A condominium is one of a group of housing units where each homeowner owns their individual unit space, and all the dwelling share ownership of areas of common use. The individual units normally share walls, but that isn't a requirement. The main difference in condos and regular single homes is that there is no individual ownership of a plot of land. All the land in the condominium project is owned in common by all the homeowners. Usually, the exterior maintenance is paid for out of homeowner dues collected and managed under strict rules. The exterior walls and roof are insured by the condominium association, while all interior walls and items are insured by the homeowner.

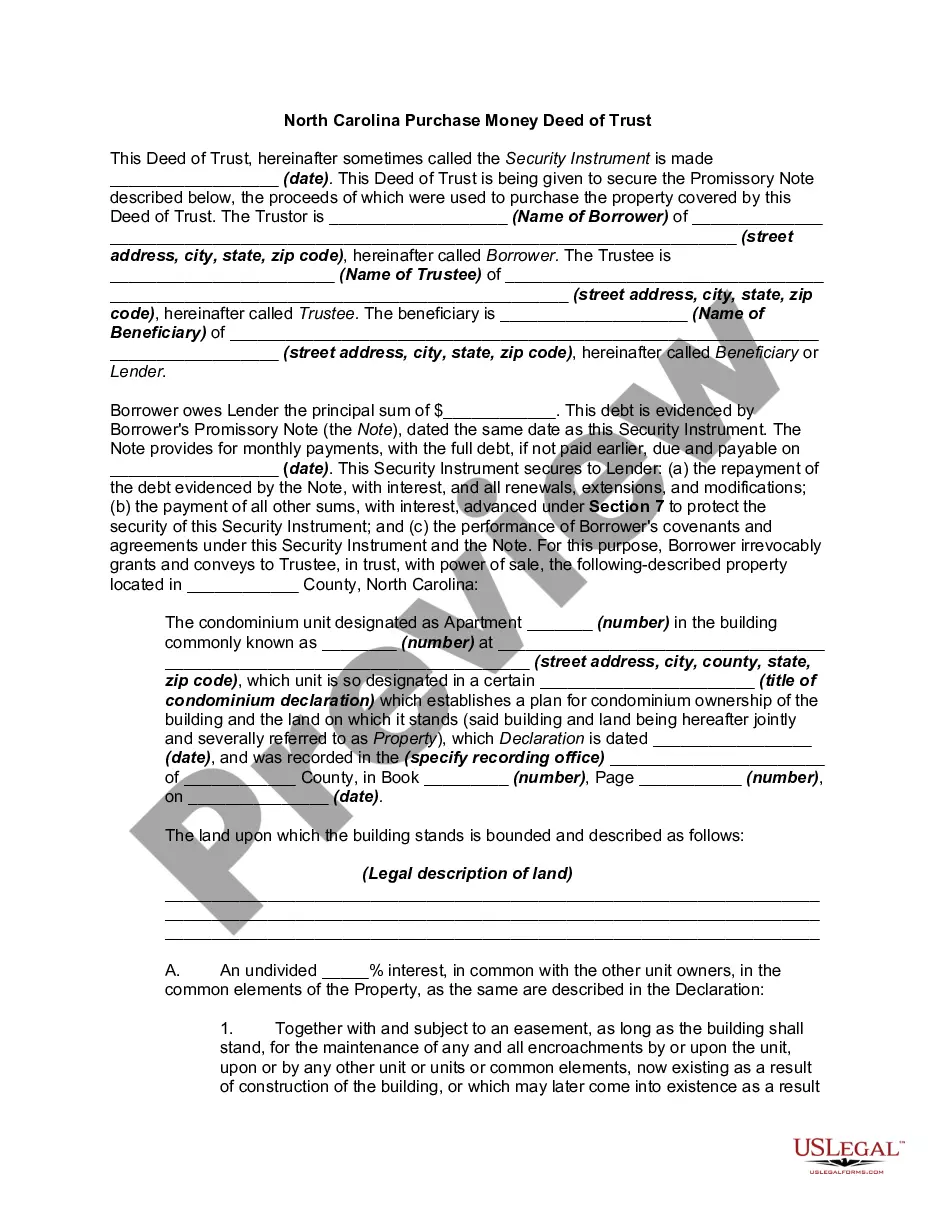

The Mecklenburg North Carolina Purchase Money Deed of Trust — Condominium is a legal document that outlines the terms and conditions of a loan used to finance the purchase of a condominium property in Mecklenburg County, North Carolina. This type of deed of trust is specific to condominium units and includes provisions related to the purchase and financing of the property. A purchase money deed of trust is commonly used in real estate transactions where the borrower (buyer) obtains financing from a lender to purchase a property. In this case, it is specifically tailored for condominium purchases in Mecklenburg County, North Carolina. Some key features and provisions typically included in a Mecklenburg North Carolina Purchase Money Deed of Trust — Condominium may include: 1. Property Description: The deed of trust will include a detailed description of the condominium unit being financed, including its address, unit number, and any other relevant identifying information. 2. Parties Involved: The document will identify the parties involved in the transaction, including the borrower (buyer), the lender, and any other necessary individuals or entities. 3. Loan Amount and Terms: The deed of trust will outline the specific loan amount, the interest rate, and the repayment terms agreed upon by the borrower and the lender. It may also include provisions for late payments, default, and remedies available to the lender in case of default. 4. Priority of Liens: This type of deed of trust may address the priority of liens in the event of foreclosure or other legal actions. It clarifies the position of the lender's lien in relation to other potential liens or claims on the property. 5. Default and Remedies: The document will typically outline the actions that may constitute a default on the loan, including failure to make timely payments. It will also specify the remedies available to the lender in case of default, such as foreclosure proceedings. 