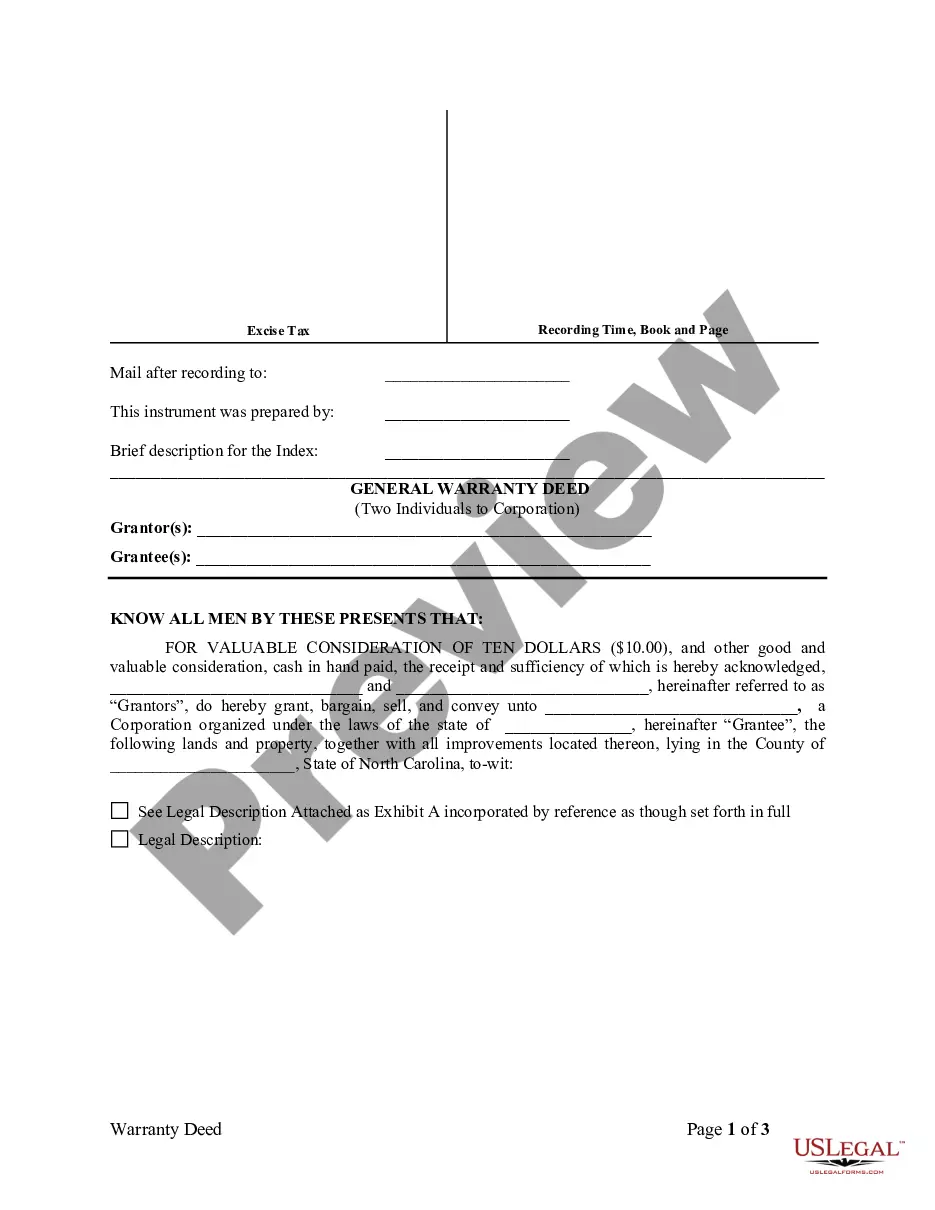

Charlotte North Carolina General Warranty Deed from two Individuals to Corporation

Description

How to fill out North Carolina General Warranty Deed From Two Individuals To Corporation?

If you have previously availed yourself of our service, Log In to your account and store the Charlotte North Carolina General Warranty Deed transferring ownership from two Individuals to a Corporation on your device by selecting the Download button. Ensure your subscription remains active. If not, renew it in line with your payment plan.

