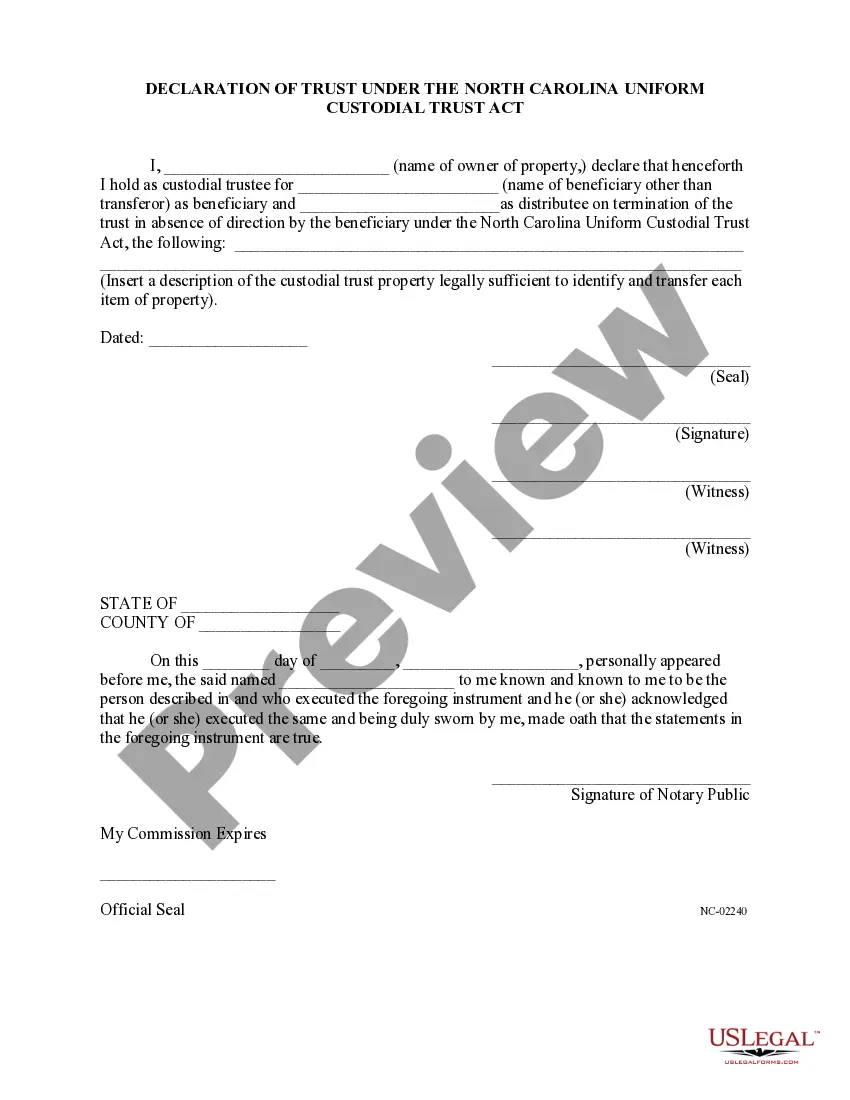

Raleigh Declaration of Trust Under the North Carolina Uniform Custodial Trust Act

Description

How to fill out Raleigh Declaration Of Trust Under The North Carolina Uniform Custodial Trust Act?

Regardless of social or occupational standing, finalizing legal papers is an unfortunate requirement in the modern world.

Often, it’s nearly unfeasible for someone lacking legal expertise to draft such documents from scratch, primarily due to the intricate language and legal nuances they contain.

This is where US Legal Forms is useful.

Check that the form you have found is appropriate for your region since the regulations of one state or area do not apply to another.

Preview the document and review a brief summary (if available) of cases for which the document can be utilized.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors who wish to enhance their efficiency by using our DIY forms.

- Whether you require the Raleigh Declaration of Trust Under the North Carolina Uniform Custodial Trust Act or any other document suitable for your state or locality, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Raleigh Declaration of Trust Under the North Carolina Uniform Custodial Trust Act in just a few minutes using our dependable service.

- If you are currently a subscriber, feel free to Log In to your account to access the required form.

- However, if you are new to our platform, please ensure to follow these steps before downloading the Raleigh Declaration of Trust Under the North Carolina Uniform Custodial Trust Act.

Form popularity

FAQ

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

A trust can remain open for up to 21 years after the death of anyone living at the time the trust is created, but most trusts end when the trustor dies and the assets are distributed immediately.

The states that have enacted a version of the Uniform Trust Code are Alabama, Arizona, Arkansas, Florida, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Hampshire, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania,

Key Takeaways. The remainderman is the person who inherits property after the termination of a life estate. For trust accounts, the remainderman receives the remaining principal after the estate has been distributed. A remainder interest is a future interest a person has in an asset.

Irrevocable trusts are just that?you generally cannot change or revoke the trust after you create it. These trusts are therefore much less flexible than revocable living trusts, but they do have some benefits that revocable trusts don't offer.

We are a company with a strong ambition to improve the lives of children and their families, with a focus on ensuring a positive impact on those children most in need of protection and care.

A court may create or establish a trust by judgment or decree, including a trust pursuant to section 1396p(d)(4) of Title 42 of the United States Code, upon petition of an interested party in accordance with the provisions of this Chapter or in any other matter properly before the court. (2009-267, s.

A trust protector is a person or entity other than the trustee or trust grantor that has certain powers over a trust. Trust protectors are also referred to as ?power holders? under North Carolina law. Trust protectors can provide a system of checks and balances for your trust.

Particularly, in the case of trusts some scholars view the equitable right of a beneficiary (also known as the cestui que trust) simply as a right in personam (i.e. a personal right) against the trustee and not as a right in rem (i.e. a proprietary right) exercisable against the trust fund5.