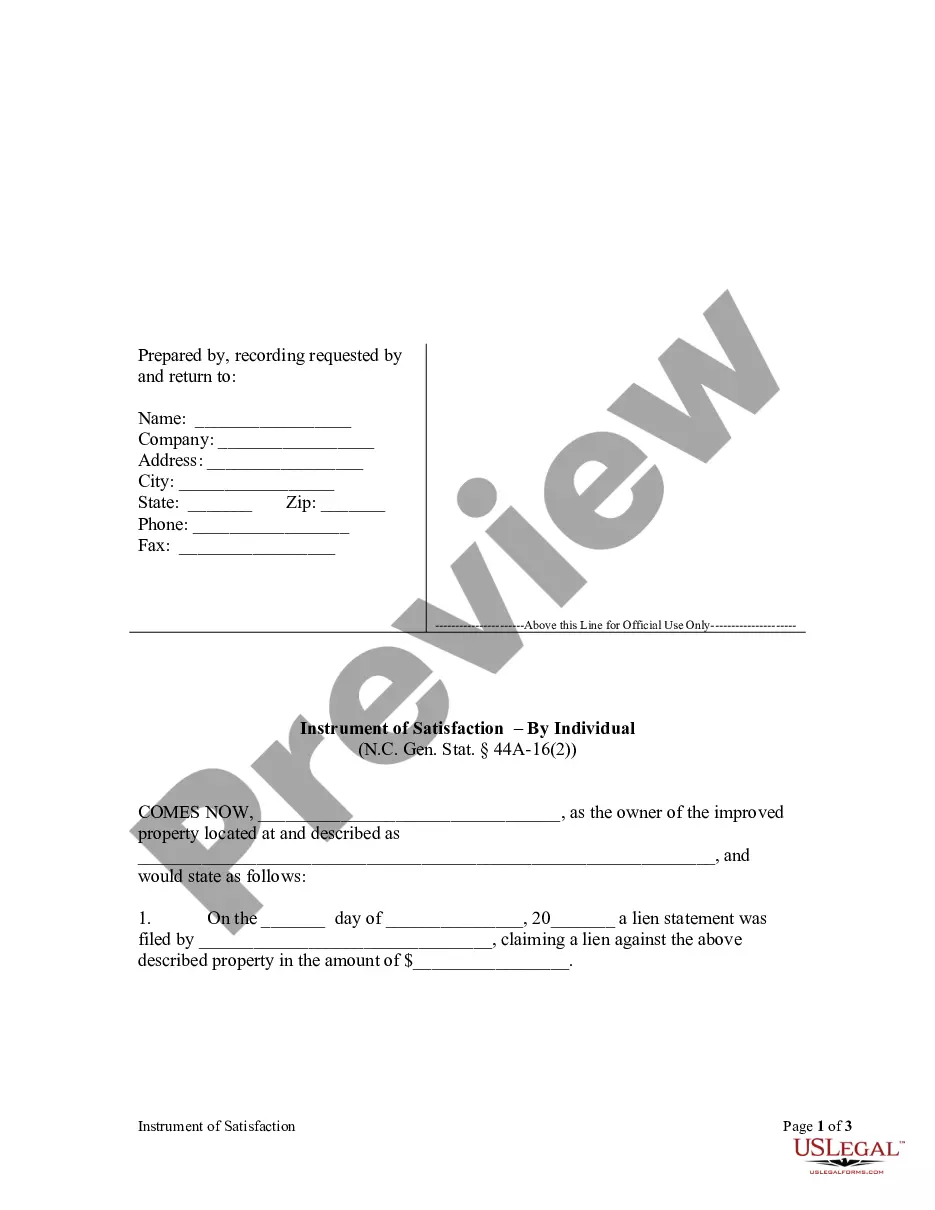

North Carolina law permits a property owner to file an instrument of satisfaction acknowledging the satisfaction of a lien. The instrument must have been signed by the lien claimant of record.

