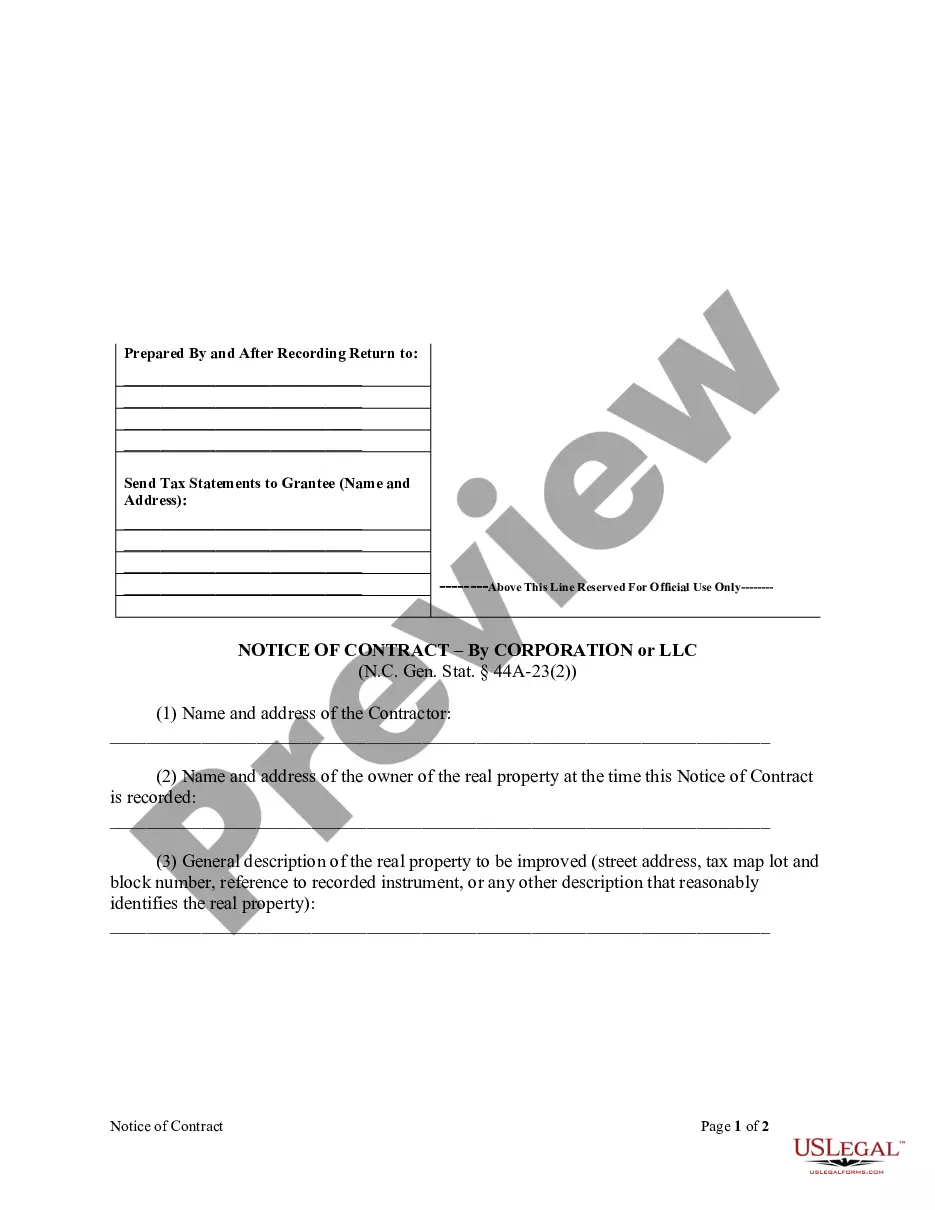

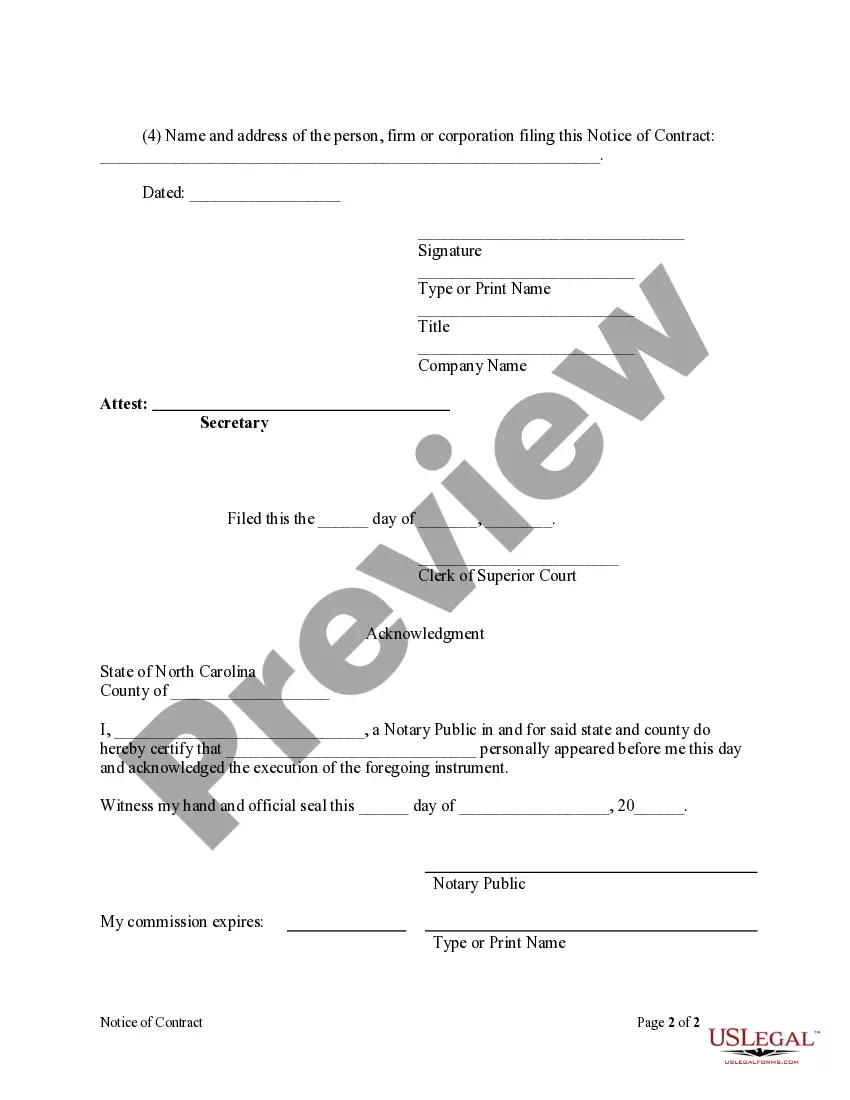

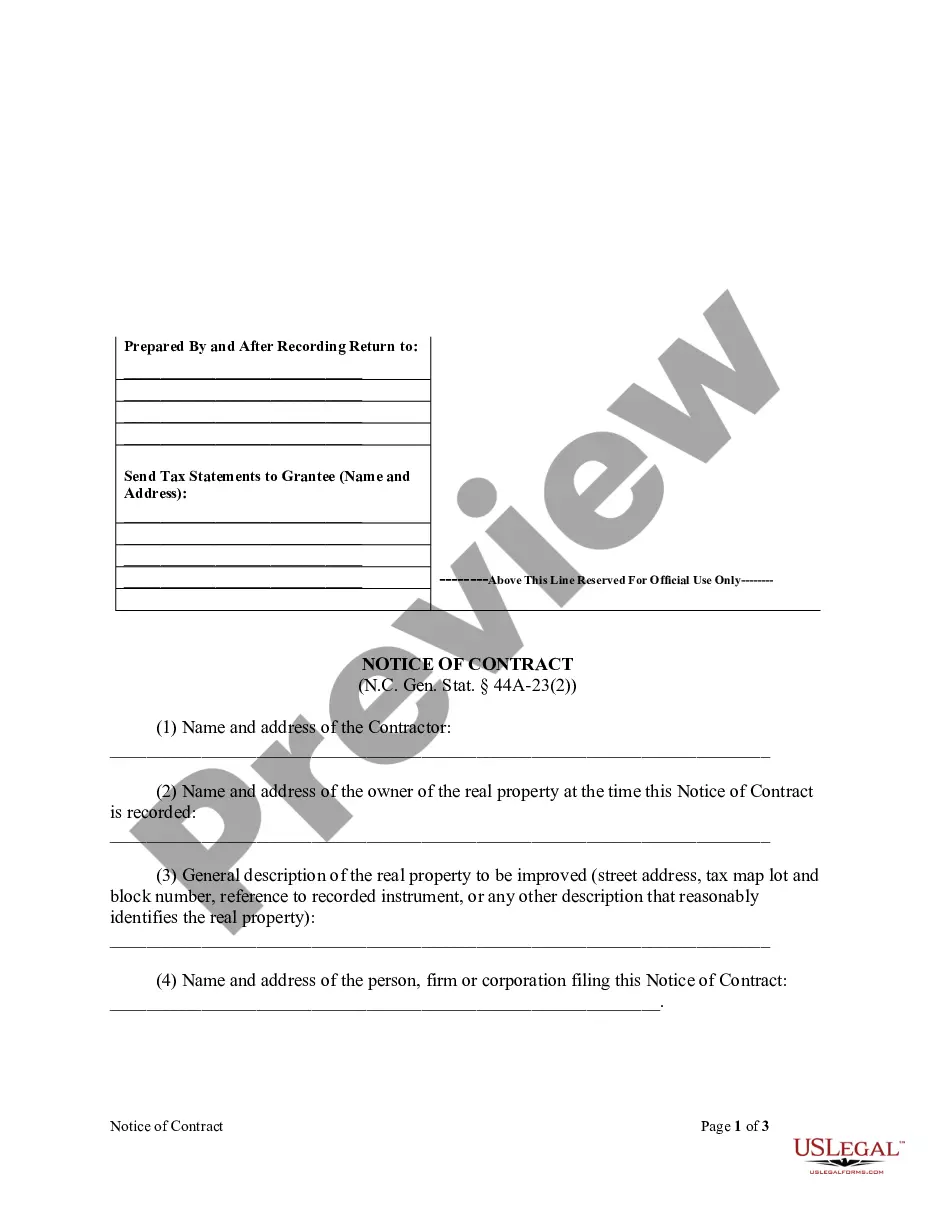

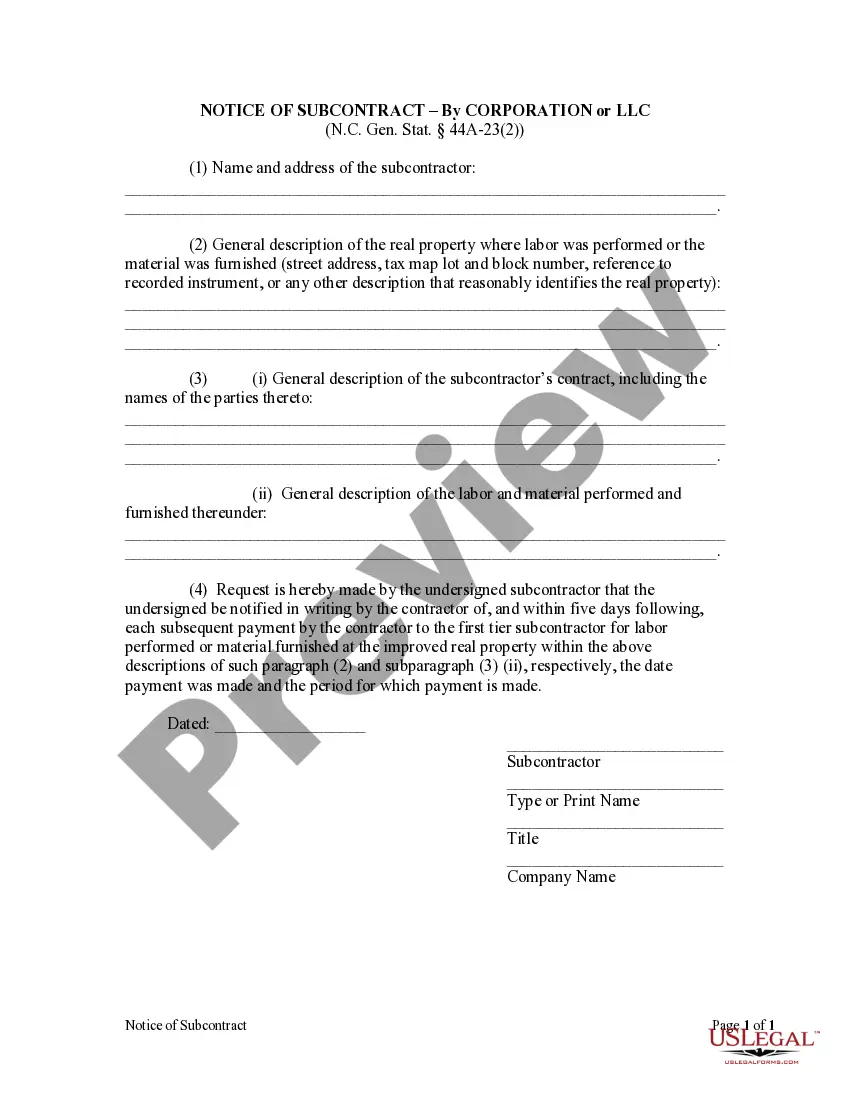

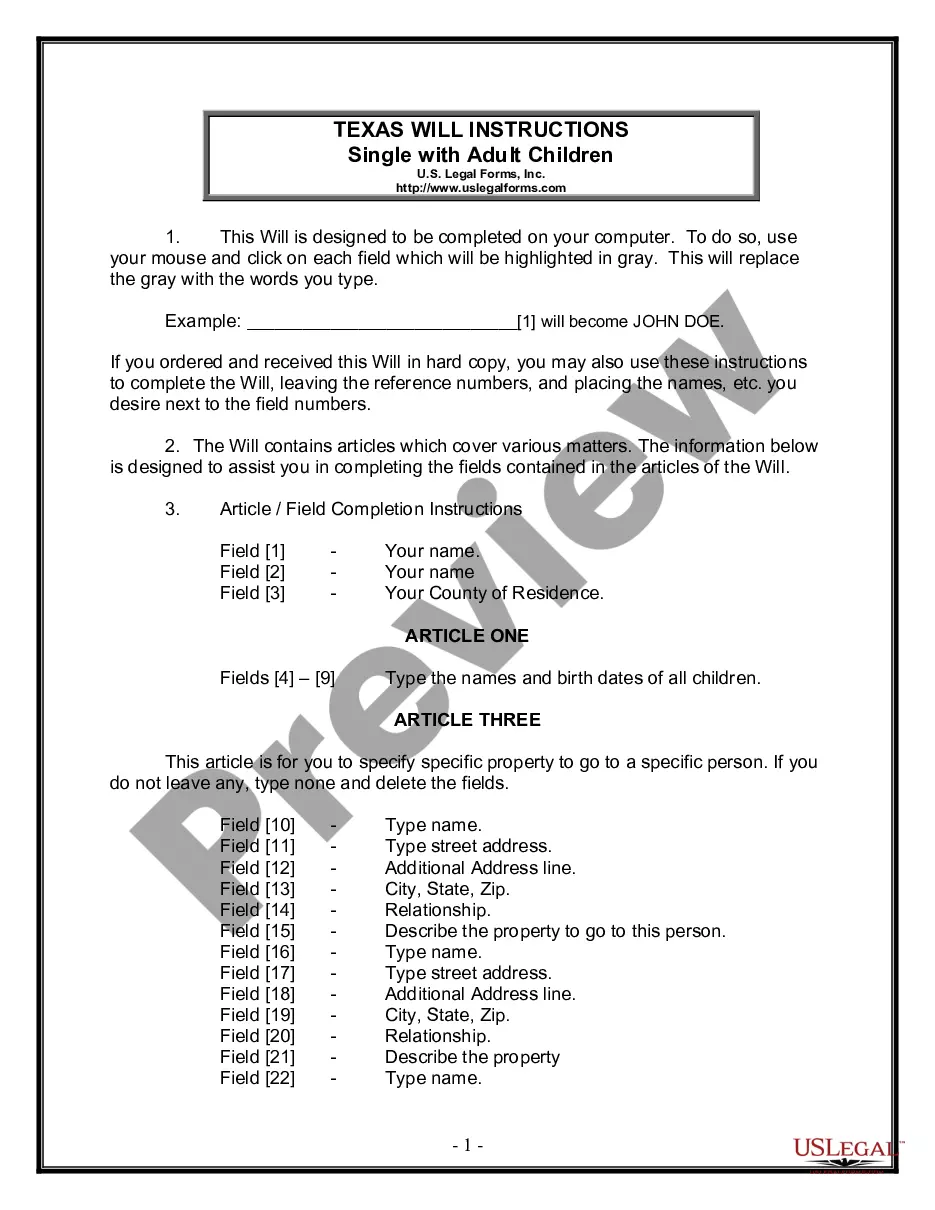

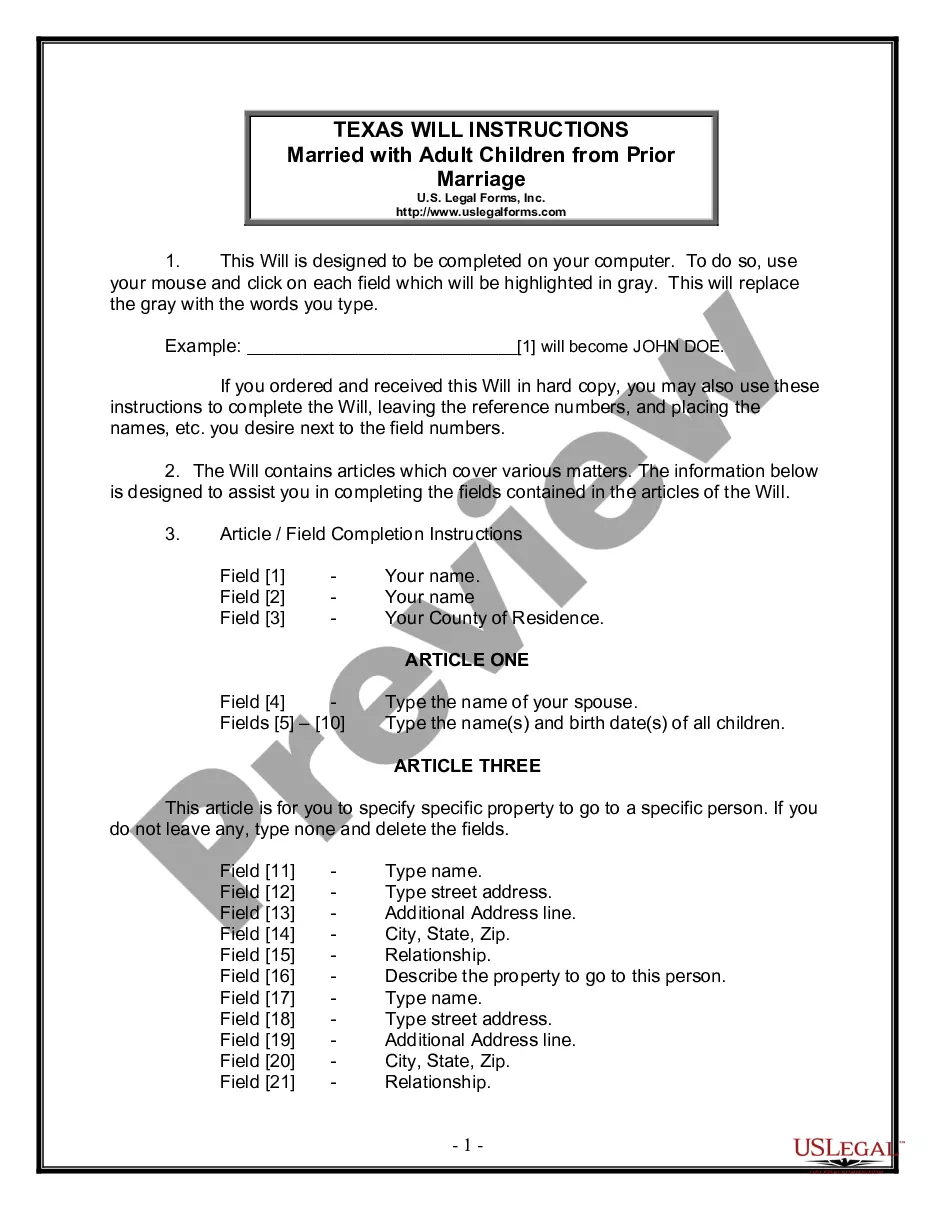

A second or third tier subcontractor is barred from enforcing a lien when a contractor, within thirty (30) days following the date the building permit is issued, posts on the property and files in the office of the Clerk of the Superior Court a completed and signed Notice of Contract form.

Charlotte North Carolina Notice of Contract - Corporation

Description

How to fill out North Carolina Notice Of Contract - Corporation?

