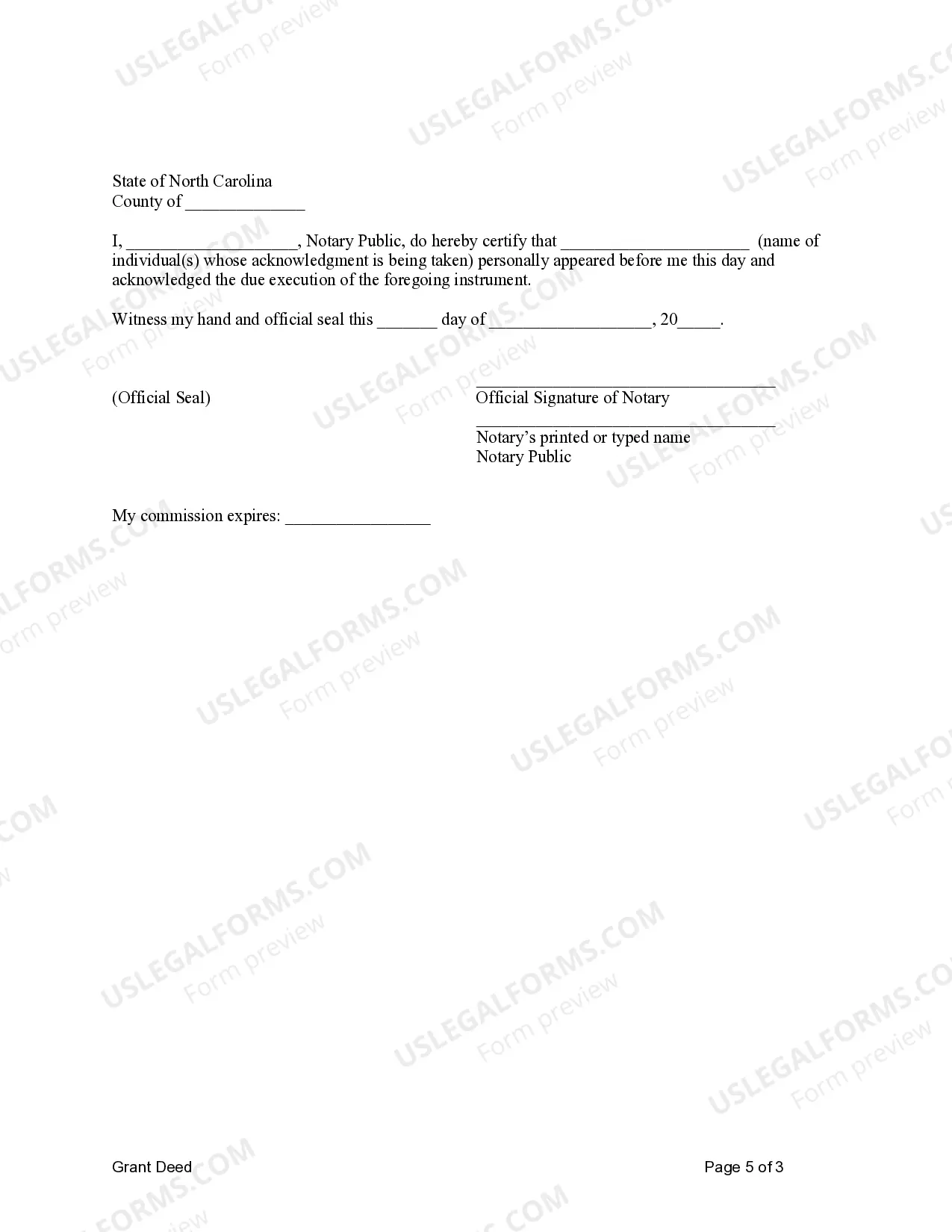

This form is a Grant Deed where the Grantors are husband and wife, or two individuals, and the Grantee is an LLC. Grantors convey the described property to the Grantee. This grant deed simply transfers the title of the property to the grantee. Included in the deed are statements verifying the property is not sold to other parties and all encumbrances on the property are known to the grantee. This deed complies with all state statutory laws.