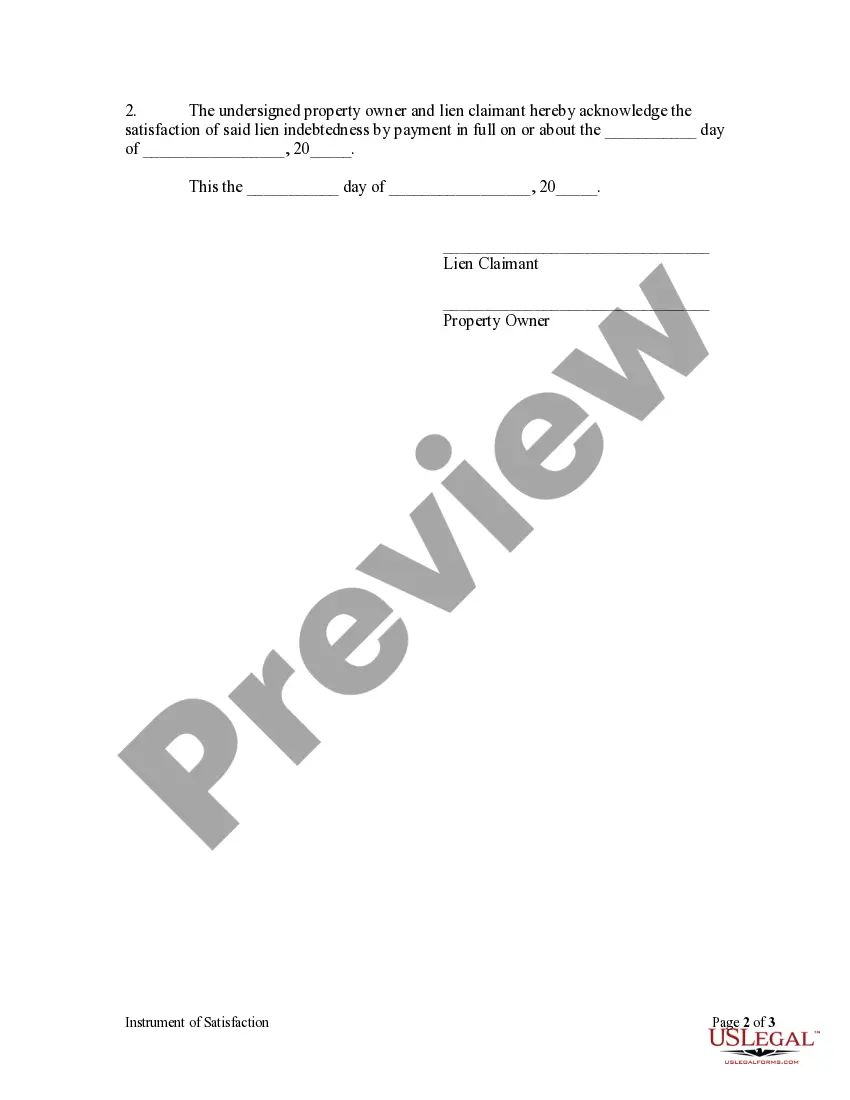

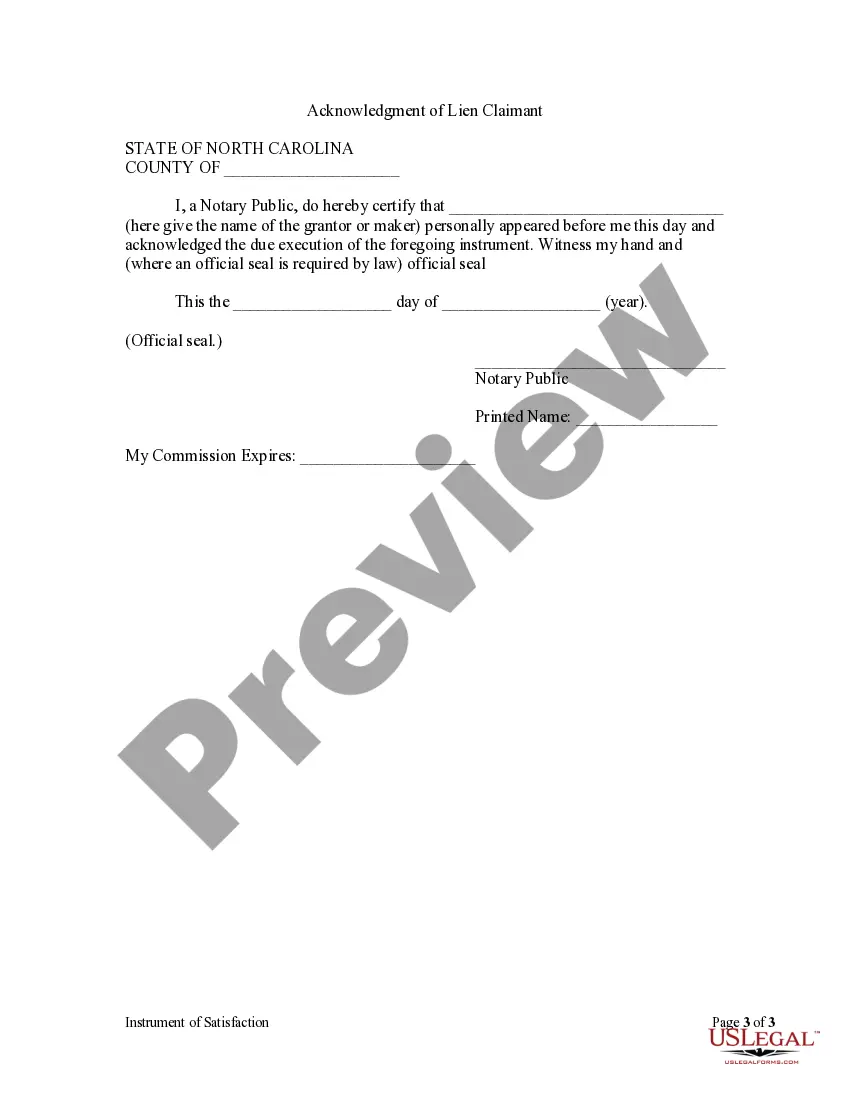

Title: Greensboro North Carolina Instrument of Satisfaction — Individual: A Comprehensive Guide to Understanding and Utilizing this Important Legal Document Introduction: The Greensboro North Carolina Instrument of Satisfaction — Individual is a crucial legal document used in real estate transactions to officially confirm the repayment and satisfaction of a mortgage or deed of trust. This comprehensive guide will provide a detailed description of this instrument, its purpose, required information, applicable parties, and the different types of satisfaction instruments found in Greensboro, North Carolina. Keywords: Greensboro North Carolina, Instrument of Satisfaction — Individual, real estate transactions, mortgage satisfaction, deed of trust satisfaction, legal document Section 1: Understanding the Greensboro North Carolina Instrument of Satisfaction: 1.1 Purpose: The Greensboro North Carolina Instrument of Satisfaction — Individual ensures that the borrower has fulfilled their financial obligations and confirms that the mortgage or deed of trust attached to a property has been completely satisfied. 1.2 Importance: This instrument plays a significant role in maintaining a clear and unencumbered property title, allowing the borrower to have full ownership without any lingering liens or claims by the lender. Section 2: Required Information in the Instrument of Satisfaction: 2.1 Identification: The instrument must clearly identify the mortgage or deed of trust being satisfied, providing specific details such as the original mortgagee or trustee, mortgage or deed of trust reference numbers, and recording information. 2.2 Borrower's Information: The borrower's name, address, and contact details are essential in identifying the individual who has fulfilled the mortgage or deed of trust obligations. 2.3 Date and Signatures: The instrument must include the date of satisfaction and the signature of the borrower, signifying their agreement to the document's accuracy. Section 3: Parties Involved: 3.1 Borrower: The individual who has successfully repaid their mortgage or deed of trust and seeks to obtain an instrument of satisfaction to prove release from the debt. 3.2 Lender or Trustee: The original mortgagee or trustee, who holds the lien on the property until the borrower satisfies their obligations. It is typically