This form is a Warranty Deed where the grantors are seven individuals and the grantee is a trust. Grantors convey and warrants the described property to the trust. This deed complies with all state statutory laws.

High Point North Carolina Warranty Deed - Seven Individuals to a Trust

Description

How to fill out North Carolina Warranty Deed - Seven Individuals To A Trust?

We consistently aim to minimize or evade legal complications when handling intricate legal or financial issues.

To achieve this, we seek legal assistance that, as a norm, is exceedingly expensive.

However, not every legal issue is similarly complicated. A majority can be managed independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you lose the document, you can always retrieve it from the My documents tab. The procedure is just as straightforward if you’re new to the platform! You can set up your account in just a few minutes. Ensure to verify that the High Point North Carolina Warranty Deed - Seven Individuals to a Trust abides by the laws and rules of your state and region. It is also essential to review the form’s description (if available), and if you find any inconsistencies with your initial requirements, look for an alternative template. Once you've confirmed that the High Point North Carolina Warranty Deed - Seven Individuals to a Trust is suitable for your situation, you can select the subscription option and proceed with payment. You will then be able to download the document in any compatible file format. For more than 24 years of our existence in the market, we’ve assisted millions by providing customizable and current legal forms. Take full advantage of US Legal Forms today to conserve effort and resources!

- Our library empowers you to handle your affairs autonomously without requiring an attorney's services.

- We provide access to legal form templates that aren't always available to the public.

- Our templates are specific to regions and states, greatly simplifying the search process.

- Utilize US Legal Forms whenever you need to obtain and download the High Point North Carolina Warranty Deed - Seven Individuals to a Trust or any other form with ease and security.

Form popularity

FAQ

Deciding whether to gift a house or put it in a trust depends on your long-term goals. Gifting a house can result in immediate ownership transfer, but it may have tax implications. In contrast, placing the house in a trust, such as a High Point North Carolina Warranty Deed - Seven Individuals to a Trust, allows you to maintain control while providing for future management and distribution according to your wishes.

Transferring assets into a trust involves formally changing ownership from your name to the trust's name. This can include filling out required documents, such as deeds for real estate or transfer forms for bank accounts and other property. When dealing with a High Point North Carolina Warranty Deed - Seven Individuals to a Trust, it’s essential to follow the correct legal procedures to ensure a smooth transfer.

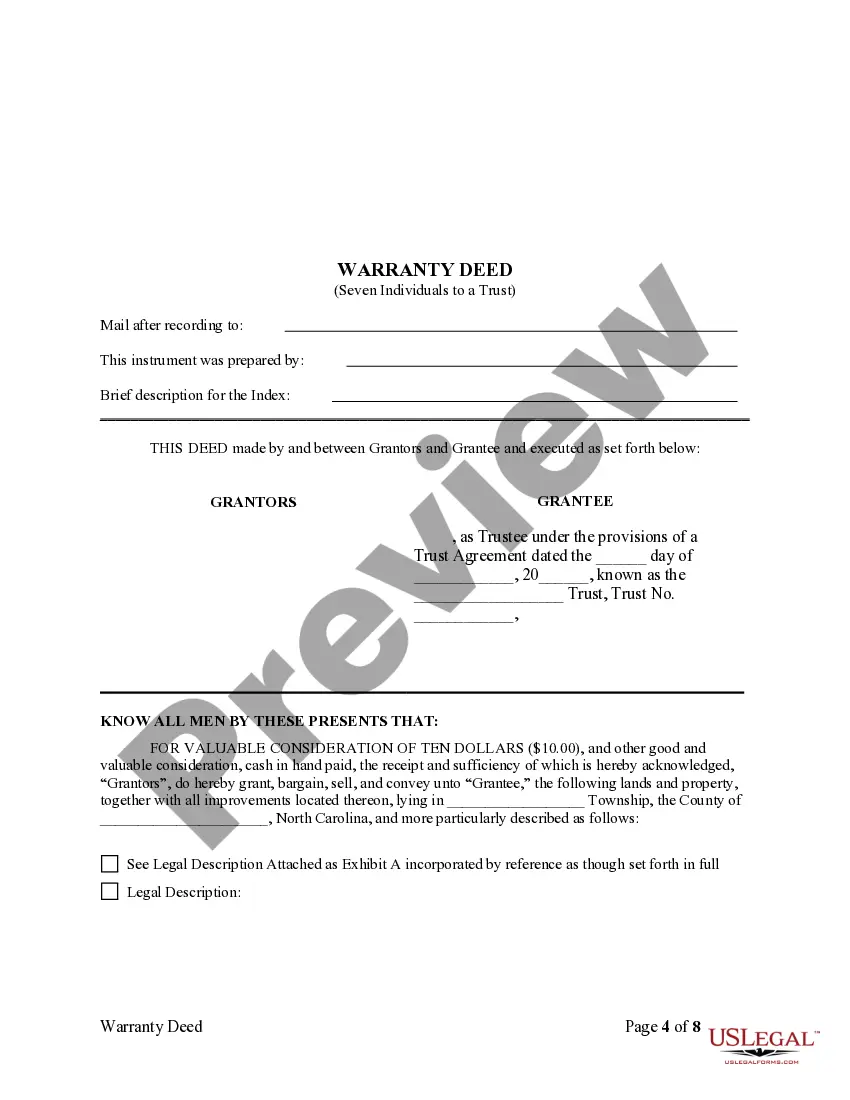

Filling out a warranty deed form requires you to provide specific details about the property and the parties involved in the transaction. Ensure you include the full legal description of the property, the names of the grantor and grantee, and any necessary dates. Using a service like uslegalforms can guide you through this process, especially for a High Point North Carolina Warranty Deed - Seven Individuals to a Trust.