6. Condominium Association Approval: Depending on the specific requirements of the condominium association, the deed of trust may include provisions regarding the association's approval process and any necessary documentation or fees. While the Mecklenburg North Carolina Purchase Money Deed of Trust — Condominium is a standard document, there may not be different types of this specific deed of trust for condominiums. However, it is important to consult with a legal professional or title company to ensure that the specific terms and conditions of the deed of trust align with the laws and regulations in Mecklenburg County, North Carolina.The Mecklenburg North Carolina Purchase Money Deed of Trust — Condominium is a legal document that outlines the terms and conditions of a loan used to finance the purchase of a condominium property in Mecklenburg County, North Carolina. This type of deed of trust is specific to condominium units and includes provisions related to the purchase and financing of the property. A purchase money deed of trust is commonly used in real estate transactions where the borrower (buyer) obtains financing from a lender to purchase a property. In this case, it is specifically tailored for condominium purchases in Mecklenburg County, North Carolina. Some key features and provisions typically included in a Mecklenburg North Carolina Purchase Money Deed of Trust — Condominium may include: 1. Property Description: The deed of trust will include a detailed description of the condominium unit being financed, including its address, unit number, and any other relevant identifying information. 2. Parties Involved: The document will identify the parties involved in the transaction, including the borrower (buyer), the lender, and any other necessary individuals or entities. 3. Loan Amount and Terms: The deed of trust will outline the specific loan amount, the interest rate, and the repayment terms agreed upon by the borrower and the lender. It may also include provisions for late payments, default, and remedies available to the lender in case of default. 4. Priority of Liens: This type of deed of trust may address the priority of liens in the event of foreclosure or other legal actions. It clarifies the position of the lender's lien in relation to other potential liens or claims on the property. 5. Default and Remedies: The document will typically outline the actions that may constitute a default on the loan, including failure to make timely payments. It will also specify the remedies available to the lender in case of default, such as foreclosure proceedings. 6. Condominium Association Approval: Depending on the specific requirements of the condominium association, the deed of trust may include provisions regarding the association's approval process and any necessary documentation or fees. While the Mecklenburg North Carolina Purchase Money Deed of Trust — Condominium is a standard document, there may not be different types of this specific deed of trust for condominiums. However, it is important to consult with a legal professional or title company to ensure that the specific terms and conditions of the deed of trust align with the laws and regulations in Mecklenburg County, North Carolina.