This form is a Quitclaim Deed where the grantors are husband and wife and the grantees are two individuals. Grantors convey and quitclaim the described property to grantees are tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

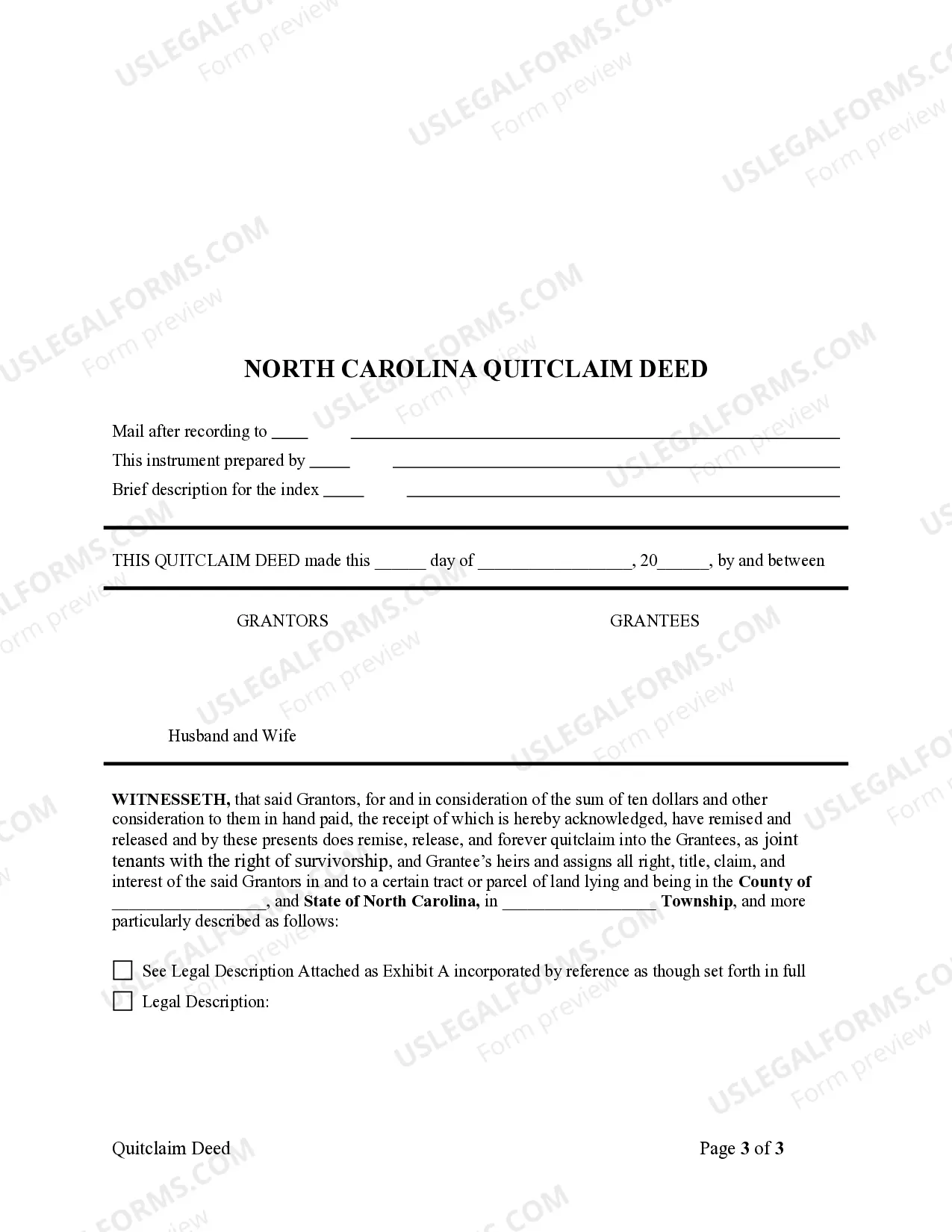

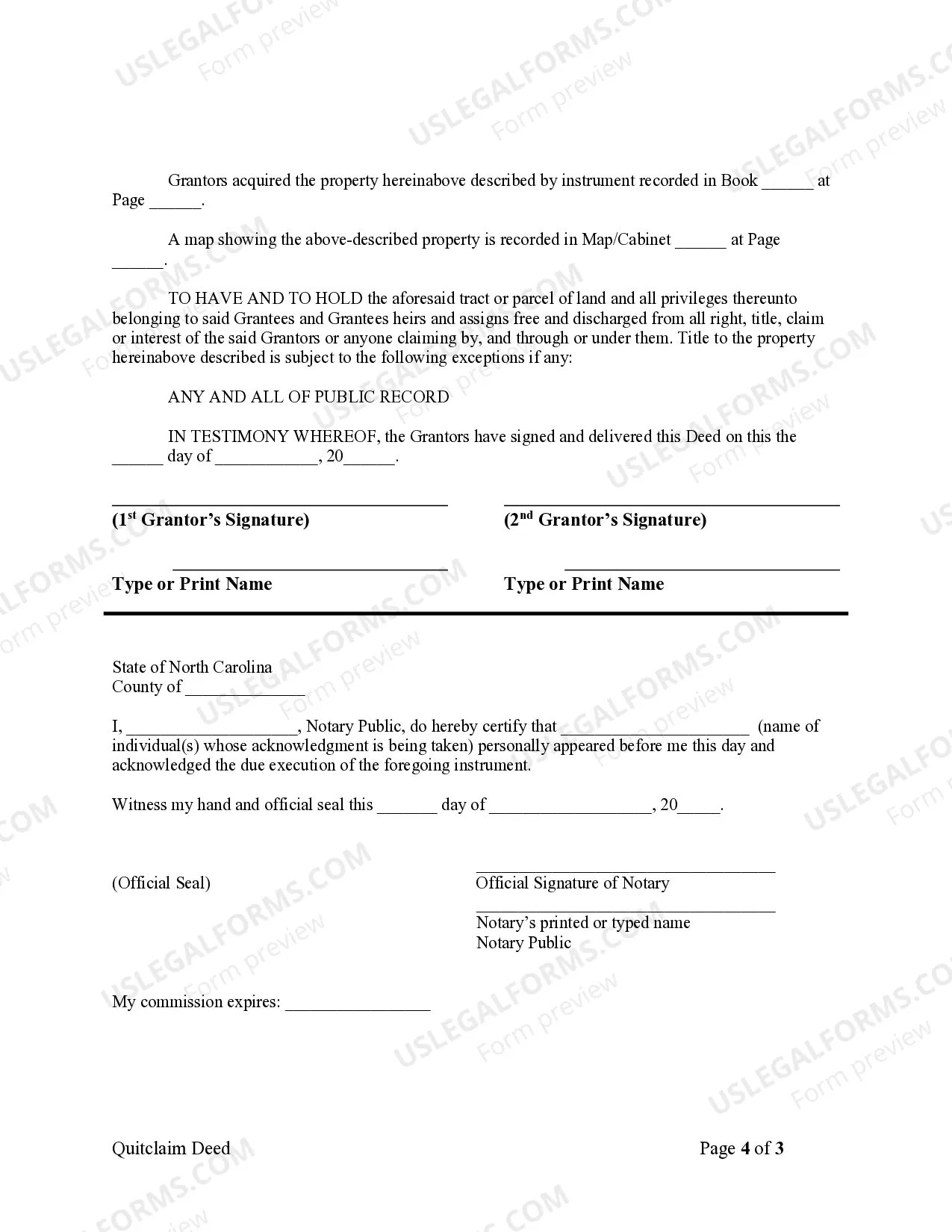

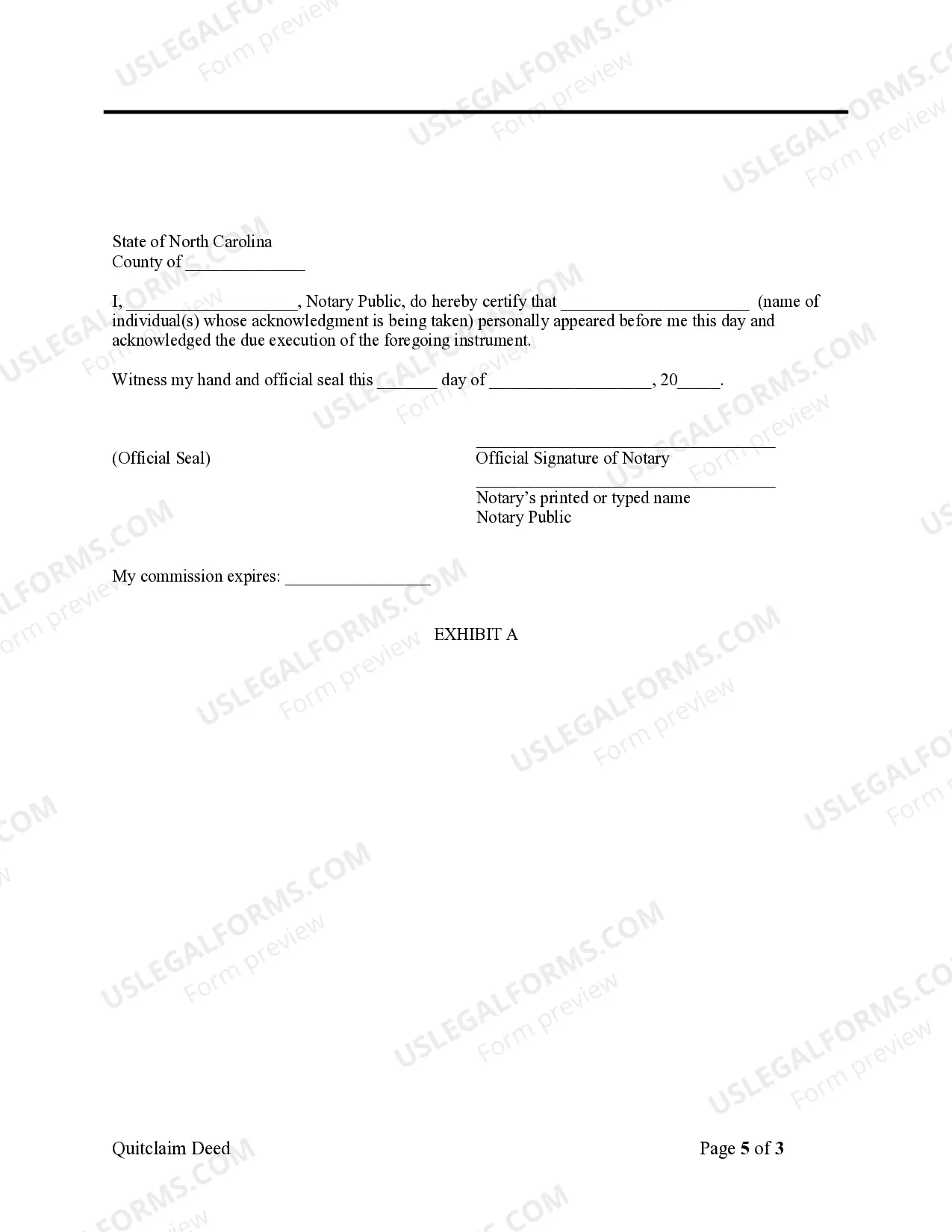

A Mecklenburg North Carolina Quitclaim Deed — Husband and Wife to Two Individuals is a legal document used to transfer ownership of real estate property from a married couple to two individuals. This type of deed eliminates any interest the couple may have in the property and conveys it solely to the named individuals. This particular quitclaim deed variation is commonly used when a husband and wife jointly own a property and wish to transfer their shared ownership to two specific individuals, who may be family members, friends, or business partners. The Mecklenburg County, located in North Carolina, follows specific procedures for executing this type of quitclaim deed. It is important to familiarize yourself with these requirements to ensure a successful transfer of property and avoid any legal complications. There are no different types of Mecklenburg North Carolina Quitclaim Deed — Husband and Wife to Two Individuals as it is a specific and self-explanatory legal document that serves a particular purpose. However, there may be variations in terms of additional clauses or provisions that can be