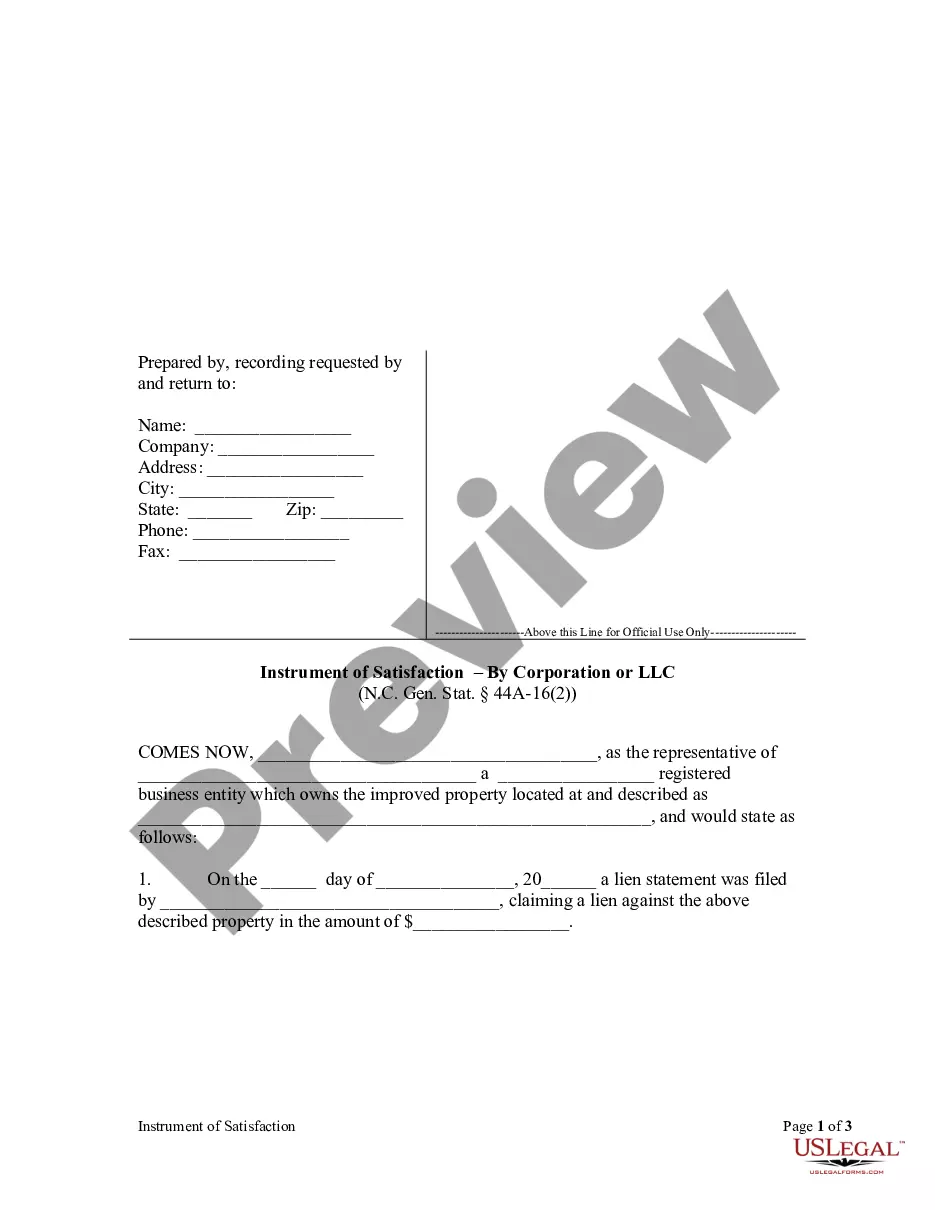

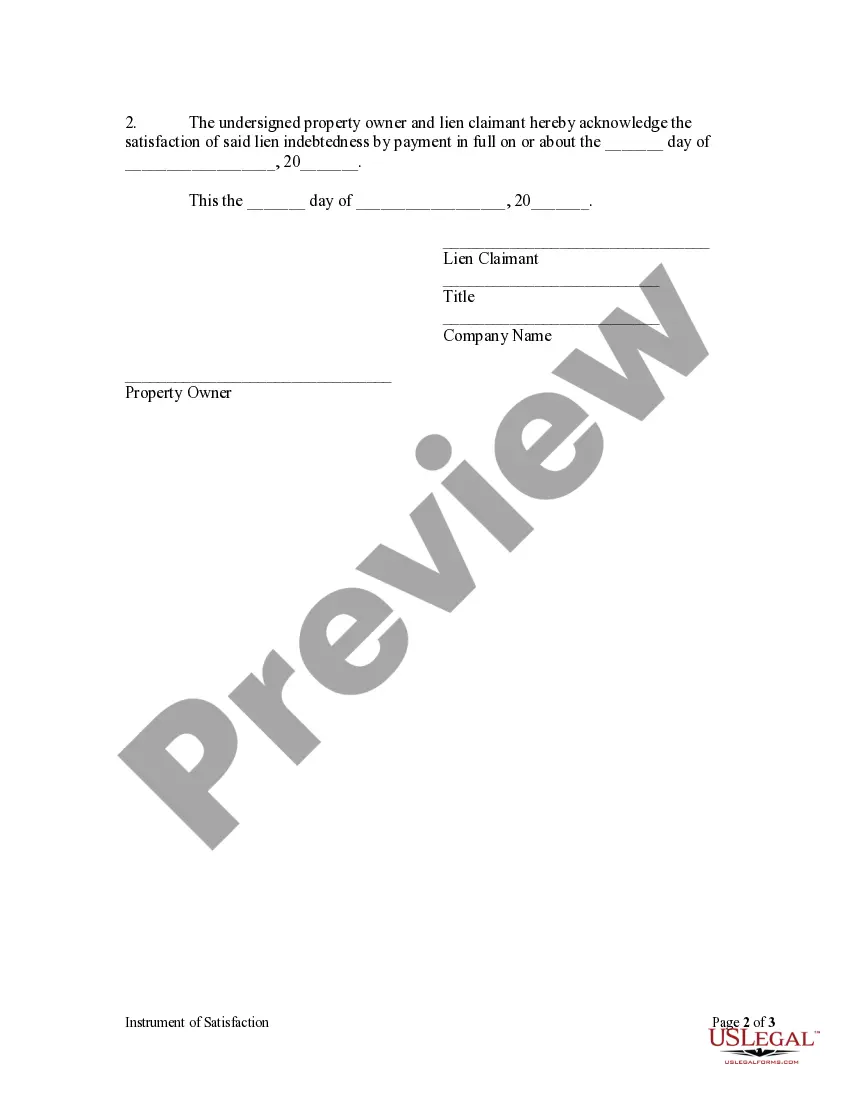

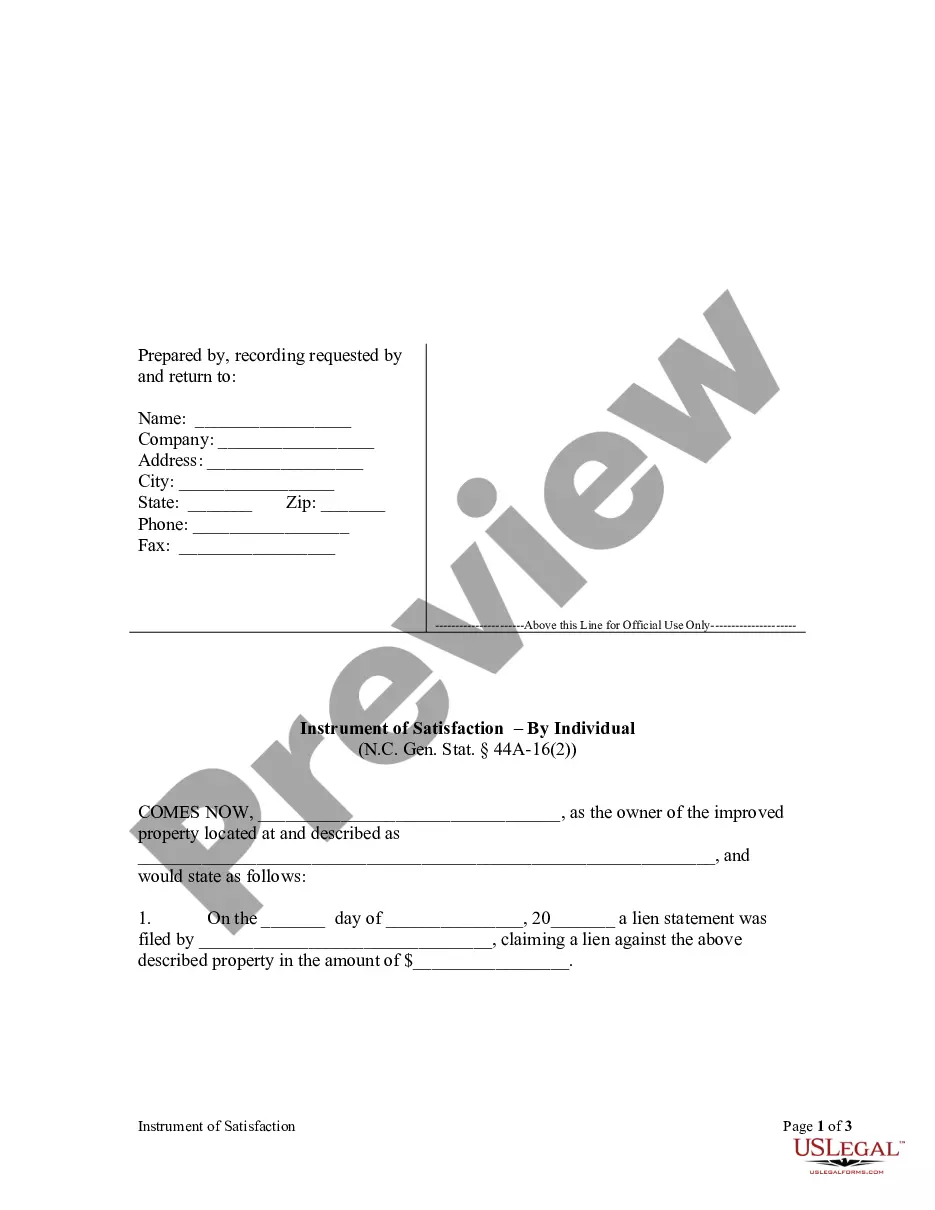

North Carolina law permits a property owner to file an instrument of satisfaction acknowledging the satisfaction of a lien. The instrument must have been signed by the lien claimant of record.

Wake North Carolina Instrument of Satisfaction by Corporation

Description

How to fill out North Carolina Instrument Of Satisfaction By Corporation?

We consistently endeavor to minimize or evade legal complications when engaged in intricate legal or financial matters.

To achieve this, we enlist attorney services that are typically very expensive.

However, not all legal issues are as complicated as they seem. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Just Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always retrieve it again in the My documents section. The procedure is just as simple if you are a newcomer to the website! You