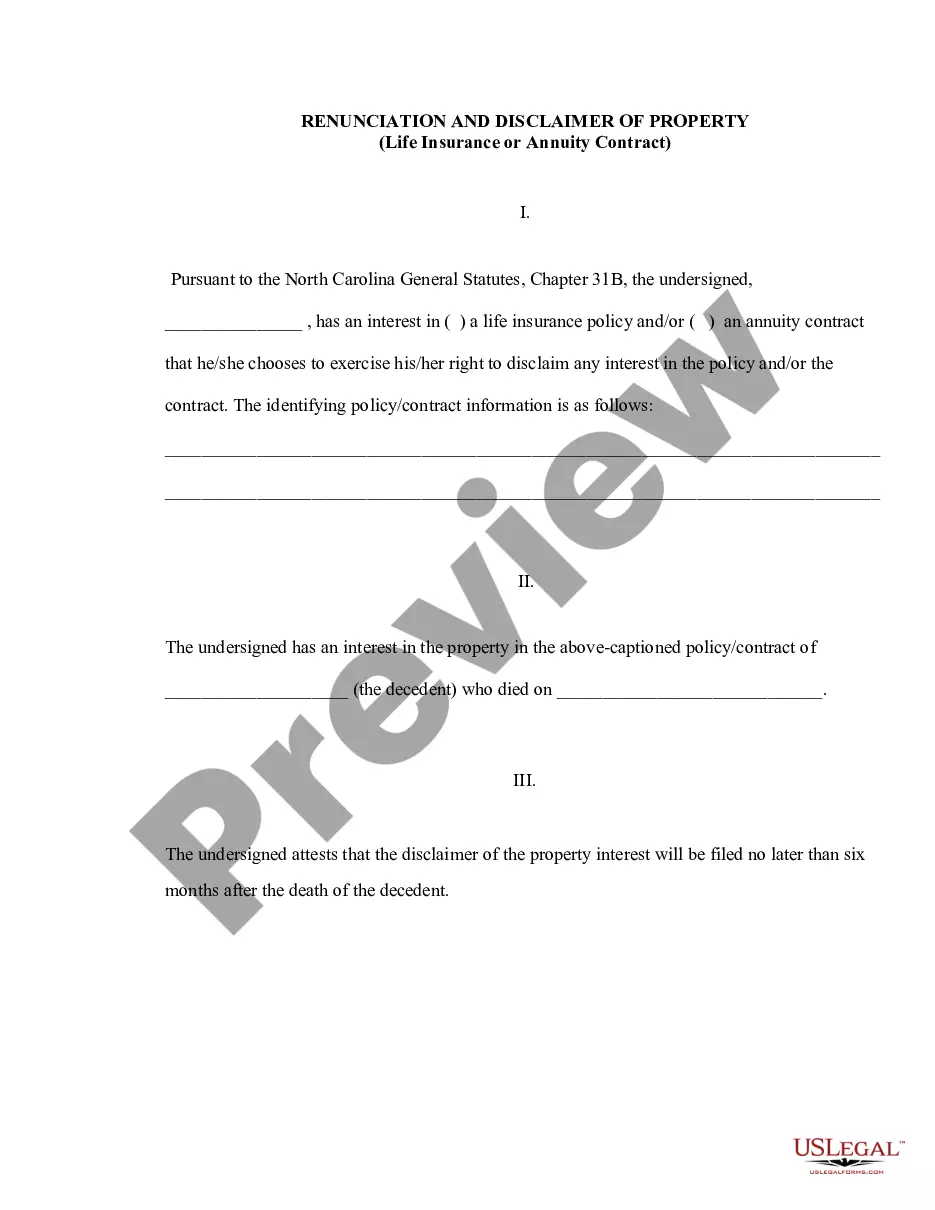

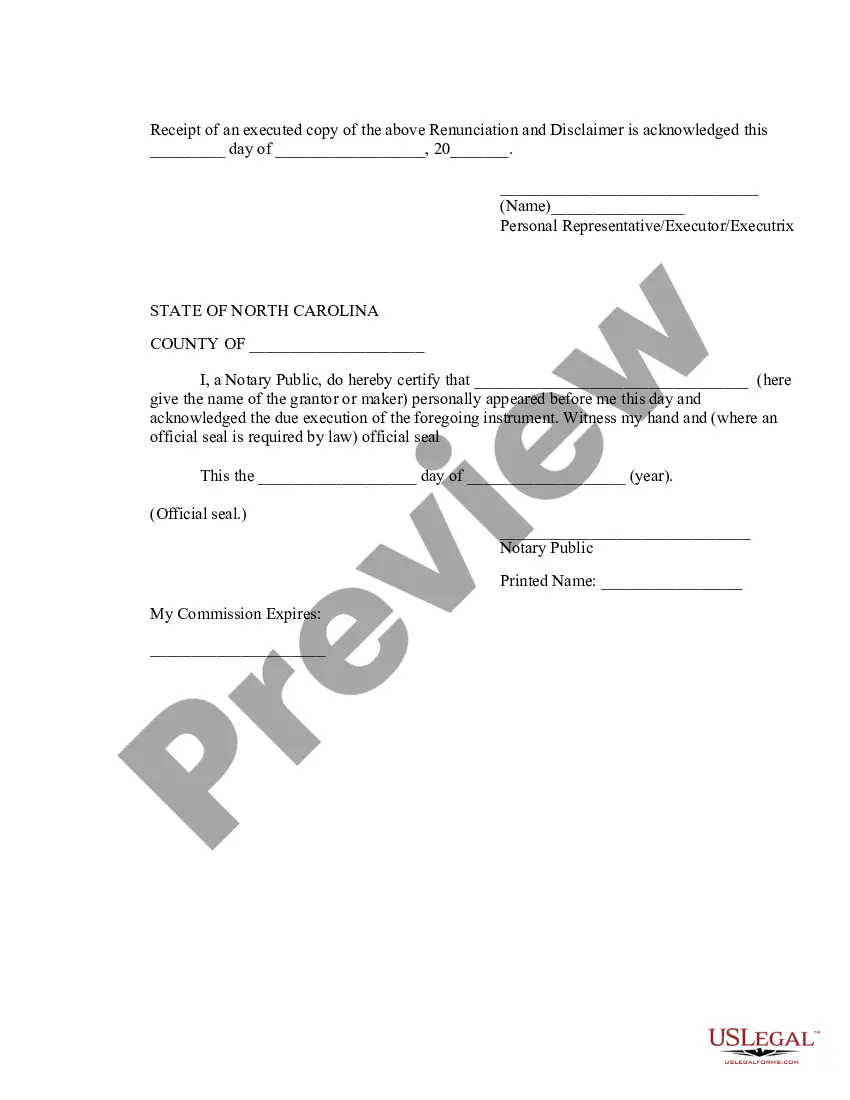

This form is a Renunciation and Disclaimer of Life Insurance or Annuity Contract proceeds. This form is for a beneficiary who gains an interest in the proceeds upon the death of the decedent, but, pursuant to the North Carolina General Statutes, Chapter 31B, has chosen to disclaim the life insurance or annuity contract proceeds. Therefore, the proceeds will devolve as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify delivery.

High Point North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to waive their rights to property received from a life insurance policy or annuity contract. In High Point, North Carolina, individuals have the option to renounce or disclaim any property they would otherwise be entitled to receive from a life insurance policy or annuity contract. This process typically occurs when a beneficiary decides that they do not wish to accept the property due to personal reasons or financial implications. By renouncing or disclaiming the property, the individual forfeits any rights or claims to it. There are various circumstances in which individuals may choose to employ the renunciation or disclaimer process. Some possible situations include: 1. Financial Planning: Individuals may renounce or disclaim property to manage their assets strategically. This could be to avoid potential taxes, maintain eligibility for government assistance programs, or to distribute assets among beneficiaries more equitably. 2. Estate Planning: Renunciation or disclaimer of property can be utilized as part of an overall estate plan to ensure that assets are distributed according to the individual's wishes. This can be particularly useful when attempting to minimize tax burdens or provide for the needs of specific beneficiaries. 3. Personal Reasons: An individual may choose to renounce or disclaim property due to personal beliefs, values, or preferences. This could include not wishing to benefit from a life insurance policy or annuity contract due to a moral objection to the nature of the insurance industry. It is important to note that the process of renunciation or disclaimer must adhere to the laws and regulations set forth in North Carolina. Failure to comply with the necessary legal requirements could result in unintended consequences, such as the property being distributed as if the renunciation or disclaimer never occurred. In High Point, North Carolina, there are no specific different types of renunciation or disclaimer processes for life insurance or annuity contracts. The general process involves formally declaring the intention to renounce or disclaim the property in written form, which must be accepted and acknowledged by the relevant parties involved, such as the insurance company or the estate executor. Overall, the High Point North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract provides individuals with the option to relinquish property received from life insurance policies or annuity contracts under specific legal conditions. It is a valuable tool for those seeking to manage their assets, plan their estates, or adhere to personal principles.

Free preview

How to fill out High Point North Carolina Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you’ve already utilized our service before, log in to your account and save the High Point North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your High Point North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!