Cary Transfer Under The North Carolina Uniform Custodial Trust Act refers to a legal provision that allows individuals in Cary, North Carolina, to establish custodial trusts for the benefit of minor children or individuals with disabilities. These trusts are governed by the North Carolina Uniform Custodial Trust Act, which outlines specific rules and guidelines for their creation and management. A Cary Transfer refers to the process of transferring property or assets into a custodial trust in accordance with the provisions of the North Carolina Uniform Custodial Trust Act. This act ensures that the property is held and managed for the benefit of the designated beneficiary until they reach a certain age or meet other specified conditions. Under the North Carolina Uniform Custodial Trust Act, there are different types of Cary Transfers that individuals can utilize to meet their specific needs: 1. Minor's Custodial Trust: This type of trust allows parents or legal guardians to transfer assets to a trust on behalf of a minor child. The assets are held and managed by a custodian until the minor reaches the age of termination, typically 18 or 21 years old. The trust can include various types of assets, such as cash, securities, real estate, or personal property. 2. Incapacitated Beneficiary's Custodial Trust: This type of trust is established for the benefit of an individual with a disability or incapacity. The trust assets are managed by a custodian who is responsible for meeting the beneficiary's needs and ensuring their financial well-being. The trust can provide for the beneficiary's ongoing care, medical expenses, education, and other necessary support. 3. Charitable Custodial Trust: This type of trust allows individuals to transfer assets to a trust for charitable purposes. The trust assets are held and managed by a custodian, who distributes the income or principal in accordance with the terms set forth in the trust agreement. This type of trust enables individuals to support their preferred charitable organizations or causes while enjoying potential tax benefits. When establishing a Cary Transfer under the North Carolina Uniform Custodial Trust Act, it is crucial to adhere to the specific requirements outlined in the act. These requirements encompass factors such as the appointment and powers of the custodian, termination or distribution of the trust assets, and any reporting obligations that may apply. In conclusion, Cary Transfer Under The North Carolina Uniform Custodial Trust Act allows individuals in Cary to establish custodial trusts for minors, incapacitated beneficiaries, or charitable causes. Adhering to the guidelines provided by the act ensures the proper management and distribution of trust assets for the intended beneficiaries.

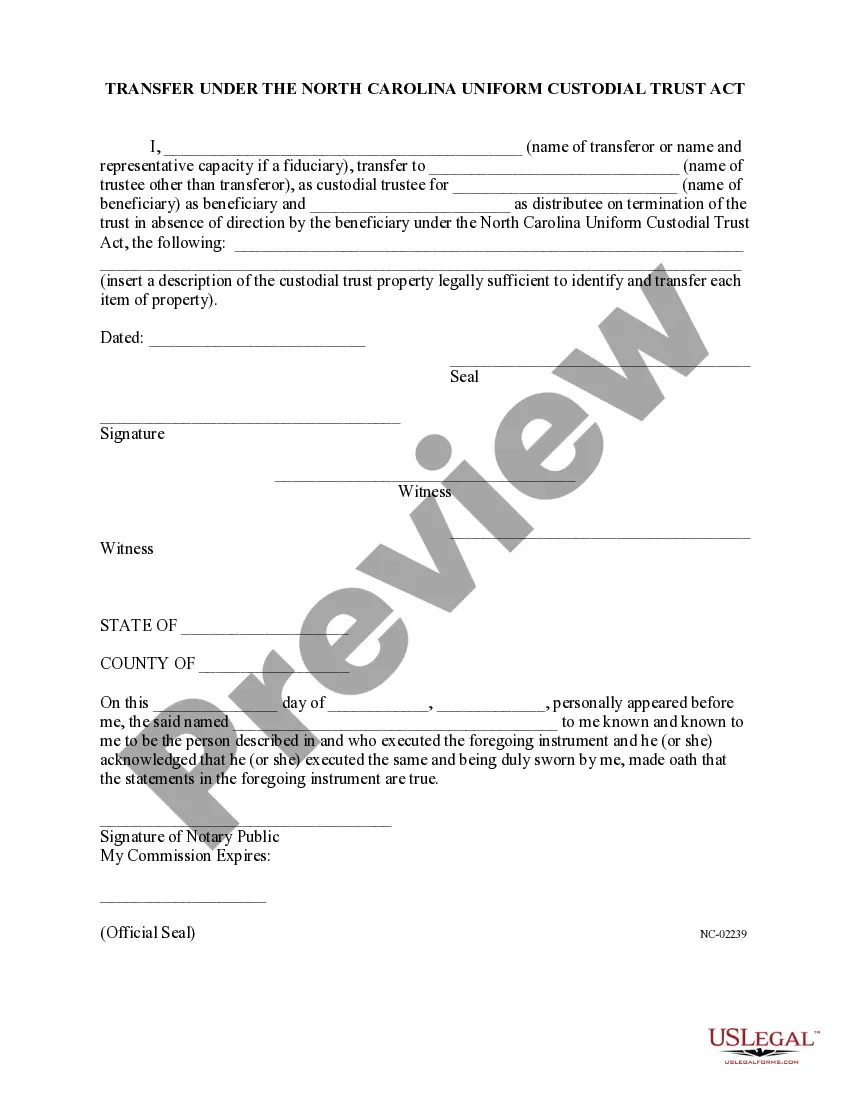

Cary Transfer Under The North Carolina Uniform Custodial Trust Act

Description

How to fill out Cary Transfer Under The North Carolina Uniform Custodial Trust Act?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney services that, as a rule, are very expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Cary Transfer Under The North Carolina Uniform Custodial Trust Act or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Cary Transfer Under The North Carolina Uniform Custodial Trust Act complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Cary Transfer Under The North Carolina Uniform Custodial Trust Act is proper for your case, you can select the subscription option and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!