the responsibility of the lender or trustee to provide the borrower with the instrument after the debt is cleared. Section 4: Different Types of Greensboro North Carolina Instruments of Satisfaction: 4.1 Individual Satisfaction: This type of instrument is specifically designed for an individual borrower who has repaid their mortgage or deed of trust. It is the most common and straightforward instrument used in Greensboro, North Carolina. 4.2 Corporate Satisfaction: In some instances where a mortgage or deed of trust is held by a corporation or business entity, a separate instrument known as the Greensboro North Carolina Instrument of Satisfaction — Corporate may be utilized. Conclusion: The Greensboro North Carolina Instrument of Satisfaction — Individual is a crucial legal document used to demonstrate the repayment and satisfaction of a mortgage or deed of trust. Understanding the purpose, required information, parties involved, and potential types of satisfaction instruments ensures a smooth and accurate completion of real estate transactions in Greensboro, North Carolina. Keywords: Greensboro North Carolina, Instrument of Satisfaction — Individual, real estate transactions, mortgage satisfaction, deed of trust satisfaction, legal document.Title: Greensboro North Carolina Instrument of Satisfaction — Individual: A Comprehensive Guide to Understanding and Utilizing this Important Legal Document Introduction: The Greensboro North Carolina Instrument of Satisfaction — Individual is a crucial legal document used in real estate transactions to officially confirm the repayment and satisfaction of a mortgage or deed of trust. This comprehensive guide will provide a detailed description of this instrument, its purpose, required information, applicable parties, and the different types of satisfaction instruments found in Greensboro, North Carolina. Keywords: Greensboro North Carolina, Instrument of Satisfaction — Individual, real estate transactions, mortgage satisfaction, deed of trust satisfaction, legal document Section 1: Understanding the Greensboro North Carolina Instrument of Satisfaction: 1.1 Purpose: The Greensboro North Carolina Instrument of Satisfaction — Individual ensures that the borrower has fulfilled their financial obligations and confirms that the mortgage or deed of trust attached to a property has been completely satisfied. 