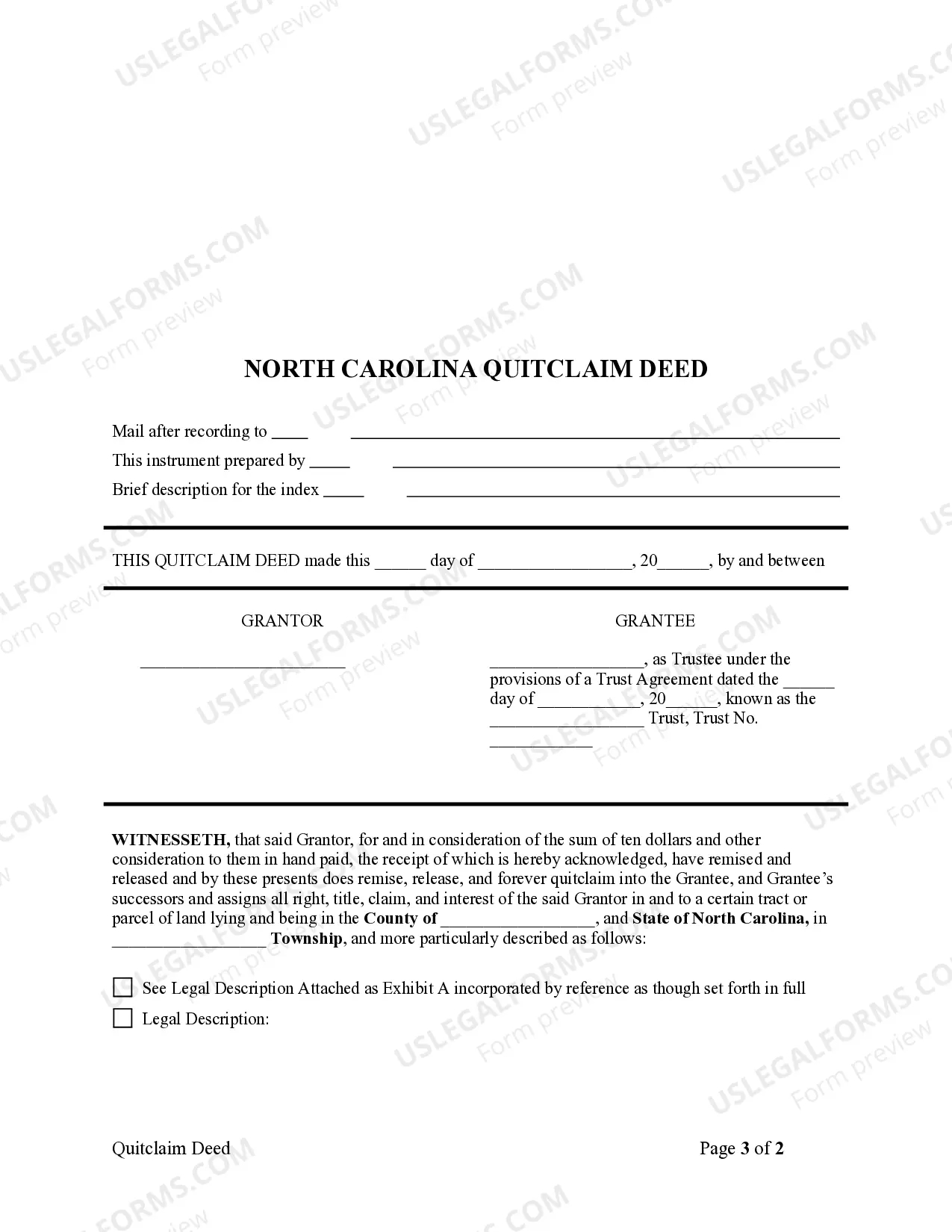

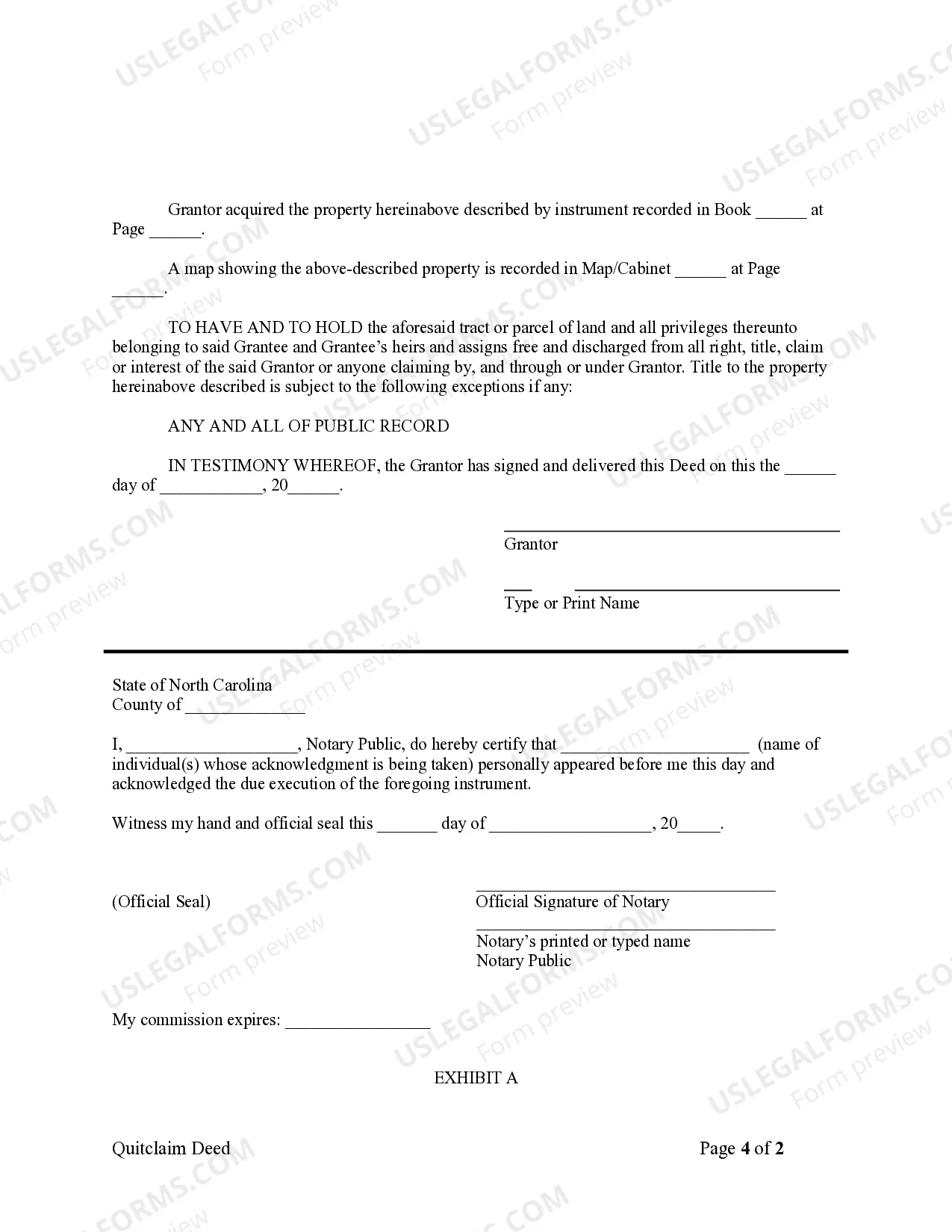

This form is a Quitclaim Deed where the grantor is an individual and the grantee is a Trustee acting in their capacity as trustee. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Mecklenburg North Carolina Quitclaim Deed — Individual to Trust is a legal document used to transfer ownership of a property from an individual to a trust. This type of deed is commonly used in estate planning and asset protection strategies. In this specific type of quitclaim deed, the individual granter (also known as the seller or transferor) relinquishes all rights, interests, and claims to the property, and transfers their ownership to a trust (the grantee or transferee). This process can be beneficial for individuals who want to secure their assets within a trust, providing them with important legal protections and potential tax advantages. The trust, acting as the new owner of the property, holds and manages it according to the terms and conditions outlined in the trust agreement. It is important to note that there may be slight variations or different types of Mecklenburg North Carolina Quitclaim Deeds — Individual to Trust. These variations could include: 1. Mecklenburg North Carolina Quitclaim Deed — Individual to Living Trust: This type of quitclaim deed allows an individual to transfer their property directly into a revocable living trust during their lifetime. The granter retains control over the trust and can make changes or revoke it if necessary. 2. Mecklenburg North Carolina Quitclaim Deed — Individual to Irrevocable Trust: With this type of quitclaim deed, the individual granter transfers their property to an irrevocable trust, which means the terms and conditions cannot be altered or revoked without the consent of the beneficiaries. This type of trust offers strong asset protection and potential estate tax planning benefits. 3. Mecklenburg North Carolina Quitclaim Deed — Individual to Special Needs Trust: This specific quitclaim deed allows for the transfer of property to a special needs trust, designed to financially support individuals with disabilities. This type of trust ensures that the beneficiary's eligibility for government assistance programs is not affected while providing them with necessary financial support. Overall, the use of a Mecklenburg North Carolina Quitclaim Deed — Individual to Trust can be an important part of estate planning strategies, asset protection, and achieving specific financial goals. It is crucial to consult with a qualified