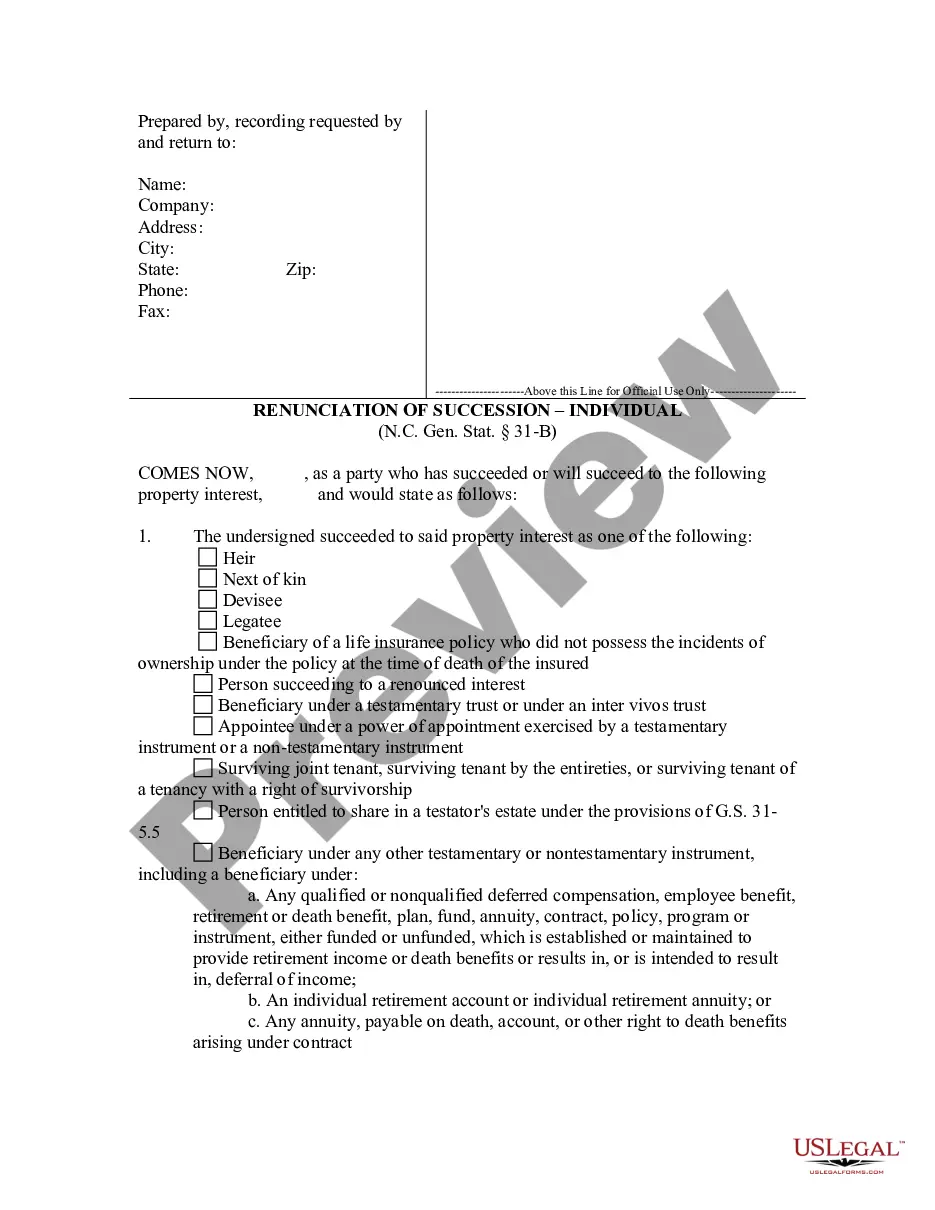

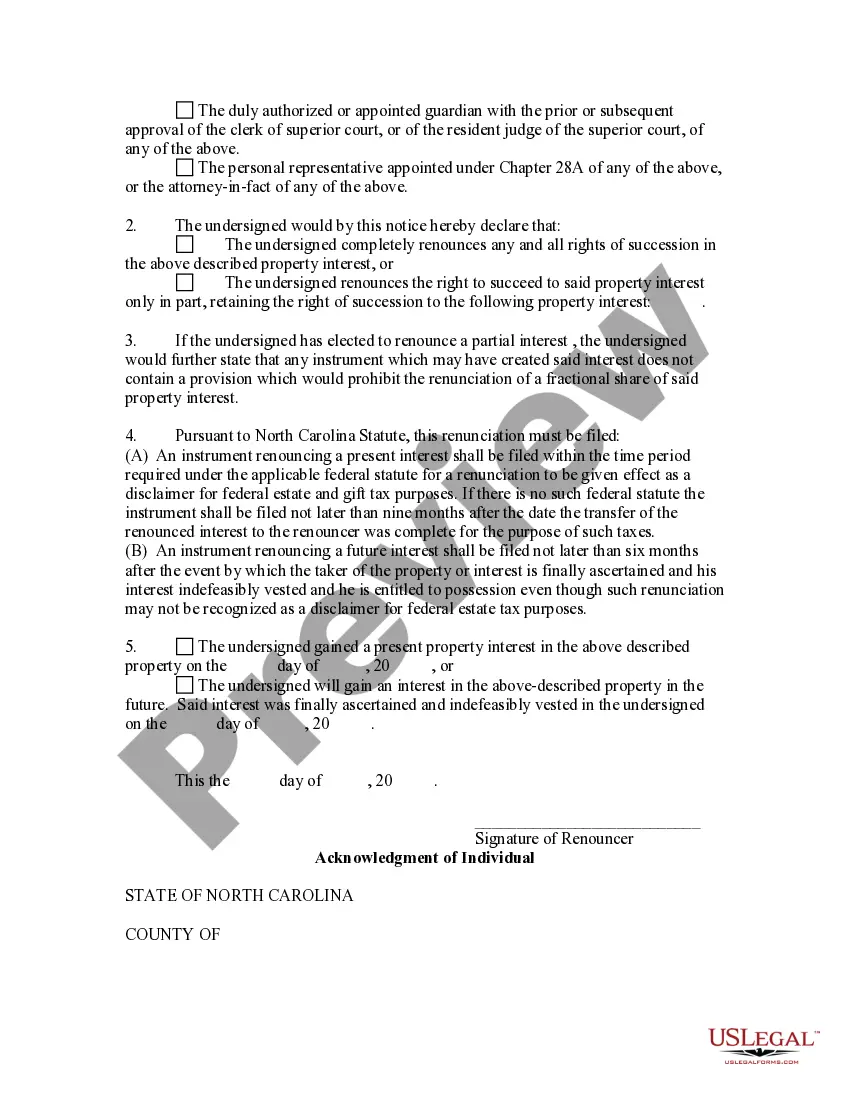

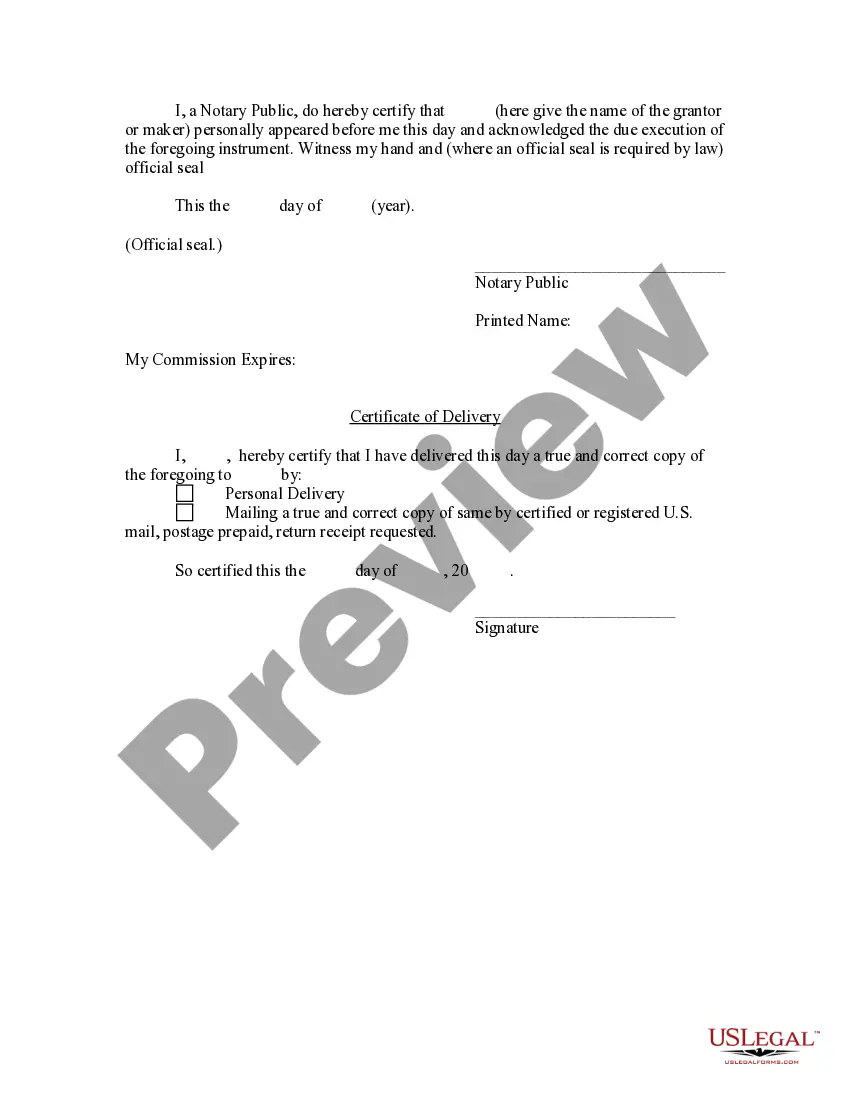

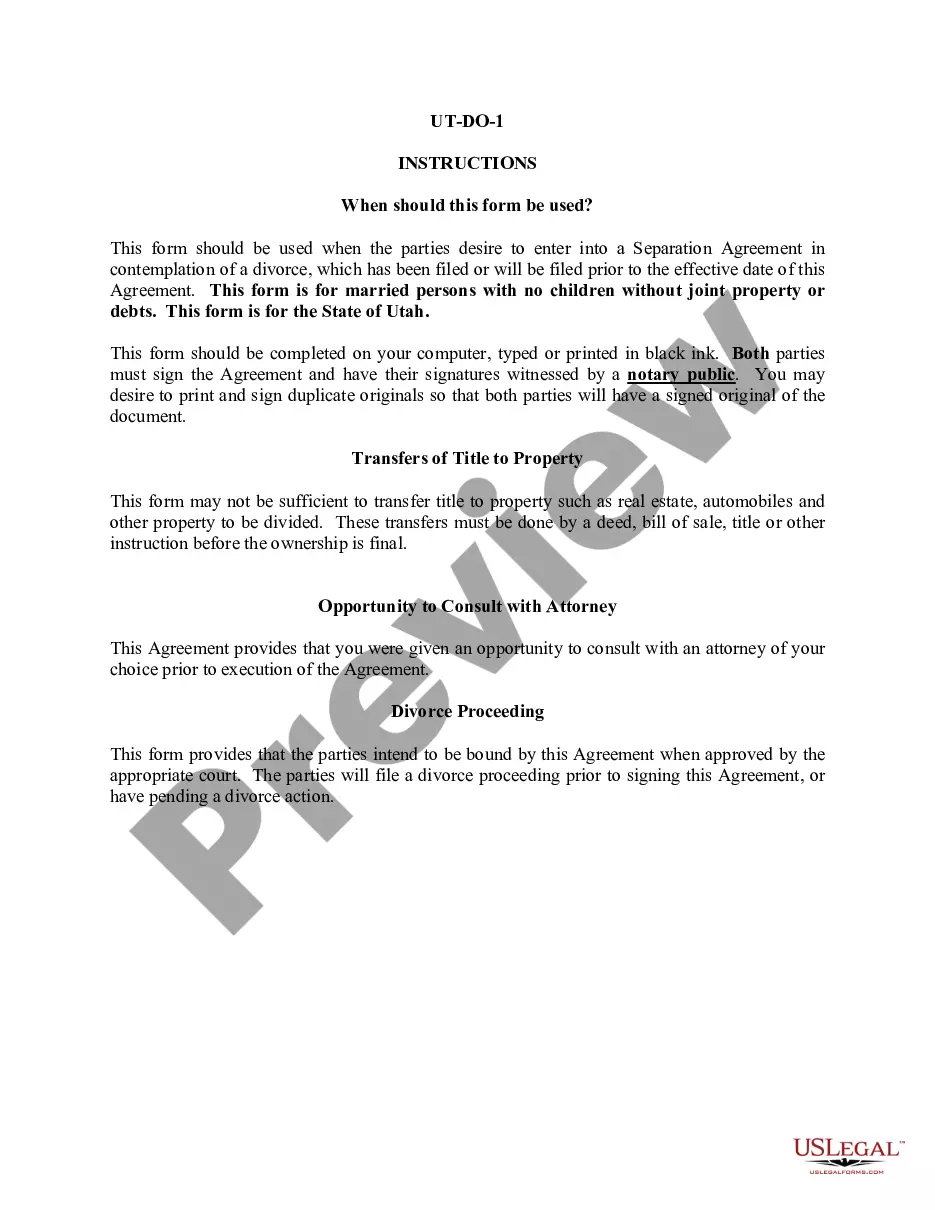

Raleigh North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract: Explained Introduction: Renunciation and disclaimer of property from life insurance or annuity contracts provide individuals in Raleigh, North Carolina, with an option to relinquish their rights to certain property upon the occurrence of specific events. This legal process allows individuals to disclaim their claims to property, specifically life insurance or annuity contracts, ensuring a smooth transition of assets and estates. In this article, we will explore the intricacies of Raleigh North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract while highlighting different types of renunciations available. Understanding Renunciation and Disclaimer of Property: Renunciation and disclaimer of property refer to the act of voluntarily abandoning or refusing any rights, claims, or interest