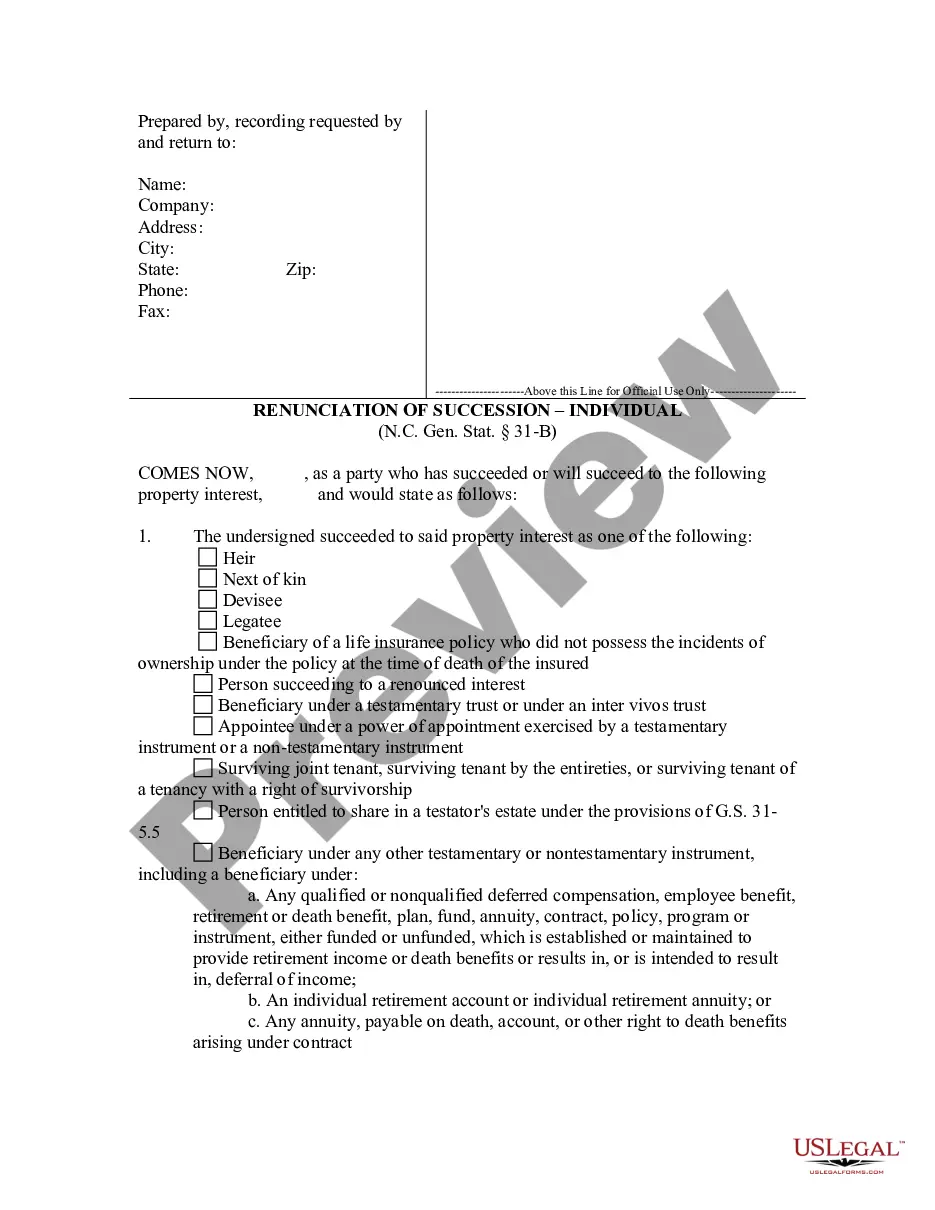

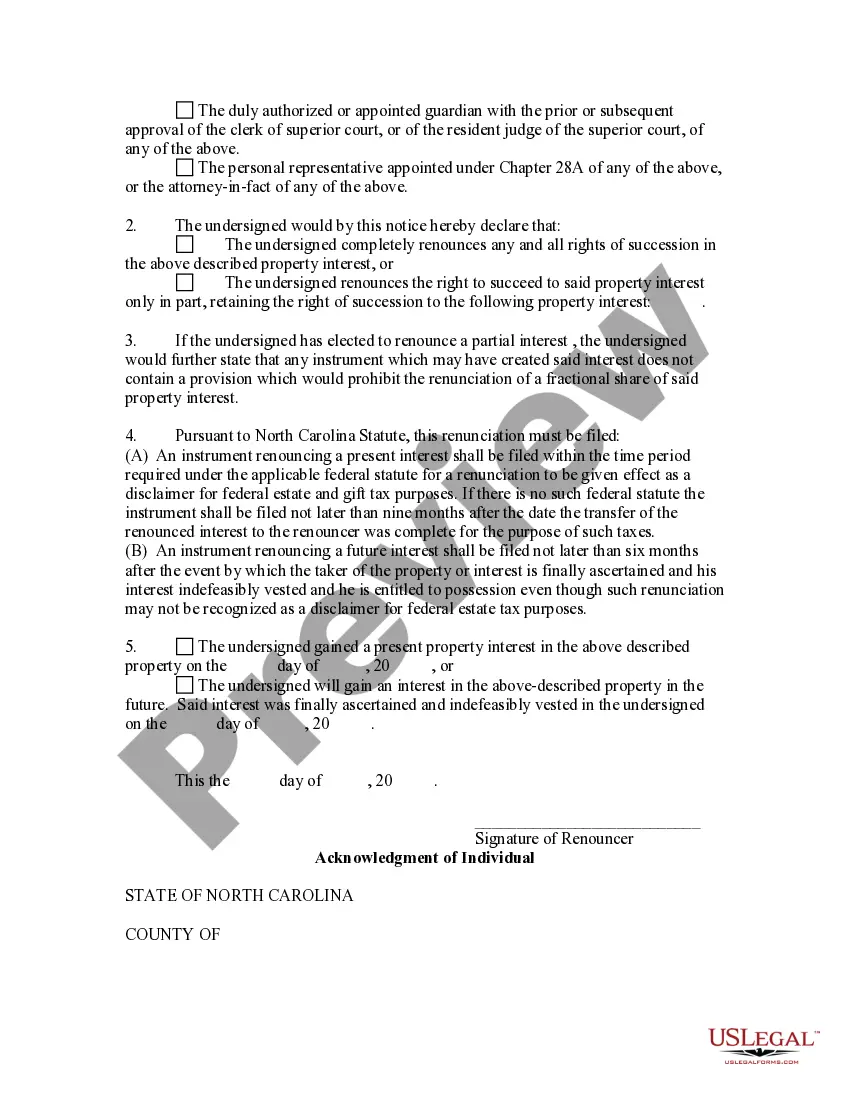

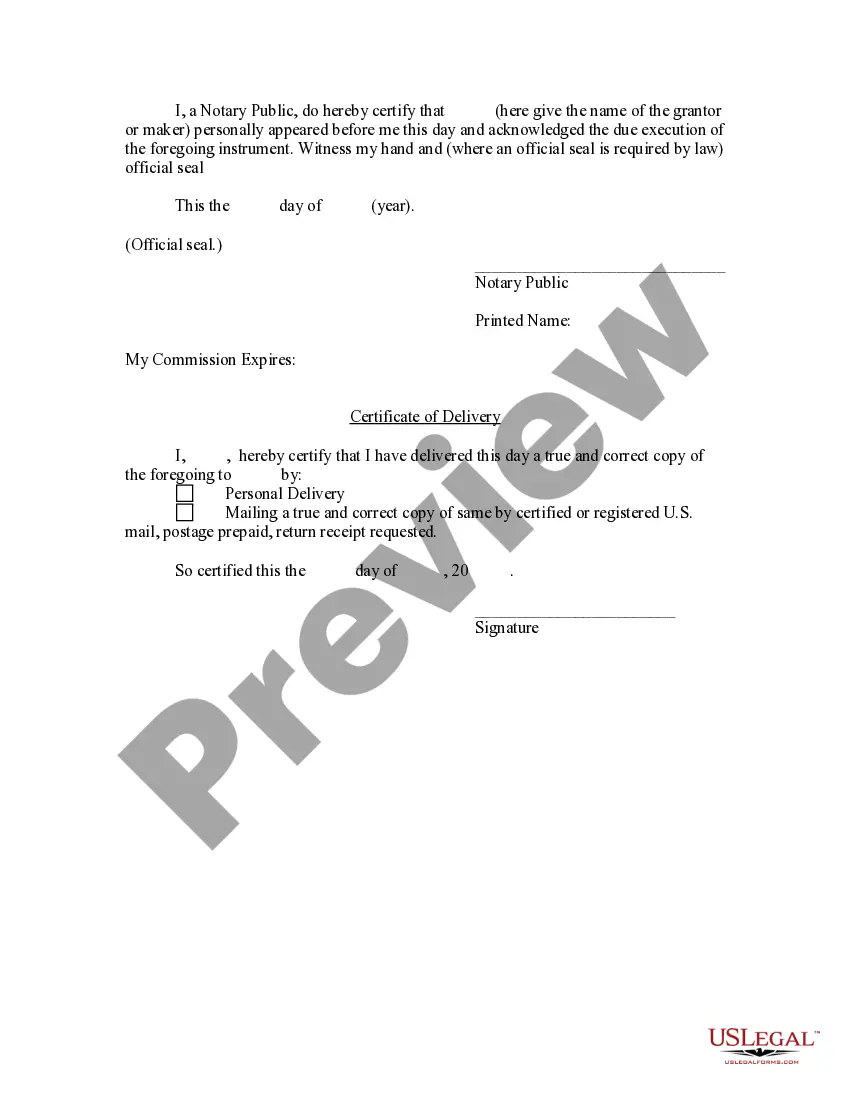

Raleigh North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract: Explained Introduction: Renunciation and disclaimer of property from life insurance or annuity contracts provide individuals in Raleigh, North Carolina, with an option to relinquish their rights to certain property upon the occurrence of specific events. This legal process allows individuals to disclaim their claims to property, specifically life insurance or annuity contracts, ensuring a smooth transition of assets and estates. In this article, we will explore the intricacies of Raleigh North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract while highlighting different types of renunciations available. Understanding Renunciation and Disclaimer of Property: Renunciation and disclaimer of property refer to the act of voluntarily abandoning or refusing any rights, claims, or interest in a particular life insurance or annuity contract. By renouncing a contract, individuals in Raleigh, North Carolina, effectively signify that they do not wish to accept the benefits associated with said contract. Purpose and Benefits: There are various reasons why individuals might opt for renunciation or disclaimer of property from life insurance or annuity contracts: 