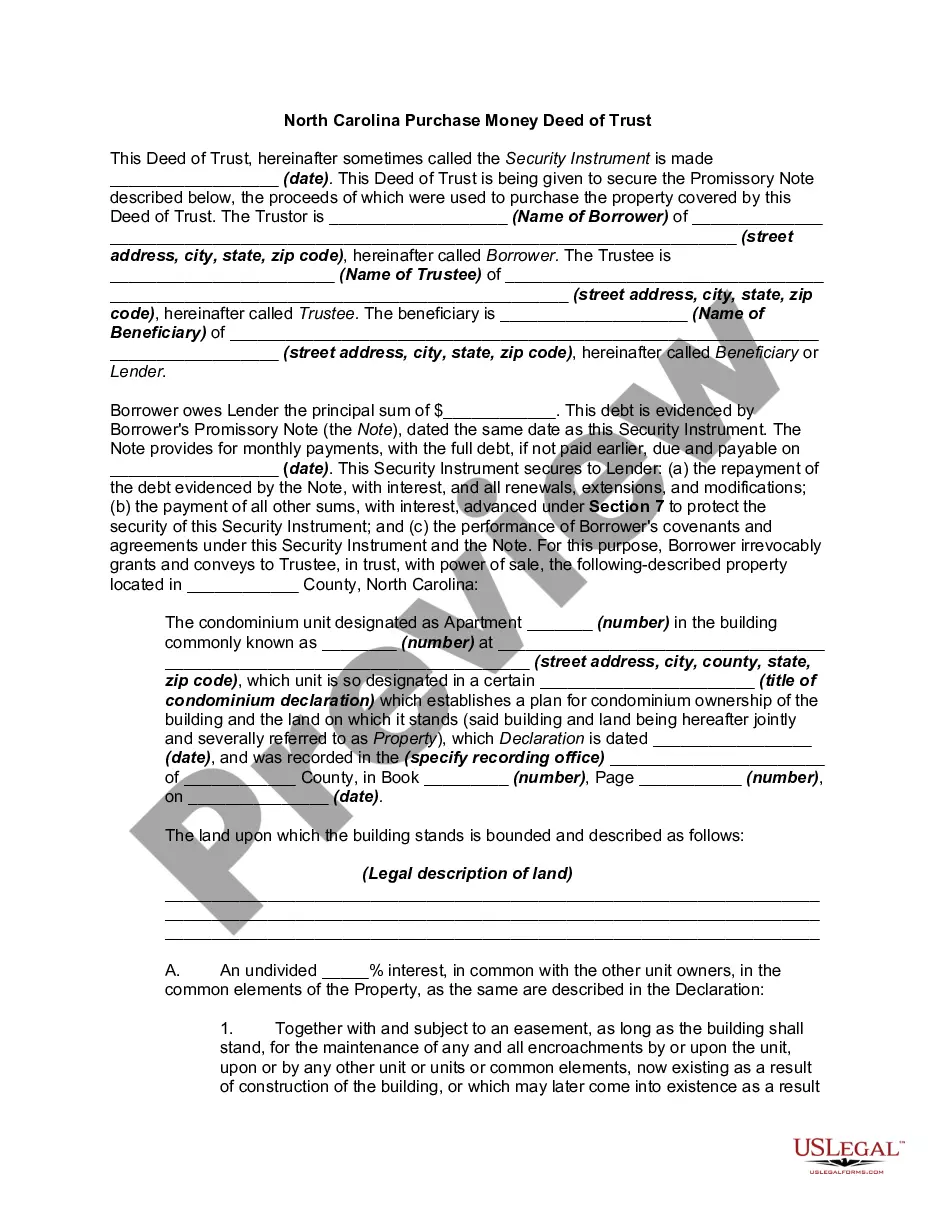

A condominium is one of a group of housing units where each homeowner owns their individual unit space, and all the dwelling share ownership of areas of common use. The individual units normally share walls, but that isn't a requirement. The main difference in condos and regular single homes is that there is no individual ownership of a plot of land. All the land in the condominium project is owned in common by all the homeowners. Usually, the exterior maintenance is paid for out of homeowner dues collected and managed under strict rules. The exterior walls and roof are insured by the condominium association, while all interior walls and items are insured by the homeowner.

Keywords: Raleigh, North Carolina, Purchase Money Deed of Trust, Condominium A Raleigh North Carolina Purchase Money Deed of Trust — Condominium is a legal document that serves as the mortgage and security instrument for a loan used to purchase a condominium in Raleigh, North Carolina. This type of deed of trust specifically applies to condominium properties. The purchase money deed of trust is entered into between the borrower (buyer) and the lender (usually a financial institution) to establish the terms and conditions of the loan. It outlines the rights and obligations of both parties involved in a real estate transaction. By signing this document, the borrower grants the lender a security interest in the condominium property until the loan is repaid in full. In Raleigh, North Carolina, there are various types of Purchase Money Deed of Trust — Condominium that buyers may encounter. These variations can include: 1. Fixed-rate Purchase Money Deed of Trust — Condominium: This type of deed of trust establishes a fixed interest rate for the loan, providing borrowers with stability and predictability in their monthly mortgage payments. 2. Adjustable-rate Purchase Money Deed of Trust — Condominium: In this case, the interest rate on the loan is adjustable and may fluctuate over time based on market conditions. Borrowers may benefit from initially lower interest rates, but there is a level of uncertainty regarding future payment amounts. 3. Balloon Payment Purchase Money Deed of Trust — Condominium: With this type, borrowers can enjoy lower monthly payments for an initial period, followed by a large lump sum payment (balloon payment) at the end of the loan term. This option may suit buyers who anticipate a significant increase in income or plan to sell the property before the balloon payment becomes due. 4. Assumable Purchase Money Deed of Trust — Condominium: This type of deed of trust allows the borrower to transfer the loan and the property to another party, subject to the lender's approval. The new buyer would assume the loan and its remaining terms, which can be advantageous in certain situations, such as when interest rates are high. It is important for buyers to carefully review and understand the terms and conditions outlined in the Raleigh North Carolina Purchase Money Deed of Trust — Condominium before signing. Consulting with a real estate attorney or a knowledgeable professional can provide clarity and ensure the buyer makes informed decisions.