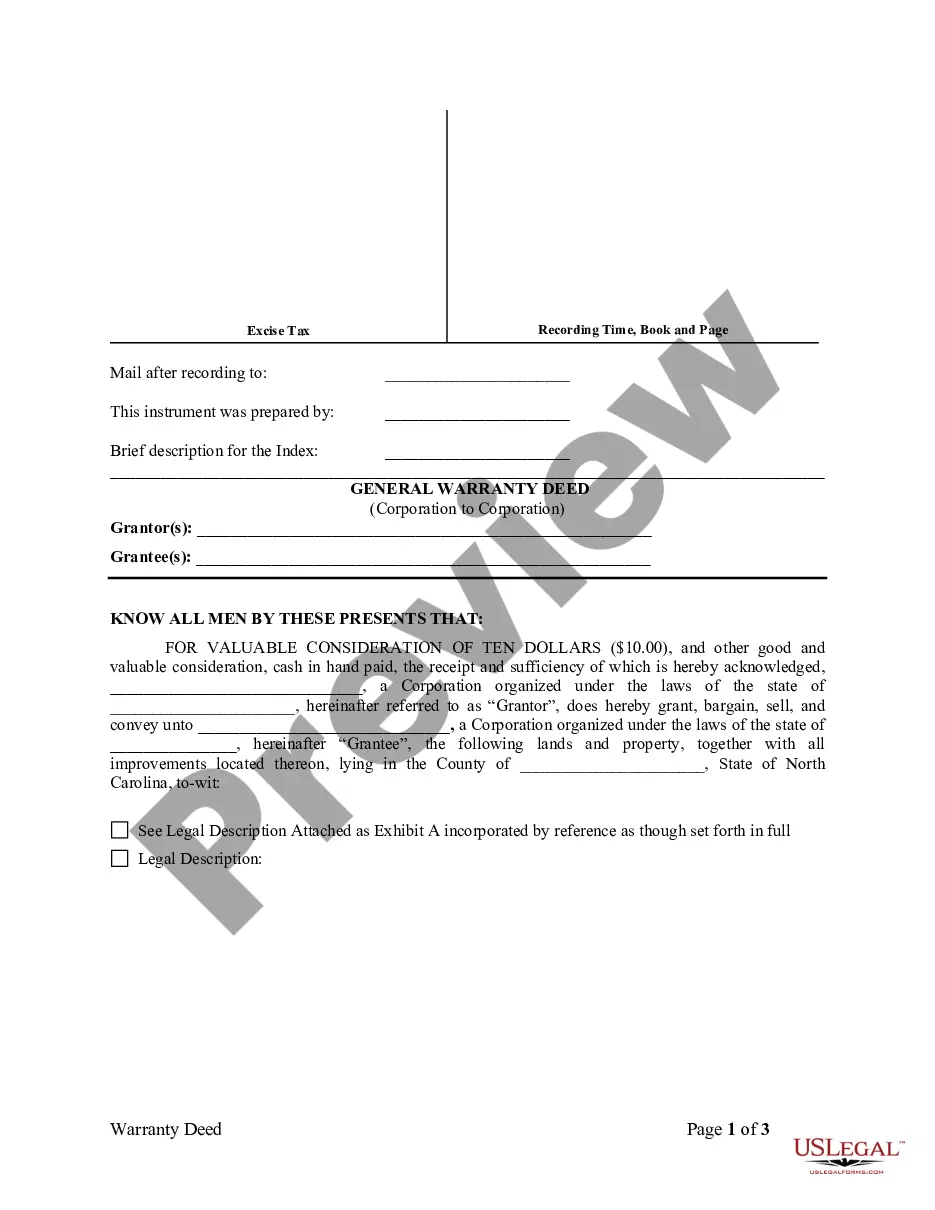

Greensboro North Carolina General Warranty Deed from Corporation to Corporation

Description