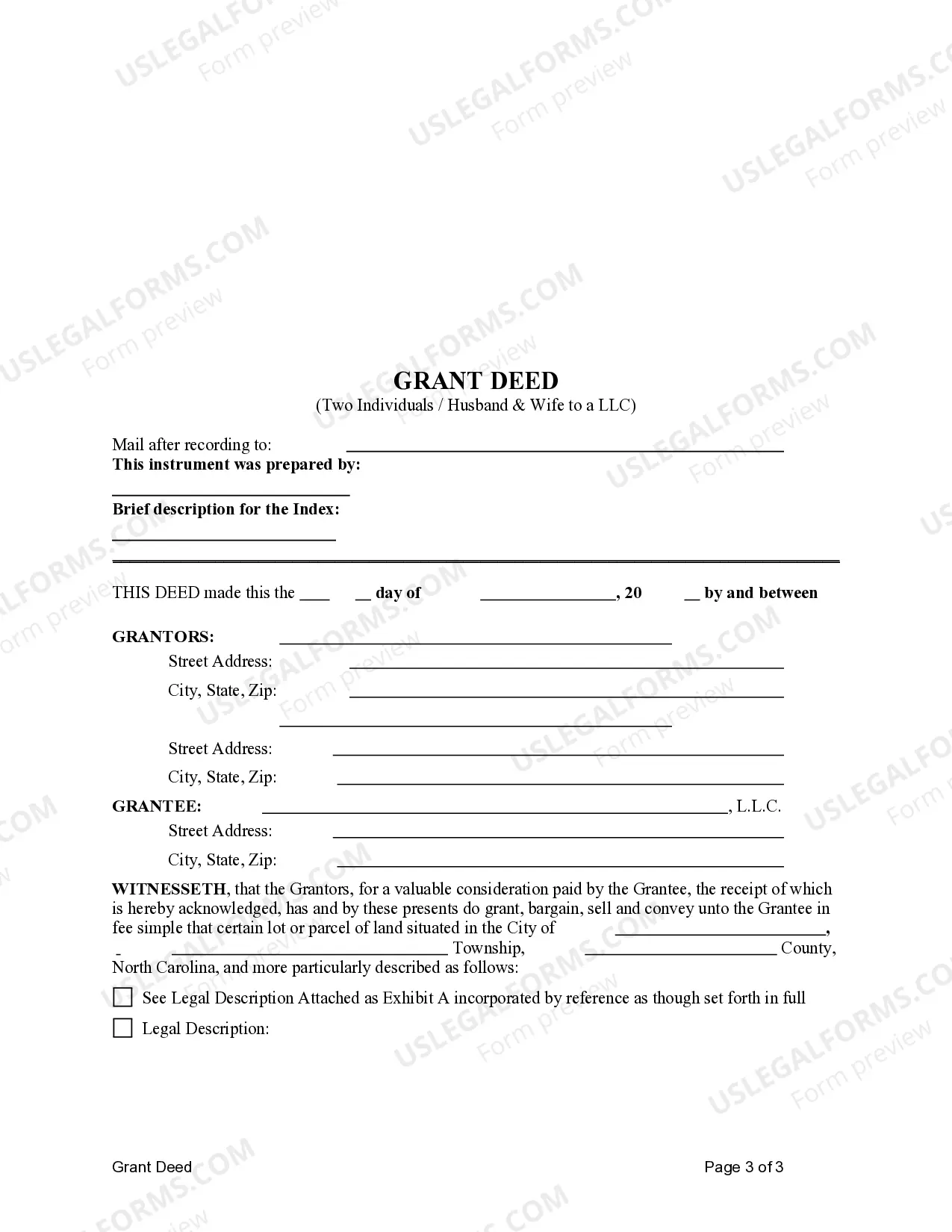

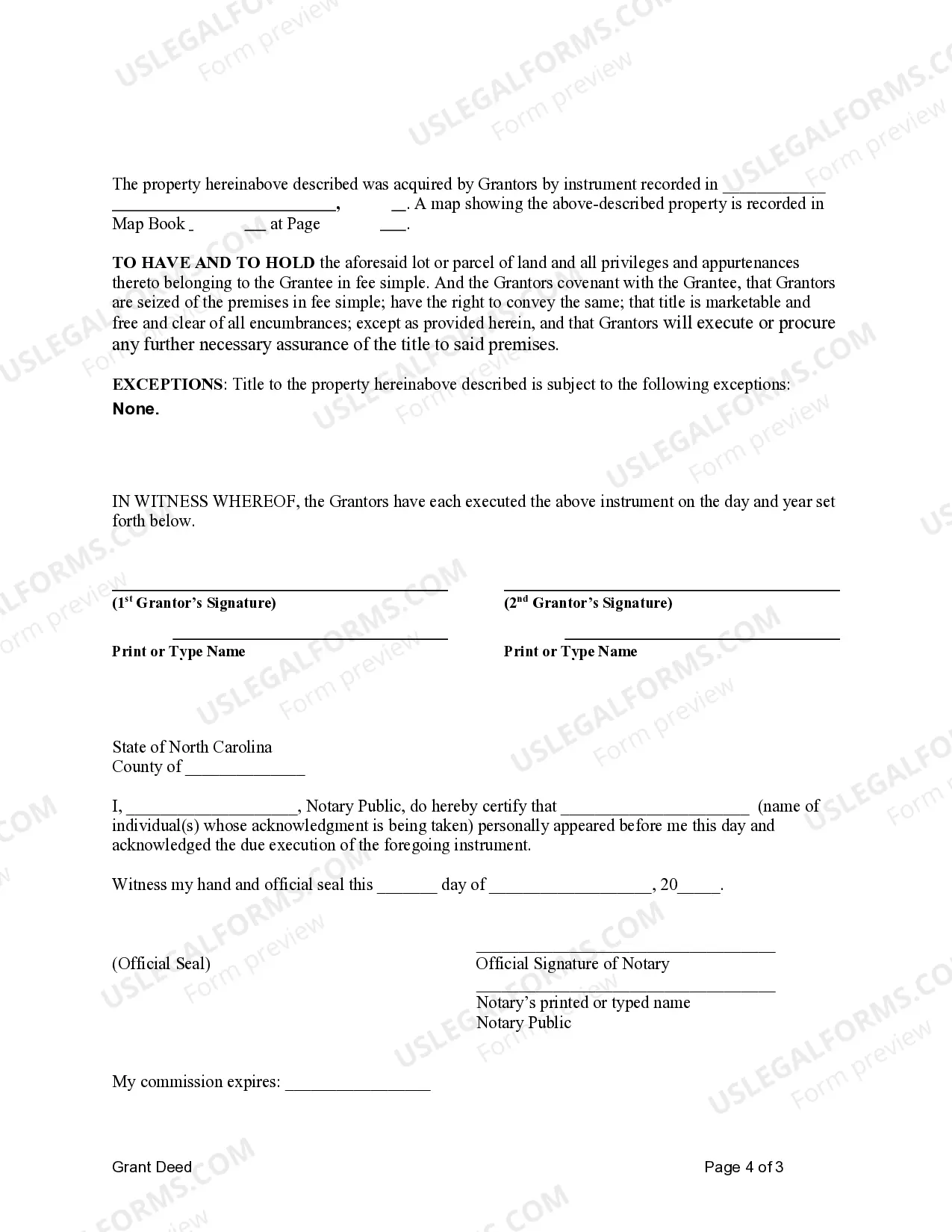

A Charlotte North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company is a legal document used to transfer ownership of real property from married spouses or two individuals to a limited liability company (LLC) in Charlotte, North Carolina. This type of deed is commonly used when individuals who own property jointly or as a married couple wish to transfer their interest in the property to an LLC for various reasons. The granter, which can be the husband and wife or two individuals, legally conveys and transfers their right, title, and interest in the property to the LLC as the new owner. The Charlotte North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company typically contains several key components. It begins with the introductory clause naming the granters, the married couple or two individuals, along with their marital status. The deed also identifies the marital property to be transferred, providing a detailed legal description that accurately determines the boundaries and location of the property. To make the transfer official, the grant deed must include certain language indicating the intent to transfer ownership. This typically includes phrases such as "convey and warrant," or "grant, bargain, and sell." These terms establish that the granters are transferring their interest in the property to the LLC, and that they warrant and guarantee the property's title is clear and free from any encumbrances. Additionally, the grant deed must state the consideration provided for the transfer. Consideration refers to the value exchanged between the granters and the LLC in the transfer of ownership. It could be money, services, or any other valuable asset agreed upon between both parties. It is important to note that there may be different types or variations of this deed, specifically tailored to different situations. For example, a specific grant deed may be used when the granters are married, a general grant deed may be utilized when the granters are two individuals who are not married, and a special warranty deed may be employed if the granters wish to limit their warranty of title. Overall, a Charlotte North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company serves as a legal mechanism to transfer ownership rights of real property from married spouses or two individuals to an LLC, ensuring a clear and legitimate transaction while protecting the