in a particular life insurance or annuity contract. By renouncing a contract, individuals in Raleigh, North Carolina, effectively signify that they do not wish to accept the benefits associated with said contract. Purpose and Benefits: There are various reasons why individuals might opt for renunciation or disclaimer of property from life insurance or annuity contracts: 1. Estate Planning Purposes: Renunciation helps individuals manage their estates effectively, allowing assets to be passed to other beneficiaries. This can be especially useful if the designated beneficiary has sufficient resources or if the property's value is disproportionate. 2. Tax and Liability Considerations: Renouncing property from life insurance or annuity contracts can assist individuals in avoiding potential tax liabilities associated with inheriting substantial assets. 3. Personal Choice: In certain cases, individuals might want to renounce a property due to personal beliefs, family dynamics, or financial considerations. Types of Renunciations and Disclaimers: Raleigh, North Carolina, recognizes various types of renunciations and disclaimers specific to life insurance or annuity contracts. These include: 1. Total Renunciation: This type of renunciation involves the complete abandonment of any rights, claims, or interests in the life insurance or annuity contract. 2. Qualified Renunciation: A qualified renunciation allows individuals to disclaim the property while imposing certain conditions or restrictions on the renunciation process. 3. Partial Renunciation: Sometimes, individuals may decide to renounce only a portion of the life insurance or annuity property, keeping some benefits intact. Legal Process and Considerations: To effectively renounce or disclaim property from a life insurance or annuity contract in Raleigh, North Carolina, it is crucial to follow the appropriate legal procedures. Here are some key considerations: 1. Timely Filing: Renunciations must be filed within a specific timeframe, typically within nine months after the death of the policyholder or annuitant or within a set period from the beneficiary's knowledge of the policy. 2. Filing Documentation: Individuals need to complete and file specific legal documents, such as a Renunciation and Disclaimer of Property Form, with the appropriate authorities or estate executor. 3. Consultation with Professionals: It is advisable to consult with an attorney specializing in estate planning or a financial advisor familiar with the intricacies of renunciations and disclaimers to ensure compliance with legal requirements. Conclusion: Raleigh, North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is an essential aspect of estate planning, allowing individuals to manage and distribute their assets efficiently. Whether opting for total renunciation, qualified renunciation, or partial renunciation of property, understanding the legal process and seeking appropriate guidance is paramount. By utilizing this legal framework, individuals can effectively shape their estate plans while considering tax implications and their individual needs.

