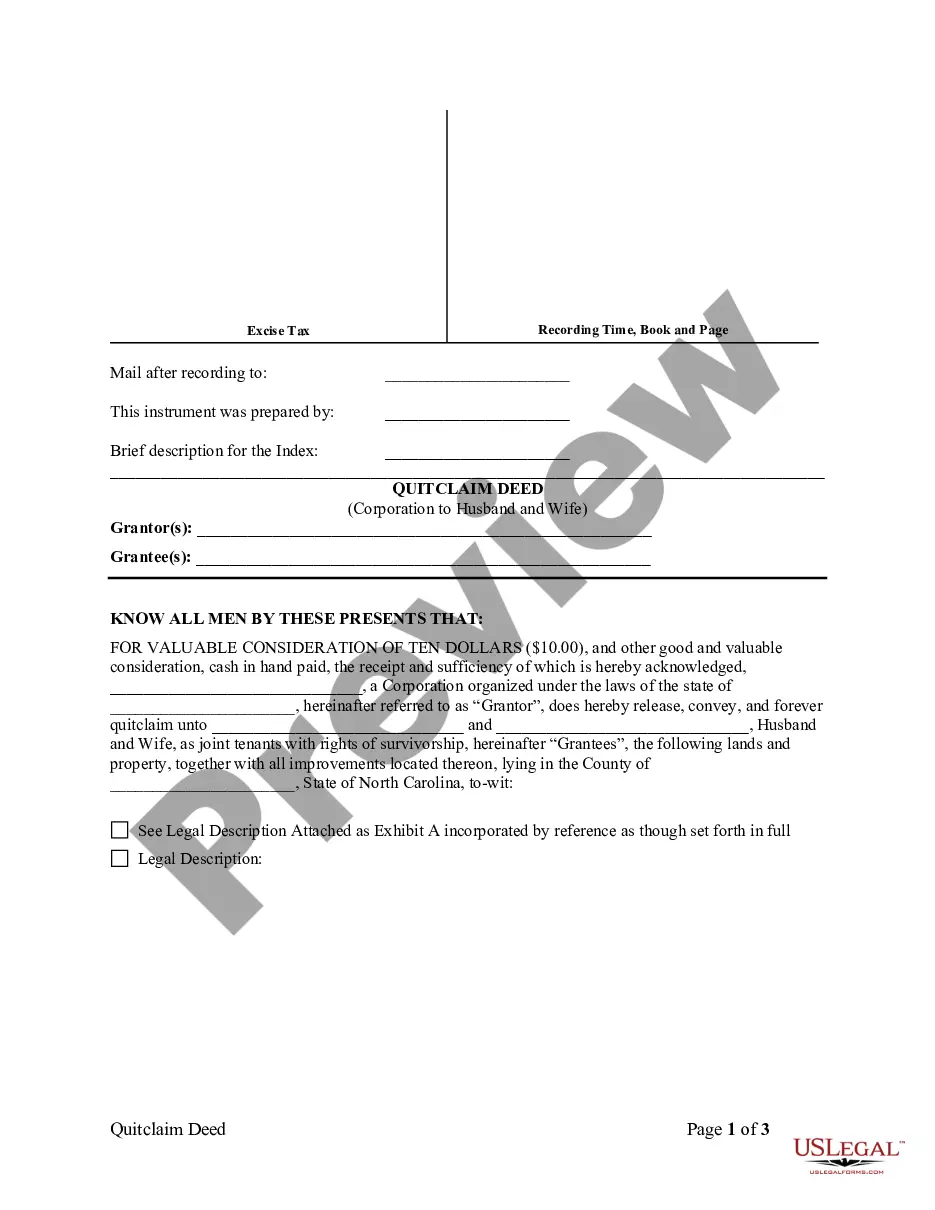

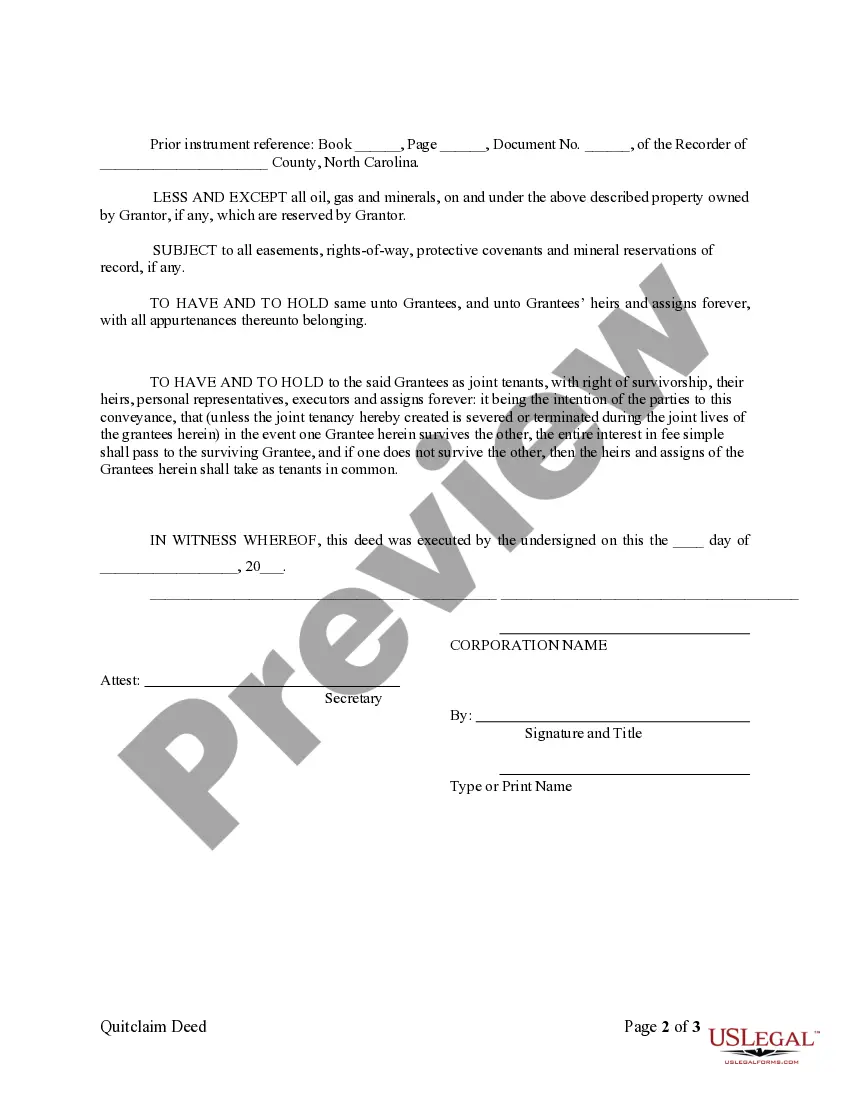

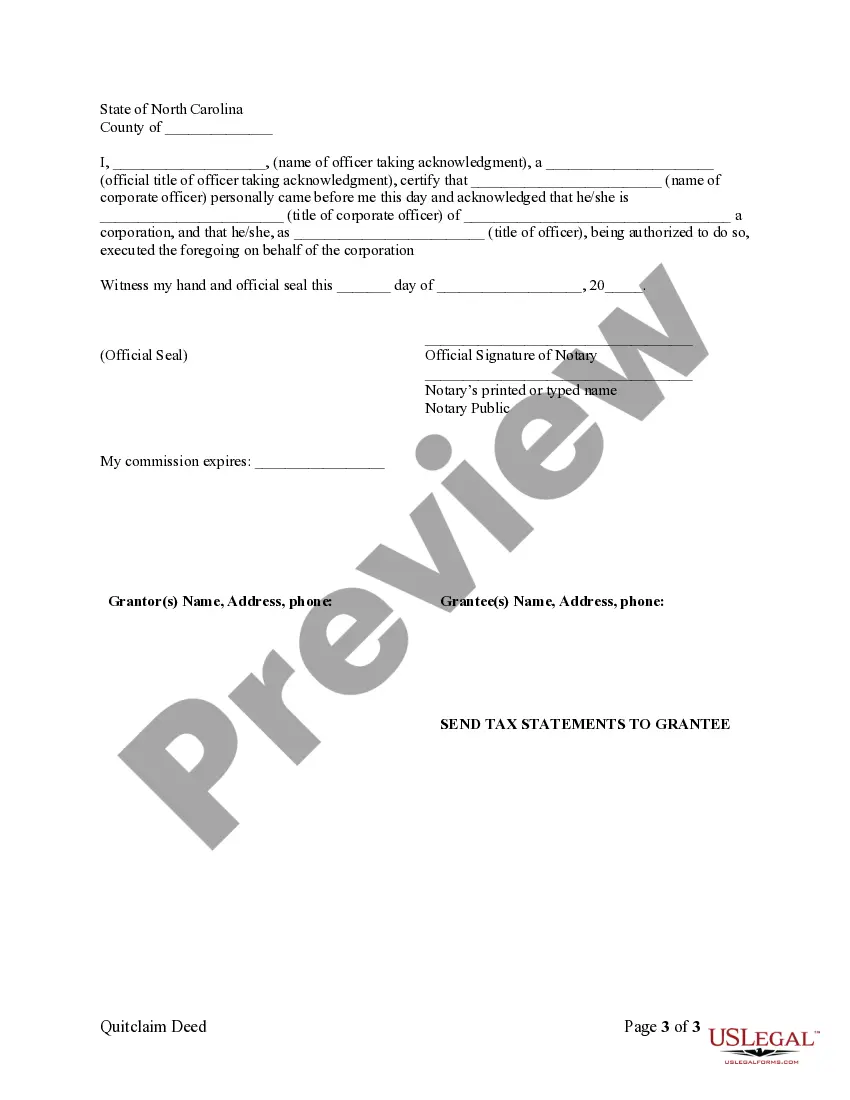

A Charlotte North Carolina Quitclaim Deed from Corporation to Husband and Wife is a legal document that transfers the ownership of a property from a corporation to a married couple. This type of deed is commonly used when the property is being transferred within a family or between closely related parties. Keywords: Charlotte North Carolina, Quitclaim Deed, Corporation, Husband and Wife There are typically two types of Charlotte North Carolina Quitclaim Deeds from Corporation to Husband and Wife: 1. General Quitclaim Deed: This type of deed transfers the corporation's interest in the property to the husband and wife without any guarantee or warranty regarding the property's title. The corporation essentially releases any claim it may have on the property and transfers its ownership rights to the married couple. It is important for the husband and wife to understand that they are assuming all risks associated with the property's title. 2. Special Warranty Deed: Unlike the general quitclaim deed, a special warranty deed provides a limited warranty of the property's title. The corporation warrants that it is transferring the property to the husband and wife free and clear of any encumbrances, except those specifically stated in the deed. This means that the corporation takes responsibility for any title issues that occurred during its ownership of the property but does not provide a broad warranty of the property's entire history. When preparing a Charlotte North Carolina Quitclaim Deed from Corporation to Husband and Wife, the following details are typically included: 1. Parties Involved: The names and addresses of the corporation, husband, and wife are specified. It is essential to provide accurate and up-to-date information for all parties involved in the transaction. 