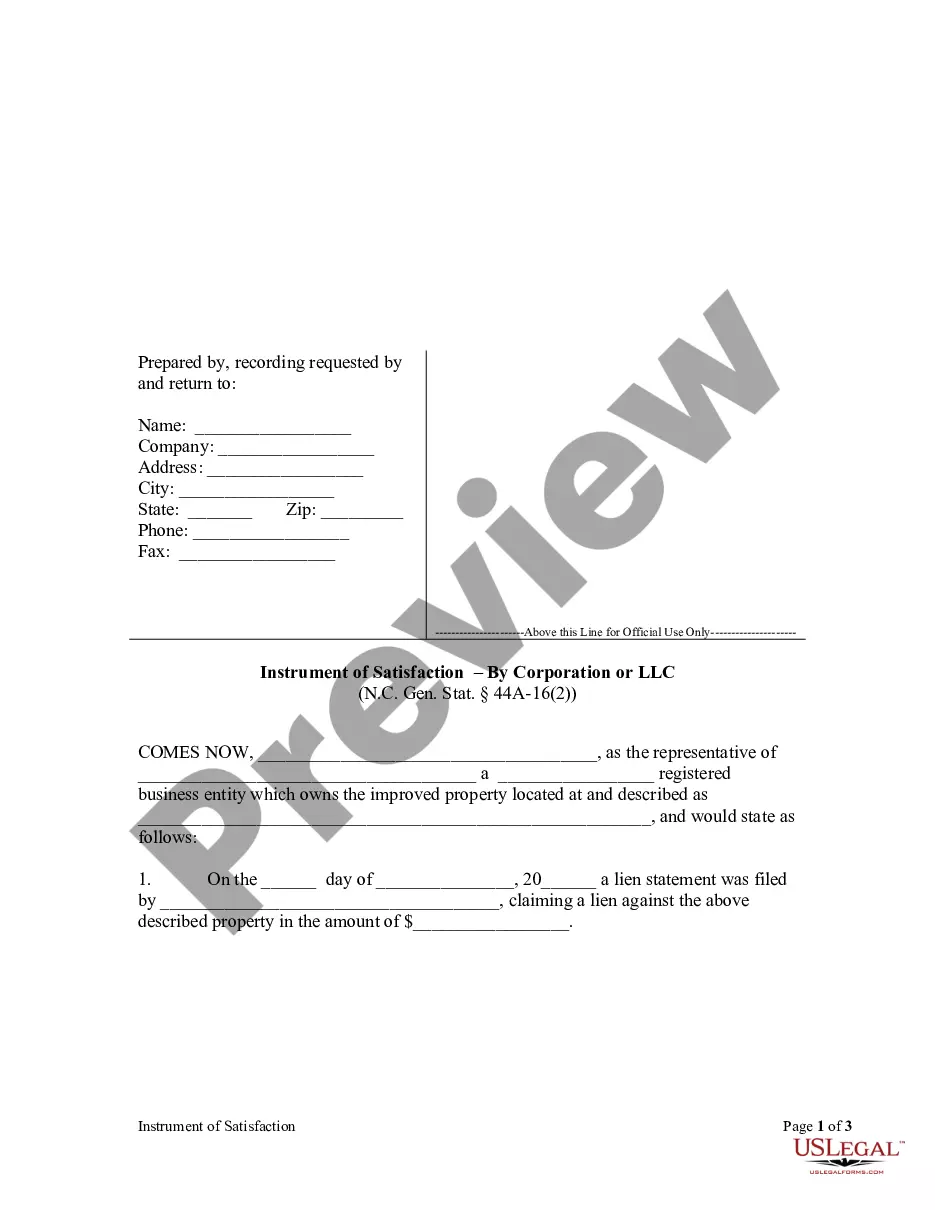

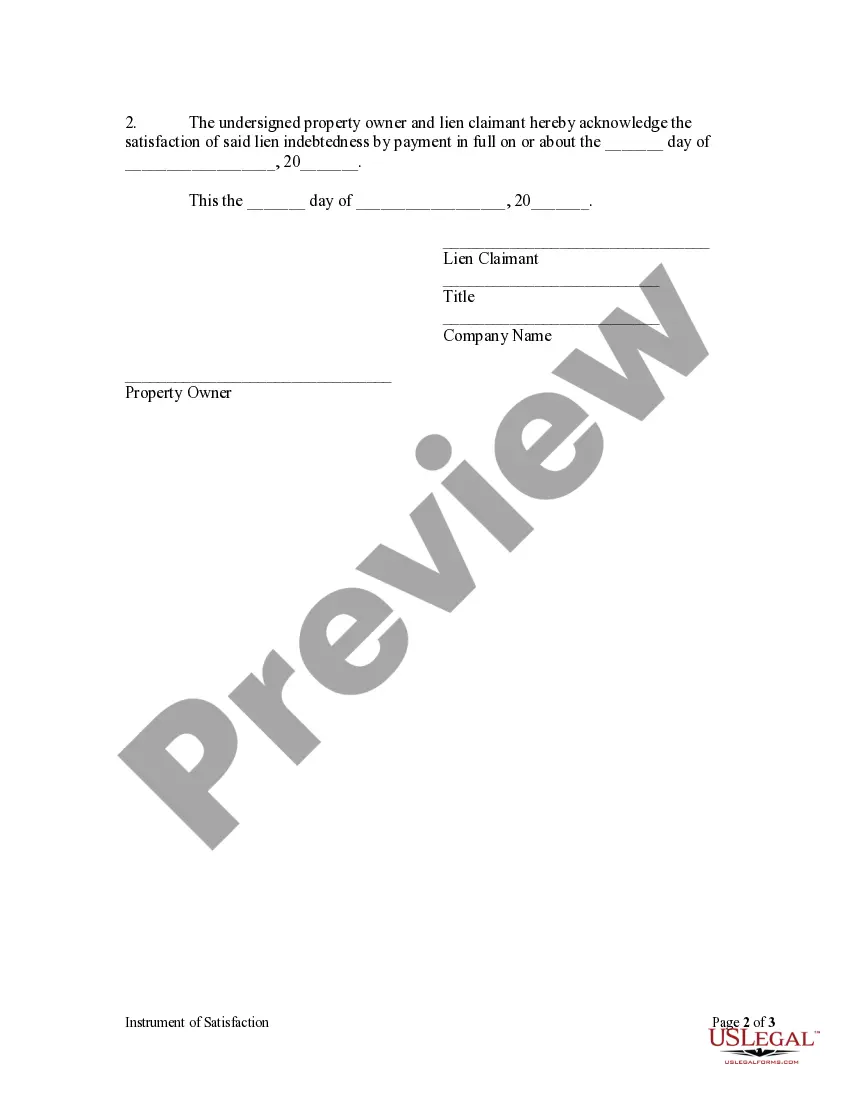

North Carolina law permits a property owner to file an instrument of satisfaction acknowledging the satisfaction of a lien. The instrument must have been signed by the lien claimant of record.

Cary North Carolina Instrument of Satisfaction by Corporation is a legal document that serves as proof of the release of a mortgage or deed of trust by a corporation. The satisfaction of the mortgage is crucial in ensuring that the borrower has fulfilled their financial obligations and that the property is no longer encumbered. Corporations play an essential role in the real estate industry, often acting as lenders or holding properties as assets. When a corporation provides a loan to an individual or another company, a mortgage or deed of trust is usually created to secure the debt. This document establishes the corporation's right to seize and sell the property in case of default. However, once the loan is paid off completely, the corporation needs to release their claim on the property. The Cary North Carolina Instrument of Satisfaction by Corporation is the specific legal instrument used in Cary, North Carolina, to formally acknowledge the repayment of a loan through a corporation and release the borrower from any further obligation. This satisfaction document is typically recorded in the county recorder's office where the original mortgage or deed of trust was initially filed. When it comes to different types of Cary North Carolina Instrument of Satisfaction by Corporation, they are primarily categorized based on the nature of the property involved and the purpose of the loan. Some common types include: 1. Residential Mortgage Satisfaction: This type of satisfaction document pertains to loans involving residential properties such as single-family homes, townhouses, or condominiums. 2. Commercial Mortgage Satisfaction: Commercial mortgages typically involve loans secured by commercial properties like office buildings, retail spaces, industrial warehouses, or mixed-use developments. The satisfaction document for these loans would fall under this category. 3. Construction Loan Satisfaction: Construction loans are temporary financing options for the construction of new buildings or significant property renovations. Once construction is completed, a construction loan satisfaction document is created to release the property from the corporation's claim. 4. Refinance Satisfaction: When a borrower refinances their existing loan with a new loan from the corporation, a refinancing satisfaction document is created to release the original mortgage or deed of trust. 