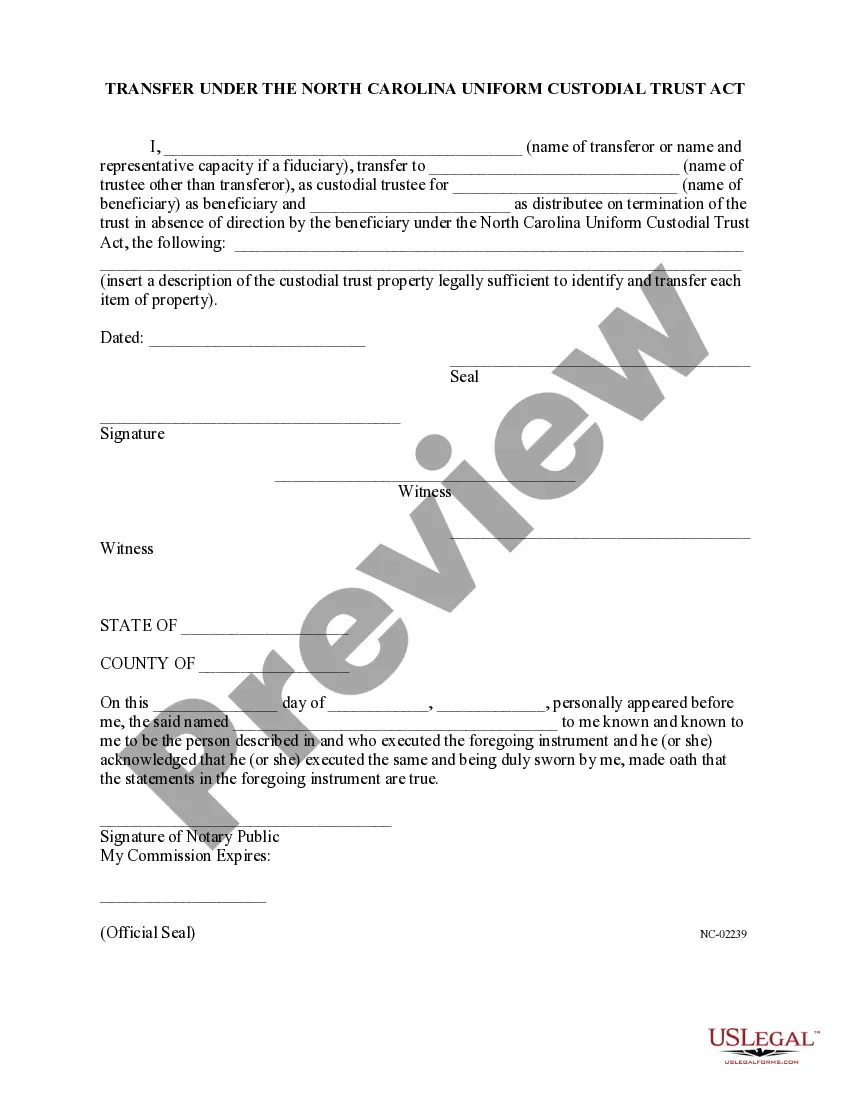

Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act refers to a specific provision within the North Carolina Uniform Custodial Trust Act pertaining to the transfer of custodial trust accounts in Raleigh, North Carolina. This act ensures smooth and organized transfer processes when it comes to custodial trust accounts in the Raleigh area. The main objective of the Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act is to protect the interests of beneficiaries and custodians while providing a legal framework for the transfer of custodial trust accounts. This act outlines the rights, responsibilities, and procedures involved in the transfer process, ensuring transparency and accountability in the establishment and management of these accounts. Under the Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act, there are different types of transfers that may occur. These include: 1. Inter Vivos Transfer: This type of transfer takes place during the lifetime of the custodian and involves the transfer of the custodial trust account to another custodian or beneficiary. 2. Testamentary Transfer: This type of transfer occurs after the death of the custodian, where the custodial trust account is transferred to the designated beneficiary as per the custodian's will or trust agreement. 3. Change of Custodian Transfer: In certain cases, a custodial trust account may require a change of custodian, either due to the existing custodian's incapacity, resignation, removal, or death. The Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act provides guidelines and procedures for executing such transfers smoothly. 4. Termination or Cessation Transfer: This type of transfer refers to the closure or cessation of a custodial trust account due to reasons such as the beneficiary attaining the age of majority or the fulfillment of the trust's purpose. The act ensures that such transfers are conducted in compliance with legal requirements. In conclusion, the Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act serves as a comprehensive framework to regulate the transfer of custodial trust accounts in Raleigh. It safeguards the rights of beneficiaries and custodians by providing a legal structure for various types of transfers under different circumstances, ensuring a fair and transparent process.

Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act

Description

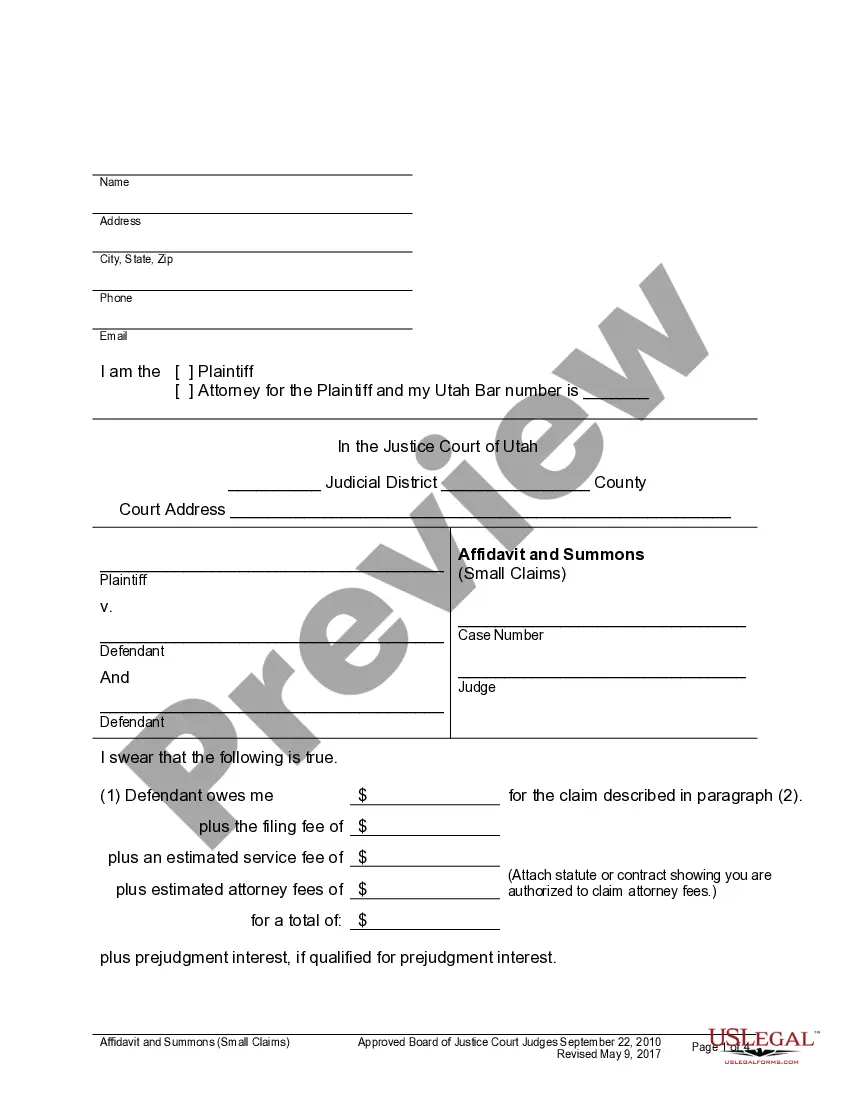

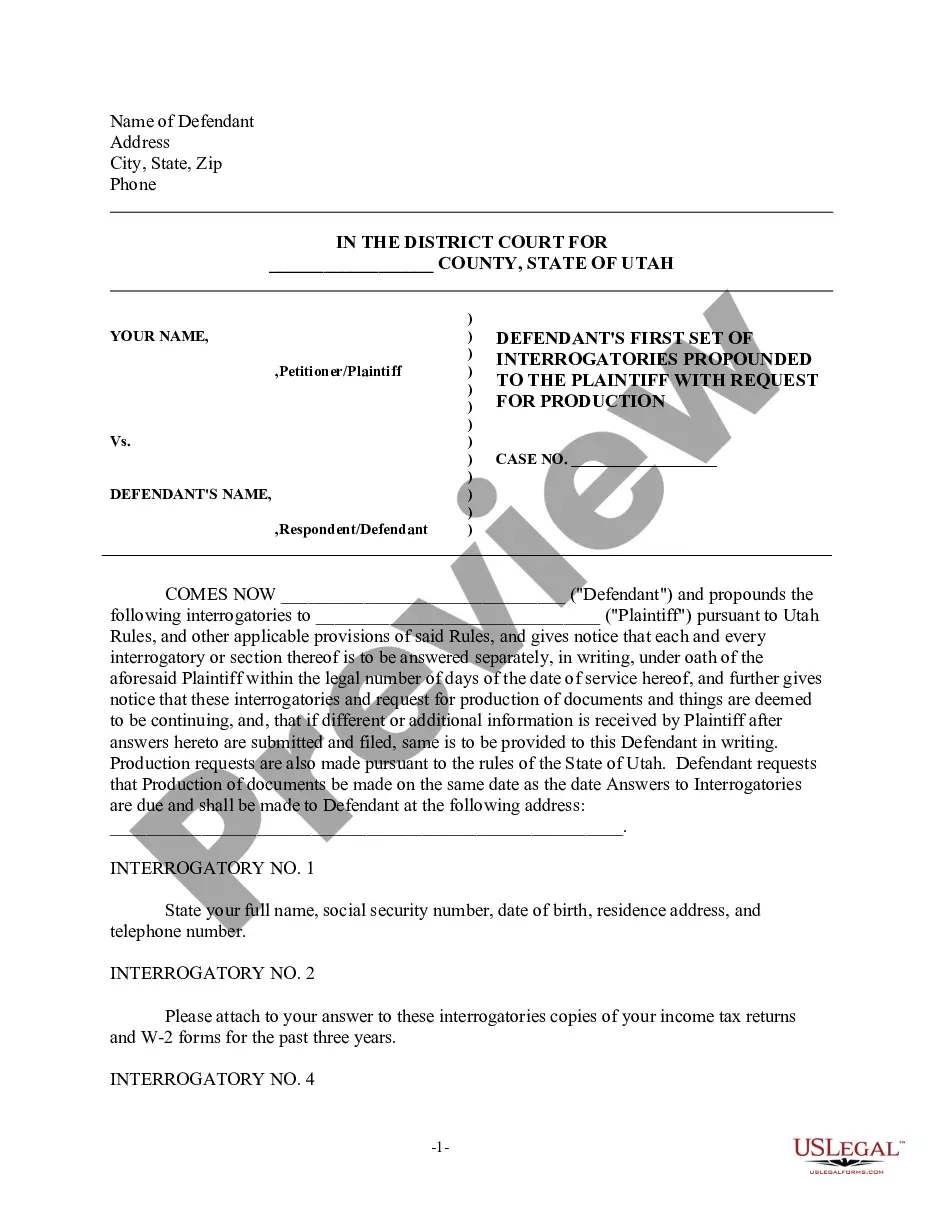

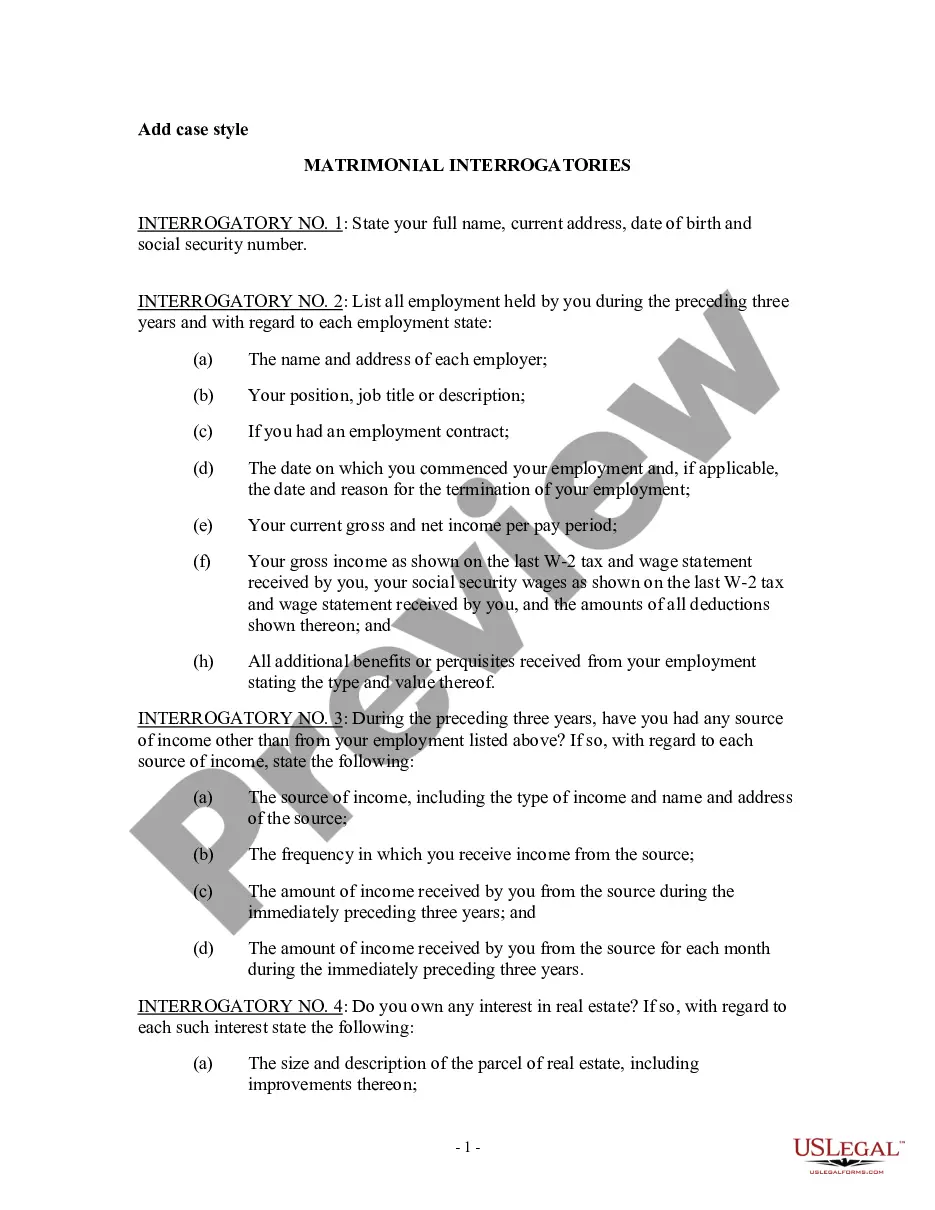

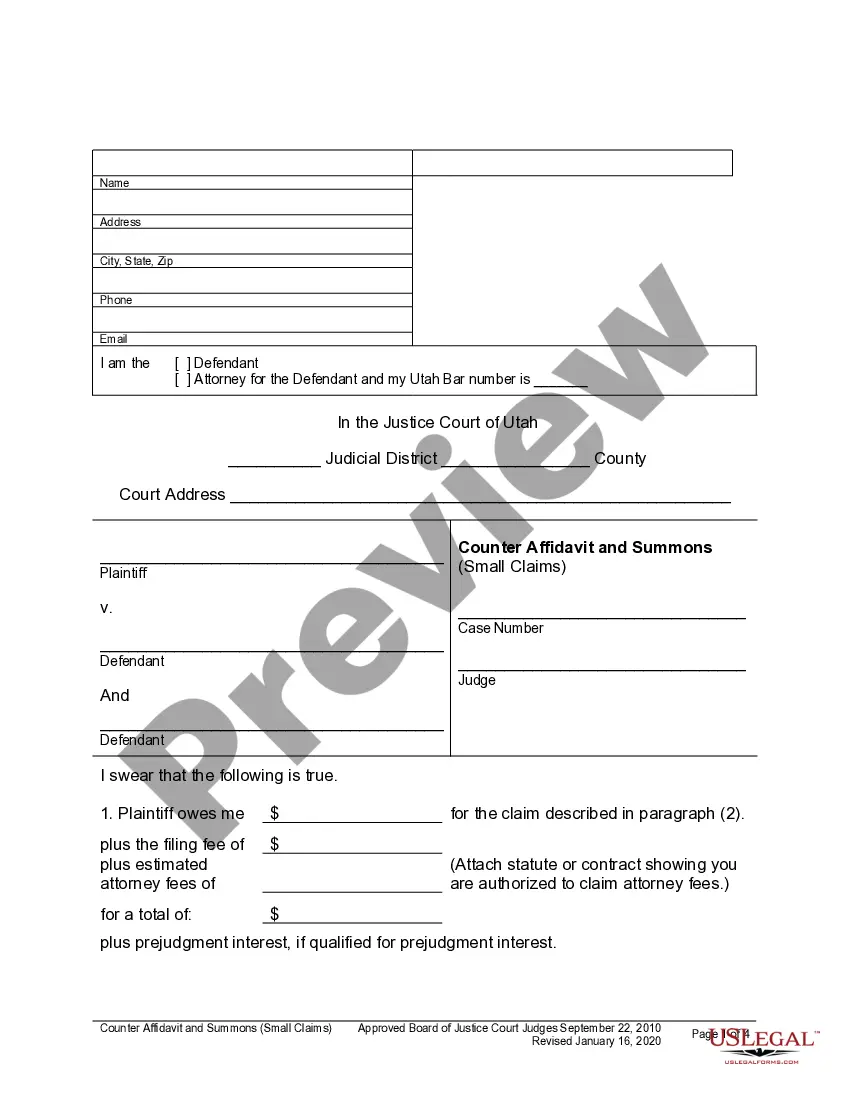

How to fill out Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act?

Utilize the US Legal Forms to gain immediate access to any form template you desire.

Our user-friendly website featuring thousands of document templates simplifies the process of locating and acquiring nearly any document example you require.

You can swiftly download, fill out, and validate the Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act in just a few minutes, rather than spending hours sifting through the internet for an appropriate template.

Using our collection is an excellent method to enhance the security of your record submissions. Our skilled legal experts routinely review all documents to ensure that the forms are suitable for a specific jurisdiction and adhere to the latest laws and regulations.

Download the document. Select the format to obtain the Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act and modify and complete or sign it as required.

