A condominium is one of a group of housing units where each homeowner owns their individual unit space, and all the dwelling share ownership of areas of common use. The individual units normally share walls, but that isn't a requirement. The main difference in condos and regular single homes is that there is no individual ownership of a plot of land. All the land in the condominium project is owned in common by all the homeowners. Usually, the exterior maintenance is paid for out of homeowner dues collected and managed under strict rules. The exterior walls and roof are insured by the condominium association, while all interior walls and items are insured by the homeowner.

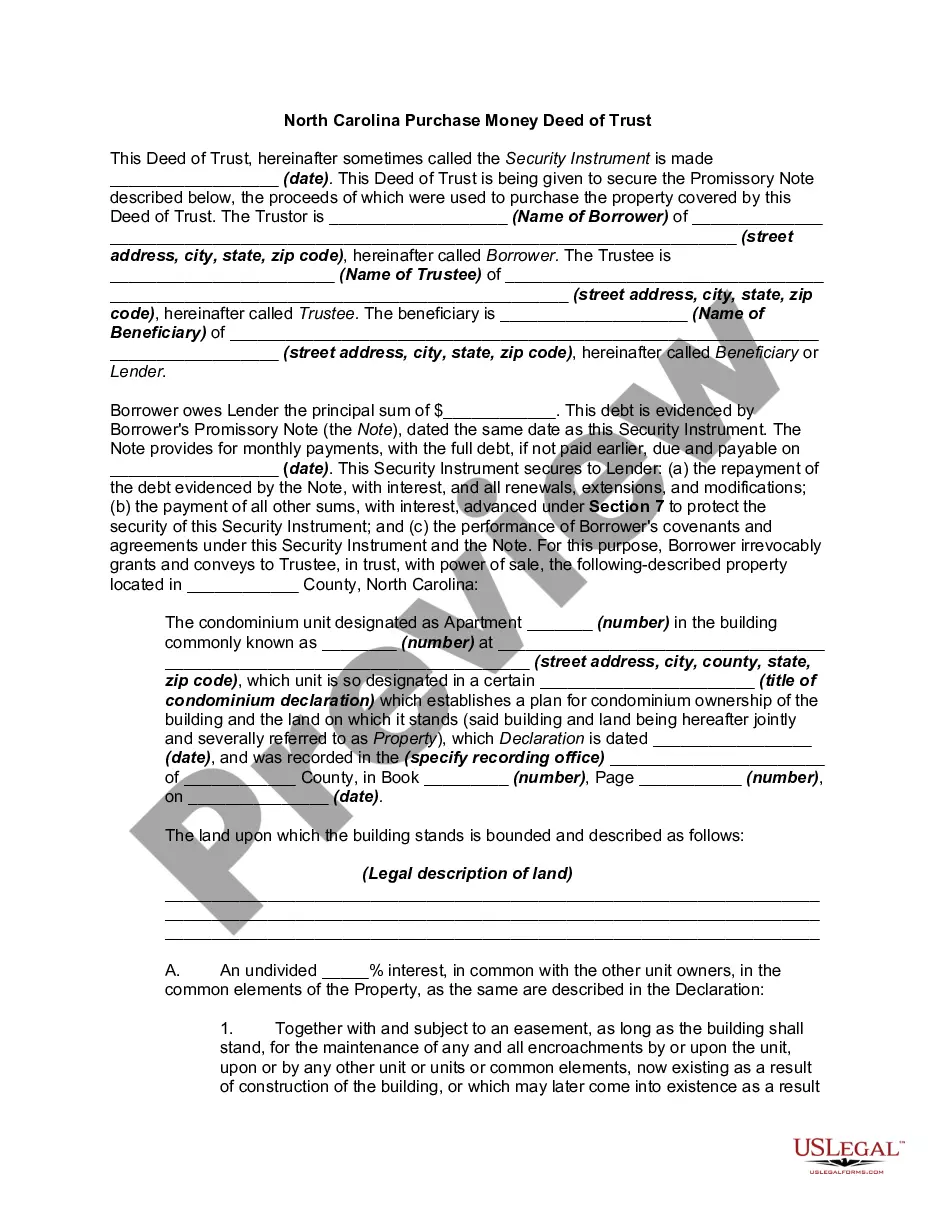

A Fayetteville North Carolina Purchase Money Deed of Trust — Condominium is a legal document that outlines the terms and conditions of a loan for the purchase of a condominium property in Fayetteville, North Carolina. It is commonly used in real estate transactions and establishes the lender's security interest in the property. Keywords: Fayetteville North Carolina, purchase money deed of trust — condominium, loan, property, real estate transactions, lender, security interest. Different types of Fayetteville North Carolina Purchase Money Deed of Trust — Condominium may include: 1. Standard Purchase Money Deed of Trust — Condominium: This is the most common type of deed of trust used in condominium purchases. It outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any applicable fees or penalties. 2. Adjustable-Rate Purchase Money Deed of Trust — Condominium: This type of deed of trust involves an adjustable interest rate, which means that the interest rate on the loan can fluctuate over time. It can provide flexibility in terms of payments but also carries the risk of higher interest rates in the future. 3. Balloon Payment Purchase Money Deed of Trust — Condominium: With this type of deed of trust, the loan payments are typically lower for a set period, usually five to seven years, after which a larger "balloon" payment is due. This can be advantageous for buyers who expect increased income in the future, but it also carries the risk of potentially being unable to afford the balloon payment. 