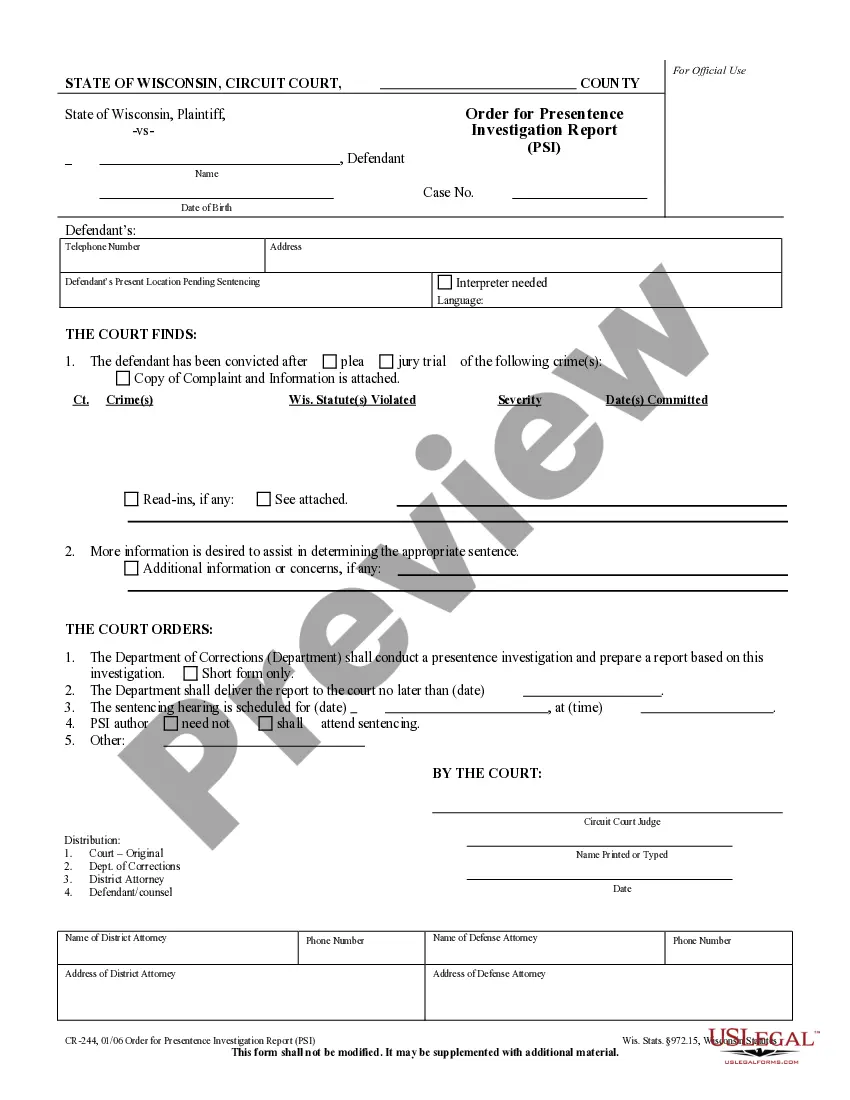

How to fill out Greensboro North Carolina General Warranty Deed From Corporation To Corporation?