US Legal Forms is arguably one of the largest and most reliable document repositories available online. We are always eager to assist you with any legal matters, even if it is simply downloading the Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act.

- How can you obtain the Raleigh Transfer Under The North Carolina Uniform Custodial Trust Act.

- If you already have an account, simply Log In to your profile. The Download feature will be visible on all the documents you access. Moreover, you can retrieve any previously saved documents from the My documents section.

- If you do not yet have an account, follow these steps.

- Visit the page with the template you need. Verify that it is the correct template: review its title and description, and take advantage of the Preview option if it's available. If not, utilize the Search bar to find the document you need.

- Begin the saving process. Click Buy Now and select the desired pricing plan. Then, create an account and pay for your order using either a credit card or PayPal.

Form popularity

FAQ

Particularly, in the case of trusts some scholars view the equitable right of a beneficiary (also known as the cestui que trust) simply as a right in personam (i.e. a personal right) against the trustee and not as a right in rem (i.e. a proprietary right) exercisable against the trust fund5.

Irrevocable trusts are just that?you generally cannot change or revoke the trust after you create it. These trusts are therefore much less flexible than revocable living trusts, but they do have some benefits that revocable trusts don't offer.

We are a company with a strong ambition to improve the lives of children and their families, with a focus on ensuring a positive impact on those children most in need of protection and care.

A court may create or establish a trust by judgment or decree, including a trust pursuant to section 1396p(d)(4) of Title 42 of the United States Code, upon petition of an interested party in accordance with the provisions of this Chapter or in any other matter properly before the court. (2009-267, s.

A custodial trust is a bank account, trust fund, or brokerage account which is created for a beneficiary but held in trust by a responsible individual. This individual is called a custodian, instead of a trustee.

What's the difference between a custodial account and a trust? Custodial accounts are simpler to establish than trusts, which generally require more planning and the help of an attorney. However, a trust can offer more flexibility, control, and protection than a custodial account.

A trust can remain open for up to 21 years after the death of anyone living at the time the trust is created, but most trusts end when the trustor dies and the assets are distributed immediately.

The states that have enacted a version of the Uniform Trust Code are Alabama, Arizona, Arkansas, Florida, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania,

A trustee is responsible for managing and maintaining trust property while the custodian is only the entity that holds the assets. When you open a trust, you must appoint a trustee to oversee the trust's activities, which includes managing, selling, and distributing trust property to beneficiaries.

Custodial accounts can be thought of as a type of trust account, and are used to save money for children, their beneficiaries. These accounts are set up under the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA).