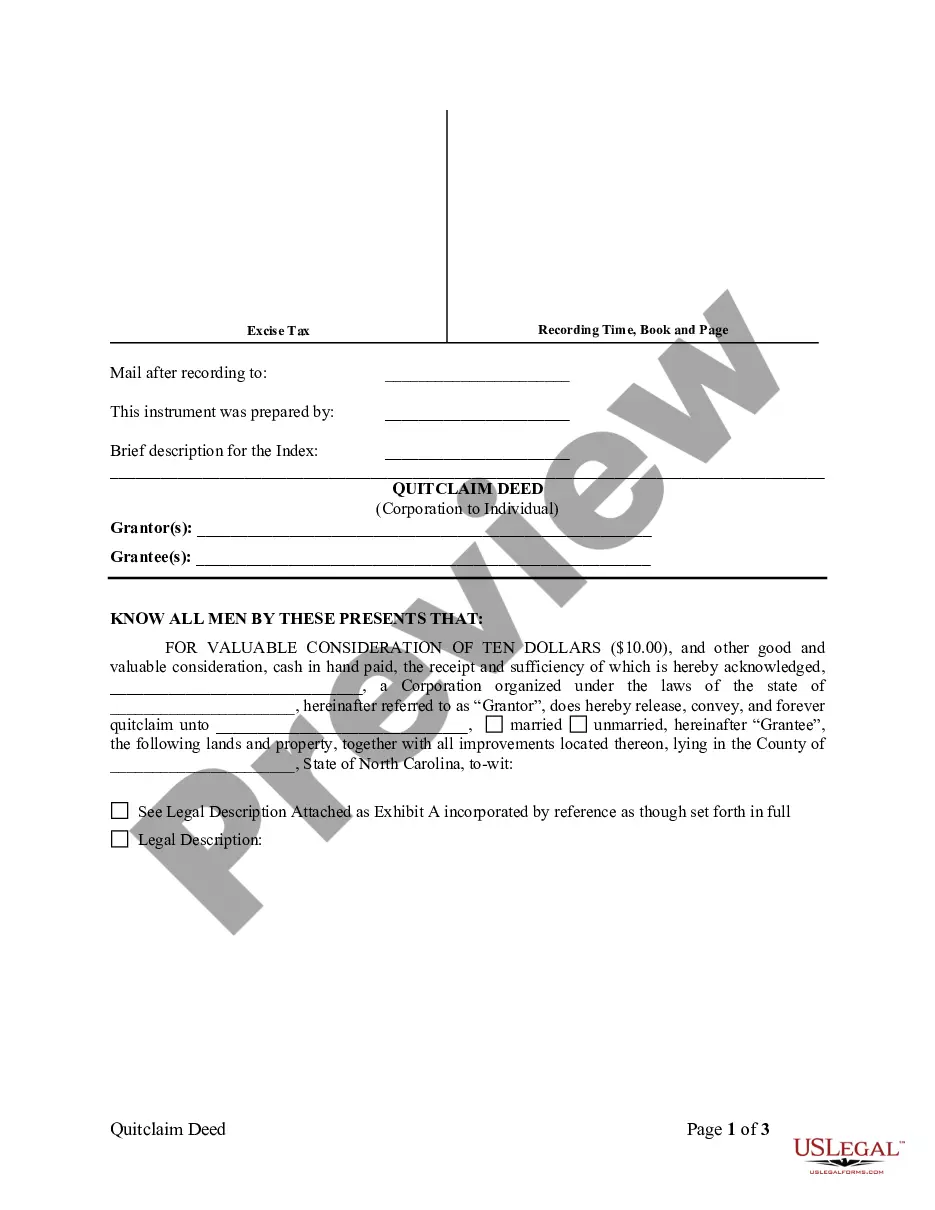

Charlotte North Carolina Quitclaim Deed from Corporation to Individual

Description

How to fill out North Carolina Quitclaim Deed From Corporation To Individual?

Utilize the US Legal Forms and gain immediate access to any form template you need.

Our valuable website with numerous documents simplifies the process of locating and obtaining nearly any document sample you desire.

You can export, complete, and sign the Charlotte North Carolina Quitclaim Deed from Corporation to Individual in just a few minutes instead of spending countless hours online searching for the correct template.

Using our catalog is an excellent approach to enhance the security of your document submissions.

If you haven't yet created an account, follow the steps below.

- Our experienced attorneys frequently examine all the documents to ensure that the templates are suitable for a specific region and adhere to current laws and regulations.

- How can you acquire the Charlotte North Carolina Quitclaim Deed from Corporation to Individual.

- If you have an account, simply Log In to your profile.

- The Download feature will be available for all the documents you access.

- Additionally, you can view all the previously saved files in the My documents section.

Form popularity

FAQ

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

Before you can transfer property ownership to someone else, you'll need to complete the following. Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

A deed is a legal instrument that evidences legal ownership of a parcel of real property, which includes land and any buildings on the land. To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.