4. Assumable Purchase Money Deed of Trust — Condominium: In certain cases, a buyer may be able to assume the seller's existing mortgage through an assumable purchase money deed of trust. This allows the buyer to take over the loan terms and conditions, saving on financing costs and potentially benefiting from favorable interest rates. It is important for buyers and lenders involved in Fayetteville North Carolina condominium purchases to carefully review and understand the specific terms and conditions outlined in the Purchase Money Deed of Trust. Consulting with a qualified real estate attorney or financial advisor is advisable to ensure a smooth and legally binding transaction.A Fayetteville North Carolina Purchase Money Deed of Trust — Condominium is a legal document that outlines the terms and conditions of a loan for the purchase of a condominium property in Fayetteville, North Carolina. It is commonly used in real estate transactions and establishes the lender's security interest in the property. Keywords: Fayetteville North Carolina, purchase money deed of trust — condominium, loan, property, real estate transactions, lender, security interest. Different types of Fayetteville North Carolina Purchase Money Deed of Trust — Condominium may include: 1. Standard Purchase Money Deed of Trust — Condominium: This is the most common type of deed of trust used in condominium purchases. It outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any applicable fees or penalties. 2. Adjustable-Rate Purchase Money Deed of Trust — Condominium: This type of deed of trust involves an adjustable interest rate, which means that the interest rate on the loan can fluctuate over time. It can provide flexibility in terms of payments but also carries the risk of higher interest rates in the future. 3. Balloon Payment Purchase Money Deed of Trust — Condominium: With this type of deed of trust, the loan payments are typically lower for a set period, usually five to seven years, after which a larger "balloon" payment is due. This can be advantageous for buyers who expect increased income in the future, but it also carries the risk of potentially being unable to afford the balloon payment. 4. Assumable Purchase Money Deed of Trust — Condominium: In certain cases, a buyer may be able to assume the seller's existing mortgage through an assumable purchase money deed of trust. This allows the buyer to take over the loan terms and conditions, saving on financing costs and potentially benefiting from favorable interest rates. It is important for buyers and lenders involved in Fayetteville North Carolina condominium purchases to carefully review and understand the specific terms and conditions outlined in the Purchase Money Deed of Trust. Consulting with a qualified real estate attorney or financial advisor is advisable to ensure a smooth and legally binding transaction.