A condominium is one of a group of housing units where each homeowner owns their individual unit space, and all the dwelling share ownership of areas of common use. The individual units normally share walls, but that isn't a requirement. The main difference in condos and regular single homes is that there is no individual ownership of a plot of land. All the land in the condominium project is owned in common by all the homeowners. Usually, the exterior maintenance is paid for out of homeowner dues collected and managed under strict rules. The exterior walls and roof are insured by the condominium association, while all interior walls and items are insured by the homeowner.

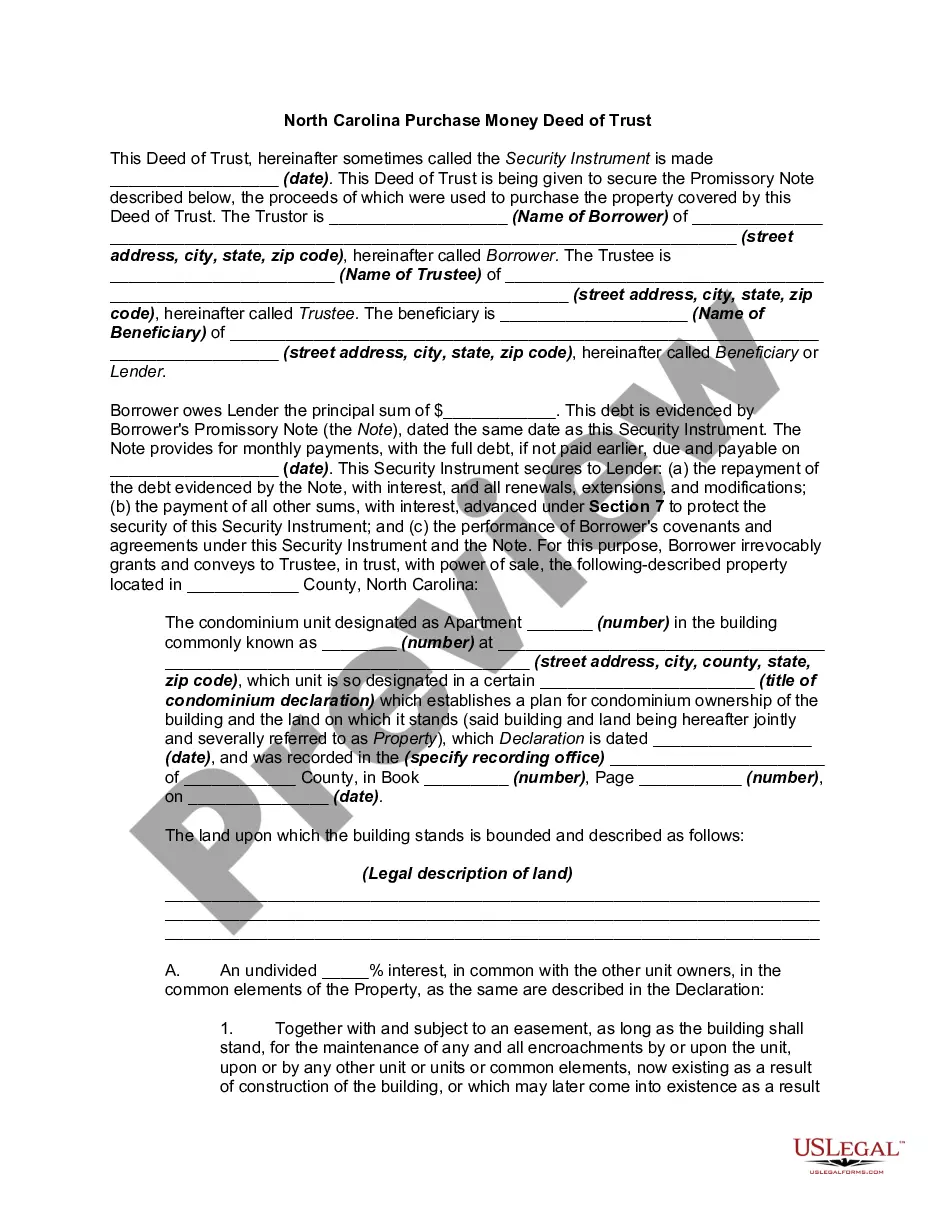

A Wilmington North Carolina Purchase Money Deed of Trust — Condominium is a legal document that outlines the terms and conditions of financing for purchasing a condominium property in Wilmington, North Carolina. This document serves as a security instrument whereby the borrower (buyer) pledges the property as collateral to the lender (usually a financial institution) in exchange for a loan to finance the purchase. The Purchase Money Deed of Trust is specific to the purchase of a condominium unit, which is a type of residential property located within a larger building or complex. This type of ownership typically involves shared common areas, such as parking lots, swimming pools, and recreational spaces, among others. The key components included in a Wilmington North Carolina Purchase Money Deed of Trust — Condominium are as follows: 1. Identification of Parties: The document identifies the borrower (buyer) and the lender, along with their legal names and contact information. It may also include the seller's information if applicable. 2. Property Description: A detailed description of the condominium unit being purchased is provided, including the legal description, address, and any other relevant information. 3. Loan Terms: The specific terms of the loan are outlined, including the principal amount, interest rate, repayment schedule, and any prepayment penalties or late fees, if applicable. 4. Responsibilities and Covenants: The borrower's responsibilities are specified, such as maintaining insurance coverage on the property, paying property taxes, and keeping the condominium unit in good condition. The document may also include other covenants such as restrictions on property use. 5. Default and Remedies: The consequences of defaulting on the loan, such as foreclosure or repossession of the condominium unit, are stated in this section. It also outlines the steps that the lender can take to remedy the default situation. 6. Closing and Escrow: Details of the closing process and any escrow accounts associated with the purchase are included in this section. Some common types of Wilmington North Carolina Purchase Money Deed of Trust — Condominium may include: 1. Standard Purchase Money Deed of Trust — Condominium: This is the standard version that outlines the basic terms and conditions of financing for buying a condominium unit in Wilmington, North Carolina. 2. FHA Purchase Money Deed of Trust — Condominium: If the borrower opts for an FHA (Federal Housing Administration) loan, specific terms and conditions required by the FHA are incorporated into the document. 3. VA Purchase Money Deed of Trust — Condominium: Similar to an FHA loan, this type of purchase money deed of trust caters to borrowers who are using a loan guaranteed by the Department of Veterans Affairs (VA). It is important to consult with a real estate attorney or mortgage professional to ensure compliance with local laws and regulations when drafting or executing a Wilmington North Carolina Purchase Money Deed of Trust — Condominium.