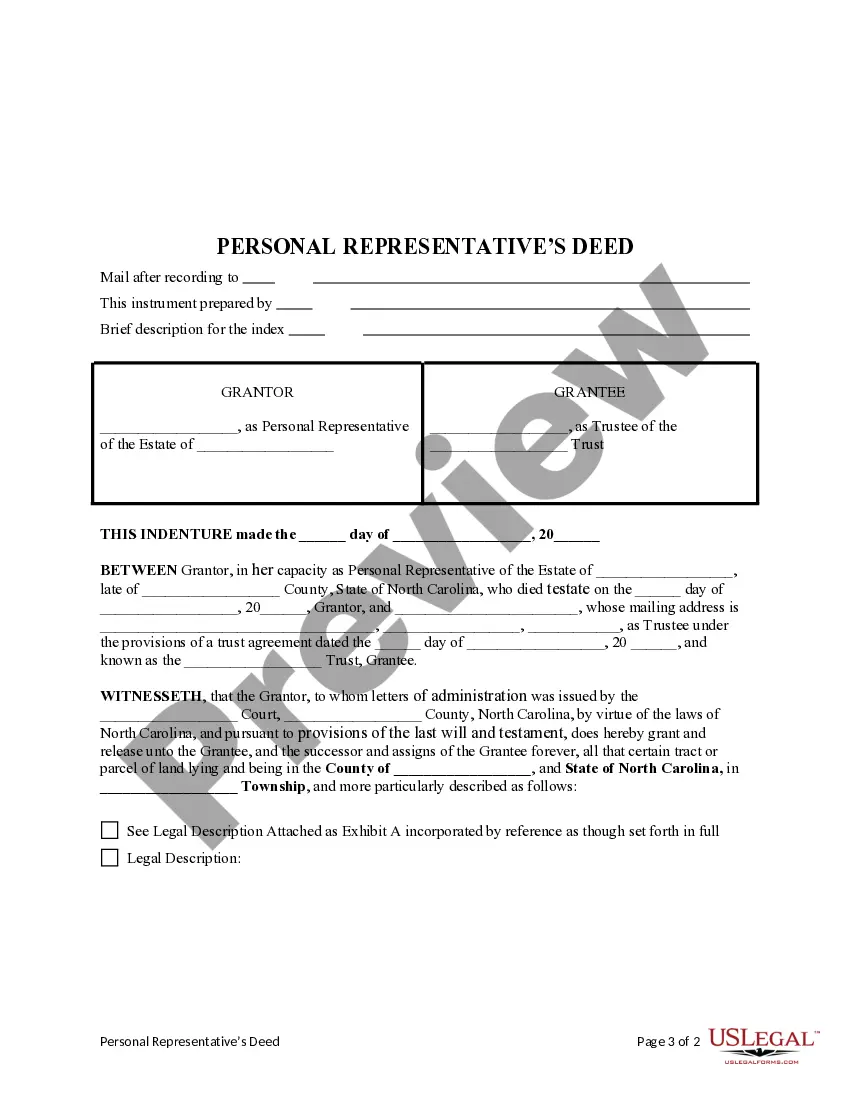

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is a trust for the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

A Wake North Carolina Personal Representative's Deed to a Trust is a legal document that involves the transfer of real property from the estate of a deceased person to a trust established for the benefit of designated beneficiaries. This type of deed is often associated with the probate process and allows a personal representative, also known as an executor or administrator, to convey titled assets into a trust established by the deceased individual. The Wake North Carolina Personal Representative's Deed to a Trust serves as a crucial step in estate planning and administration. It enables the smooth transfer of property ownership without the need for a time-consuming probate process. By executing this deed, the personal representative ensures that the deceased individual's wishes regarding asset distribution are properly carried out. The personal representative, acting on behalf of the estate, must adhere to the instructions set forth in the deceased person's will or the state's intestacy laws (in the absence of a will). The deed transfers ownership of titled assets, such as real estate properties, from the estate into a trust, where they will be managed and distributed in accordance with the trust document's provisions. This process is crucial for minimizing estate taxes, preserving privacy, and expediting the transfer of property to intended beneficiaries. There are several types of Wake North Carolina Personal Representative's Deed to a Trust that may be used depending on the specifics of the situation: 1. Wake North Carolina Personal Representative's Warranty Deed to a Trust: This particular deed guarantees that the personal representative possesses legal authority to transfer the property to the trust and assures the trust beneficiaries that the property is free from any undisclosed encumbrances. 2. Wake North Carolina Personal Representative's Quitclaim Deed to a Trust: This type of deed is often used when the personal representative is unsure about the legal status of the property or when no warranties of title are required. A quitclaim deed transfers the personal representative's interest in the property "as is," without any guarantees. 3. Wake North Carolina Personal Representative's Special Warranty Deed to a Trust: This deed type provides a limited warranty, commonly known as a "special warranty," where the personal representative guarantees that they have not created any encumbrances on the property during their tenure. Executing a Wake North Carolina Personal Representative's Deed to a Trust involves filing the appropriate documents, such as an Affidavit of Death and Warship, Letters Testamentary or Letters of Administration, along with the deed itself. It is essential for the personal representative to consult with an attorney experienced in estate law to ensure compliance with the state's specific requirements and to safeguard the interests of the estate and its beneficiaries.A Wake North Carolina Personal Representative's Deed to a Trust is a legal document that involves the transfer of real property from the estate of a deceased person to a trust established for the benefit of designated beneficiaries. This type of deed is often associated with the probate process and allows a personal representative, also known as an executor or administrator, to convey titled assets into a trust established by the deceased individual. The Wake North Carolina Personal Representative's Deed to a Trust serves as a crucial step in estate planning and administration. It enables the smooth transfer of property ownership without the need for a time-consuming probate process. By executing this deed, the personal representative ensures that the deceased individual's wishes regarding asset distribution are properly carried out. The personal representative, acting on behalf of the estate, must adhere to the instructions set forth in the deceased person's will or the state's intestacy laws (in the absence of a will). The deed transfers ownership of titled assets, such as real estate properties, from the estate into a trust, where they will be managed and distributed in accordance with the trust document's provisions. This process is crucial for minimizing estate taxes, preserving privacy, and expediting the transfer of property to intended beneficiaries. There are several types of Wake North Carolina Personal Representative's Deed to a Trust that may be used depending on the specifics of the situation: 1. Wake North Carolina Personal Representative's Warranty Deed to a Trust: This particular deed guarantees that the personal representative possesses legal authority to transfer the property to the trust and assures the trust beneficiaries that the property is free from any undisclosed encumbrances. 2. Wake North Carolina Personal Representative's Quitclaim Deed to a Trust: This type of deed is often used when the personal representative is unsure about the legal status of the property or when no warranties of title are required. A quitclaim deed transfers the personal representative's interest in the property "as is," without any guarantees. 3. Wake North Carolina Personal Representative's Special Warranty Deed to a Trust: This deed type provides a limited warranty, commonly known as a "special warranty," where the personal representative guarantees that they have not created any encumbrances on the property during their tenure. Executing a Wake North Carolina Personal Representative's Deed to a Trust involves filing the appropriate documents, such as an Affidavit of Death and Warship, Letters Testamentary or Letters of Administration, along with the deed itself. It is essential for the personal representative to consult with an attorney experienced in estate law to ensure compliance with the state's specific requirements and to safeguard the interests of the estate and its beneficiaries.