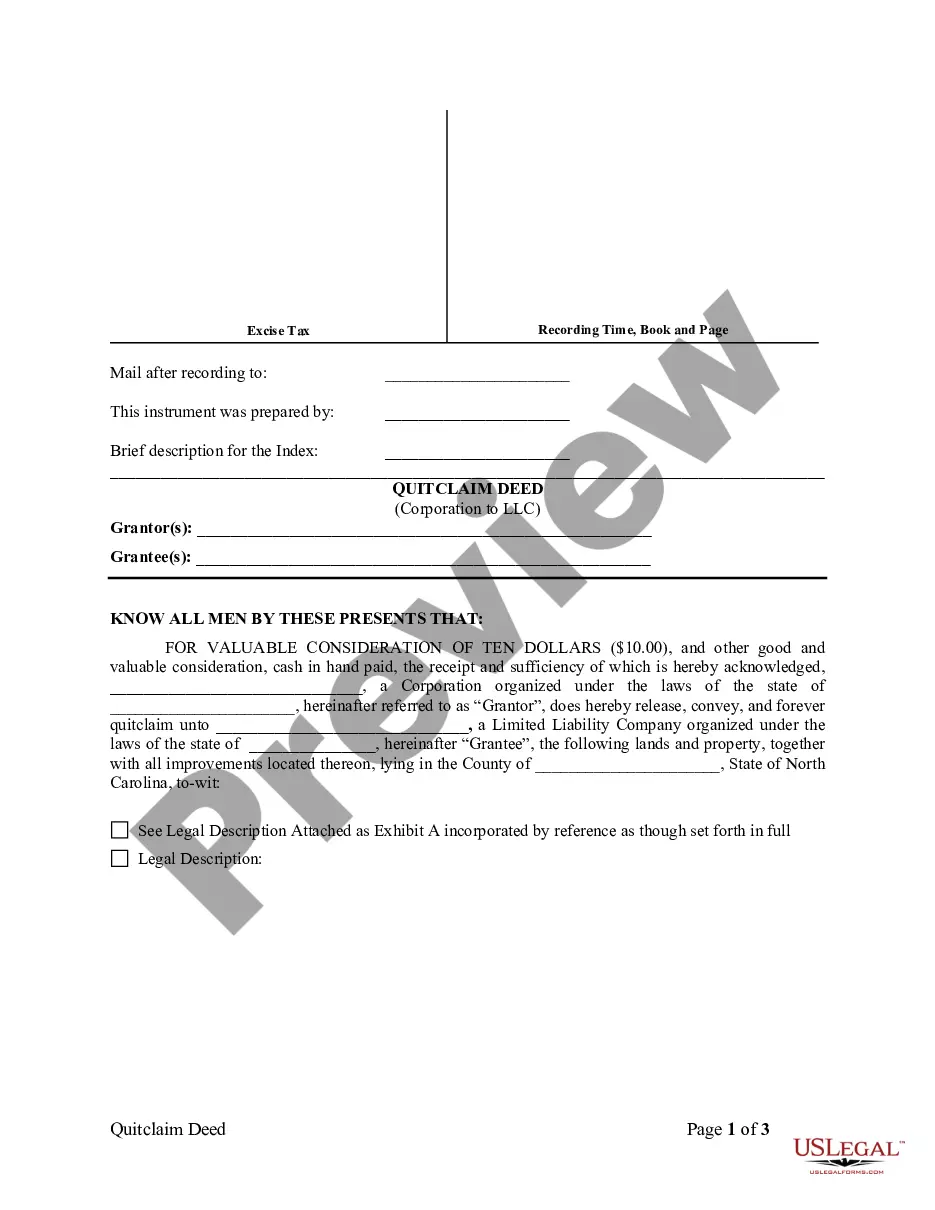

Charlotte North Carolina Quitclaim Deed from Corporation to LLC

Description

How to fill out North Carolina Quitclaim Deed From Corporation To LLC?

If you have previously used our service, sign in to your account and store the Charlotte North Carolina Quitclaim Deed from Corporation to LLC on your device by selecting the Download option. Ensure your subscription is current. If not, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have indefinite access to every document you have acquired: you can find it in your profile under the My documents section whenever you wish to reuse it again. Take advantage of the US Legal Forms service to effortlessly find and save any template for your personal or business requirements!

- Confirm you’ve found the correct document. Review the description and utilize the Preview feature, if present, to verify if it aligns with your requirements. If it does not suit you, use the Search tab above to find the right one.

- Buy the template. Click the Buy Now option and select a monthly or annual subscription plan.

- Create an account and process the payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Charlotte North Carolina Quitclaim Deed from Corporation to LLC. Select the file format for your document and store it on your device.

- Finish your document. Print it out or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

If your county government does not provide a deed, you may purchase one from a local stationery store or download one from the Internet. You could even prepare your own, although you'll need to make sure the language is correct. You can also pay an attorney to prepare one for you.

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.

A North Carolina quit claim deed is a legal form used to convey real estate in North Carolina from one person to another. A quitclaim, unlike a warranty deed, does not come with a guarantee from the seller, or grantor, as to whether the grantor has clear title to the property or has the authority to sell the property.

A quitclaim deed is likely the fastest, easiest, and most convenient way to transfer your ownership interest in a property or asset to a family member. Unlike other kinds of deeds, such as general and special warranty deeds, quitclaim deeds make no warranties or promises about what is being transferred.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

Can I prepare my own deed and have it recorded? A. North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advice of legal counsel.

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.

Average Title transfer service fee is ?20,000 for properties within Metro Manila and ?30,000 for properties outside of Metro Manila.

As the buyer of a property, you are the one responsible for recording the deed. Deeds for real estate need to be filed directly with the municipality or county where the property is located. The documents must be signed, witnessed, and notarized in order to be registered.

A deed is a legal instrument that evidences legal ownership of a parcel of real property, which includes land and any buildings on the land. To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.