can establish your account in a matter of minutes. Ensure to verify if the Wake North Carolina Instrument of Satisfaction by Corporation adheres to the laws and regulations of your state and region. Furthermore, it’s essential to review the form’s description (if available), and if you notice any inconsistencies with what you initially sought, look for an alternative form. Once you’ve confirmed that the Wake North Carolina Instrument of Satisfaction by Corporation is suitable for you, you can opt for the subscription plan and move to payment. You can then download the form in any appropriate format. For more than 24 years of our existence in the market, we’ve assisted millions of individuals by providing customizable and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Our collection empowers you to take control of your matters without relying on an attorney's services.

- We offer access to legal form templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, greatly enhancing the search process.

- Utilize US Legal Forms anytime you need to acquire and download the Wake North Carolina Instrument of Satisfaction by Corporation or any other form conveniently and securely.

Form popularity

FAQ

A deed can be declared invalid in North Carolina if it lacks essential elements like a proper signature, if it was not notarized, or if it does not contain a legal description of the property. Other factors include issues like fraud or if the grantor lacked the legal capacity to sign. It's wise to utilize UsLegalForms to avoid these pitfalls, especially when preparing an Instrument of Satisfaction by Corporation.

Another name for a mortgage deed is a mortgage agreement. This document outlines the terms between the borrower and lender regarding the property. If you're managing property transactions in Wake North Carolina, consider how the Instrument of Satisfaction by Corporation relates to your mortgage deed.

