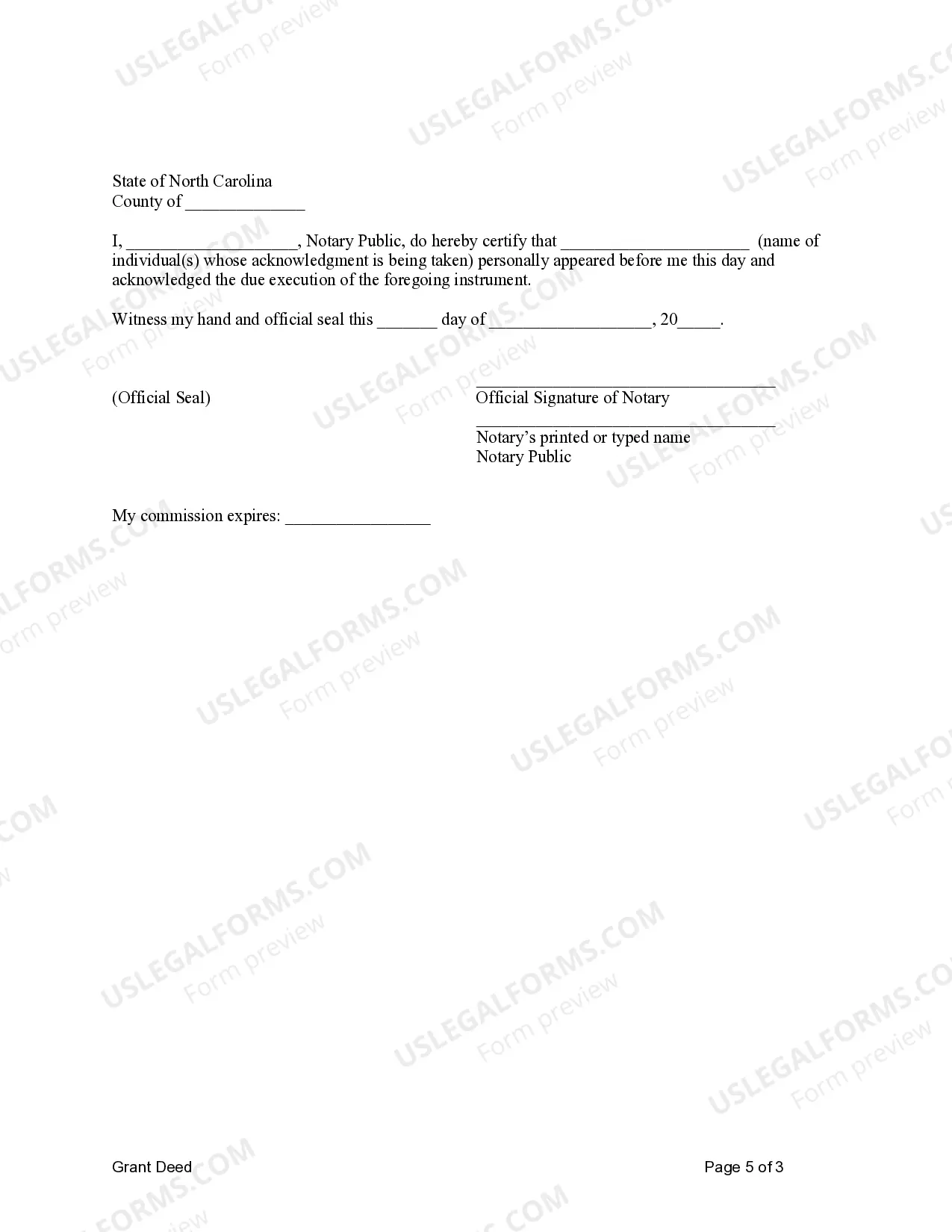

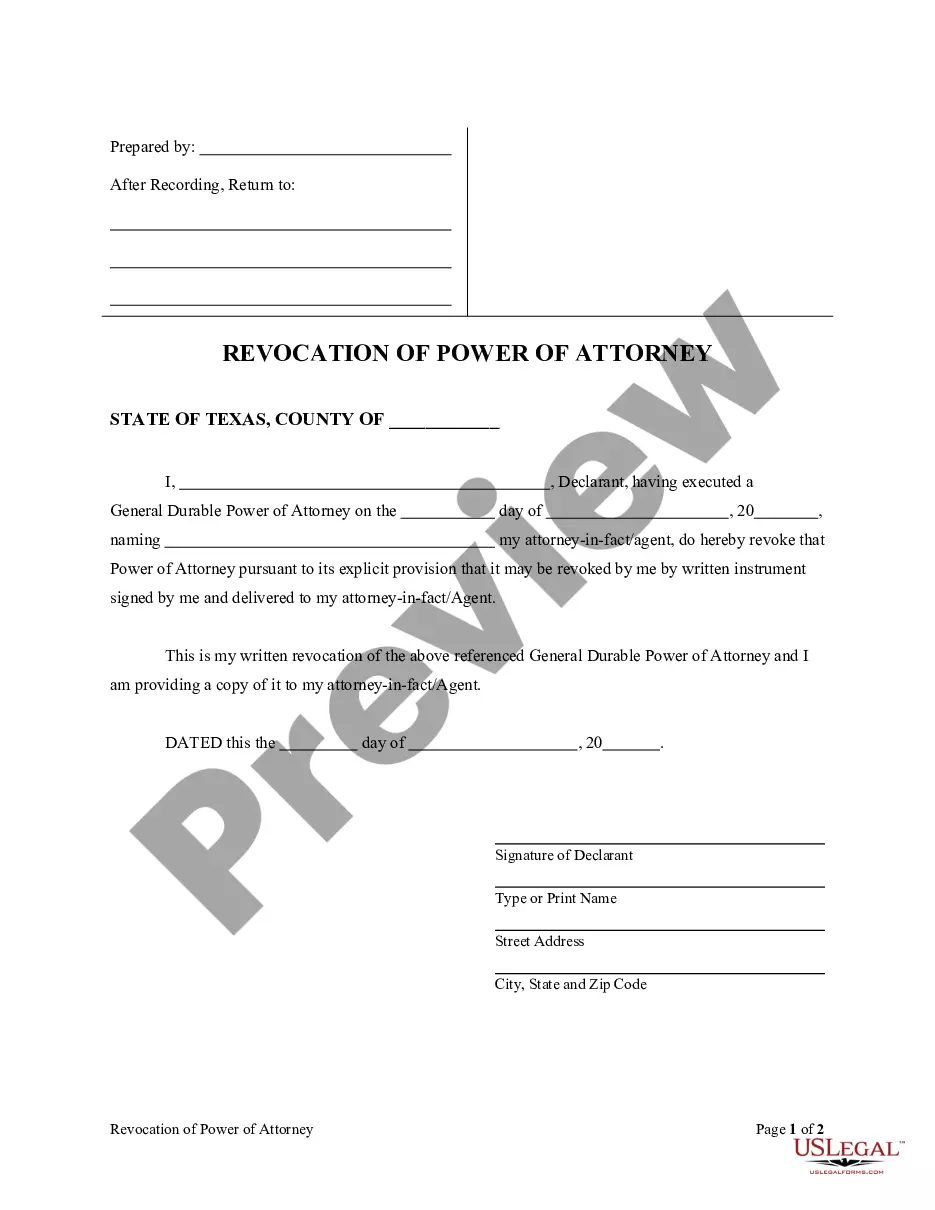

This form is a Grant Deed where the Grantors are husband and wife, or two individuals, and the Grantee is an LLC. Grantors convey the described property to the Grantee. This grant deed simply transfers the title of the property to the grantee. Included in the deed are statements verifying the property is not sold to other parties and all encumbrances on the property are known to the grantee. This deed complies with all state statutory laws.

Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company

Description

How to fill out North Carolina Grant Deed From Husband And Wife, Or Two Individuals, To A Limited Liability Company?

Locating validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

This is an online database containing over 85,000 legal documents for both personal and professional purposes as well as various real-world situations.

All the files are appropriately sorted by usage category and jurisdiction areas, making it as simple as 123 to search for the Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company.

Maintaining documents tidy and compliant with legal mandates is highly significant. Utilize the US Legal Forms library to always have crucial document templates for any needs right at your fingertips!

- For those already familiar with our inventory and who have used it previously, obtaining the Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company takes just a few clicks.

- Simply sign in to your account, choose the document, and hit Download to save it on your device.

- New users will have to complete a few more steps to finish this process.

- Follow the instructions below to begin with the largest online form collection.

- Review the Preview option and form overview. Ensure you’ve chosen the correct one that aligns with your requirements and fully complies with your local jurisdiction standards.

Form popularity

FAQ

The best proof of ownership includes a Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company, effectively showing the legal transfer of property. Additionally, keeping records like the property title and tax documents can further substantiate your claim. When it comes to documentation, professional advice can assist you in ensuring everything is in order. Using platforms like uslegalforms can simplify the process of obtaining necessary documents.

In North Carolina, it is not mandatory for your wife to be on the deed if you are purchasing property together; however, it is advisable. Including both spouses in the Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company can help protect both parties' rights to the property. Together, you can avoid potential disputes regarding ownership in the future. For peace of mind, consider consulting a legal expert.

A Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company is a formal document that establishes ownership of property. This type of deed includes the legal description of the property and both parties' signatures, confirming the transfer of interest. When recorded, it provides public notice of ownership. Hence, obtaining and filing this deed correctly is essential for proving property ownership.

In North Carolina, it is not mandatory for both spouses to be on the deed when transferring property through a grant deed. However, it is often advisable for both parties to be listed to ensure clarity and avoid potential disputes later on. If you are considering a Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company, having both names on the deed can provide additional protection and confirmation of ownership. Utilizing platforms like uslegalforms can help you navigate this process effectively.

Yes, in Wilmington, North Carolina, a grant deed from Husband and Wife, or two Individuals, to a Limited Liability Company is considered public record. This means that anyone can access it through the local county recorder's office. You can check for the existence of a grant deed and review its details. Knowing that these records are public helps maintain transparency in property transactions.

The strongest form of deed is typically considered to be a warranty deed. A warranty deed guarantees that the grantor holds clear title to the property and provides the grantee with specific legal protections. If you are exploring property transactions, such as a Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company, utilizing a warranty deed may offer additional security and peace of mind for both parties.

Yes, a grant deed serves as a legal document that proves ownership of a property. It contains essential details, including the property description and the names of the grantors and grantees. Thus, when you obtain a Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company, it strengthens your position as a recognized owner of that property. Always ensure you keep this deed secure to validate ownership.

A gift deed may lead to unexpected tax implications for the recipient. In addition, once a gift deed is executed, the giver typically relinquishes any control over the property. This lack of control can become problematic if the relationship between the parties changes. If you consider transferring assets via a Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company, it’s prudent to consult a legal professional.

A gift deed transfers property without any payment, while a grant deed involves a sale or exchange where the grantee compensates the grantor. The primary difference lies in the intent; a grant deed signifies a transaction, while a gift deed reflects a generous transfer without financial expectation. Understanding these distinctions is vital when creating a Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company.

In North Carolina, if both spouses own the property together, both must be on the deed. This protects the rights of both individuals in any property transaction. Hence, when preparing a Wilmington North Carolina Grant Deed from Husband and Wife, or two Individuals, to a Limited Liability Company, including both names can help prevent future disputes regarding ownership.