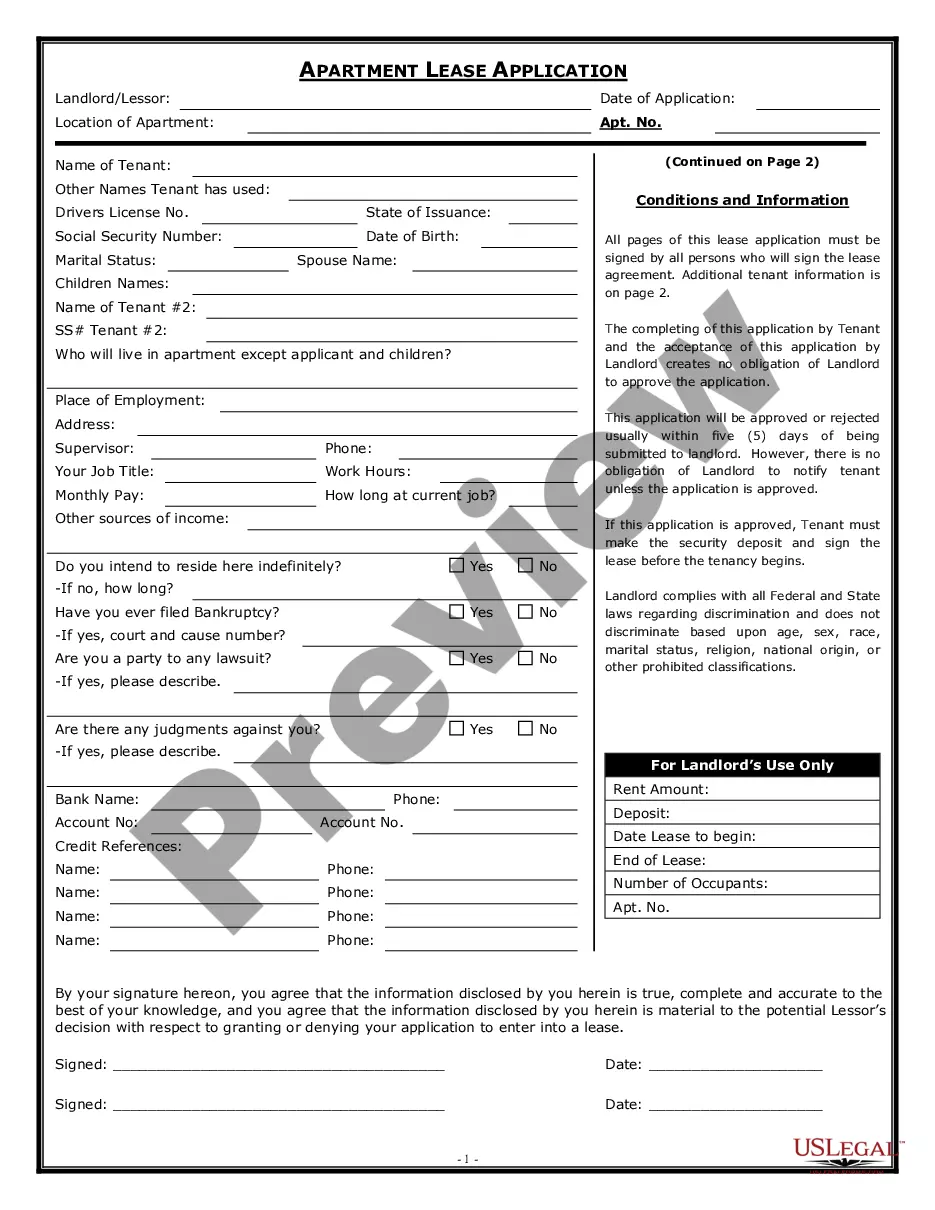

Regardless of one's social or professional ranking, filling out law-related documents is a regrettable requirement in the contemporary professional landscape.

Frequently, it is nearly impossible for individuals without legal education to create such documents from scratch, primarily due to the complex terminology and legal subtleties they entail.

This is where US Legal Forms steps in to provide assistance.

Confirm that the form you have discovered is tailored to your locality, as the regulations of one state or county do not apply to another.

Examine the form and review a brief summary (if available) of situations where the document can be utilized.

- Our platform boasts an extensive collection of over 85,000 ready-to-utilize state-specific forms suitable for nearly every legal situation.

- US Legal Forms is also an excellent tool for associates or legal advisors aiming to save time with our DIY paperwork.

- Whether you're seeking the Greensboro North Carolina General Warranty Deed from Corporation to Corporation or any other document relevant to your jurisdiction, US Legal Forms makes everything easily accessible.

- Here’s a quick guide to obtaining the Greensboro North Carolina General Warranty Deed from Corporation to Corporation swiftly using our dependable service.

- If you are already a subscriber, simply Log In/">Log In to your account to acquire the necessary form.

- If you are new to our library, ensure you follow these steps before downloading the Greensboro North Carolina General Warranty Deed from Corporation to Corporation.

Form popularity

FAQ

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

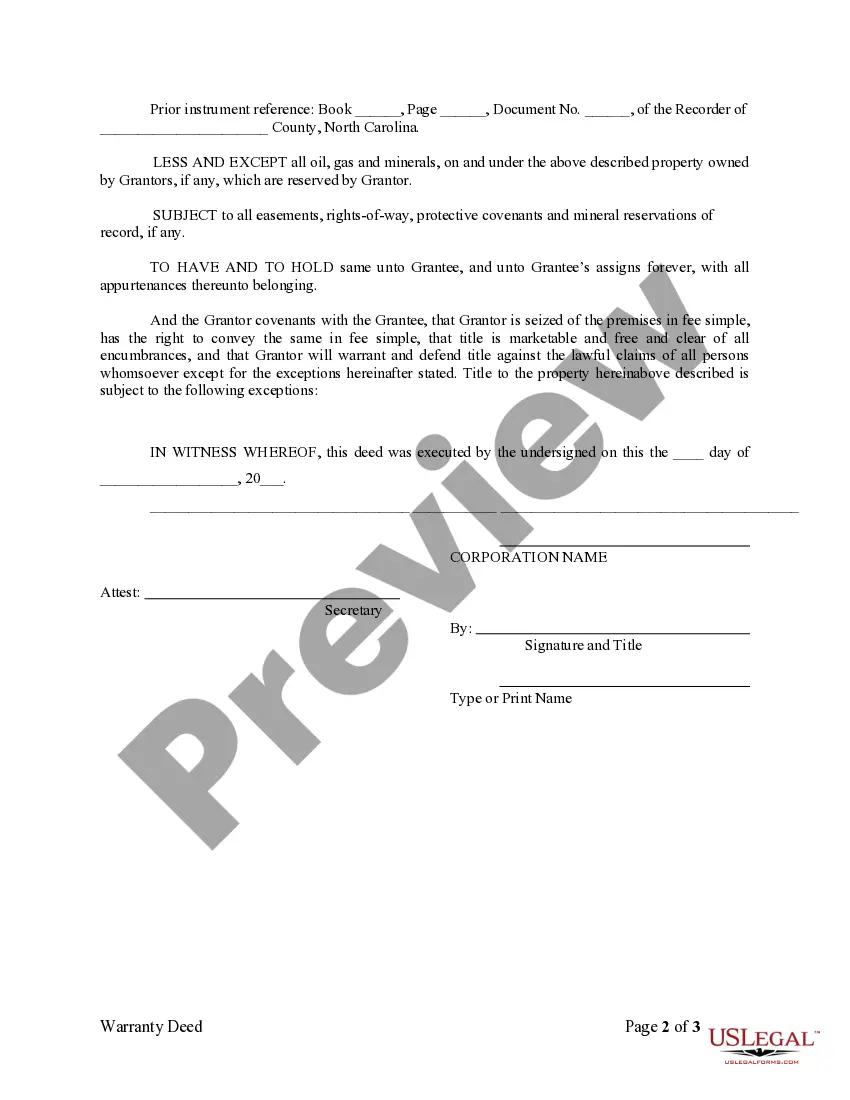

The key legal requirements for a document to be a formal deed are: The document must be in writing. The document must make clear that it is intended to be a deed ? known as the face value requirement.The document must be properly executed as a deed.The document must be delivered.

