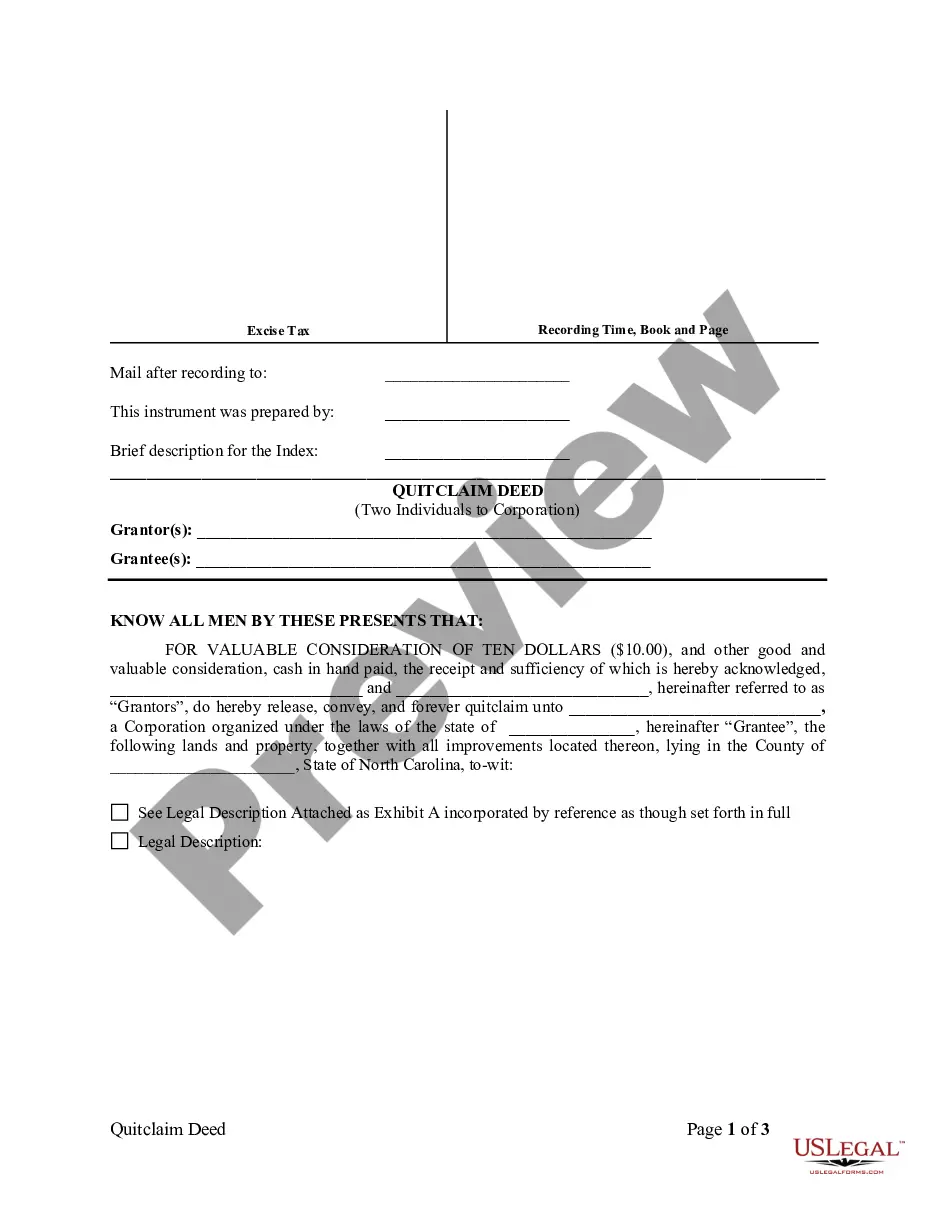

Raleigh North Carolina Quitclaim Deed by Two Individuals to Corporation

Description

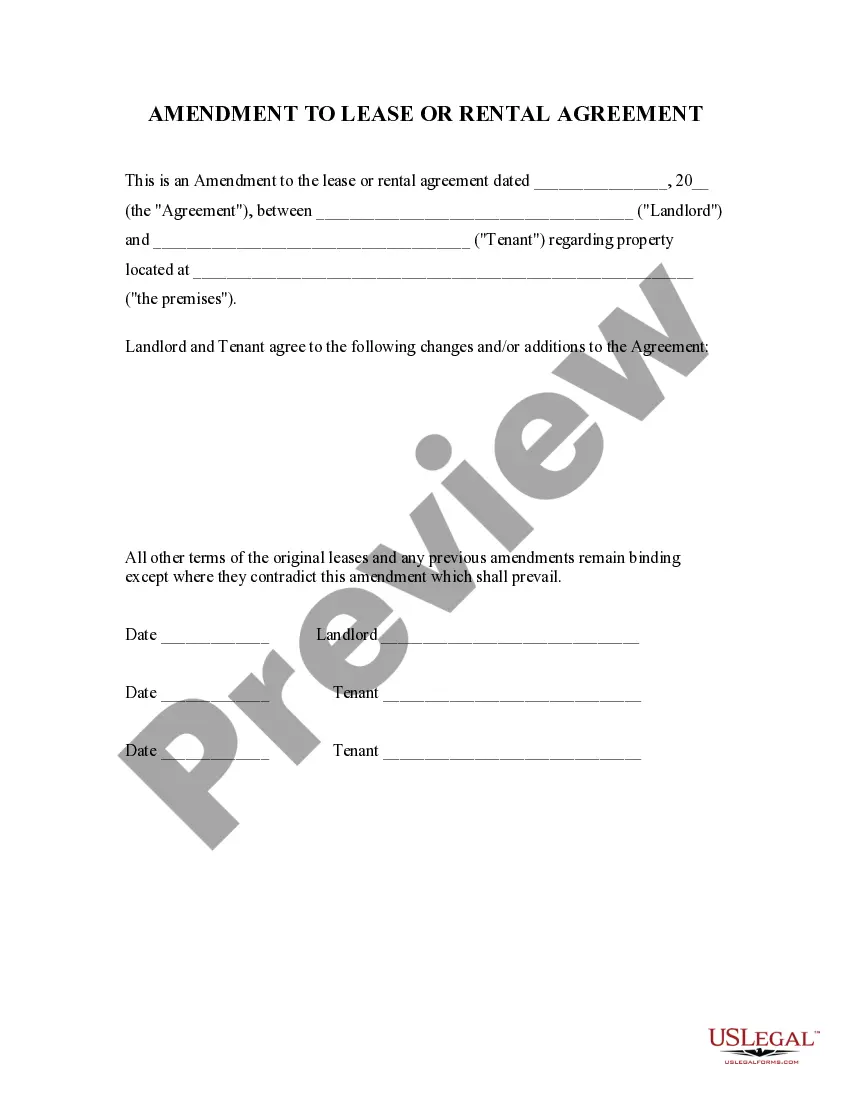

How to fill out Raleigh North Carolina Quitclaim Deed By Two Individuals To Corporation?

Regardless of social or professional standing, completing law-associated forms is a regrettable requirement in today's society.

Too frequently, it’s nearly infeasible for an individual without legal expertise to create such documents from scratch, primarily due to the intricate vocabulary and legal subtleties they contain.

This is where US Legal Forms can come to the rescue.

Confirm that the template you have located is appropriate for your area since the regulations of one state or region do not apply to another.

Examine the form and read a brief summary (if available) of the scenarios the document can address.

- Our service offers an extensive collection with over 85,000 state-specific documents that cater to nearly every legal matter.

- US Legal Forms also acts as a valuable tool for associates or legal advisors who wish to enhance their efficiency using our DIY forms.

- Regardless of whether you need the Raleigh North Carolina Quitclaim Deed by Two Individuals to Corporation or any other documentation suitable for your state or region, with US Legal Forms, everything is within reach.

- Here’s how to obtain the Raleigh North Carolina Quitclaim Deed by Two Individuals to Corporation in moments using our reliable service.

- If you are already a customer, you may proceed to Log In to your account to download the required form.

