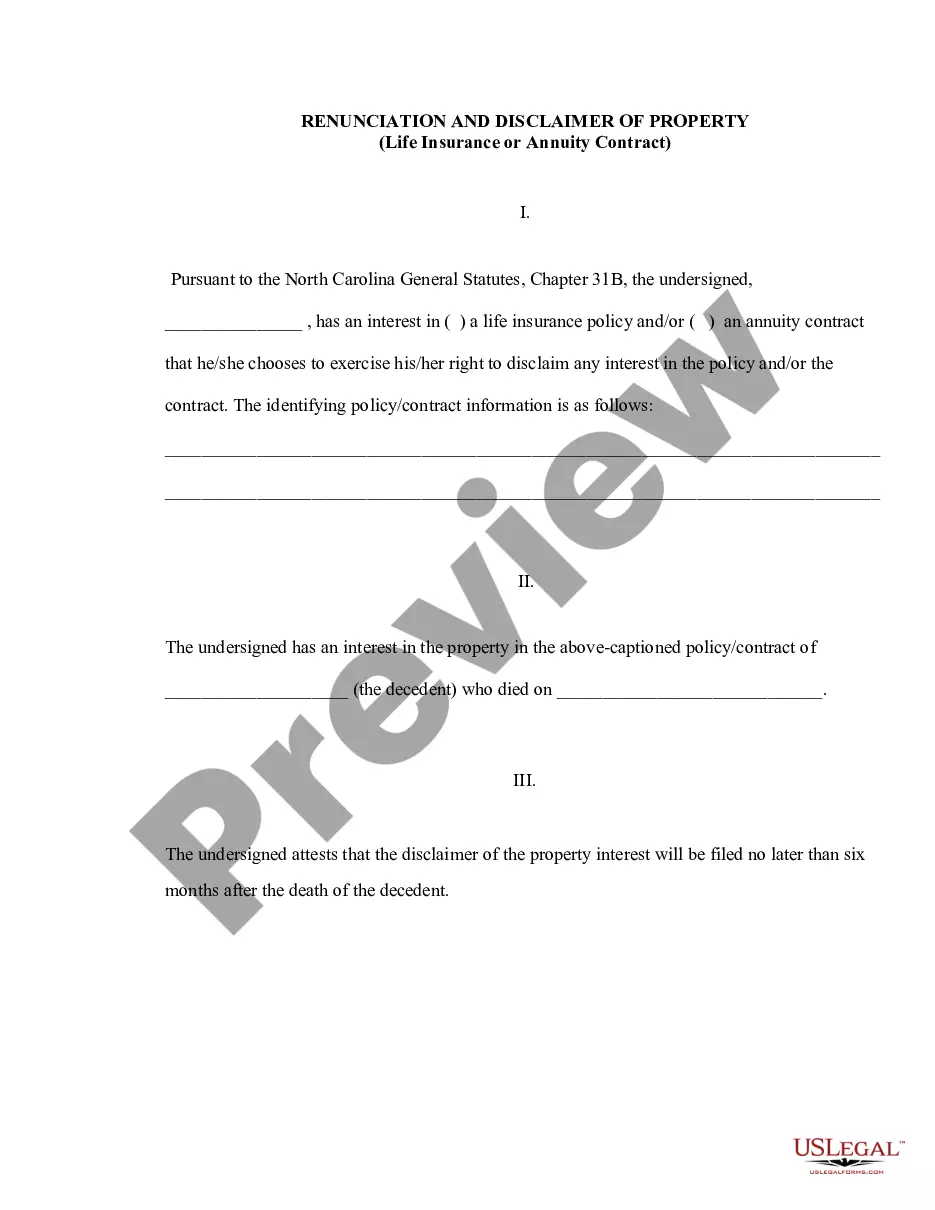

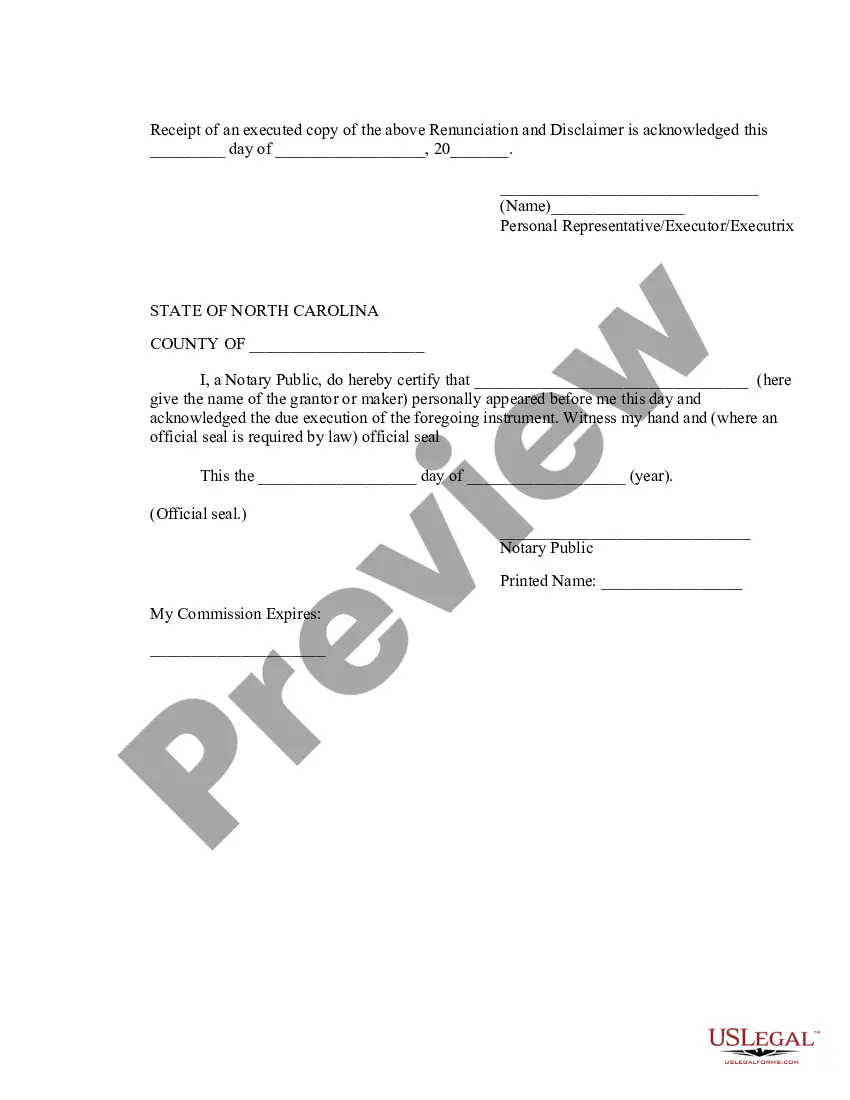

Winston-Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is a legal process that allows individuals to relinquish their rights to property received from a life insurance or annuity contract. This renunciation and disclaimer of property is usually initiated when an individual does not wish to accept the property or has a valid reason to disclaim it. Different types of renunciation and disclaimer of property include beneficiary renunciation and disclaimer, trustee renunciation and disclaimer, and executor renunciation and disclaimer. Beneficiary Renunciation and Disclaimer: In this type, a named beneficiary in a life insurance or annuity contract chooses to renounce or disclaim their right to any benefits or property received from the contract. This may occur if the beneficiary believes they are ineligible to receive the property or wishes to pass it on to another eligible individual. Trustee Renunciation and Disclaimer: When a trustee of a trust established by a life insurance or annuity contract decides to renounce or disclaim property, they are engaging in trustee renunciation and disclaimer. This could happen if the trustee believes that accepting the property would go against the best interests of the trust's beneficiaries or if they are unable or unwilling to fulfill their duties as a trustee. Executor Renunciation and Disclaimer: Executors of estates may also renounce or disclaim property received from a life insurance or annuity contract meant for the estate. They may choose to do so if they believe accepting the property could cause complications or conflicts within the estate administration process, or if they are unable or unwilling to fulfill their responsibilities as an executor. The Winston-Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract allows individuals to legally avoid responsibilities and obligations associated with accepting property received from life insurance or annuity contracts. It provides a formal process to disclaim the property, ensuring clarity and avoiding any misunderstandings. It is crucial to consult with an attorney or seek professional advice before initiating this renunciation or disclaimer process to fully understand the legal implications and requirements in Winston-Salem, North Carolina.

Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Winston–Salem North Carolina Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

We consistently aim to minimize or avert legal complications when navigating intricate law-related or financial issues.

To accomplish this, we seek legal assistance that is typically quite costly.

However, not all legal matters are likewise complicated; many can be resolved independently.

US Legal Forms is a virtual repository of current DIY legal documents addressing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and click the Get button beside it. If you misplace the document, you can always re-download it in the My documents tab.

- Our platform enables you to manage your affairs without needing to consult legal advice.

- We offer access to legal document templates that may not be readily available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Take advantage of US Legal Forms anytime you need to obtain and download the Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract or any other document swiftly and securely.

Form popularity

FAQ

To disclaim an inheritance in North Carolina, you must file a written renunciation stating your intention to refuse the property. First, ensure you complete the disclaimer within nine months of the inheritance. This process is crucial when dealing with benefits from a life insurance or annuity contract. Utilizing the USLegalForms platform can streamline your submission and provide templates for a proper Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

To disclaim an inheritance in North Carolina, you must file a disclaimer in writing, stating your intention to refuse the property. This document should be submitted to the estate executor or administrator within a reasonable period after the inheritance is received. By following these steps, the property can be passed on to the next beneficiary as specified in the will or by state law. For further assistance, platforms like USLegalForms can provide useful templates and guidance on the Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

To avoid capital gains tax on inherited property in North Carolina, you should first understand the stepped-up basis rule. This rule allows you to inherit property at its fair market value at the time of death, which can reduce or eliminate capital gains when you eventually sell it. It's crucial to consult a knowledgeable attorney or financial advisor to navigate this process effectively. You can find helpful information regarding the Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract to learn more about your options.

When you refuse an inheritance, it means you are renouncing it formally. In Winston–Salem North Carolina, when you choose to disregard your inheritance, it generally passes to the next eligible beneficiary under the terms of the will or state laws. This process can sometimes benefit others in your family, as they may receive a larger share. If you need assistance with this process, consider exploring resources on the Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

The law of renunciation in North Carolina allows individuals to refuse inheritance rights, enabling them to disavow property, including life insurance and annuity contracts. This law is significant in estate planning, as it provides an option for beneficiaries who may prefer not to accept certain assets. Renunciation must be executed following state guidelines to be legally binding. US Legal Forms can assist you in navigating the Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, ensuring compliance with all legal requirements.

In North Carolina, a spouse does not automatically inherit everything, but they do receive a significant portion of the estate. North Carolina law entitles spouses to a share of the marital property and potentially other assets, depending on the estate's structure. If a spouse wishes to renounce their share, especially in cases involving life insurance or annuity contracts, they must follow the appropriate legal procedures. For more information about the Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, US Legal Forms can be a useful resource.

In North Carolina, the statute of limitations for filing a disclaimer is generally set at three years from the date of the decedent's death. However, understanding the nuances of how this applies specifically to disclaimed property from life insurance or annuity contracts is essential. Failing to act within this timeframe could result in losing your right to renounce your inheritance. Consider using platforms like US Legal Forms to navigate these timelines effectively, especially concerning the Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

The statute of renunciation in North Carolina allows individuals to formally renounce their rights to inherit property. This law is detailed in the North Carolina General Statutes and provides guidelines on how to execute a renunciation effectively. Understanding the specifics of this statute is essential, especially when dealing with property from life insurance or annuity contracts. You can consult resources like US Legal Forms for comprehensive guidance on the Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

To disclaim an inheritance in North Carolina, you must follow specific legal procedures outlined in the law. Generally, you need to file a written disclaimer with the estate's personal representative. This disclaimer should clearly state your intention to renounce your inheritance related to property from a life insurance or annuity contract. Ensure this process aligns with the Winston–Salem North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract statutes to avoid any complications.