attorney and understand the legal implications before initiating such a transfer to ensure compliance with local laws and regulations.A Mecklenburg North Carolina Quitclaim Deed — Individual to Trust is a legal document used to transfer ownership of a property from an individual to a trust. This type of deed is commonly used in estate planning and asset protection strategies. In this specific type of quitclaim deed, the individual granter (also known as the seller or transferor) relinquishes all rights, interests, and claims to the property, and transfers their ownership to a trust (the grantee or transferee). This process can be beneficial for individuals who want to secure their assets within a trust, providing them with important legal protections and potential tax advantages. The trust, acting as the new owner of the property, holds and manages it according to the terms and conditions outlined in the trust agreement. It is important to note that there may be slight variations or different types of Mecklenburg North Carolina Quitclaim Deeds — Individual to Trust. These variations could include: 1. Mecklenburg North Carolina Quitclaim Deed — Individual to Living Trust: This type of quitclaim deed allows an individual to transfer their property directly into a revocable living trust during their lifetime. The granter retains control over the trust and can make changes or revoke it if necessary. 2. Mecklenburg North Carolina Quitclaim Deed — Individual to Irrevocable Trust: With this type of quitclaim deed, the individual granter transfers their property to an irrevocable trust, which means the terms and conditions cannot be altered or revoked without the consent of the beneficiaries. This type of trust offers strong asset protection and potential estate tax planning benefits. 3. Mecklenburg North Carolina Quitclaim Deed — Individual to Special Needs Trust: This specific quitclaim deed allows for the transfer of property to a special needs trust, designed to financially support individuals with disabilities. This type of trust ensures that the beneficiary's eligibility for government assistance programs is not affected while providing them with necessary financial support. Overall, the use of a Mecklenburg North Carolina Quitclaim Deed — Individual to Trust can be an important part of estate planning strategies, asset protection, and achieving specific financial goals. It is crucial to consult with a qualified attorney and understand the legal implications before initiating such a transfer to ensure compliance with local laws and regulations.