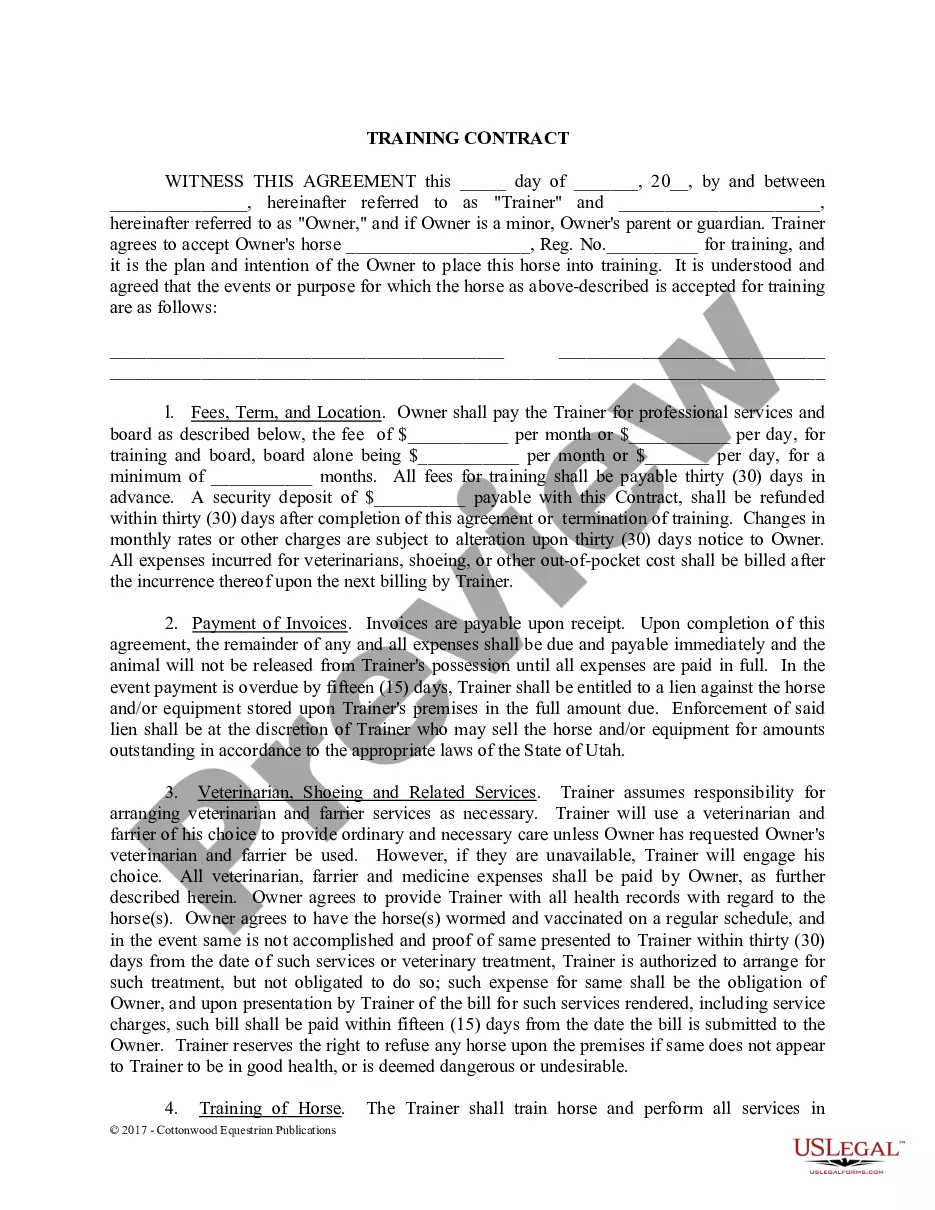

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is a trust for the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Raleigh North Carolina Personal Representative's Deed to a Trust

Description

How to fill out Raleigh North Carolina Personal Representative's Deed To A Trust?

Are you in search of a dependable and budget-friendly legal forms provider to obtain the Raleigh North Carolina Personal Representative's Deed to a Trust? US Legal Forms is your ideal choice.

Whether you require a simple agreement to establish rules for living with your partner or a collection of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our platform provides over 85,000 current legal document templates for both personal and business requirements. All the templates we supply are tailored to meet the specifications of particular states and counties.

To retrieve the document, you must Log In to your account, find the desired form, and click the Download button next to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents section.

Is this your first time visiting our site? No problem. You can create an account with great ease, but before doing so, ensure to do the following.

Now you can set up your account. Then select a subscription plan and proceed with the payment. Once the transaction is completed, download the Raleigh North Carolina Personal Representative's Deed to a Trust in any available format. You can revisit the website anytime to redownload the document at no cost.

Finding current legal documents has never been simpler. Try US Legal Forms today, and put an end to wasting hours researching legal papers online once and for all.

- Verify that the Raleigh North Carolina Personal Representative's Deed to a Trust aligns with the regulations of your state and locality.

- Examine the form’s description (if accessible) to understand who and what the document is suitable for.

- Restart the search if the form is not appropriate for your legal situation.

Form popularity

FAQ

A Grant of Representation provides authority to the personal representative to deal with the estate including selling any property and closing any accounts. A Grant of Representation is known as a Grant of Probate (where there is a Will) or a Grant of Letters of Administration (where there is no Will).

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative.

The answer is yes, it's perfectly normal (and perfectly legal) to name the same person as an executor and a beneficiary in your will.

North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

With regard to transfer or real property by beneficiary designation, as of the date of this writing, North Carolina (unlike some other states) does not allow real property to transfer through a beneficiary designation - transfer on death deeds.

If both parents are deceased, then your siblings (or the descendants of your deceased siblings) will inherit your property. If you are single, have no surviving descendants, and no surviving parents, surviving siblings, or nieces or nephews, then your property will be split into two halves.

Can a personal representative be a beneficiary of a will? Yes. A personal representative can also be a named beneficiary in the decedent's will. For example, in a family with four siblings, one of the siblings or even the spouse may act as a personal representative.

Transfer-on-Death Deeds for Real Estate North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

As long as they meet the legal requirements of being an executor?being of age and capable of carrying out an executor's duties?a beneficiary can be an estate's executor.

A North Carolina Transfer on Death Deed is a legally binding document that certifies the property owner's intention to transfer the items indicated in writing to their beneficiary upon the death of the grantor.