This form is a Quitclaim Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

Charlotte North Carolina Quitclaim Deed - Individual to a Trust

Description

How to fill out North Carolina Quitclaim Deed - Individual To A Trust?

Obtaining certified templates tailored to your local laws can be challenging unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents for personal and professional requirements and various real-world situations.

All the forms are correctly categorized by field of application and jurisdiction, making the search for the Charlotte North Carolina Quitclaim Deed - Individual to a Trust as straightforward as pie.

Utilize the US Legal Forms library to keep your documentation organized and compliant with legal standards, ensuring you always have vital templates readily available to meet your needs!

- Review the Preview mode and form overview.

- Ensure you’ve selected the appropriate one that fulfills your criteria and fully aligns with your local jurisdiction stipulations.

- Search for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your needs, proceed to the next phase.

- Purchase the document.

Form popularity

FAQ

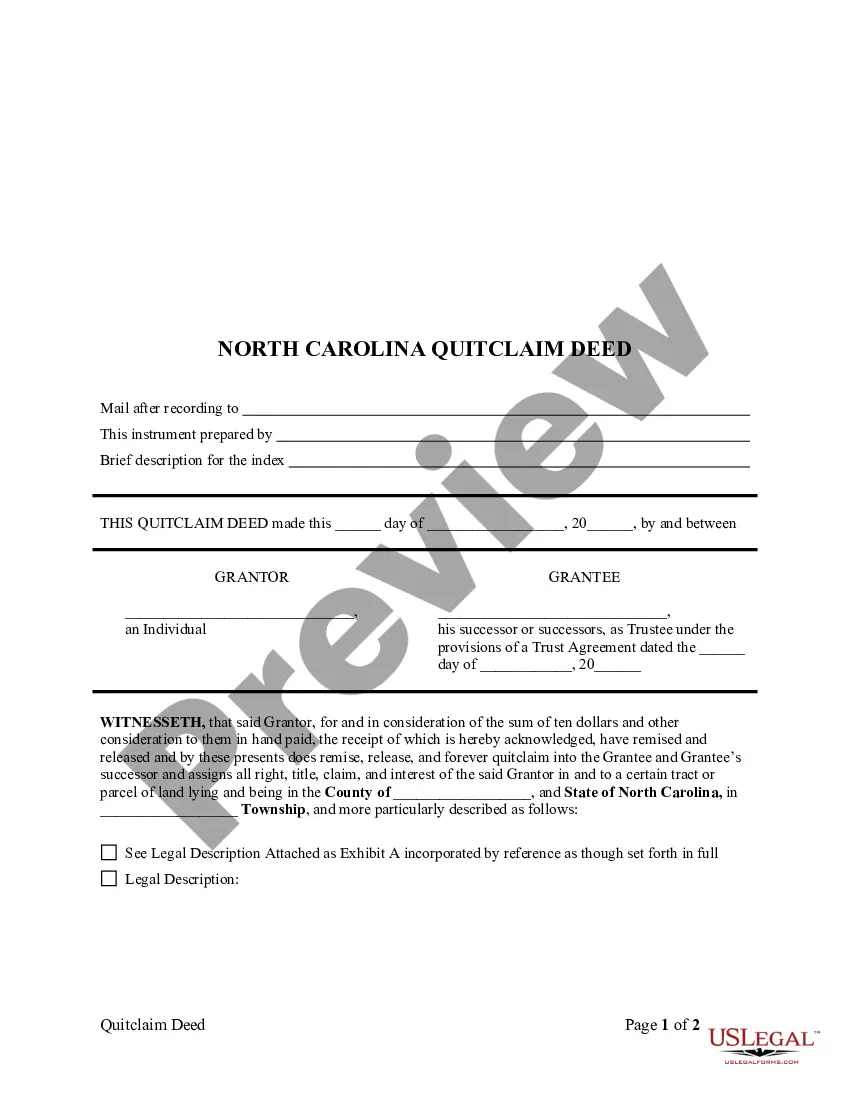

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

A quitclaim deed is what some people think is called a ?quick? claim deed ? but the correct terminology is quitclaim deed. In North Carolina, a quitclaim deed is a document that is signed by two parties with the purpose of transferring one party's interest in real estate to another party.

A. North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advice of legal counsel.

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

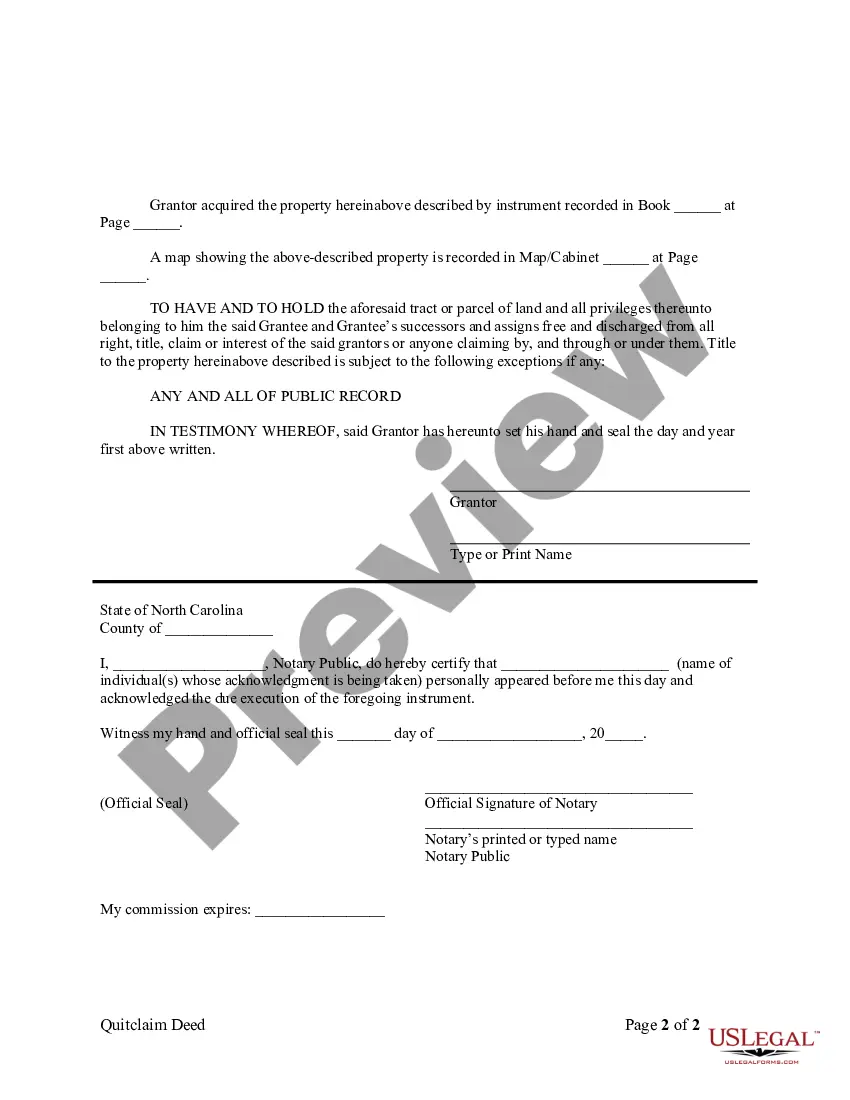

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

A quitclaim deed is likely the fastest, easiest, and most convenient way to transfer your ownership interest in a property or asset to a family member. Unlike other kinds of deeds, such as general and special warranty deeds, quitclaim deeds make no warranties or promises about what is being transferred.

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.