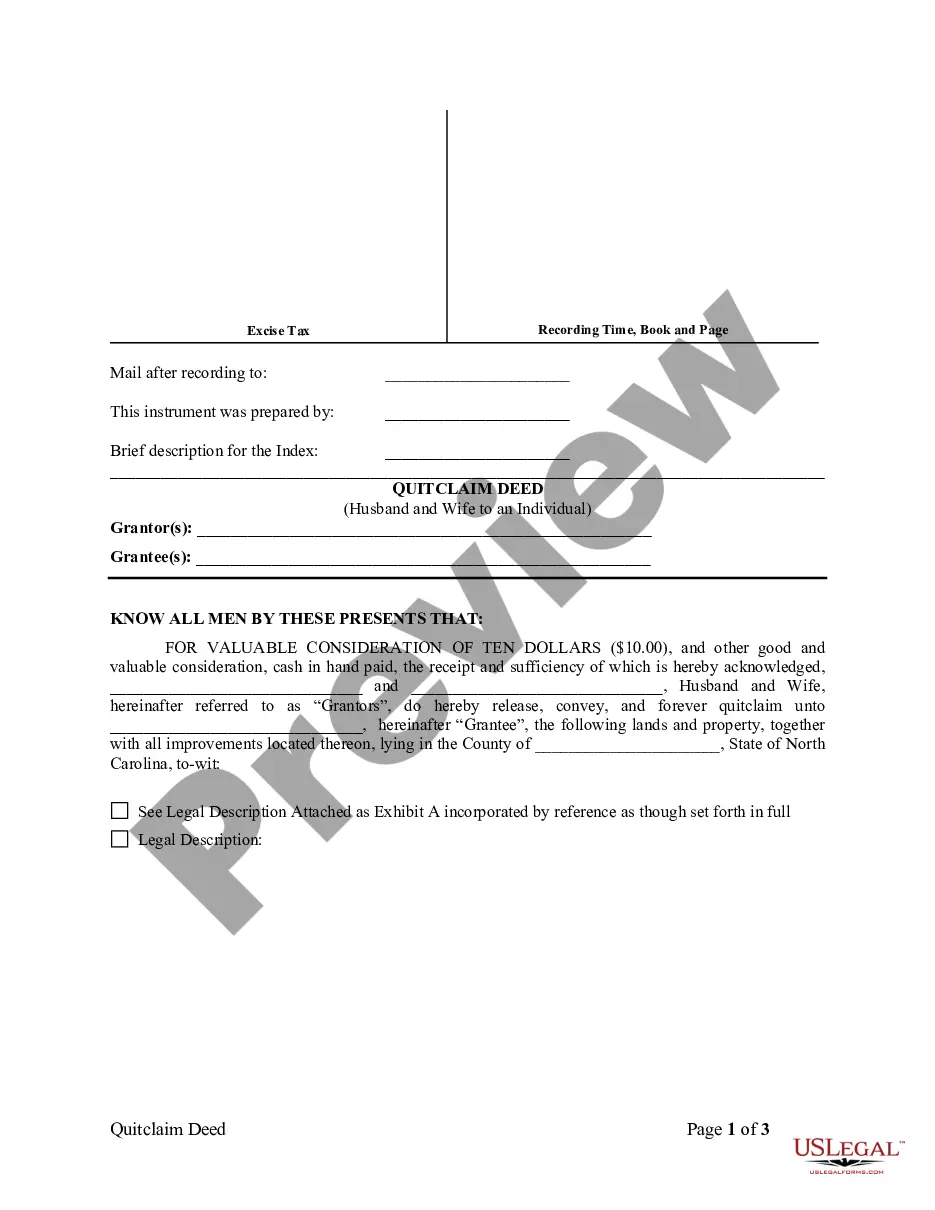

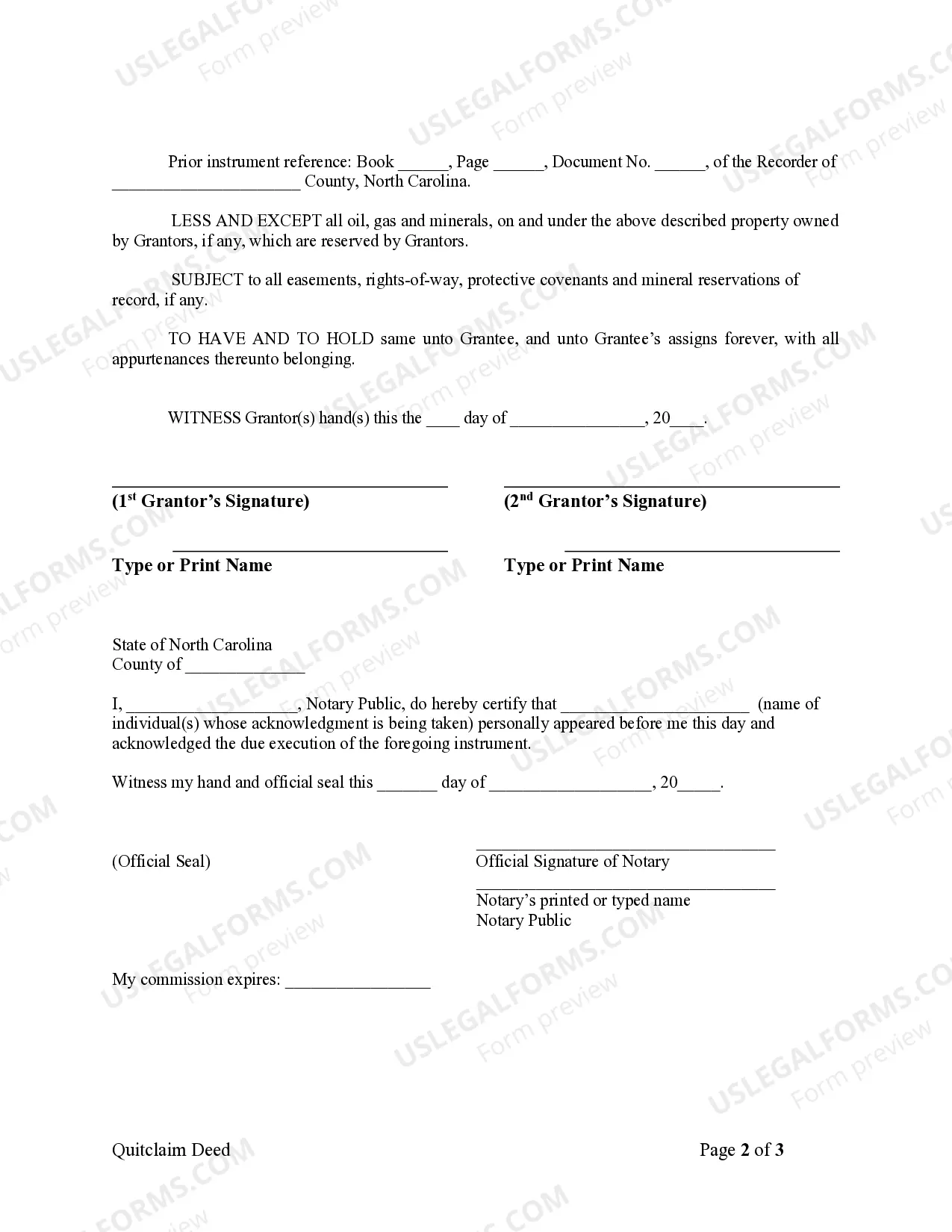

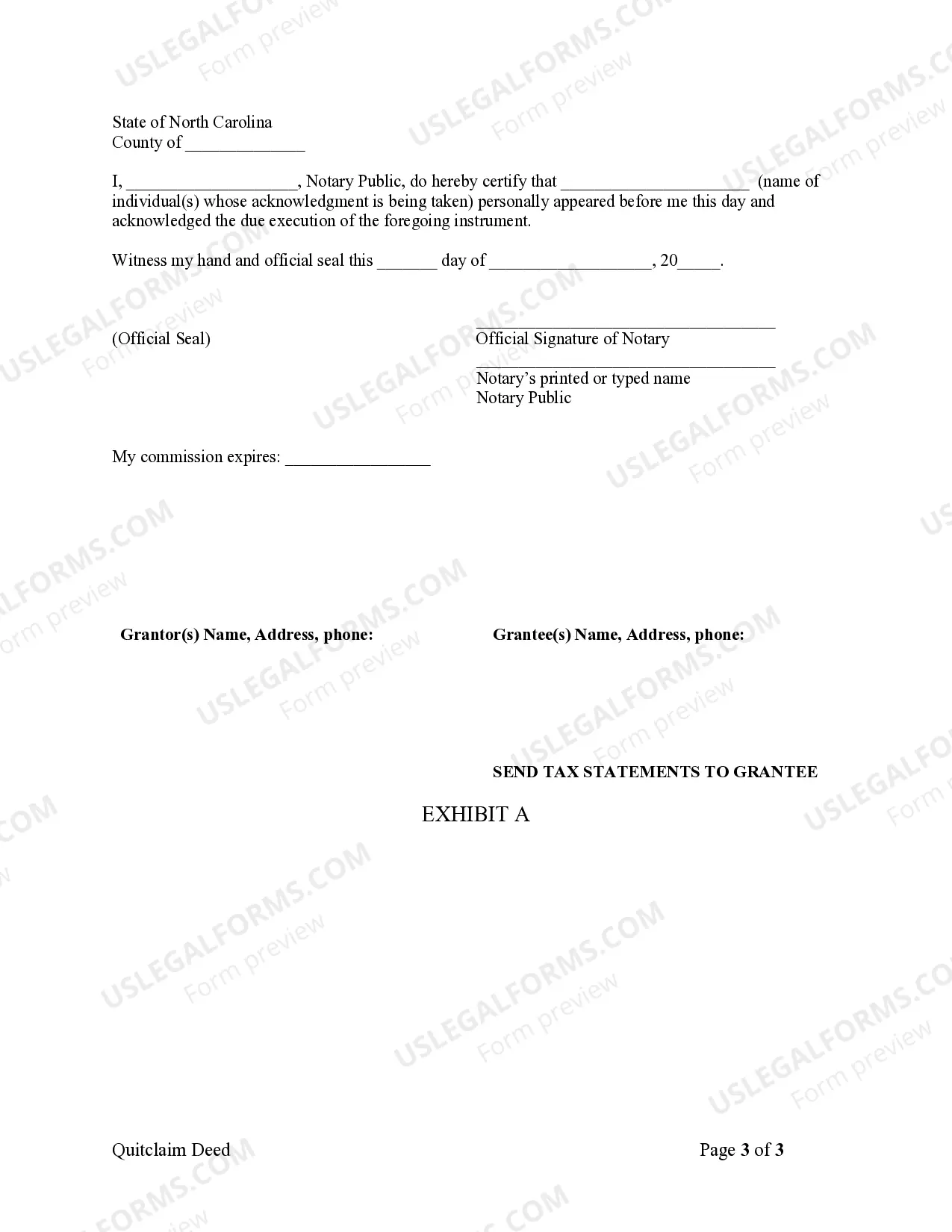

A Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual is a legal document that transfers the ownership interest of a property from a married couple to a single person, using a quitclaim deed. This type of deed is commonly used when a husband and wife jointly own a property, and one spouse is relinquishing their ownership rights to the other spouse or a third party. A quitclaim deed is a deed that transfers any interest or claim the granter (the spouse who is giving up their ownership rights) has in a property to the grantee (the individual receiving ownership rights). It is important to note that a quitclaim deed does not guarantee or warrant the title or ownership status of the property. In Cary, North Carolina, there are several types of Quitclaim Deeds from Husband and Wife to an Individual that can be used depending on the specific circumstances: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed used to transfer ownership from a husband and wife to an individual. It states that the granter(s) are releasing any interest they have in the property to the grantee without making any warranties or guarantees. 2. Joint Tenancy with Rights of Survivorship (TWOS) Quitclaim Deed: This type of quitclaim deed is used when the property is owned by the husband and wife as joint tenants. It ensures that in the event of one spouse's death, the surviving spouse automatically becomes the sole owner of the property. 3. Tenants in Common Quitclaim Deed: If the husband and wife own the property as tenants in common, this type of quitclaim deed can be used. It allows each spouse to transfer their individual ownership share to the grantee, without affecting the other spouse's ownership rights. When preparing a Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual, it is essential to ensure that all legal requirements are met. This includes accurately describing the property being transferred, providing the names and signatures of the granters and grantee, and having the deed properly notarized and recorded with the county clerk's office. Consulting with a real estate attorney or a qualified professional is highly recommended ensuring the deed is executed correctly and to address any specific legal considerations.

Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual

Description

How to fill out Cary North Carolina Quitclaim Deed From Husband And Wife To An Individual?

Do you require a reliable and economical provider of legal documents to obtain the Cary North Carolina Quitclaim Deed from a Husband and Wife to an Individual? US Legal Forms is your ideal choice.

Whether you are looking for a straightforward agreement to establish rules for living together with your partner or a collection of forms to facilitate your divorce through the judicial system, we have you covered. Our platform presents over 85,000 current legal document templates for both personal and business purposes. All the templates we offer are not generic and are crafted in accordance with the requirements of individual states and counties.

To download the document, you must Log In to your account, find the necessary form, and click the Download button next to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can create an account with ease quickly, but first, ensure you do the following.

Now you can set up your account. Then choose the subscription option and continue to payment. Once the payment is finalized, download the Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual in any available format. You can return to the website whenever you need and redownload the document at no cost.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and put an end to spending hours researching legal documents online once and for all.

- Check if the Cary North Carolina Quitclaim Deed from a Husband and Wife to an Individual complies with your state and local laws.

- Review the details of the form (if accessible) to understand who and what the document is designed for.

- Restart the search if the form is not applicable to your particular situation.

Form popularity

FAQ

While it is not legally required to have a lawyer for a quitclaim deed in North Carolina, it is highly recommended, especially for a Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual. A lawyer can help clarify legal implications and ensure accurate completion of all necessary documents. This guidance can prevent future disputes and ensure the deed is properly recorded. Utilizing a platform like US Legal Forms can also simplify the process and provide valuable resources.

To remove a spouse from a deed in North Carolina, you can utilize a Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual. This deed allows you to transfer ownership interest legally. Both spouses should sign the quitclaim deed, and you must record it with your county's Register of Deeds. It's important to ensure that all paperwork is correctly completed to avoid issues later.

The usual reason for using a quitclaim deed is to quickly transfer ownership rights without the need for extensive legal procedures. This type of deed is common in scenarios like divorce settlements, family transfers, or clearing up title issues. Specifically, the Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual can provide a simple solution for couples wishing to reallocate property ownership. By using this deed, couples can ensure their intentions regarding property are clearly documented.

A quitclaim deed for a married couple is a legal document that transfers ownership interest in property from one spouse to another. This is often used to simplify property transactions during divorce or estate planning. Specifically, the Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual allows one spouse to relinquish their claim to the property, ensuring clarity in ownership. This method provides an efficient way to establish ownership without the need for extensive legal procedures.

Filling out a quitclaim deed in North Carolina involves a few straightforward steps. First, you need a standard form for the Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual. Fill in the names of the parties involved, the property description, and the consideration amount. After signing the document, have it notarized and file it with your local register of deeds.

To add your wife's name to the house deeds, you will need to complete a Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual. This form allows you to transfer part of the ownership from one spouse to another. After filling out the deed, both spouses need to sign it in front of a notary. Finally, you will file the completed deed with the county clerk to make it official.

The most common way to transfer ownership is through a quitclaim deed. It allows for a straightforward transfer of interests and is particularly useful in familial situations. Utilizing a Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual can help streamline the process and minimize potential issues.

While it is not always required, hiring an attorney for a quitclaim deed in North Carolina is highly advisable. An attorney can clarify complexities and ensure your Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual meets all legal criteria. This guidance can prevent future disputes and ensure a smooth transfer.

After signing a quitclaim deed in North Carolina, a spouse generally relinquishes their rights to the property conveyed. This means the spouse will not have future claims to the property unless otherwise stipulated in a legal agreement. It’s crucial to fully understand the implications of signing a Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual.

The process of transferring ownership typically involves drafting a quitclaim deed, signing it in front of a notary, and filing it with the county clerk. The Cary North Carolina Quitclaim Deed from Husband and Wife to an Individual simplifies this process. Ensure that all pertinent information, including property details and signatures, is accurately captured.