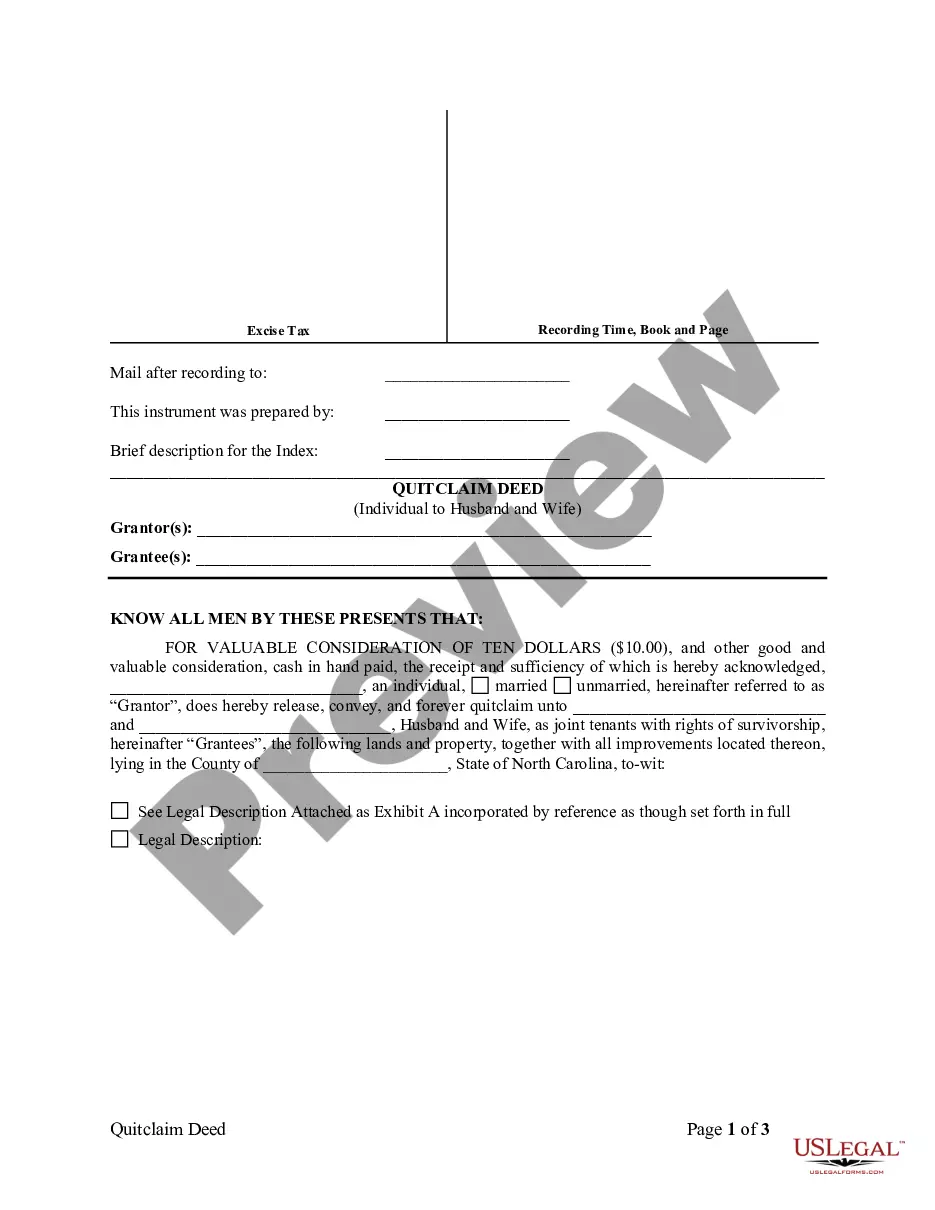

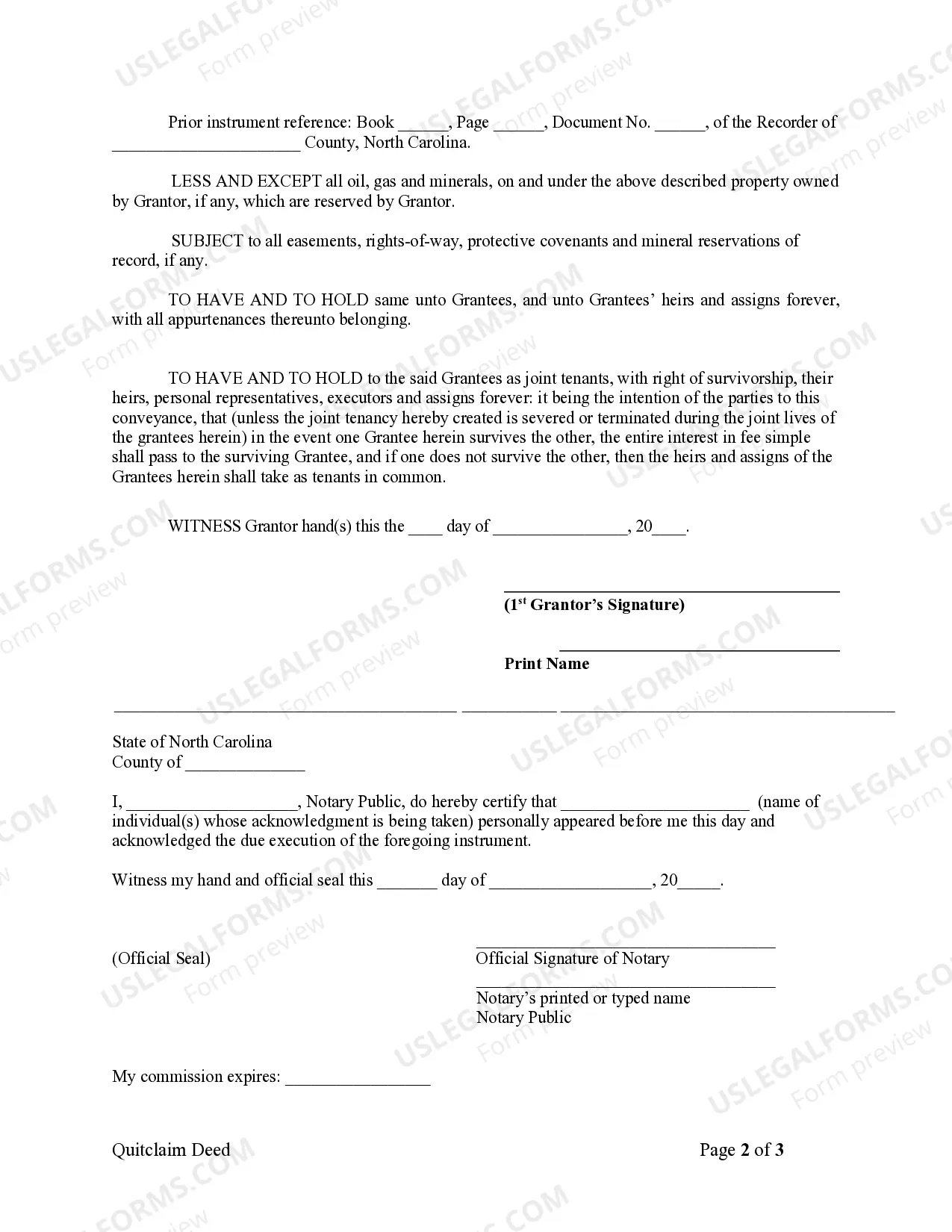

A High Point North Carolina Quitclaim Deed from Individual to Husband and Wife is a legal document that allows an individual to transfer their interest in a property to a married couple. This deed is commonly used in real estate transactions when one spouse wants to transfer their ownership in a property to both themselves and their spouse. In such a deed, the individual acts as the granter, while the husband and wife act as the grantees. The granter is the person giving up their ownership rights, and the grantees are the recipients of the property rights. The purpose of this deed is to legally transfer the granter's interest in a property to the couple, ensuring joint ownership. This type of transaction is a common way for a married couple to establish joint ownership of a property or for one spouse to add their partner as an owner. It is important to note that a quitclaim deed transfers the granter's interest "as-is," without any warranties or guarantees regarding the property's title. This means that the granter does not guarantee that they have clear ownership of the property or that there are no future claims or liens on it. Different variations or types of High Point North Carolina Quitclaim Deed from Individual to Husband and Wife may include: 1. High Point North Carolina Enhanced Life Estate Quitclaim Deed: This type of quitclaim deed includes provisions that allow the granter to retain a life estate in the property. It means that the granter can continue to live in or use the property until their death, at which point the ownership automatically transfers to the husband and wife. 2. High Point North Carolina Joint Tenancy Quitclaim Deed: This type of quitclaim deed establishes joint tenancy ownership for the husband and wife. Joint tenancy includes the right of survivorship, meaning that if one spouse passes away, their ownership interest automatically transfers to the surviving spouse. 3. High Point North Carolina Tenants in Common Quitclaim Deed: In this type of quitclaim deed, the property ownership is held by the husband and wife as tenants in common. Unlike joint tenancy, tenants in common do not have the right of survivorship. Instead, each spouse owns a specific percentage of the property, and upon their death, their ownership interest transfers according to their will or intestate succession laws. It is important to consult with a qualified real estate attorney or professional to determine the specific type of quitclaim deed that best suits the needs of the individuals involved in the property transfer.

High Point North Carolina Quitclaim Deed from Individual to Husband and Wife

Description

How to fill out High Point North Carolina Quitclaim Deed From Individual To Husband And Wife?

Do you need a trustworthy and affordable legal forms supplier to get the High Point North Carolina Quitclaim Deed from Individual to Husband and Wife? US Legal Forms is your go-to choice.

No matter if you need a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of specific state and area.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the High Point North Carolina Quitclaim Deed from Individual to Husband and Wife conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is good for.

- Start the search over if the template isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the High Point North Carolina Quitclaim Deed from Individual to Husband and Wife in any provided format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time researching legal papers online for good.