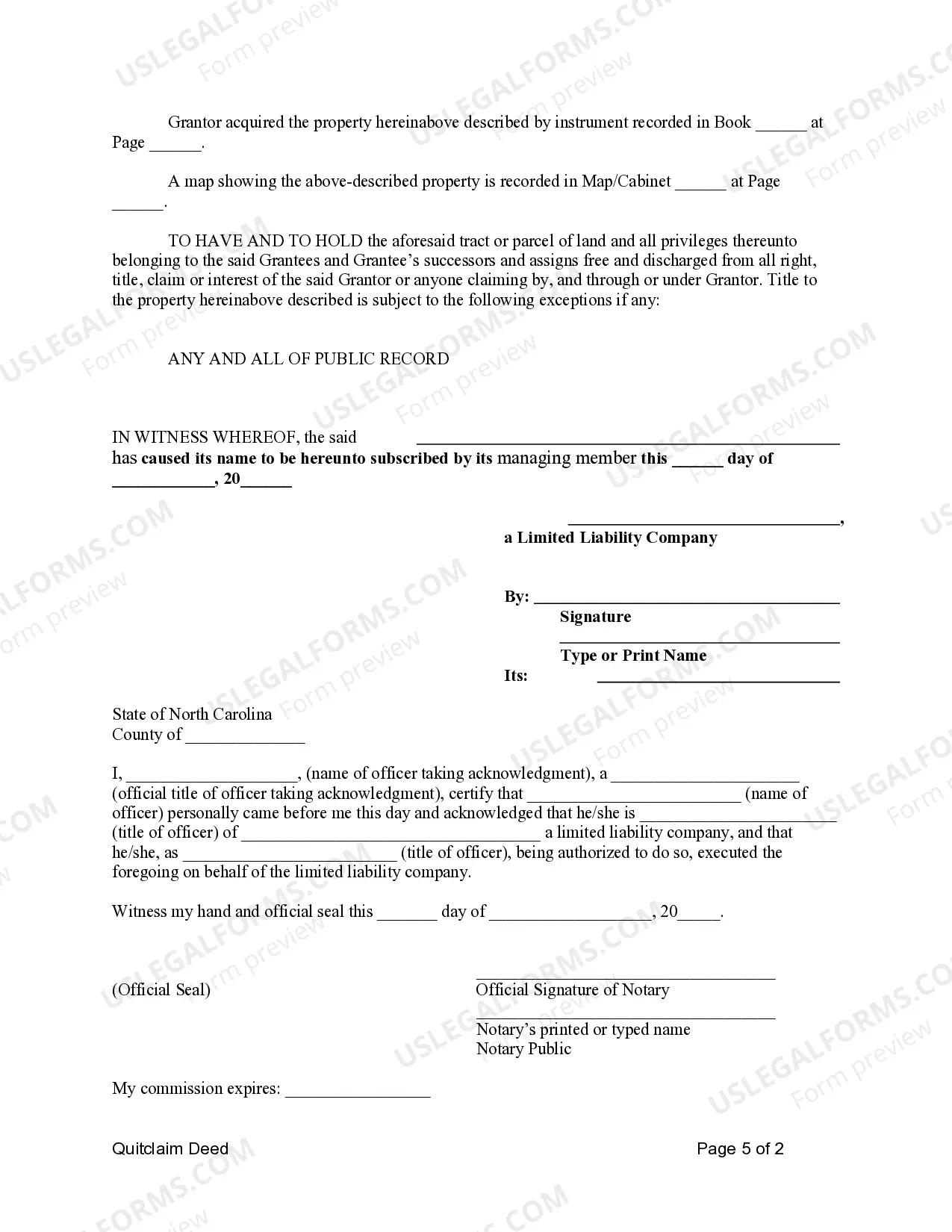

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantees are Husband and wife, or two individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

A Charlotte North Carolina Quitclaim Deed from a Limited Liability Company (LLC) to a Husband and Wife or Two Individuals is a legal document that allows the LLC to transfer its interest in a property to the mentioned parties. This type of deed is commonly used in real estate transactions when the LLC decides to relinquish its ownership rights in a specific property to the husband and wife or two individuals. The purpose of the quitclaim deed is to transfer any interest the LLC may have in the property to the recipients, without any warranties or guarantees on the title. It simply "quits" or releases any possible claims on the property that the LLC may possess. There are two main types of quitclaim deeds that can be utilized in this scenario: 1. Charlotte North Carolina Quitclaim Deed from an LLC to a Husband and Wife: This type of quitclaim deed allows a limited liability company to transfer the property ownership to a married couple. The husband and wife become the sole owners of the property once the deed is executed. 2. Charlotte North Carolina Quitclaim Deed from an LLC to Two Individuals: In this case, the quitclaim deed facilitates the transfer of property ownership from the LLC to two individuals, who can be unrelated or related by any other means. Both individuals will become co-owners of the property upon execution of the deed. The quitclaim deed includes several key elements to ensure its effectiveness and validity. These elements typically include: 1. Identification of parties: The document should clearly identify the LLC as the granter and the husband and wife or the two individuals as the grantees. 2. Legal property description: It is crucial to provide an accurate and comprehensive legal description of the property being transferred. This typically includes the address, lot number, subdivision details, and any other relevant information that uniquely identifies the property. 3. Consideration clause: A consideration clause states the value or consideration exchanged between the parties. In the case of a quitclaim deed, it is common for the consideration to be mentioned as "for valuable consideration and other good and valuable consideration." 4. Execution and notarization: The deed must be duly signed by an authorized representative of the LLC, and the signatures should be notarized to ensure validity. 5. Recording: To make the transfer of ownership official and publicly visible, the quitclaim deed must be recorded with the Register of Deeds for the county where the property is located. This serves as public notice and ensures that the transfer is legally recognized. It is important to note that while a quitclaim deed is commonly used, it does not guarantee the legitimacy of the title or provide any warranties. It simply transfers whatever interest the granter (LLC) may have in the property to the recipients (husband and wife or two individuals) at the time of the transfer. Furthermore, it is recommended to consult with a real estate attorney or a qualified professional when dealing with quitclaim deeds to ensure the legality and validity of the transaction.