1. Estate Planning Purposes: Renunciation helps individuals manage their estates effectively, allowing assets to be passed to other beneficiaries. This can be especially useful if the designated beneficiary has sufficient resources or if the property's value is disproportionate. 2. Tax and Liability Considerations: Renouncing property from life insurance or annuity contracts can assist individuals in avoiding potential tax liabilities associated with inheriting substantial assets. 3. Personal Choice: In certain cases, individuals might want to renounce a property due to personal beliefs, family dynamics, or financial considerations. Types of Renunciations and Disclaimers: Raleigh, North Carolina, recognizes various types of renunciations and disclaimers specific to life insurance or annuity contracts. These include: 1. Total Renunciation: This type of renunciation involves the complete abandonment of any rights, claims, or interests in the life insurance or annuity contract. 2. Qualified Renunciation: A qualified renunciation allows individuals to disclaim the property while imposing certain conditions or restrictions on the renunciation process. 3. Partial Renunciation: Sometimes, individuals may decide to renounce only a portion of the life insurance or annuity property, keeping some benefits intact. Legal Process and Considerations: To effectively renounce or disclaim property from a life insurance or annuity contract in Raleigh, North Carolina, it is crucial to follow the appropriate legal procedures. Here are some key considerations: 1. Timely Filing: Renunciations must be filed within a specific timeframe, typically within nine months after the death of the policyholder or annuitant or within a set period from the beneficiary's knowledge of the policy. 2. Filing Documentation: Individuals need to complete and file specific legal documents, such as a Renunciation and Disclaimer of Property Form, with the appropriate authorities or estate executor. 3. Consultation with Professionals: It is advisable to consult with an attorney specializing in estate planning or a financial advisor familiar with the intricacies of renunciations and disclaimers to ensure compliance with legal requirements. Conclusion: Raleigh, North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is an essential aspect of estate planning, allowing individuals to manage and distribute their assets efficiently. Whether opting for total renunciation, qualified renunciation, or partial renunciation of property, understanding the legal process and seeking appropriate guidance is paramount. By utilizing this legal framework, individuals can effectively shape their estate plans while considering tax implications and their individual needs.