Raleigh North Carolina Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract: Explained Introduction: Renunciation and disclaimer of property from life insurance or annuity contracts provide individuals in Raleigh, North Carolina, with an option to relinquish their rights to certain property upon the occurrence of specific events. This legal process allows individuals to disclaim their claims to property, specifically life insurance or annuity contracts, ensuring a smooth transition of assets and estates. In this article, we will explore the intricacies of Raleigh North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract while highlighting different types of renunciations available. Understanding Renunciation and Disclaimer of Property: Renunciation and disclaimer of property refer to the act of voluntarily abandoning or refusing any rights, claims, or interest in a particular life insurance or annuity contract. By renouncing a contract, individuals in Raleigh, North Carolina, effectively signify that they do not wish to accept the benefits associated with said contract. Purpose and Benefits: There are various reasons why individuals might opt for renunciation or disclaimer of property from life insurance or annuity contracts: 1. Estate Planning Purposes: Renunciation helps individuals manage their estates effectively, allowing assets to be passed to other beneficiaries. This can be especially useful if the designated beneficiary has sufficient resources or if the property's value is disproportionate. 2. Tax and Liability Considerations: Renouncing property from life insurance or annuity contracts can assist individuals in avoiding potential tax liabilities associated with inheriting substantial assets. 3. Personal Choice: In certain cases, individuals might want to renounce a property due to personal beliefs, family dynamics, or financial considerations. Types of Renunciations and Disclaimers: Raleigh, North Carolina, recognizes various types of renunciations and disclaimers specific to life insurance or annuity contracts. These include: 1. Total Renunciation: This type of renunciation involves the complete abandonment of any rights, claims, or interests in the life insurance or annuity contract. 2. Qualified Renunciation: A qualified renunciation allows individuals to disclaim the property while imposing certain conditions or restrictions on the renunciation process. 3. Partial Renunciation: Sometimes, individuals may decide to renounce only a portion of the life insurance or annuity property, keeping some benefits intact. Legal Process and Considerations: To effectively renounce or disclaim property from a life insurance or annuity contract in Raleigh, North Carolina, it is crucial to follow the appropriate legal procedures. Here are some key considerations: 1. Timely Filing: Renunciations must be filed within a specific timeframe, typically within nine months after the death of the policyholder or annuitant or within a set period from the beneficiary's knowledge of the policy. 2. Filing Documentation: Individuals need to complete and file specific legal documents, such as a Renunciation and Disclaimer of Property Form, with the appropriate authorities or estate executor. 3. Consultation with Professionals: It is advisable to consult with an attorney specializing in estate planning or a financial advisor familiar with the intricacies of renunciations and disclaimers to ensure compliance with legal requirements. Conclusion: Raleigh, North Carolina Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is an essential aspect of estate planning, allowing individuals to manage and distribute their assets efficiently. Whether opting for total renunciation, qualified renunciation, or partial renunciation of property, understanding the legal process and seeking appropriate guidance is paramount. By utilizing this legal framework, individuals can effectively shape their estate plans while considering tax implications and their individual needs.