This form is a Quitclaim Deed where the Grantor is an LLC and the Grantees are Husband and wife, or two individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals

Description

How to fill out North Carolina Quitclaim Deed From Limited Liability Company To A Husband And Wife Or Two Individuals?

Regardless of one's social or professional rank, completing legal documents is a regrettable requirement in today’s workplace.

Frequently, it’s nearly impossible for individuals lacking legal training to generate such documentation from the ground up, primarily due to the intricate terminology and legal intricacies involved.

This is where US Legal Forms can come to the rescue.

Confirm that the template you found aligns with your location as the regulations of one state or county do not apply to another.

Examine the document and review a brief summary (if available) of situations for which the document can be utilized.

- Our platform provides an extensive collection with over 85,000 ready-to-use state-specific templates applicable in nearly any legal context.

- US Legal Forms is also a valuable resource for paralegals or legal advisors seeking to enhance their time efficiency by using our DIY papers.

- Whether you need the High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals or any other relevant documents permitted in your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how you can quickly acquire the High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals while utilizing our reliable platform.

- If you are already a registered user, you can proceed to Log In to your account to access the required form.

- However, if you are new to our collection, ensure you follow these steps before securing the High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals.

Form popularity

FAQ

A quitclaim deed does not override a will; however, it can impact how property is distributed upon death. If the property has been transferred via a quitclaim deed, it may not be part of the deceased's estate. To understand the nuances relevant to a High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals, legal advice can clarify how to properly plan your estate.

Quitclaim deeds are often used for transferring property between family members, clearing up title issues, or during a divorce settlement. They can also serve to add or remove someone's name from a deed without the complexities of a sale. In the case of a High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals, couples frequently use this deed to secure joint ownership.

The main disadvantage of a quitclaim deed lies in the lack of guarantees regarding the property’s title. Unlike a warranty deed, the quitclaim does not protect the new owners from existing liens or claims. If you're considering a High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals, ensure you fully understand these risks before proceeding.

The strongest form of deed is usually the warranty deed, which provides a guarantee of clear title to the property. In contrast, a quitclaim deed, like the High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals, transfers ownership but offers no warranties. This means the new owners could potentially inherit unwanted claims against the property.

In North Carolina, a spouse retains rights to property even after signing a quitclaim deed, depending on the circumstances. If a spouse signs the deed to transfer their interest, they may waive some rights, but the equitable distribution laws still apply. Therefore, consulting with a legal expert on High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals is advisable to understand the implications.

A quitclaim deed primarily benefits individuals who want to transfer property ownership quickly, such as family members or business partners. It allows for a straightforward transfer without the need for exhaustive legal formalities. In the context of a High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals, couples often utilize this deed to consolidate ownership efficiently.

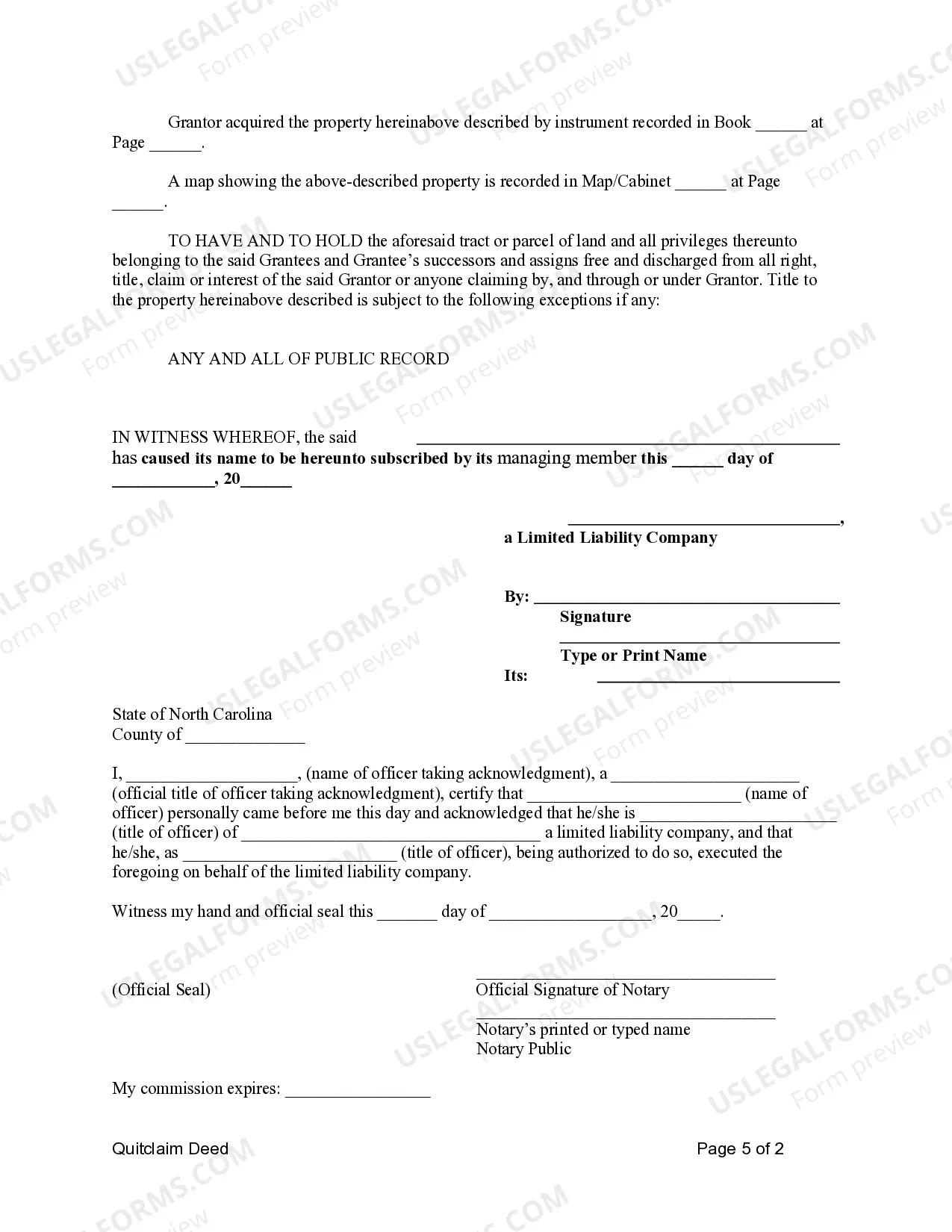

To file a quitclaim deed in North Carolina, you must complete the deed with required information and sign it before a notary. After signing, you should file the deed with the local Register of Deeds in the county where the property is located. When handling a High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals, ensure that you complete all steps correctly to avoid complications.

Yes, an LLC can gift property to an individual, usually through a quitclaim deed. This transfer requires careful documentation to ensure that it is legally binding and clear. If you look at a High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals, be sure to follow appropriate state guidelines.

While it is not a legal requirement to have an attorney for a quitclaim deed in North Carolina, consulting one can be beneficial. An attorney can guide you through the process, ensuring that everything is filed correctly. If you are using a High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals, professional advice may help you avoid mistakes.

To transfer property from an LLC to a person, you typically need to execute a quitclaim deed. This deed should clearly identify the LLC as the grantor and the individual as the grantee. When completing a High Point North Carolina Quitclaim Deed from Limited Liability Company to a Husband and Wife or Two Individuals, ensure compliance with local regulations for a valid transfer.