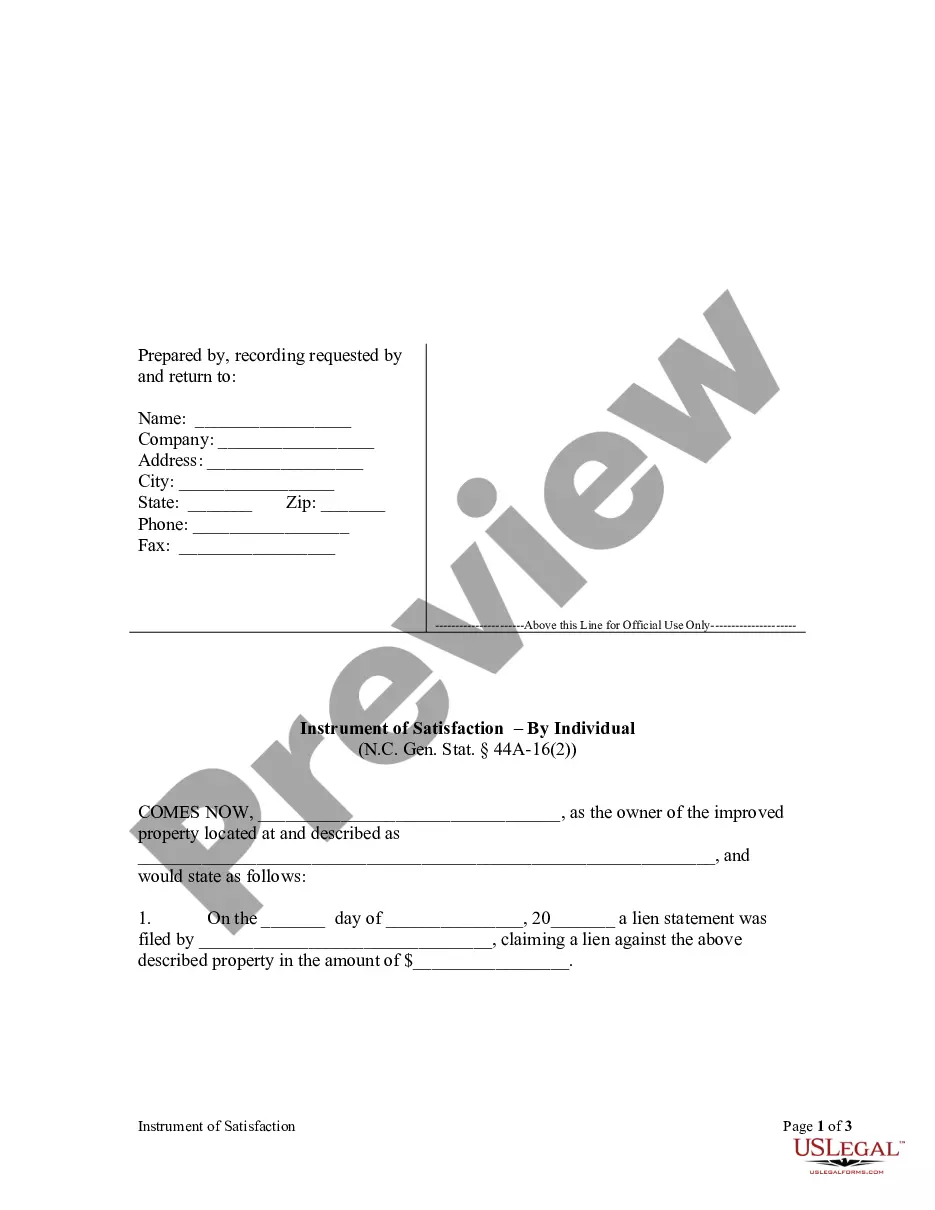

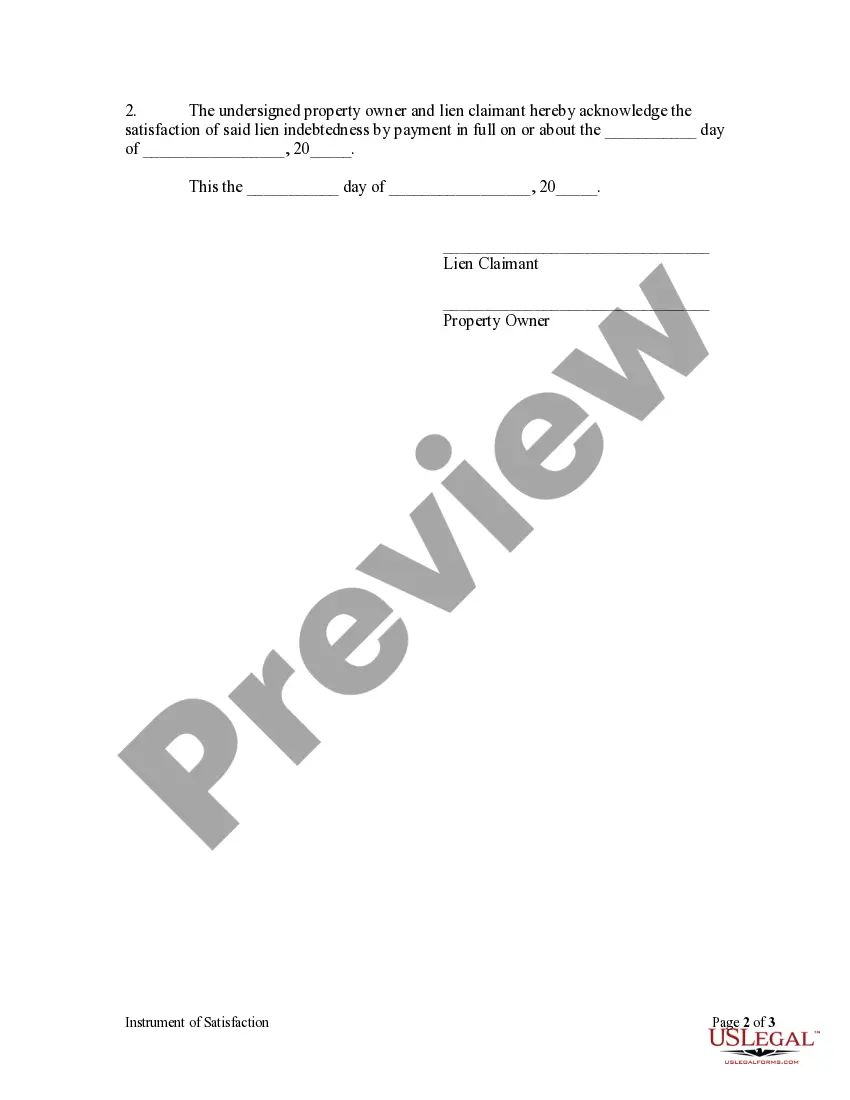

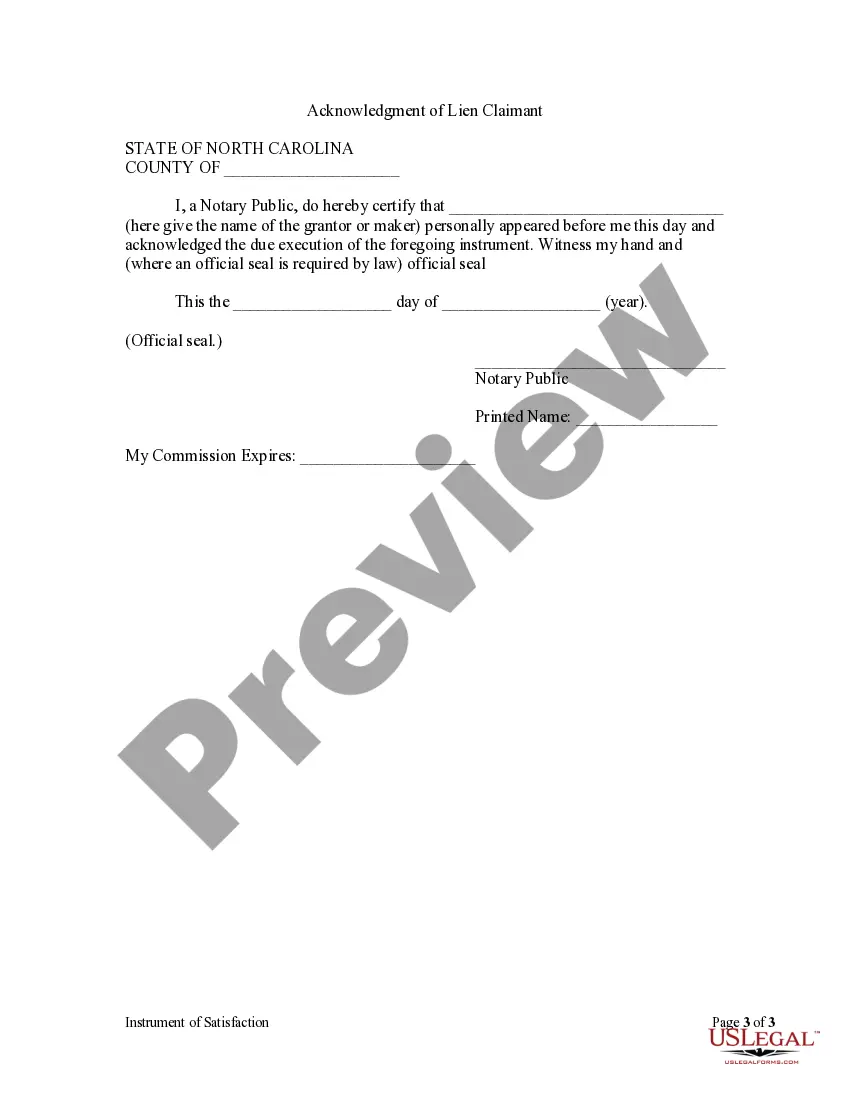

North Carolina law permits a property owner to file an instrument of satisfaction acknowledging the satisfaction of a lien. The instrument must have been signed by the lien claimant of record.

The Raleigh North Carolina Instrument of Satisfaction — Individual is an important legal document used in the real estate industry, specifically in the state of North Carolina. This instrument serves as proof that a mortgage loan or other financial obligation secured by a property has been fully paid and satisfied. It provides assurance to both the borrower and the lender that all terms and conditions of the loan agreement have been fulfilled, allowing for the release of the lien on the property. Keywords: Raleigh, North Carolina, Instrument of Satisfaction, Individual, real estate, mortgage loan, financial obligation, paid, satisfied, lien, property, loan agreement. Types