If this is your inaugural use of our service, adhere to these straightforward steps to acquire your document.

You will have ongoing access to all documents you have purchased: you can find them in your profile under the My documents section whenever you wish to reference them again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Ensure you have located the correct document. Review the description and utilize the Preview feature, if accessible, to verify if it fulfills your needs. If it does not suit you, utilize the Search function above to find the correct one.

- Purchase the template. Click the Buy Now button and opt for a monthly or yearly subscription plan.

- Create an account and process payment. Provide your credit card information or select the PayPal option to finalize the purchase.

- Retrieve your Charlotte North Carolina General Warranty Deed transferring ownership from two Individuals to a Corporation. Choose the file format for your document and store it on your device.

- Finalize your document. Print it or use professional online editors to complete it and sign electronically.

Form popularity

FAQ

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

Can I prepare my own deed and have it recorded? A. North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advice of legal counsel.

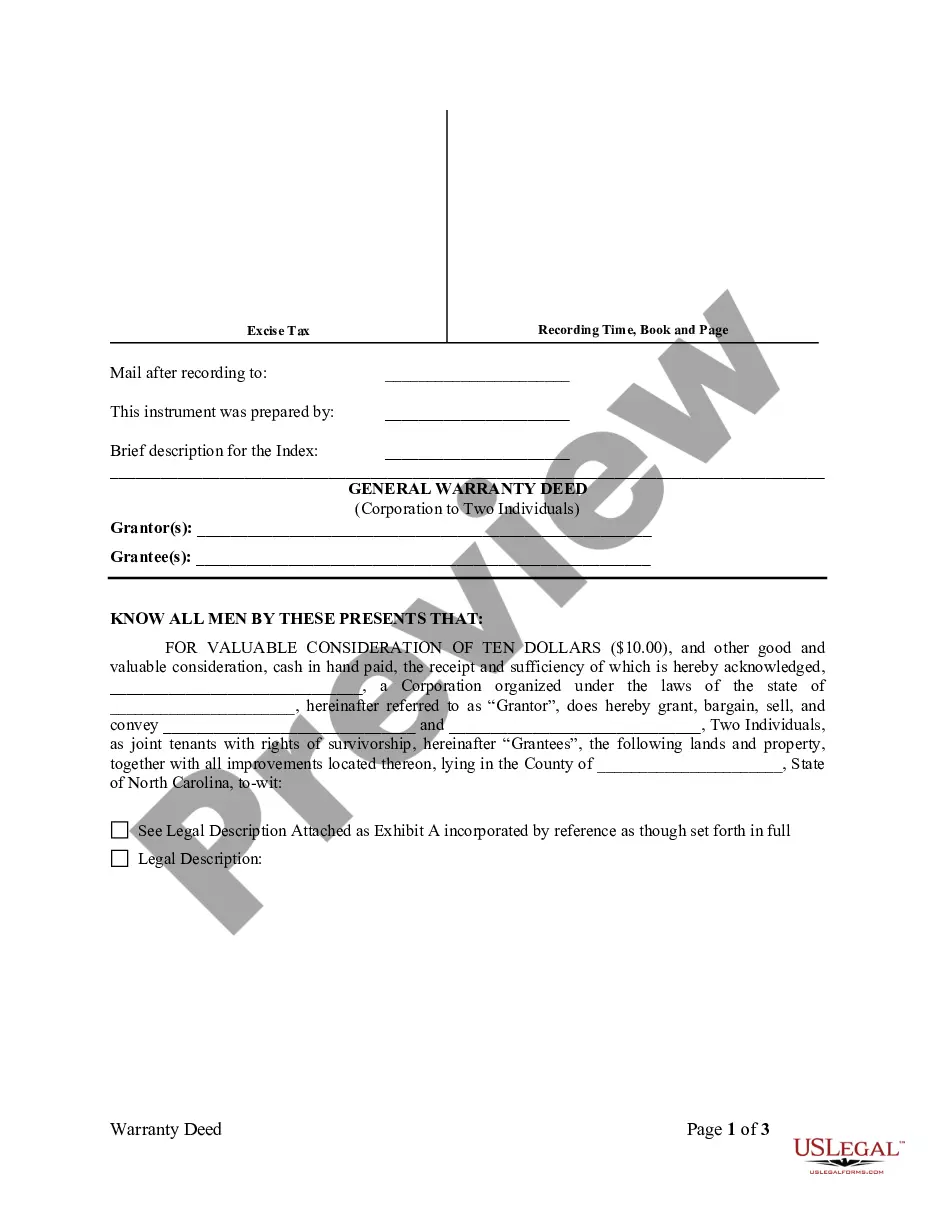

A General Warranty Deed is a deed in which the party conveying the property (the ?Grantor?) warrants and guarantees to the party receiving the conveyance (the ?Grantee?) that the title to the property he is conveying is good and unencumbered as against all persons.

A deed is a legal instrument that evidences legal ownership of a parcel of real property, which includes land and any buildings on the land. To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

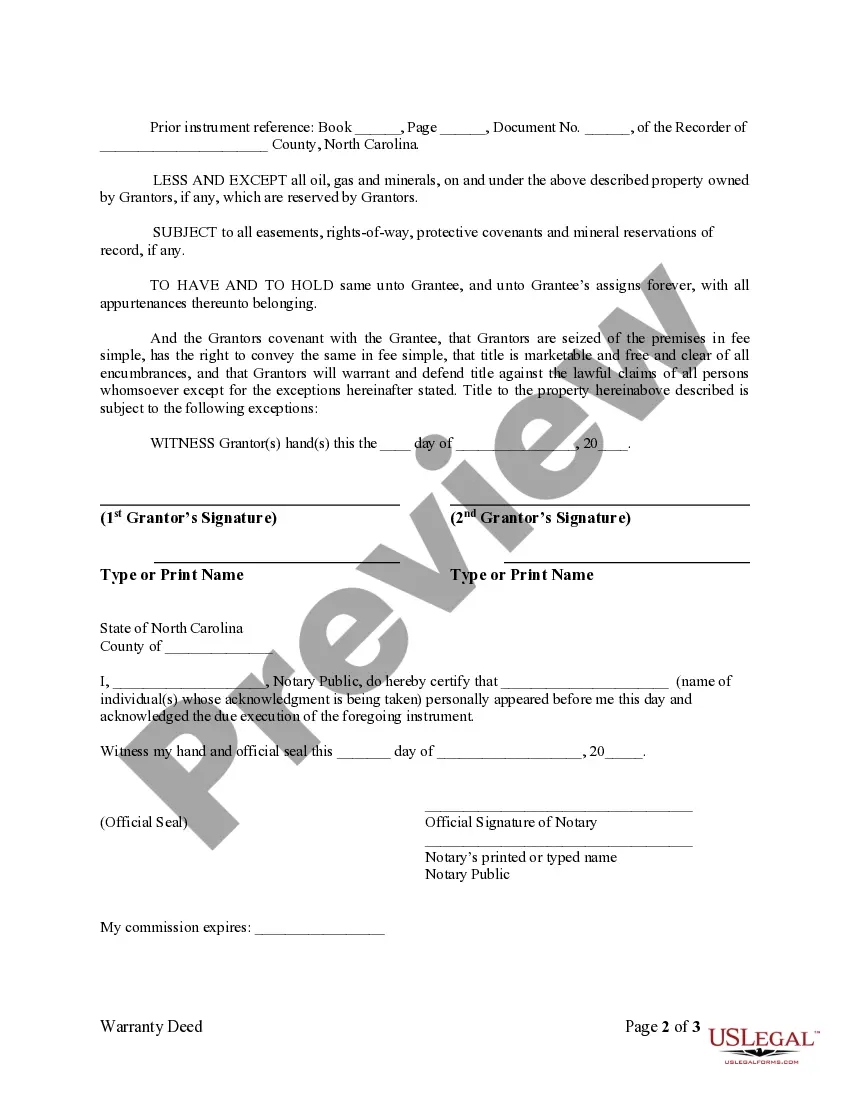

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.