rights and interests of all parties involved.A Charlotte North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company is a legal document used to transfer ownership of real property from married spouses or two individuals to a limited liability company (LLC) in Charlotte, North Carolina. This type of deed is commonly used when individuals who own property jointly or as a married couple wish to transfer their interest in the property to an LLC for various reasons. The granter, which can be the husband and wife or two individuals, legally conveys and transfers their right, title, and interest in the property to the LLC as the new owner. The Charlotte North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company typically contains several key components. It begins with the introductory clause naming the granters, the married couple or two individuals, along with their marital status. The deed also identifies the marital property to be transferred, providing a detailed legal description that accurately determines the boundaries and location of the property. To make the transfer official, the grant deed must include certain language indicating the intent to transfer ownership. This typically includes phrases such as "convey and warrant," or "grant, bargain, and sell." These terms establish that the granters are transferring their interest in the property to the LLC, and that they warrant and guarantee the property's title is clear and free from any encumbrances. Additionally, the grant deed must state the consideration provided for the transfer. Consideration refers to the value exchanged between the granters and the LLC in the transfer of ownership. It could be money, services, or any other valuable asset agreed upon between both parties. It is important to note that there may be different types or variations of this deed, specifically tailored to different situations. For example, a specific grant deed may be used when the granters are married, a general grant deed may be utilized when the granters are two individuals who are not married, and a special warranty deed may be employed if the granters wish to limit their warranty of title. Overall, a Charlotte North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company serves as a legal mechanism to transfer ownership rights of real property from married spouses or two individuals to an LLC, ensuring a clear and legitimate transaction while protecting the rights and interests of all parties involved.