A condominium is one of a group of housing units where each homeowner owns their individual unit space, and all the dwelling share ownership of areas of common use. The individual units normally share walls, but that isn't a requirement. The main difference in condos and regular single homes is that there is no individual ownership of a plot of land. All the land in the condominium project is owned in common by all the homeowners. Usually, the exterior maintenance is paid for out of homeowner dues collected and managed under strict rules. The exterior walls and roof are insured by the condominium association, while all interior walls and items are insured by the homeowner.

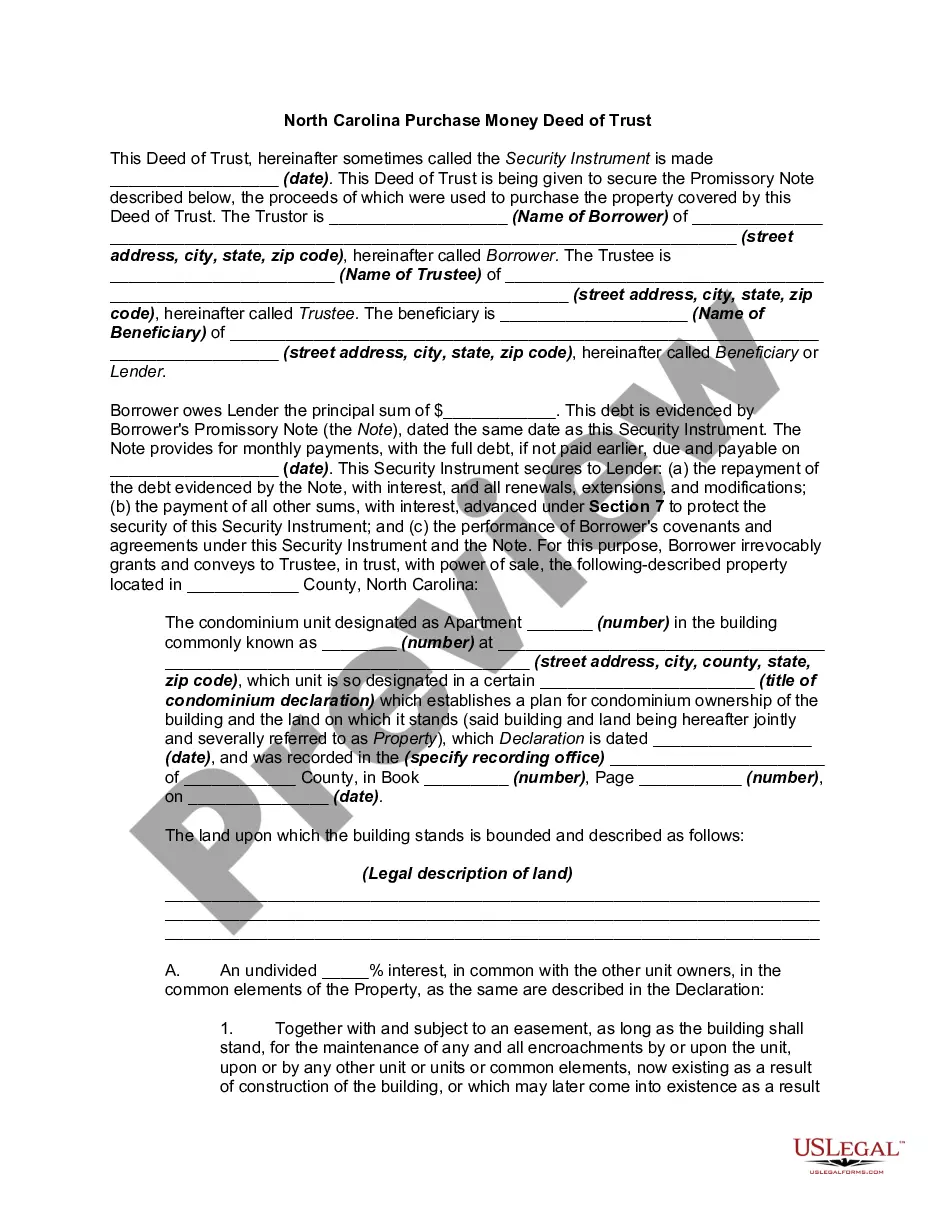

The Wake North Carolina Purchase Money Deed of Trust — Condominium is a legal document that is used in real estate transactions in Wake County, North Carolina. It is specifically related to the purchase of a condominium property and the financing associated with it. This document outlines the terms and conditions of the loan and the rights and responsibilities of the lender and the borrower. Keywords: Wake North Carolina, Purchase Money Deed of Trust, Condominium, real estate transactions, financing, terms and conditions, loan, lender, borrower. There are several types of Wake North Carolina Purchase Money Deed of Trust — Condominium, including: 1. Standard Purchase Money Deed of Trust — Condominium: This is the most common type of deed of trust used in Wake County for financing the purchase of a condominium. It outlines the purchase price, loan amount, interest rate, repayment terms, and other pertinent details. 2. Adjustable Rate Purchase Money Deed of Trust — Condominium: This type of deed of trust includes an adjustable interest rate, meaning the interest rate may change over the life of the loan. This allows borrowers to initially have lower payments, but the rate can increase in the future. 3. Balloon Payment Purchase Money Deed of Trust — Condominium: This type of deed of trust includes a larger final payment, called a balloon payment, due at the end of the loan term. Borrowers typically make smaller payments throughout the duration of the loan and then pay off the remaining balance at the end. 4. Government-insured Purchase Money Deed of Trust — Condominium: This type of deed of trust is backed by a government agency such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). It offers certain benefits and protections for borrowers, such as lower down payment requirements or more favorable interest rates. 