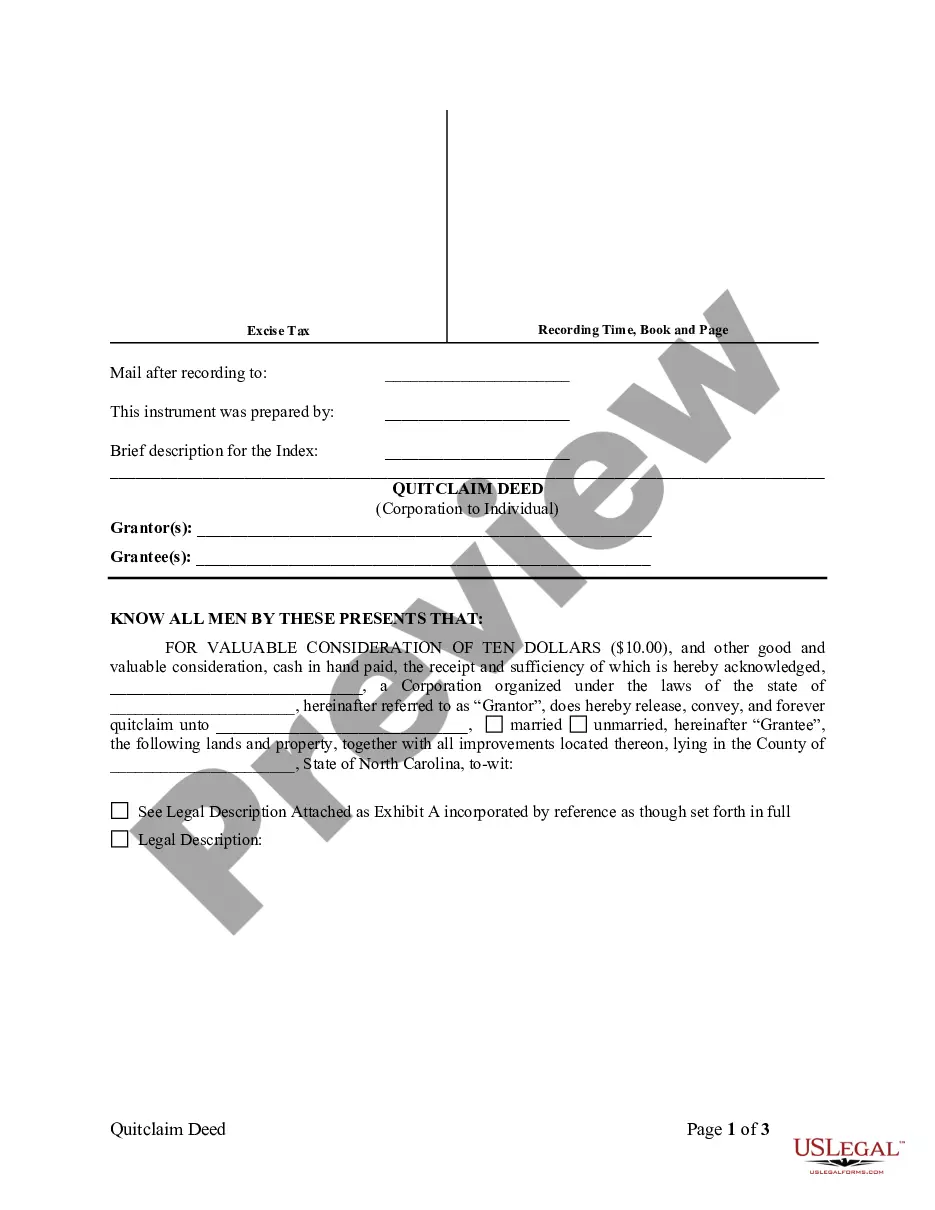

Greensboro North Carolina Quitclaim Deed from Corporation to Individual

Description

How to fill out Greensboro North Carolina Quitclaim Deed From Corporation To Individual?

Regardless of social or professional rank, finalizing legal documents is an unfortunate requirement in today's society.

Frequently, it’s nearly impossible for individuals without a legal background to create such documents from scratch, primarily due to the intricate language and legal intricacies they entail.

This is where US Legal Forms can provide assistance.

Ensure that the form you’ve located is tailored to your region since the regulations of one state or county do not apply to another.

Preview the document and review a brief outline (if available) of scenarios for which the document can be utilized.

- Our service features an extensive library containing over 85,000 state-specific documents that cater to nearly every legal situation.

- US Legal Forms also acts as a valuable tool for associates or legal advisors aiming to enhance their efficiency with our do-it-yourself forms.

- Whether you seek the Greensboro North Carolina Quitclaim Deed from Corporation to Individual or any other document relevant to your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how you can swiftly obtain the Greensboro North Carolina Quitclaim Deed from Corporation to Individual using our reliable service.

- If you are currently a subscriber, you can simply Log In to your account to download the required form.

- However, if you are new to our platform, follow these steps before acquiring the Greensboro North Carolina Quitclaim Deed from Corporation to Individual.

Form popularity

FAQ

A deed is a legal instrument that evidences legal ownership of a parcel of real property, which includes land and any buildings on the land. To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

A. North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advice of legal counsel.

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.