1.2 Importance: This instrument plays a significant role in maintaining a clear and unencumbered property title, allowing the borrower to have full ownership without any lingering liens or claims by the lender. Section 2: Required Information in the Instrument of Satisfaction: 2.1 Identification: The instrument must clearly identify the mortgage or deed of trust being satisfied, providing specific details such as the original mortgagee or trustee, mortgage or deed of trust reference numbers, and recording information. 2.2 Borrower's Information: The borrower's name, address, and contact details are essential in identifying the individual who has fulfilled the mortgage or deed of trust obligations. 2.3 Date and Signatures: The instrument must include the date of satisfaction and the signature of the borrower, signifying their agreement to the document's accuracy. Section 3: Parties Involved: 3.1 Borrower: The individual who has successfully repaid their mortgage or deed of trust and seeks to obtain an instrument of satisfaction to prove release from the debt. 3.2 Lender or Trustee: The original mortgagee or trustee, who holds the lien on the property until the borrower satisfies their obligations. It is typically the responsibility of the lender or trustee to provide the borrower with the instrument after the debt is cleared. Section 4: Different Types of Greensboro North Carolina Instruments of Satisfaction: 4.1 Individual Satisfaction: This type of instrument is specifically designed for an individual borrower who has repaid their mortgage or deed of trust. It is the most common and straightforward instrument used in Greensboro, North Carolina. 4.2 Corporate Satisfaction: In some instances where a mortgage or deed of trust is held by a corporation or business entity, a separate instrument known as the Greensboro North Carolina Instrument of Satisfaction — Corporate may be utilized. Conclusion: The Greensboro North Carolina Instrument of Satisfaction — Individual is a crucial legal document used to demonstrate the repayment and satisfaction of a mortgage or deed of trust. Understanding the purpose, required information, parties involved, and potential types of satisfaction instruments ensures a smooth and accurate completion of real estate transactions in Greensboro, North Carolina. Keywords: Greensboro North Carolina, Instrument of Satisfaction — Individual, real estate transactions, mortgage satisfaction, deed of trust satisfaction, legal document.