5. Assumable Purchase Money Deed of Trust — Condominium: This type of deed of trust allows the borrower to transfer the responsibility of the loan to another person, known as the assumable buyer. The assumable buyer takes over the loan payments and becomes the new borrower. In summary, the Wake North Carolina Purchase Money Deed of Trust — Condominium is a legal document used in real estate transactions specific to condominium purchases. It outlines the terms and conditions of the loan and there are various types available, including the standard deed of trust, adjustable rate, balloon payment, government-insured, and assumable options.The Wake North Carolina Purchase Money Deed of Trust — Condominium is a legal document that is used in real estate transactions in Wake County, North Carolina. It is specifically related to the purchase of a condominium property and the financing associated with it. This document outlines the terms and conditions of the loan and the rights and responsibilities of the lender and the borrower. Keywords: Wake North Carolina, Purchase Money Deed of Trust, Condominium, real estate transactions, financing, terms and conditions, loan, lender, borrower. There are several types of Wake North Carolina Purchase Money Deed of Trust — Condominium, including: 1. Standard Purchase Money Deed of Trust — Condominium: This is the most common type of deed of trust used in Wake County for financing the purchase of a condominium. It outlines the purchase price, loan amount, interest rate, repayment terms, and other pertinent details. 2. Adjustable Rate Purchase Money Deed of Trust — Condominium: This type of deed of trust includes an adjustable interest rate, meaning the interest rate may change over the life of the loan. This allows borrowers to initially have lower payments, but the rate can increase in the future. 3. Balloon Payment Purchase Money Deed of Trust — Condominium: This type of deed of trust includes a larger final payment, called a balloon payment, due at the end of the loan term. Borrowers typically make smaller payments throughout the duration of the loan and then pay off the remaining balance at the end. 4. Government-insured Purchase Money Deed of Trust — Condominium: This type of deed of trust is backed by a government agency such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). It offers certain benefits and protections for borrowers, such as lower down payment requirements or more favorable interest rates. 5. Assumable Purchase Money Deed of Trust — Condominium: This type of deed of trust allows the borrower to transfer the responsibility of the loan to another person, known as the assumable buyer. The assumable buyer takes over the loan payments and becomes the new borrower. In summary, the Wake North Carolina Purchase Money Deed of Trust — Condominium is a legal document used in real estate transactions specific to condominium purchases. It outlines the terms and conditions of the loan and there are various types available, including the standard deed of trust, adjustable rate, balloon payment, government-insured, and assumable options.