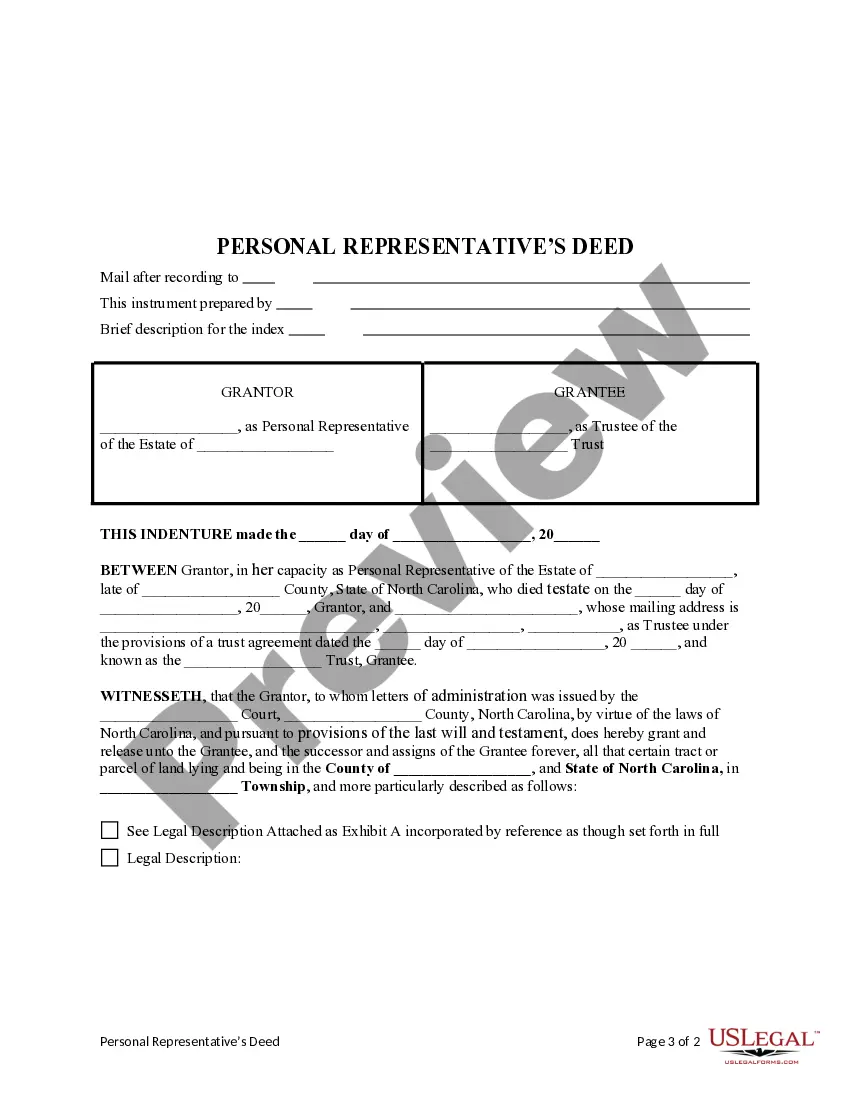

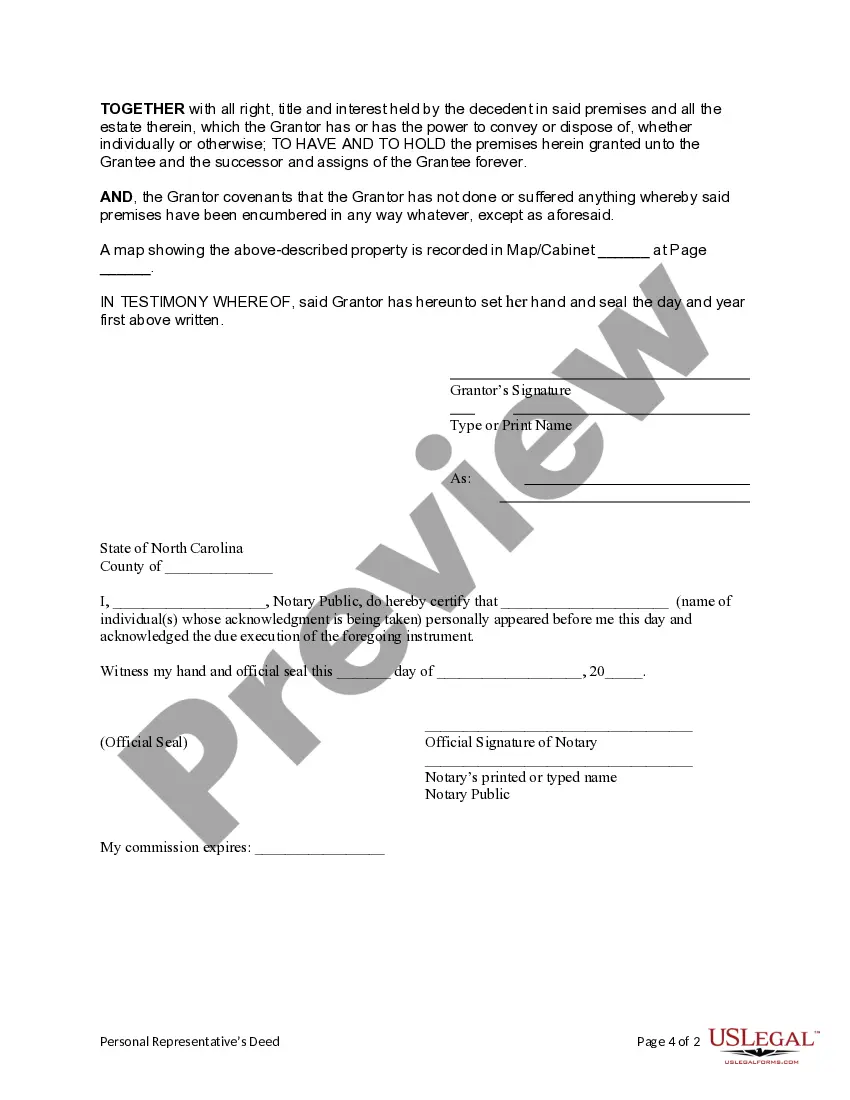

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is a trust for the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