of Raleigh North Carolina Instrument of Satisfaction — Individual: 1. Mortgage Instrument of Satisfaction — Individual: This type of instrument is used when an individual borrower has successfully paid off their mortgage loan. It contains details about the loan, the borrower, the lender, and the property. By signing the document, the borrower acknowledges and confirms the full repayment of the mortgage, leading to the satisfaction of the loan. 2. Deed of Trust Instrument of Satisfaction — Individual: In some cases, a deed of trust is used instead of a traditional mortgage. This instrument is applicable when the borrower has satisfied their financial obligation under a deed of trust arrangement. Similar to the mortgage instrument of satisfaction, the deed of trust instrument of satisfaction confirms the full payment of the loan and the release of the lien on the property. 3. Home Equity Loan Instrument of Satisfaction — Individual: This type of instrument pertains to individuals who have paid off their home equity loan, which is a loan taken against the equity built within a property. Once this loan is fully satisfied, the instrument of satisfaction is executed, ensuring the release of the lien and confirming the borrower's successful repayment. 4. Promissory Note Instrument of Satisfaction — Individual: Occasionally, individuals may have executed promissory notes for various financial obligations, such as personal loans. If the borrower fully settles the debt, an instrument of satisfaction is created to acknowledge the repayment and release any liens or encumbrances associated with the note. It is important to note that these descriptions are general guidelines and may not encompass all variations of the Raleigh North Carolina Instrument of Satisfaction — Individual. It is alwayrecommendeconsultinglt with a legal professional or relevant authorities for accurate and up-to-date information on specific types and requirements of these instruments in Raleigh, North Carolina.