The basic requirements of a valid deed are (1) written instrument, (2) competent grantor, (3) identity of the grantee, (4) words of conveyance, (5) adequate description of the land, (6) consideration, (7) signature of grantor, (8) witnesses, and (9) delivery of the completed deed to the grantee.

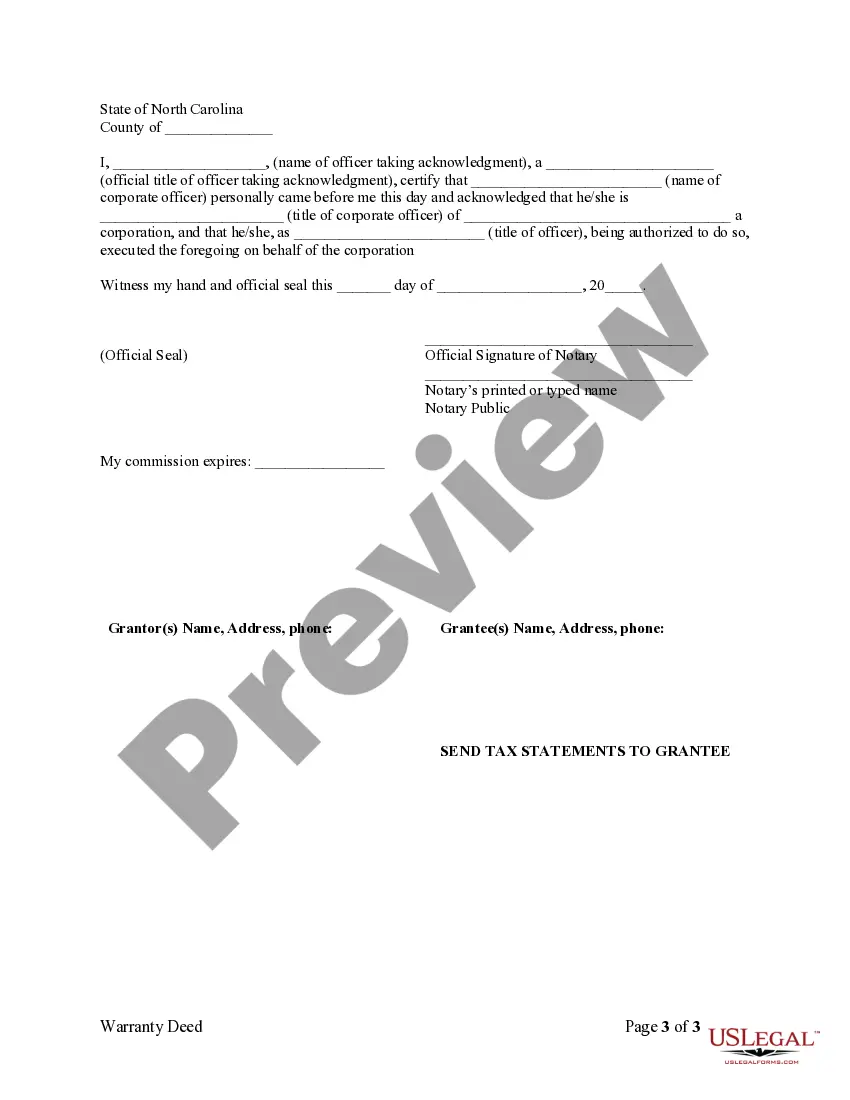

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.