High Point North Carolina Personal Representative's Deed to a Trust

Description

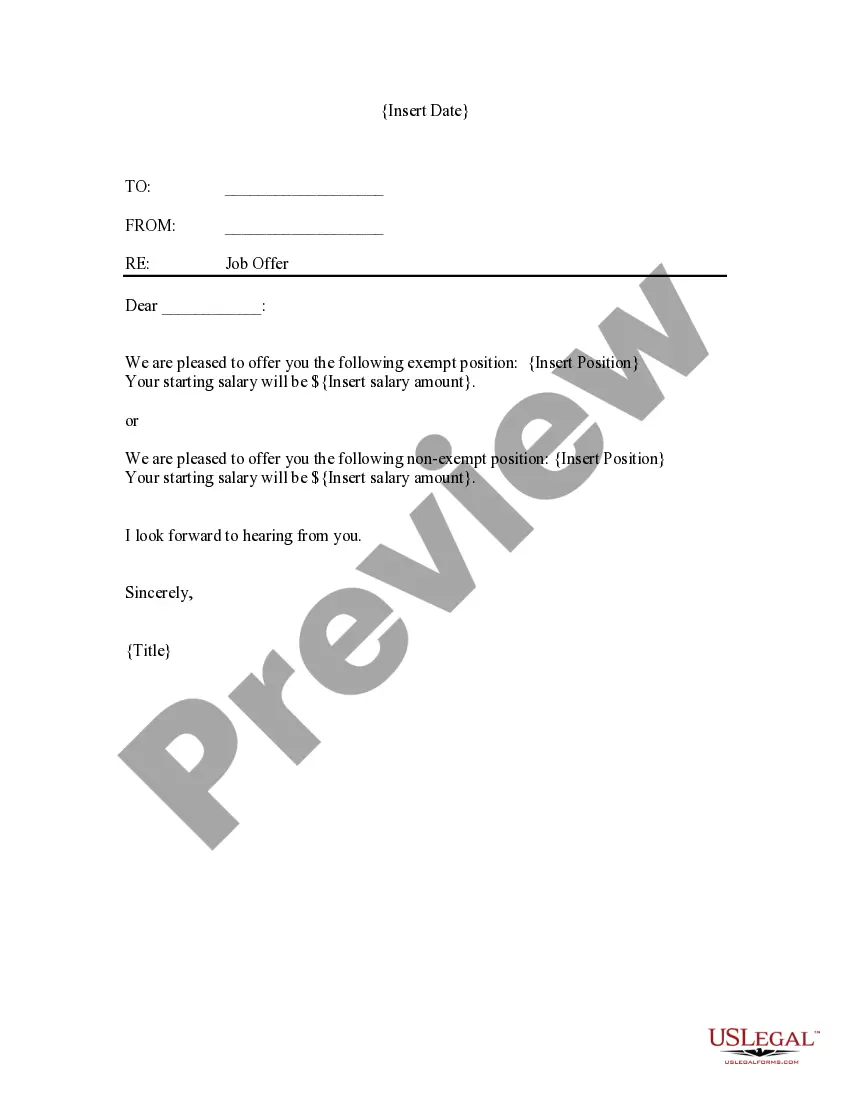

How to fill out North Carolina Personal Representative's Deed To A Trust?

We consistently endeavor to minimize or avert legal harm when navigating intricate law-related or financial matters.

To achieve this, we enroll in legal services that are typically quite costly.

Nonetheless, not every legal concern is equally complicated.

Many of them can be managed independently.

Utilize US Legal Forms whenever you need to obtain and download the High Point North Carolina Personal Representative's Deed to a Trust or any other form quickly and securely. Simply Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it from the My documents tab. The procedure is just as straightforward if you're new to the platform! You can set up your account in a matter of minutes. Ensure that the High Point North Carolina Personal Representative's Deed to a Trust adheres to the laws and regulations of your state and locality. Additionally, it is crucial that you review the form’s description (if available), and if you detect any inconsistencies with what you were seeking originally, look for an alternative template. Once you’ve confirmed that the High Point North Carolina Personal Representative's Deed to a Trust is suitable for your situation, you can select the subscription option and move forward to payment. Following that, you can download the form in any preferred format. With over 24 years of our presence in the industry, we’ve assisted millions by providing customizable and current legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection empowers you to take control of your matters without resorting to a lawyer.

- We provide access to legal form templates that are not always accessible to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

This type of ownership does not have survivorship rights in the property. So, at the death of one owner, the property passes to the deceased owner's heirs, as opposed to other owners.

29-14. As detailed in this statute, if the person who dies is survived by a spouse, the spouse will take in one of the following manners: If the person who dies is not survived by a child, a grandchild, or a parent, the spouse takes the entire estate, both real and personal property.

North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

The surviving children will split 2/3 of the real estate and the remaining personal property assets in equal shares under the rules of intestacy in North Carolina.

Spouses in North Carolina Inheritance Law If you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

Q.Is Inheritance Considered Marital Property in a North Carolina Divorce? No. Unless the inheritance was giving as a marital gift or the spouse receiving the inheritance contributes the funds into a shared bank account or provides the additional spouse reasonable access to the inherited assets.

When dealing with estates and estate contracts, the best practice is to have all parties sign all agreements. The heirs will need to sign because, more than likely, they will hold title to the property subject to the debts of the estate.

This means you don't need to do anything to change the deed on a property you inherit. The deed to the property automatically transfers to you after your loved one passes away. From that point, all you would need to prove that you are the rightful owner of the property is: A copy of your loved one's death certificate.

Unlike South Carolina and many other states, real property in North Carolina does not typically pass through probate. When a decedent dies intestate (without a Will), title to the decedent's non-survivorship real property is vested in his or heir heirs as of the time of death G.S. 28A-15-2(b).

With regard to transfer or real property by beneficiary designation, as of the date of this writing, North Carolina (unlike some other states) does not allow real property to transfer through a beneficiary designation - transfer on death deeds.