Raleigh North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Raleigh North Carolina Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

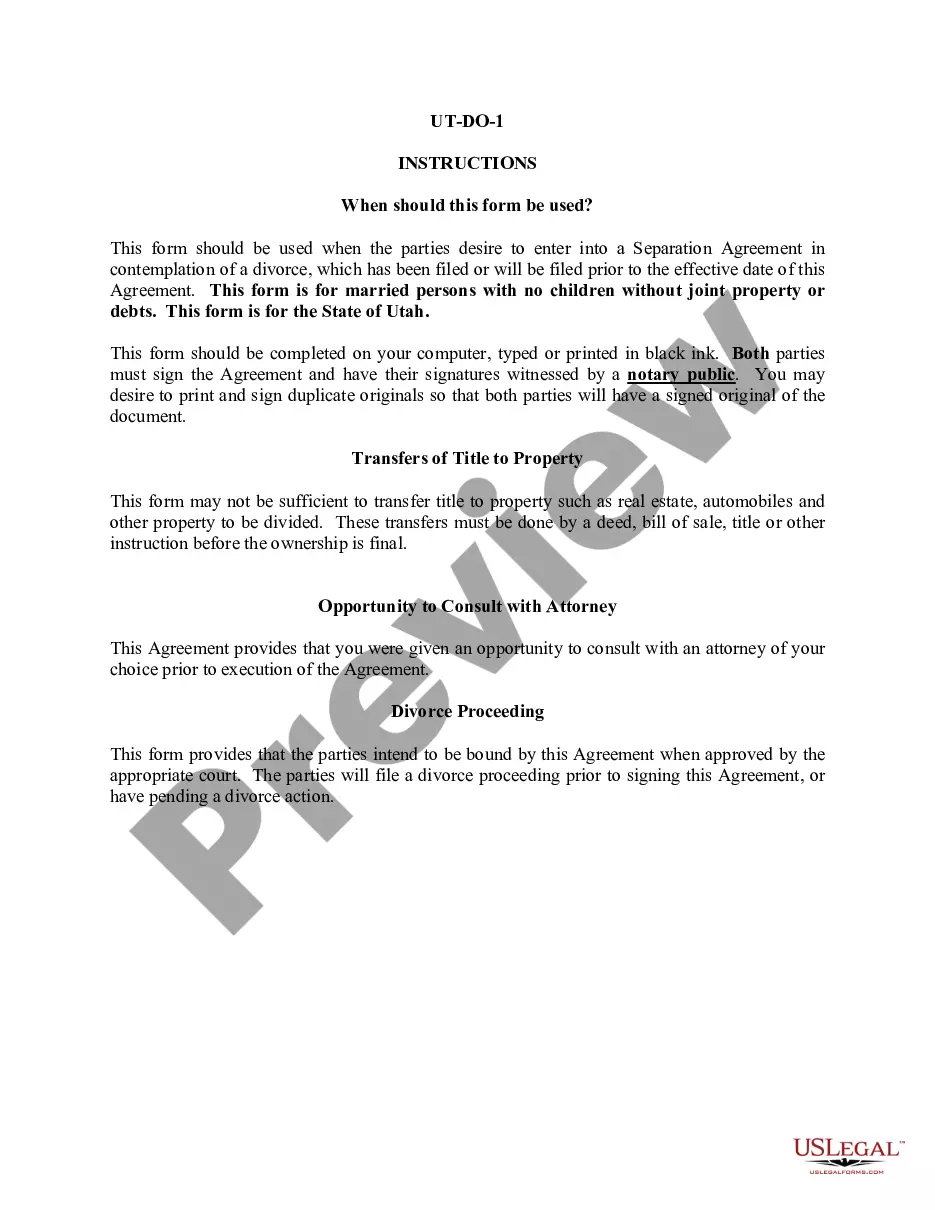

If you are looking for a valid form template, it’s difficult to choose a more convenient service than the US Legal Forms website – one of the most considerable libraries on the internet. Here you can get a large number of templates for organization and personal purposes by types and states, or key phrases. Using our high-quality search feature, getting the latest Raleigh North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is as easy as 1-2-3. Moreover, the relevance of each and every document is confirmed by a group of expert lawyers that regularly check the templates on our website and update them based on the latest state and county demands.

If you already know about our system and have a registered account, all you need to get the Raleigh North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is to log in to your profile and click the Download button.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the form you want. Look at its explanation and utilize the Preview feature (if available) to see its content. If it doesn’t meet your needs, use the Search field near the top of the screen to discover the needed file.

- Affirm your selection. Click the Buy now button. Following that, select the preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the form. Select the file format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the received Raleigh North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Every form you add to your profile does not have an expiry date and is yours permanently. You always have the ability to access them using the My Forms menu, so if you want to receive an additional version for enhancing or creating a hard copy, you may return and save it again at any time.

Make use of the US Legal Forms extensive collection to get access to the Raleigh North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract you were looking for and a large number of other professional and state-specific samples in one place!