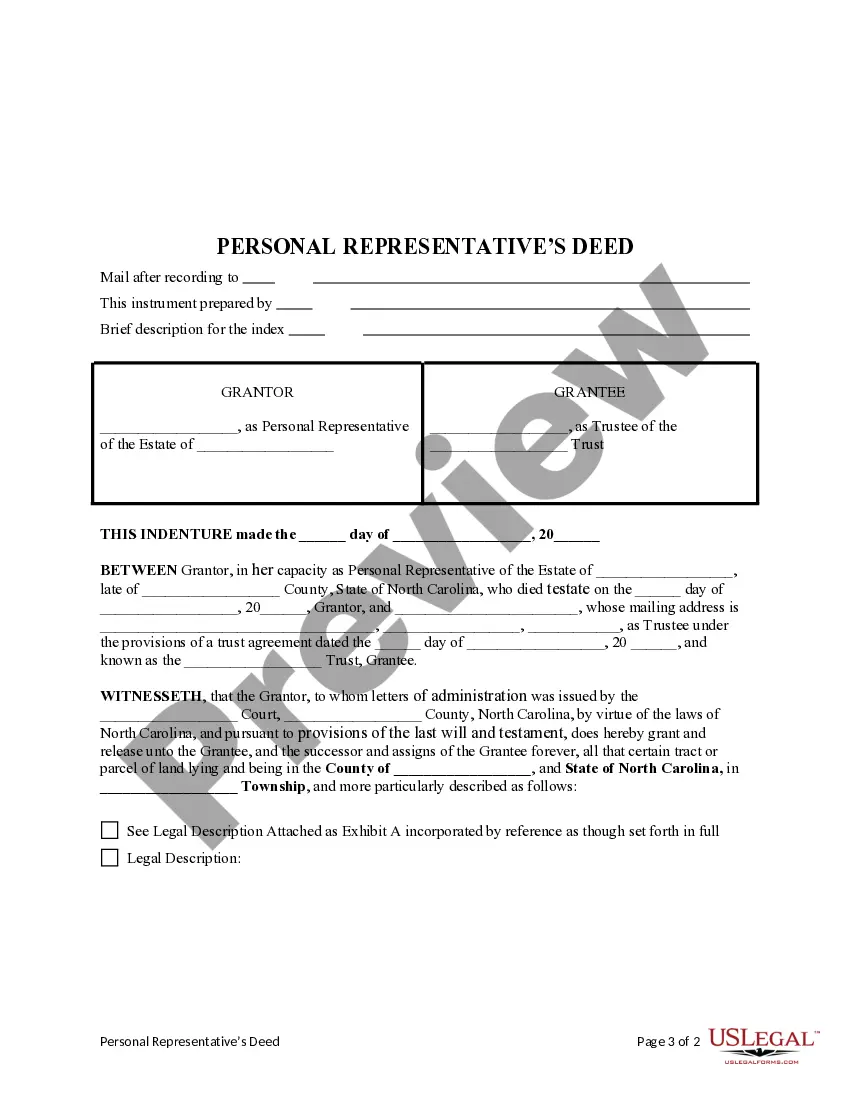

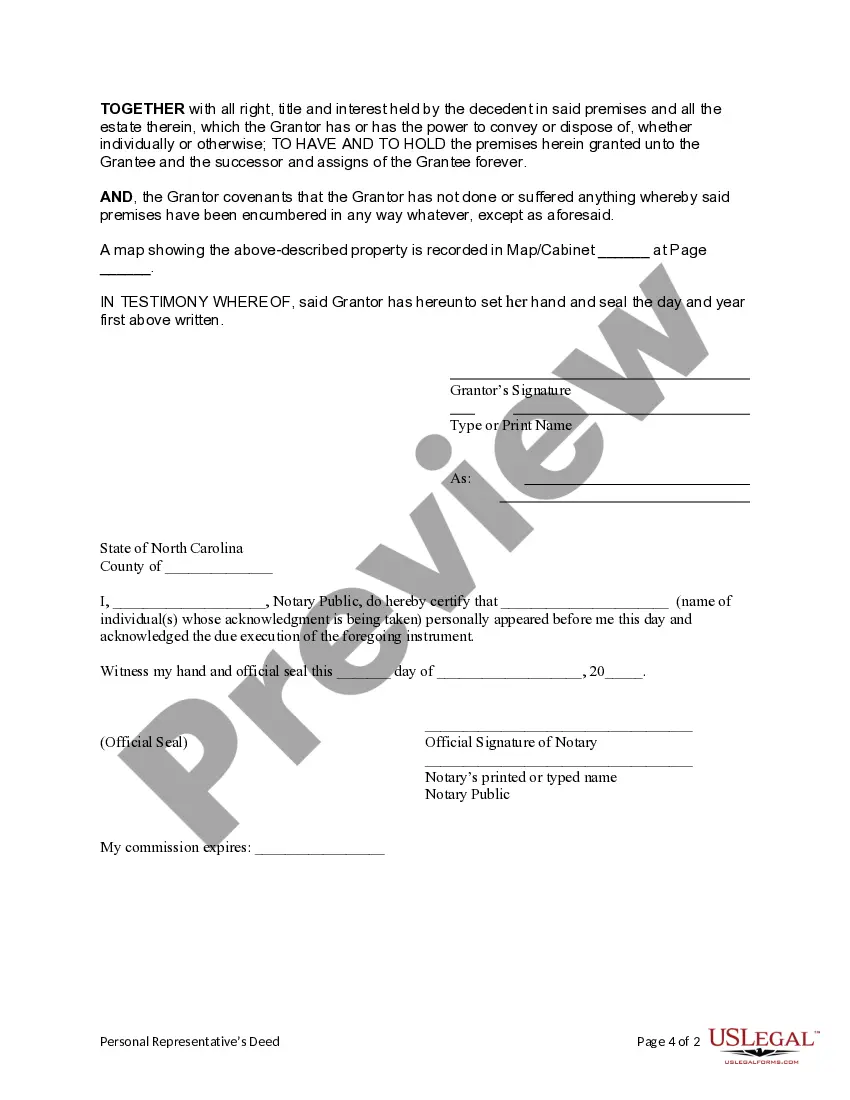

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is a trust for the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

A Mecklenburg North Carolina Personal Representative's Deed to a Trust is a legal document used in the state of North Carolina to transfer property from the estate of a deceased person to a trust. This deed is commonly utilized when a Personal Representative, also known as an executor or administrator, is appointed by the court to handle the affairs of an estate upon the death of an individual. The Personal Representative's Deed to a Trust serves as a means to ensure the orderly transfer of property to a trust, which is a legal entity created to hold assets for the benefit of one or more beneficiaries. This type of transaction often takes place during the probate process, where the deceased person's financial affairs are settled and their assets are distributed according to their will or North Carolina intestacy laws. A Mecklenburg North Carolina Personal Representative's Deed to a Trust includes essential details such as the names and addresses of the Personal Representative and the beneficiaries, a description of the property being transferred, and the terms and conditions of the transfer. It also references the specific trust agreement governing the trust where the property will be held. There are a few different types of Mecklenburg North Carolina Personal Representative's Deed to a Trust that can be distinguished based on their specific purposes or circumstances: 1. Survivor's Trust Deed: This type of deed is used in cases where the deceased person's property is being transferred to a trust for the benefit of their surviving spouse. It ensures the seamless transfer of assets while providing for the surviving spouse's financial security. 2. Testamentary Trust Deed: In situations where the deceased person's will creates a trust to hold and manage their assets after death, a testamentary trust deed is utilized. It allows for the transfer of property to the trust in accordance with the provisions outlined in the will. 3. Generation-Skipping Trust Deed: When a trust is established to benefit grandchildren or subsequent generations rather than the deceased person's immediate beneficiaries, a generation-skipping trust deed is employed. This ensures the property is bypassing one or more generations for various reasons, such as tax planning or preservation of family wealth. In conclusion, a Mecklenburg North Carolina Personal Representative's Deed to a Trust is a vital legal instrument utilized to facilitate the transfer of property from an estate to a trust. Its purpose is to legally document the terms and conditions of the transfer, ensuring transparency and compliance with North Carolina laws. The different types of such deeds, such as Survivor's Trust Deed, Testamentary Trust Deed, and Generation-Skipping