2. Property Description: A detailed description of the property being transferred is included in the deed. This may include the property's address, legal description, and any other relevant identifying information to ensure there is no confusion about the property being transferred. 3. Consideration: The consideration section of the deed states the amount of money or other valuables exchanged for the transfer of the property. In some cases, a nominal amount, such as $1, is stated to show that the transfer was a gift or part of an inheritance. 4. Signatures and Notarization: The deed must be signed by authorized representatives of the corporation, as well as the husband and wife. Notarization is also typically required to validate the signatures and ensure the proper execution of the deed. It is important to note that while a quitclaim deed transfers the corporation's interest in the property, it does not guarantee or ensure that the property is free from any liens, encumbrances, or other claims. It is highly recommended seeking legal advice and conduct a thorough title search to ensure the property's title is clear before completing the transfer.

Charlotte North Carolina Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Charlotte North Carolina Quitclaim Deed From Corporation To Husband And Wife?

Are you searching for a trustworthy and affordable provider of legal forms to purchase the Charlotte North Carolina Quitclaim Deed from Corporation to Spouse? US Legal Forms is your ultimate choice.

Whether you require a simple document to establish guidelines for living together with your partner or a collection of forms to facilitate your separation or divorce through legal channels, we have you covered. Our platform presents over 85,000 current legal document templates for personal and commercial use. All templates we provide are not generic and are tailored in accordance with the regulations of specific states and counties.

To obtain the form, you must Log Into your account, locate the needed form, and click the Download button adjacent to it. Please keep in mind that you can retrieve your previously acquired form templates at any time from the My documents section.

Is this your initial visit to our website? No problem. You can effortlessly create an account, but beforehand, please ensure to do the following.

Now you can establish your account. Then pick a subscription plan and proceed to make a payment. Once the payment is finalized, download the Charlotte North Carolina Quitclaim Deed from Corporation to Spouse in any available file format. You can revisit the site whenever needed and redownload the form without any cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and put an end to wasting hours searching for legal papers online once and for all.

- Check if the Charlotte North Carolina Quitclaim Deed from Corporation to Spouse aligns with your state and local laws.

- Review the details of the form (if available) to understand its suitability for your situation.

- Restart the search if the form does not meet your legal needs.

Form popularity

FAQ

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

A. North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advice of legal counsel.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps ? recordings costs are normally less than $50.00.)

Keep in mind that if you sign the Quitclaim Deed giving him your legal rights in the home, you no longer have any legal rights to the home but you can still be financially responsible for the mortgage if your name is on the mortgage.

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.