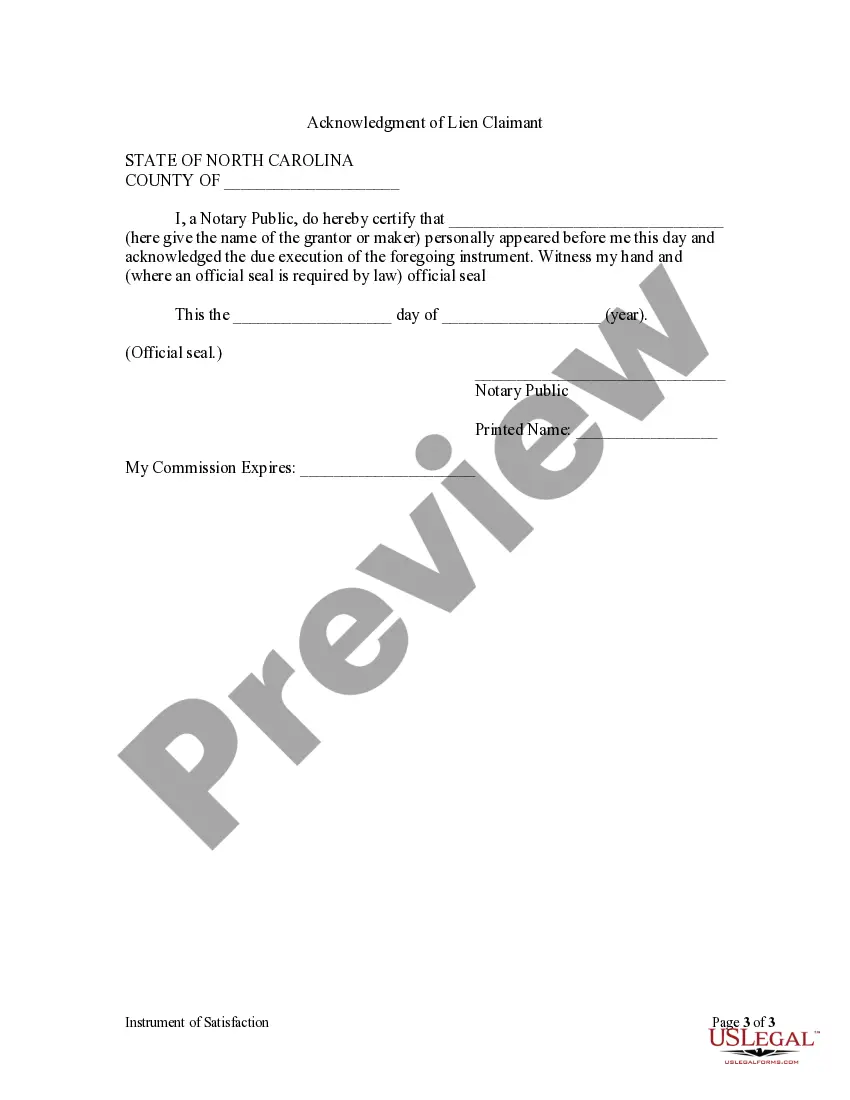

To record a deed in North Carolina, you must visit the register of deeds office in the county where the property is located. Ensure the document is properly signed, notarized, and includes all necessary information. Using the services of UsLegalForms can streamline this process; they offer templates and guidance tailored to your needs in Wake North Carolina.

While both documents indicate the release of a mortgage lien, the satisfaction of mortgage applies primarily to traditional mortgage loans. In contrast, a deed of reconveyance is typically used in trust deeds. For those in Wake North Carolina, understanding this distinction is important when dealing with an Instrument of Satisfaction by Corporation.

Filling out a North Carolina general warranty deed involves several key steps. First, gather the necessary information about the property, including its legal description and the names of the parties involved. Next, use the appropriate form to clearly state the grantor and grantee information, making sure to include the details regarding the Wake North Carolina Instrument of Satisfaction by Corporation, if applicable. Finally, ensure that the deed is properly signed, notarized, and filed with the local register of deeds to complete the process.

To invalidate a deed, you must typically prove that it was created under certain invalid conditions. This process may involve showing that the deed lacked required signatures or was entered against the grantor's will. It's also essential to provide evidence of any fraudulent actions or misrepresentation that may have occurred. When facing such issues related to a Wake North Carolina Instrument of Satisfaction by Corporation, seeking legal aid or trusted platforms like US Legal Forms can guide you through the steps needed.

A deed may be void in North Carolina for several reasons, including the absence of critical elements like signatures of the grantor and grantee. If the property description is unclear or inaccurate, that too can lead to a void deed. Furthermore, a deed created under duress or without the grantor's mental capacity often lacks validity. It’s important to consult reliable resources, such as US Legal Forms, when handling a Wake North Carolina Instrument of Satisfaction by Corporation to avoid these pitfalls.

In North Carolina, a deed must meet specific criteria to be considered valid. It should include the names of the grantor and grantee, an accurate legal description of the property, and the signatures of the parties involved. Furthermore, proper notarization and recording with the county register of deeds are essential to solidify the deed’s legitimacy. When dealing with a Wake North Carolina Instrument of Satisfaction by Corporation, ensuring all these elements are correctly addressed is vital.

Several factors can render a deed void, one of which is the lack of necessary signatures. Additionally, if the grantor does not have the legal capacity to transfer the property, such as being a minor or mentally incompetent, the deed can be void. In some cases, fraud or coercion can also invalidate a deed. Understanding these issues is crucial when dealing with a Wake North Carolina Instrument of Satisfaction by Corporation.