- However, if you’re new to our library, ensure to follow these instructions before acquiring the Raleigh North Carolina Quitclaim Deed by Two Individuals to Corporation.

Form popularity

FAQ

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

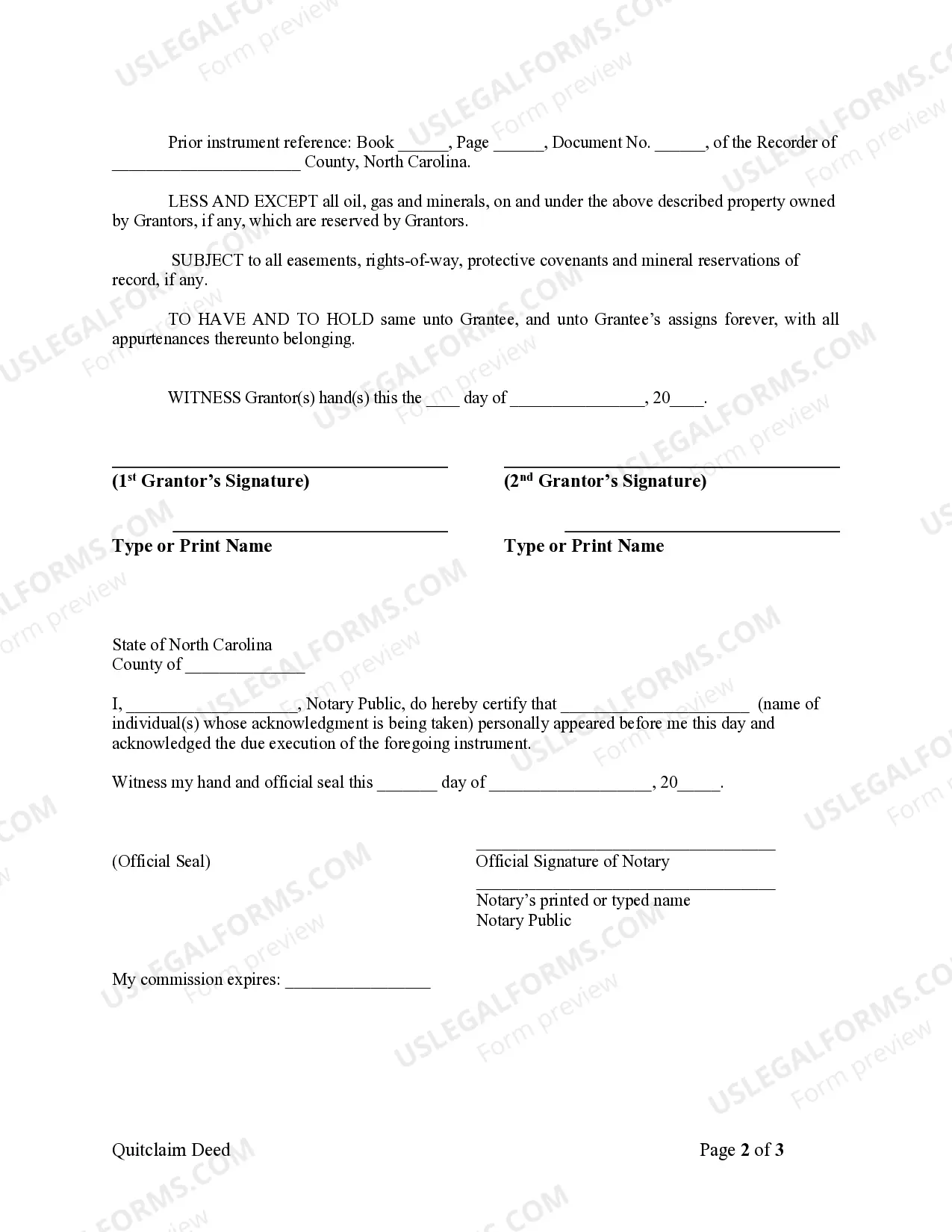

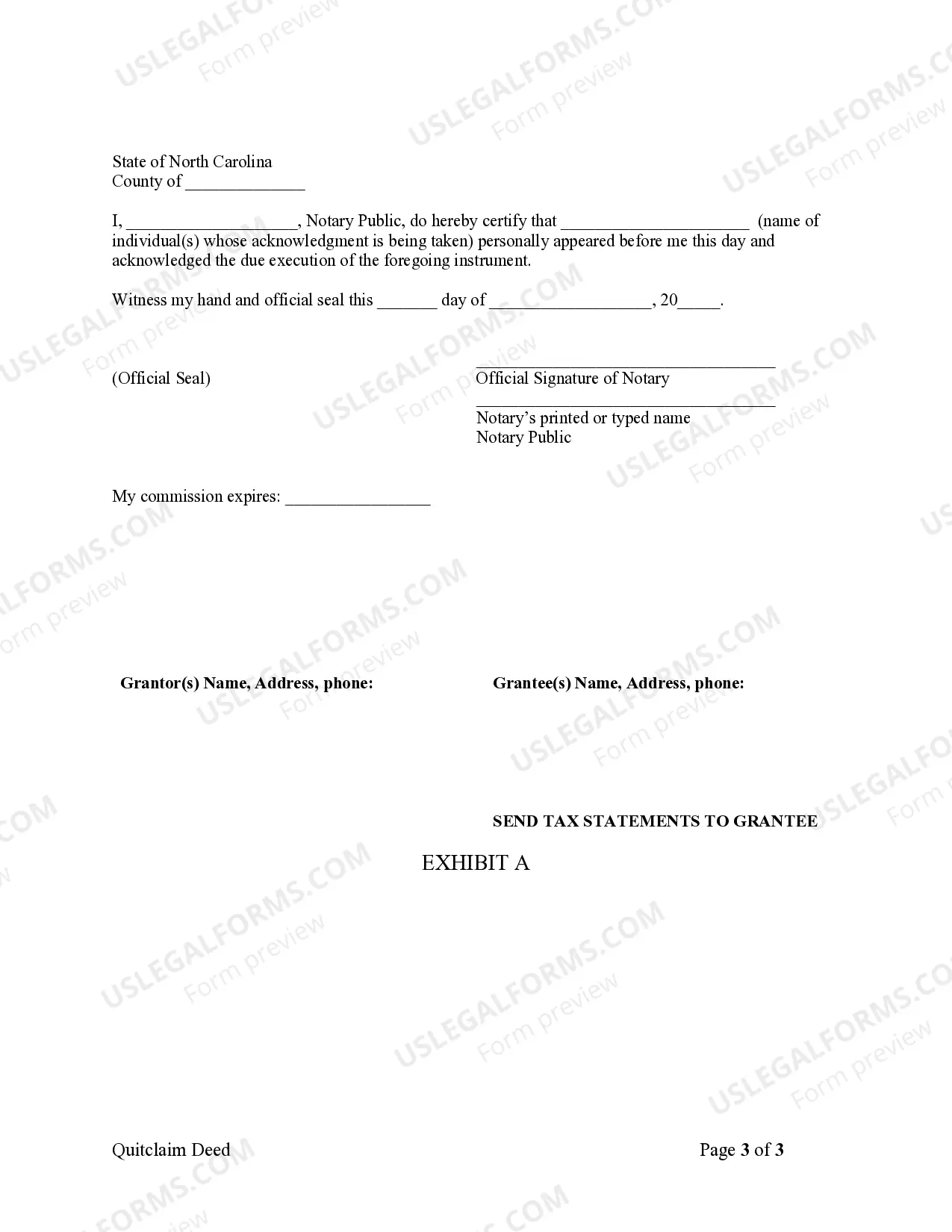

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.

Recording and Document Fees Document TypeFee DetailsDeeds of Trust and Mortgages$64 first 35 pages $4 each additional pageAmendment to Deed of Trust$26 first 15 pages $4 each additional pageAll other Documents / Instruments / Assumed Name (DBA)$26 first 15 pages $4 each additional page3 more rows

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

Before you can transfer property ownership to someone else, you'll need to complete the following. Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.