Writing a trust deed involves creating a legal document that outlines the terms and conditions of the trust. You should clearly define the trust's purpose, identify the grantor and beneficiaries, and specify any management instructions. Utilizing a template from uslegalforms can simplify this process, helping you incorporate essential information like a High Point North Carolina Warranty Deed - Seven Individuals to a Trust.

To put your house in a trust in North Carolina, start by deciding on the type of trust that fits your situation. Next, draft a High Point North Carolina Warranty Deed - Seven Individuals to a Trust, which will legally transfer the property to the trust. It's crucial to consult with an attorney to ensure all documents are correctly filled out and comply with state laws.

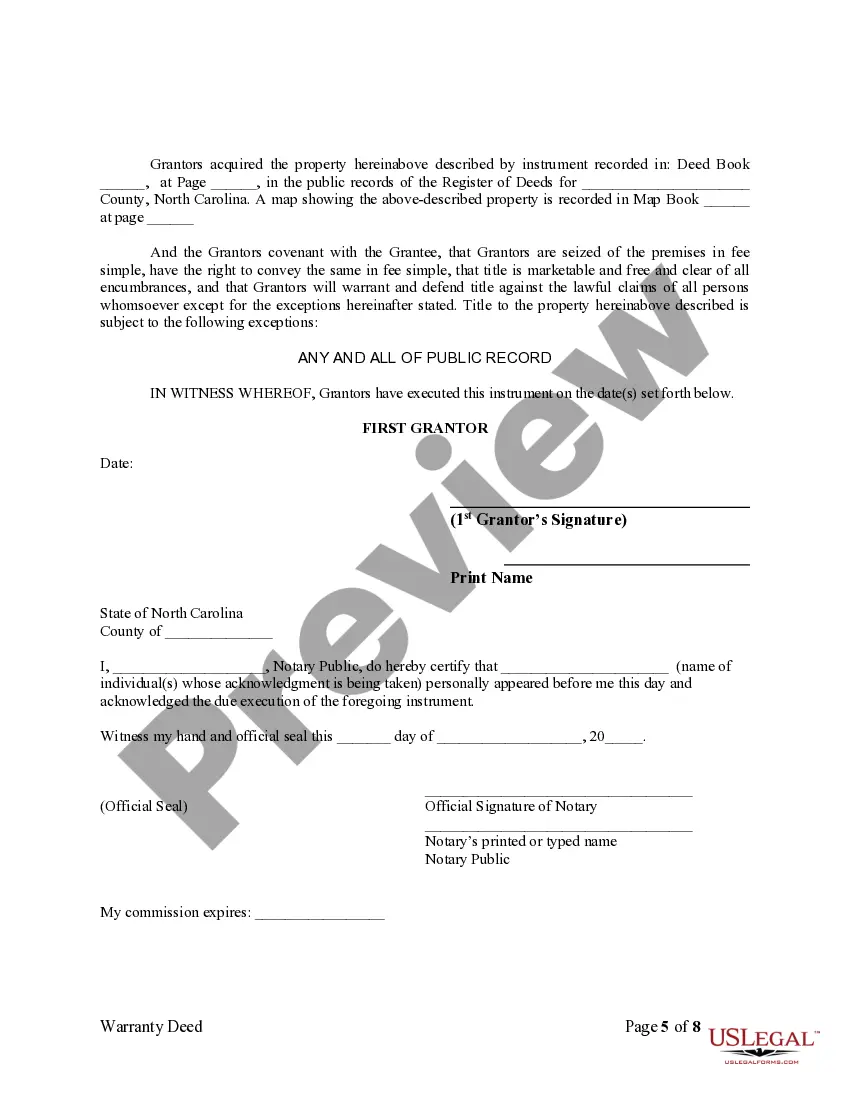

To transfer property to a trust in North Carolina, you begin by drafting a deed that outlines the transfer details. This usually involves filling out a High Point North Carolina Warranty Deed - Seven Individuals to a Trust, which specifies the trust as the new owner. After preparing the deed, you must sign it in front of a notary and file it with your county's Register of Deeds to make the transfer official.

The best way to put your house in trust typically involves working with a legal professional who specializes in estate planning. They can help determine the right type of trust for your needs and guide you through the necessary paperwork, including a High Point North Carolina Warranty Deed - Seven Individuals to a Trust. By following the right procedures and drafting clear terms, you can ensure your property is effectively managed in the future.

While putting your house in a trust can offer many benefits, there are a few disadvantages to consider. First, setting up and managing a trust can incur legal and administrative costs that may be higher than simply maintaining direct ownership. Additionally, transferring your property might affect your eligibility for certain benefits, like Medicaid, if not managed properly. It's important to evaluate these factors, especially when considering a High Point North Carolina Warranty Deed - Seven Individuals to a Trust.

Not just anyone can become a trustee; they must meet certain criteria, such as being an adult of sound mind and not disqualified from serving. It's also advisable to appoint someone trustworthy who understands their obligations. When considering the High Point North Carolina Warranty Deed - Seven Individuals to a Trust, the right choice of trustee can significantly impact the management of the trust.

To name a trust in a deed, you should include the name of the trust in the legal text, clearly identifying it to avoid confusion. This includes stating the type of trust and the date it was established. Being precise is vital in creating a High Point North Carolina Warranty Deed - Seven Individuals to a Trust to ensure all parties understand the trust's identity.