The basic requirements of a valid deed are (1) written instrument, (2) competent grantor, (3) identity of the grantee, (4) words of conveyance, (5) adequate description of the land, (6) consideration, (7) signature of grantor, (8) witnesses, and (9) delivery of the completed deed to the grantee.

A general warranty deed must include the following to be valid: The name and address of the seller (called the grantor) The name and address of the buyer (called the grantee) A legal description of the property (found on the previous deed) A statement that the grantor is transferring the property to the grantee.

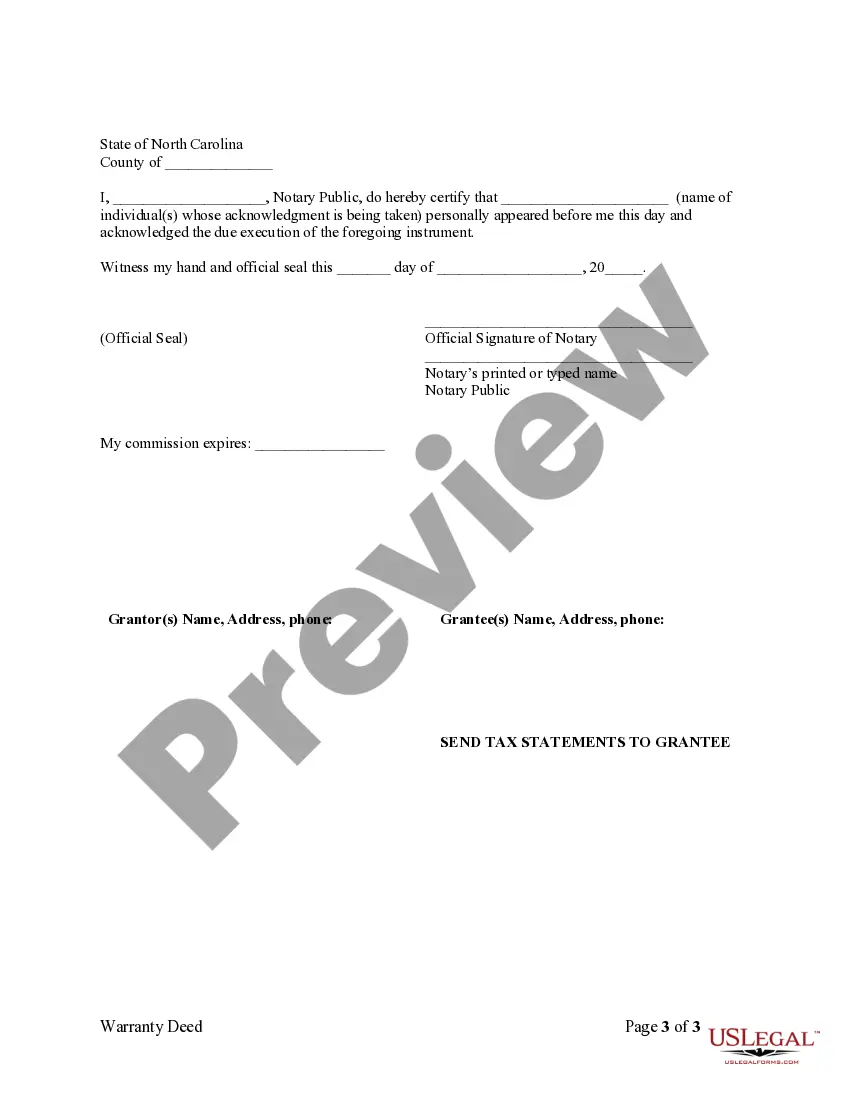

What Are the Steps to Transfer a Deed Yourself? Retrieve your original deed.Get the appropriate deed form.Draft the deed.Sign the deed before a notary.Record the deed with the county recorder.Obtain the new original deed.

Non-Warranty Deeds In a Non-Warranty or Quitclaim Deed, the seller merely is giving the buyer whatever rights, if any, that the seller has in the property and the seller makes no warranties of any nature about the seller's rights in the property.