If you have previously availed yourself of our service, Log In to your account and download the Charlotte North Carolina Notice of Contract - Corporation or LLC to your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment schedule.

If this is your first encounter with our service, follow these straightforward steps to obtain your document.

You have lifelong access to all documents you have purchased: you can find them in your profile within the My documents section whenever you need to access them again. Utilize the US Legal Forms service to quickly locate and save any template for your personal or business requirements!

- Ensure that you’ve found the right document. Browse the description and utilize the Preview option, if available, to determine if it suits your needs. If it’s not a good match, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Charlotte North Carolina Notice of Contract - Corporation or LLC. Select the file format for your document and save it to your device.

- Fill out your document. Print it out or use online professional editors to complete and sign it electronically.

Form popularity

FAQ

Business Corporations Management: A Corporation is owned by its shareholders and managed by a board of directors elected and acting under authority of the Articles of Incorporation and bylaws of the Corporation. Limited Liability Characteristics: The liability of shareholders is limited to their capital contribution.

Process of Conversion Prior to filing the necessary conversion documents with North Carolina Secretary of State, the company needs to hold a meeting of members (LLC) or directors and shareholders (corporation) and officially approve the conversion.

The articles must state the name, title, and business address of each person executing the Articles of Organization, and must also state whether each of those persons is executing the document in the capacity of a member or organizer. The Articles of Organization may identify the initial members of the LLC.

The process for an LLC to convert to a C Corp or vice versa varies by state. However, in most states, the corporations can file a ?Statuary Conversion.? In states that allow statutory conversions, the procedure is as follows: Create a plan of conversion, which must be approved by all LLC members and shareholders.

Most states allow LLCs to be converted to a corporation by the simple filing of documents with the state. At the time of the conversion the LLC by operation of law becomes a corporation and, therefore, the owner of all the assets, liabilities and obligations of the LLC.

A corporation is a legal entity separate and apart from its shareholders whereas a company may either be separate or merely be the business owner. A small company will generally be managed by its owner whereas a corporation may either be managed by its owners or have independent managers.

North Carolina does not require an operating agreement in order to form an LLC, but executing one is highly advisable.

A corporation is created when it is incorporated by a group of shareholders who share ownership of the corporation, represented by their holding of stock shares, and pursue a common goal. The vast majority of corporations have a goal of returning a profit for their shareholders.

To amend a North Carolina LLCs articles of organization, you file form L-17, Limited Liability Company Amendment of Articles of Organization with the North Carolina Secretary of State, Corporations Division SOS. You can submit the amendment by mail, in person, or online.

You can change your limited liability company (LLC) to an S corporation (S corp) by filing Form 2553 with the Internal Revenue Service (IRS).