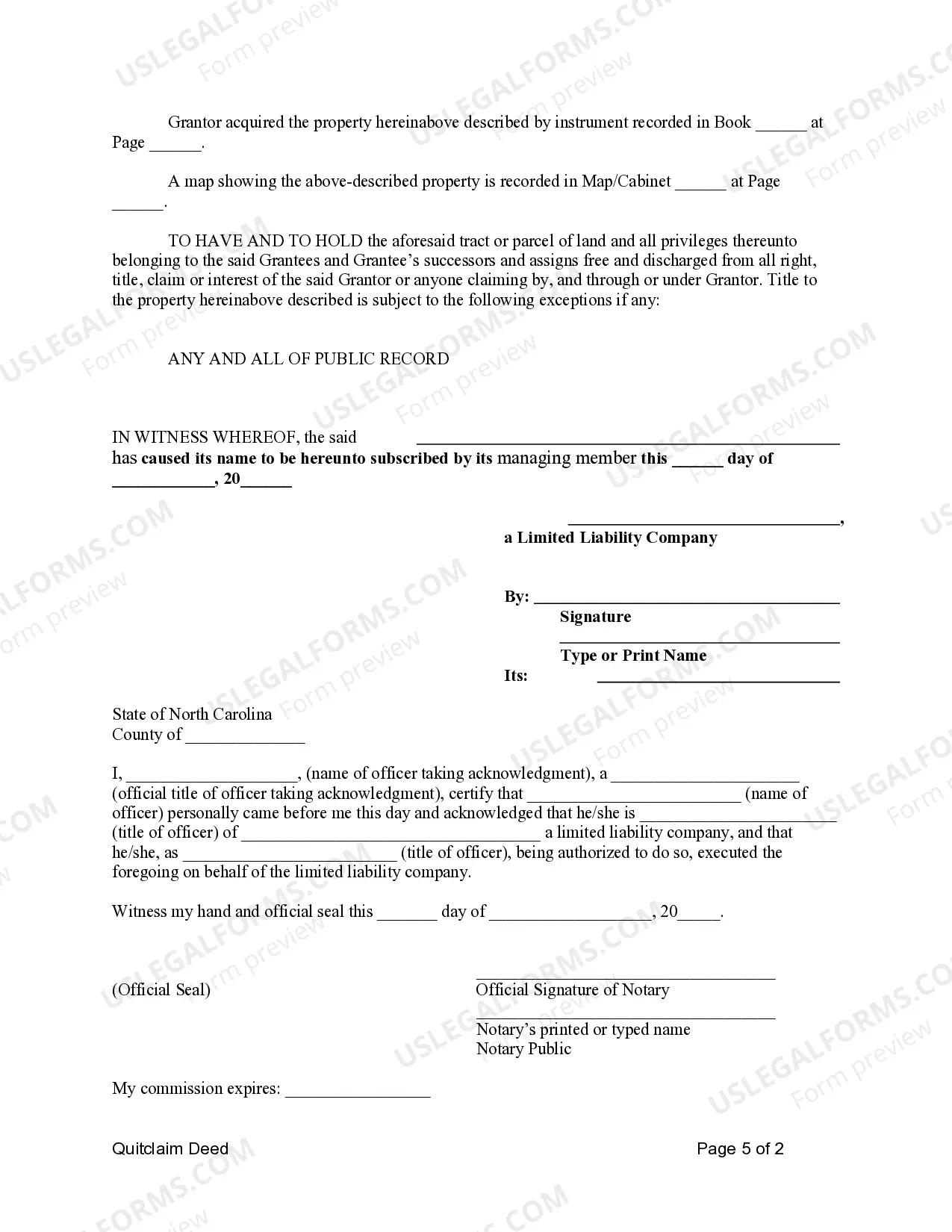

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantees are Husband and wife, or two individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

A Mecklenburg North Carolina Quitclaim Deed from a Limited Liability Company to a Husband and Wife or Two Individuals is a legal document that transfers the ownership of a property from an LLC to a married couple or two individuals. By executing this deed, the LLC relinquishes any claims or interests it may have in the property to the recipients. This type of quitclaim deed is commonly used when a property owned by an LLC is being transferred to a husband and wife jointly or two individuals jointly. This can happen in various situations, such as when the LLC members decide to dissolve the company or when they want to transfer the property to themselves personally. Some common keywords relevant to this topic include: 1. Quitclaim deed: A legal document used to transfer property ownership without providing any guarantees or warranty of title. 2. Mecklenburg County: The county in North Carolina where the property is located. 3. Limited Liability Company (LLC): A legal entity separate from its owners that offers limited liability protection. 4. Transfer of ownership: The act of transferring the legal rights and responsibilities of property ownership from one party to another. 5. Husband and wife: A married couple, recognized as joint owners under the law. 6. Two individuals: Two separate individuals not necessarily in a marital relationship. 7. Property ownership: The legal rights and responsibilities associated with owning a piece of real estate. 8. North Carolina real estate: Real property located within the state of North Carolina. 9. Legal document: A written document that is enforceable by law, such as a quitclaim deed. 10. Real estate transfer tax: Any applicable taxes or fees imposed by the local government for the transfer of real property. While there may not be different types of Mecklenburg North Carolina Quitclaim Deeds from a Limited Liability Company to a Husband and Wife or Two Individuals, it's important to note that there might be variations in the specific language, formatting, and requirements depending on the circumstances and individual preferences. Consulting with a real estate attorney or title company is always advisable to ensure compliance with local laws and regulations when dealing with property transfers.