Trust Deed, cater to specific circumstances and objectives of the deceased person's estate distribution.A Mecklenburg North Carolina Personal Representative's Deed to a Trust is a legal document used in the state of North Carolina to transfer property from the estate of a deceased person to a trust. This deed is commonly utilized when a Personal Representative, also known as an executor or administrator, is appointed by the court to handle the affairs of an estate upon the death of an individual. The Personal Representative's Deed to a Trust serves as a means to ensure the orderly transfer of property to a trust, which is a legal entity created to hold assets for the benefit of one or more beneficiaries. This type of transaction often takes place during the probate process, where the deceased person's financial affairs are settled and their assets are distributed according to their will or North Carolina intestacy laws. A Mecklenburg North Carolina Personal Representative's Deed to a Trust includes essential details such as the names and addresses of the Personal Representative and the beneficiaries, a description of the property being transferred, and the terms and conditions of the transfer. It also references the specific trust agreement governing the trust where the property will be held. There are a few different types of Mecklenburg North Carolina Personal Representative's Deed to a Trust that can be distinguished based on their specific purposes or circumstances: 1. Survivor's Trust Deed: This type of deed is used in cases where the deceased person's property is being transferred to a trust for the benefit of their surviving spouse. It ensures the seamless transfer of assets while providing for the surviving spouse's financial security. 2. Testamentary Trust Deed: In situations where the deceased person's will creates a trust to hold and manage their assets after death, a testamentary trust deed is utilized. It allows for the transfer of property to the trust in accordance with the provisions outlined in the will. 3. Generation-Skipping Trust Deed: When a trust is established to benefit grandchildren or subsequent generations rather than the deceased person's immediate beneficiaries, a generation-skipping trust deed is employed. This ensures the property is bypassing one or more generations for various reasons, such as tax planning or preservation of family wealth. In conclusion, a Mecklenburg North Carolina Personal Representative's Deed to a Trust is a vital legal instrument utilized to facilitate the transfer of property from an estate to a trust. Its purpose is to legally document the terms and conditions of the transfer, ensuring transparency and compliance with North Carolina laws. The different types of such deeds, such as Survivor's Trust Deed, Testamentary Trust Deed, and Generation-Skipping Trust Deed, cater to specific circumstances and objectives of the deceased person's estate distribution.