added to the deed based on specific circumstances or agreements between the parties involved. To execute a Mecklenburg North Carolina Quitclaim Deed — Husband and Wife to Two Individuals, certain information and steps need to be followed. The deed should include the date of execution, the full names of the husband and wife as granters, and the full names of the two individuals as grantees. It is crucial to describe the property being conveyed accurately, including detailed legal description, address, and any relevant parcel or tax identification numbers. All parties involved must sign the deed in the presence of a Notary Public, who will notarize the signatures. Additionally, it is highly recommended consulting with an attorney or a real estate professional who specializes in deeds and property transfers to ensure that all legal requirements and any potential implications are addressed during the process.A Mecklenburg North Carolina Quitclaim Deed — Husband and Wife to Two Individuals is a legal document used to transfer ownership of real estate property from a married couple to two individuals. This type of deed eliminates any interest the couple may have in the property and conveys it solely to the named individuals. This particular quitclaim deed variation is commonly used when a husband and wife jointly own a property and wish to transfer their shared ownership to two specific individuals, who may be family members, friends, or business partners. The Mecklenburg County, located in North Carolina, follows specific procedures for executing this type of quitclaim deed. It is important to familiarize yourself with these requirements to ensure a successful transfer of property and avoid any legal complications. There are no different types of Mecklenburg North Carolina Quitclaim Deed — Husband and Wife to Two Individuals as it is a specific and self-explanatory legal document that serves a particular purpose. However, there may be variations in terms of additional clauses or provisions that can be added to the deed based on specific circumstances or agreements between the parties involved. To execute a Mecklenburg North Carolina Quitclaim Deed — Husband and Wife to Two Individuals, certain information and steps need to be followed. The deed should include the date of execution, the full names of the husband and wife as granters, and the full names of the two individuals as grantees. It is crucial to describe the property being conveyed accurately, including detailed legal description, address, and any relevant parcel or tax identification numbers. All parties involved must sign the deed in the presence of a Notary Public, who will notarize the signatures. Additionally, it is highly recommended consulting with an attorney or a real estate professional who specializes in deeds and property transfers to ensure that all legal requirements and any potential implications are addressed during the process.