5. Second Mortgage Satisfaction: In cases where a borrower obtains a second mortgage from a corporation, a satisfaction document would be required for the subsequent discharge of the second mortgage upon repayment. It is essential to complete and record the Cary North Carolina Instrument of Satisfaction by Corporation accurately and timely to maintain a clear title and ensure the property can be freely transferred or sold without any encumbrances. This legal process protects both the corporation and the borrower, providing a reliable and enforceable proof of debt satisfaction.Cary North Carolina Instrument of Satisfaction by Corporation is a legal document that serves as proof of the release of a mortgage or deed of trust by a corporation. The satisfaction of the mortgage is crucial in ensuring that the borrower has fulfilled their financial obligations and that the property is no longer encumbered. Corporations play an essential role in the real estate industry, often acting as lenders or holding properties as assets. When a corporation provides a loan to an individual or another company, a mortgage or deed of trust is usually created to secure the debt. This document establishes the corporation's right to seize and sell the property in case of default. However, once the loan is paid off completely, the corporation needs to release their claim on the property. The Cary North Carolina Instrument of Satisfaction by Corporation is the specific legal instrument used in Cary, North Carolina, to formally acknowledge the repayment of a loan through a corporation and release the borrower from any further obligation. This satisfaction document is typically recorded in the county recorder's office where the original mortgage or deed of trust was initially filed. When it comes to different types of Cary North Carolina Instrument of Satisfaction by Corporation, they are primarily categorized based on the nature of the property involved and the purpose of the loan. Some common types include: 1. Residential Mortgage Satisfaction: This type of satisfaction document pertains to loans involving residential properties such as single-family homes, townhouses, or condominiums. 2. Commercial Mortgage Satisfaction: Commercial mortgages typically involve loans secured by commercial properties like office buildings, retail spaces, industrial warehouses, or mixed-use developments. The satisfaction document for these loans would fall under this category. 3. Construction Loan Satisfaction: Construction loans are temporary financing options for the construction of new buildings or significant property renovations. Once construction is completed, a construction loan satisfaction document is created to release the property from the corporation's claim. 4. Refinance Satisfaction: When a borrower refinances their existing loan with a new loan from the corporation, a refinancing satisfaction document is created to release the original mortgage or deed of trust. 5. Second Mortgage Satisfaction: In cases where a borrower obtains a second mortgage from a corporation, a satisfaction document would be required for the subsequent discharge of the second mortgage upon repayment. It is essential to complete and record the Cary North Carolina Instrument of Satisfaction by Corporation accurately and timely to maintain a clear title and ensure the property can be freely transferred or sold without any encumbrances. This legal process protects both the corporation and the borrower, providing a reliable and enforceable proof of debt satisfaction.