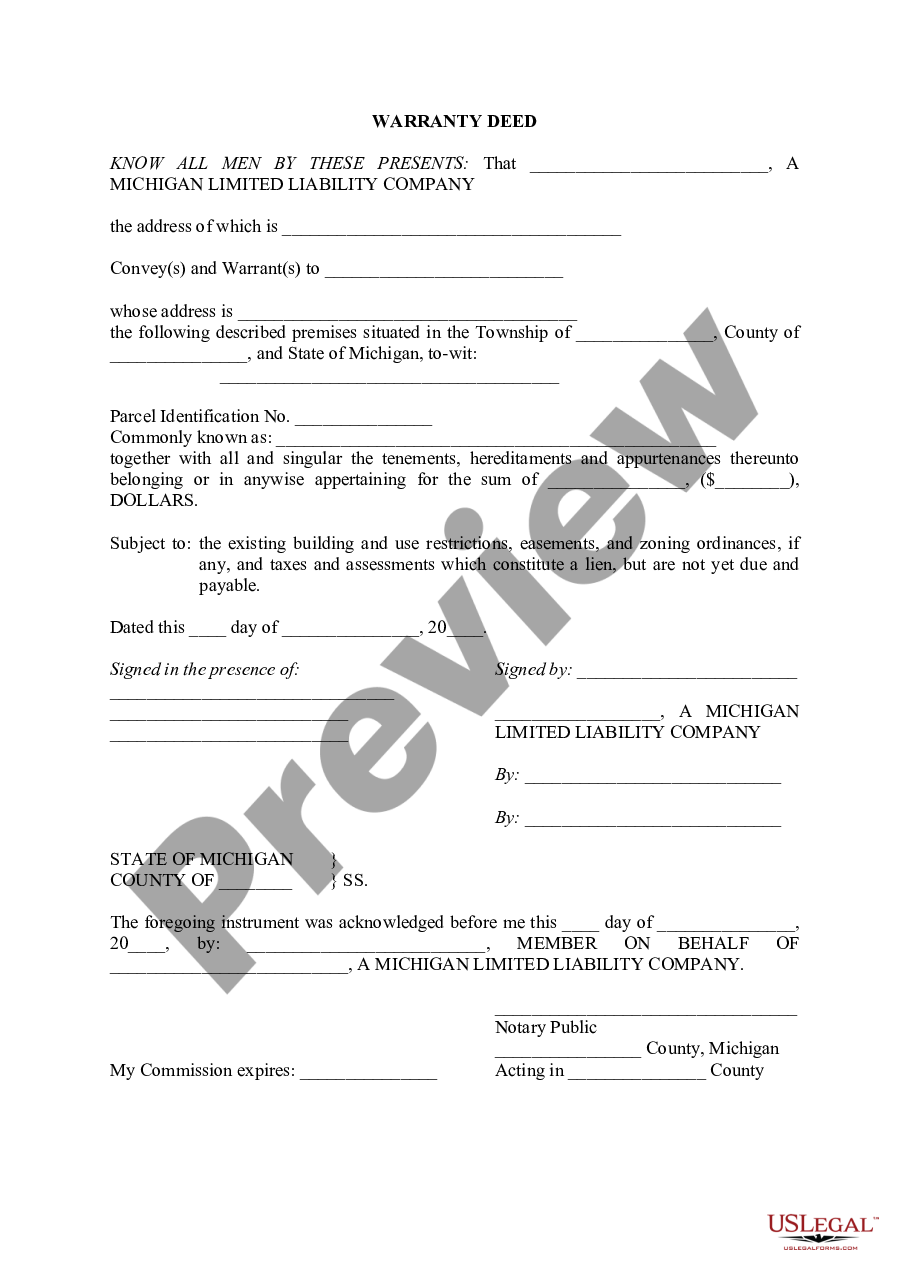

A General Warranty Deed is a deed in which the party conveying the property (the ?Grantor?) warrants and guarantees to the party receiving the conveyance (the ?Grantee?) that the title to the property he is conveying is good and unencumbered as against all persons.

A general warranty deed must include the following to be valid: The name and address of the seller (called the grantor) The name and address of the buyer (called the grantee) A legal description of the property (found on the previous deed) A statement that the grantor is transferring the property to the grantee.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

What Are the Steps to Transfer a Deed Yourself? Retrieve your original deed.Get the appropriate deed form.Draft the deed.Sign the deed before a notary.Record the deed with the county recorder.Obtain the new original deed.