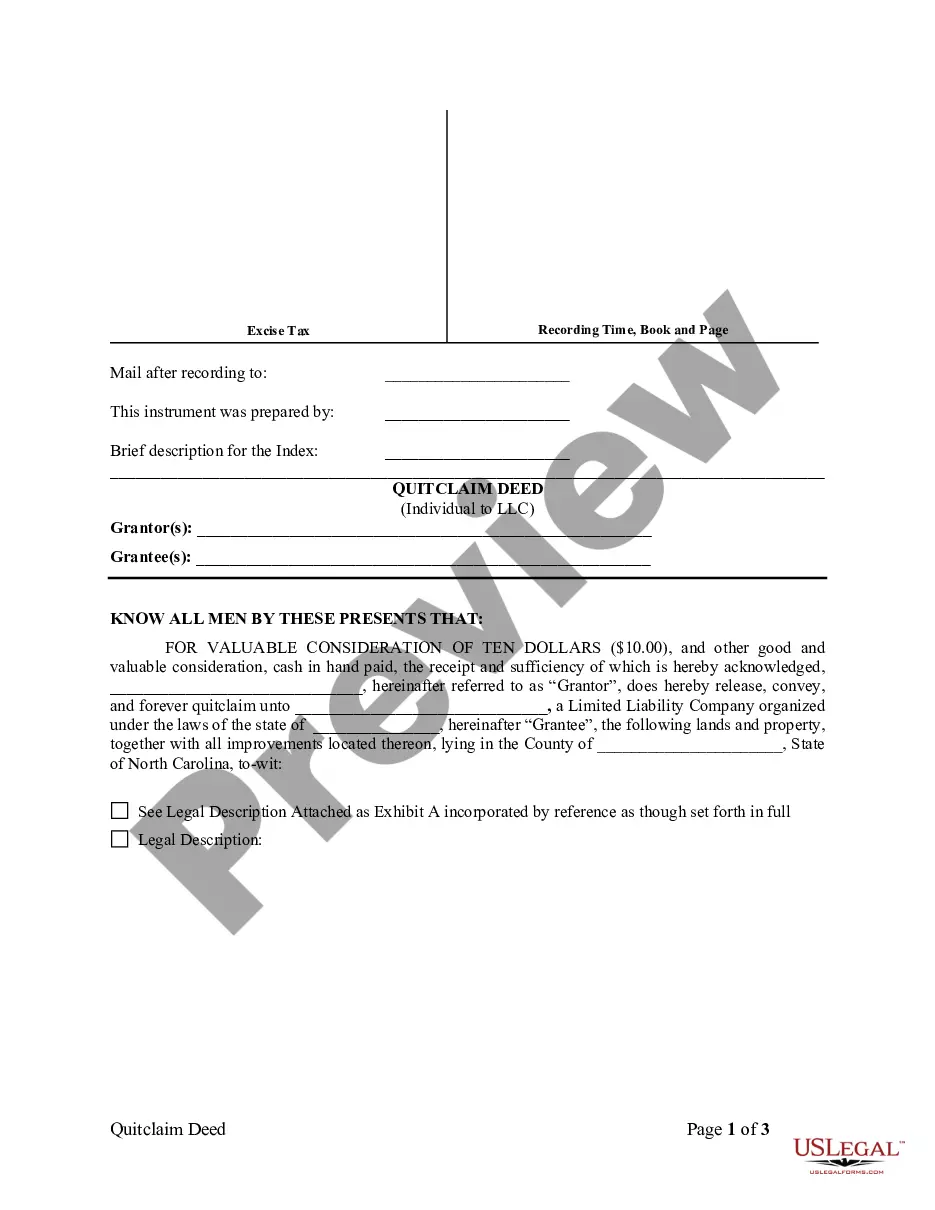

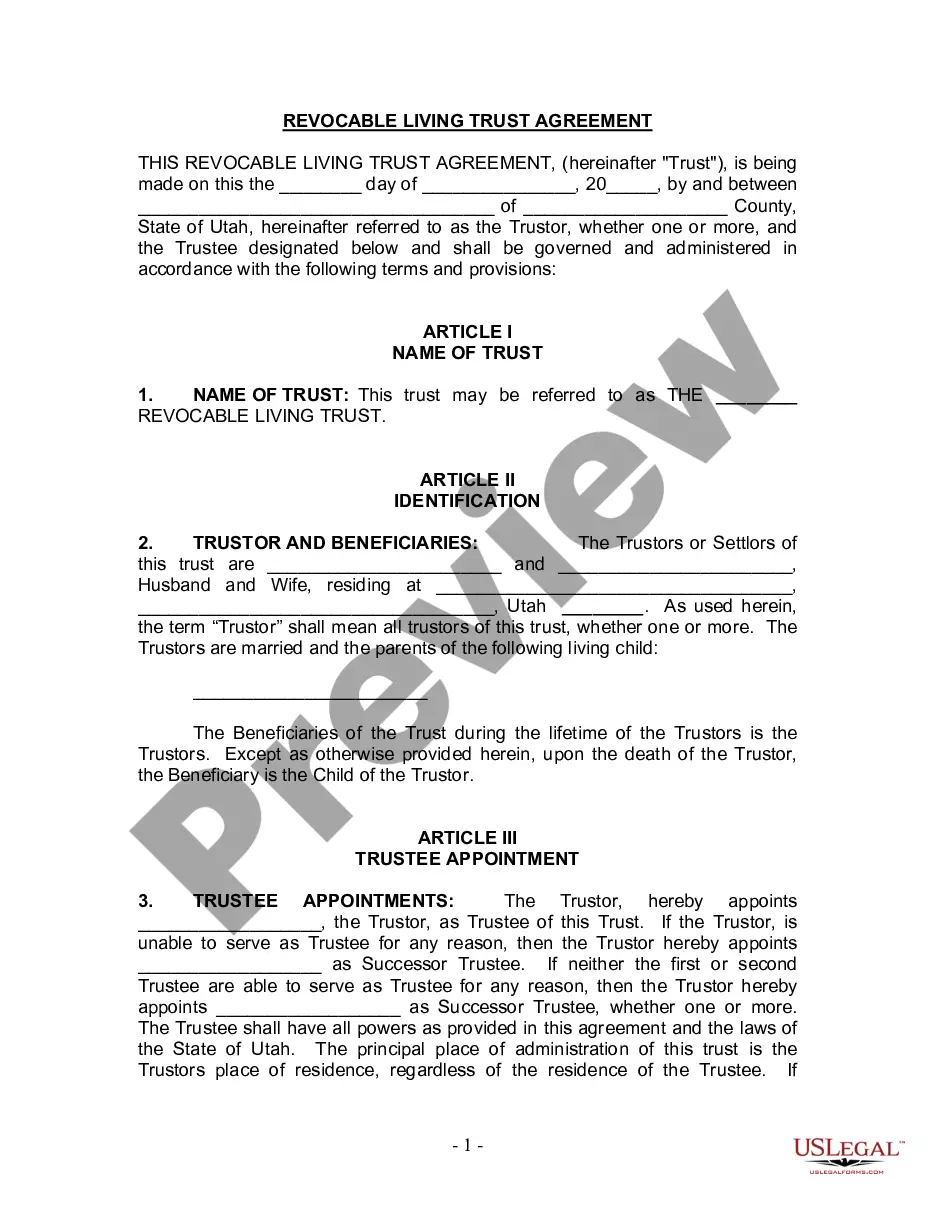

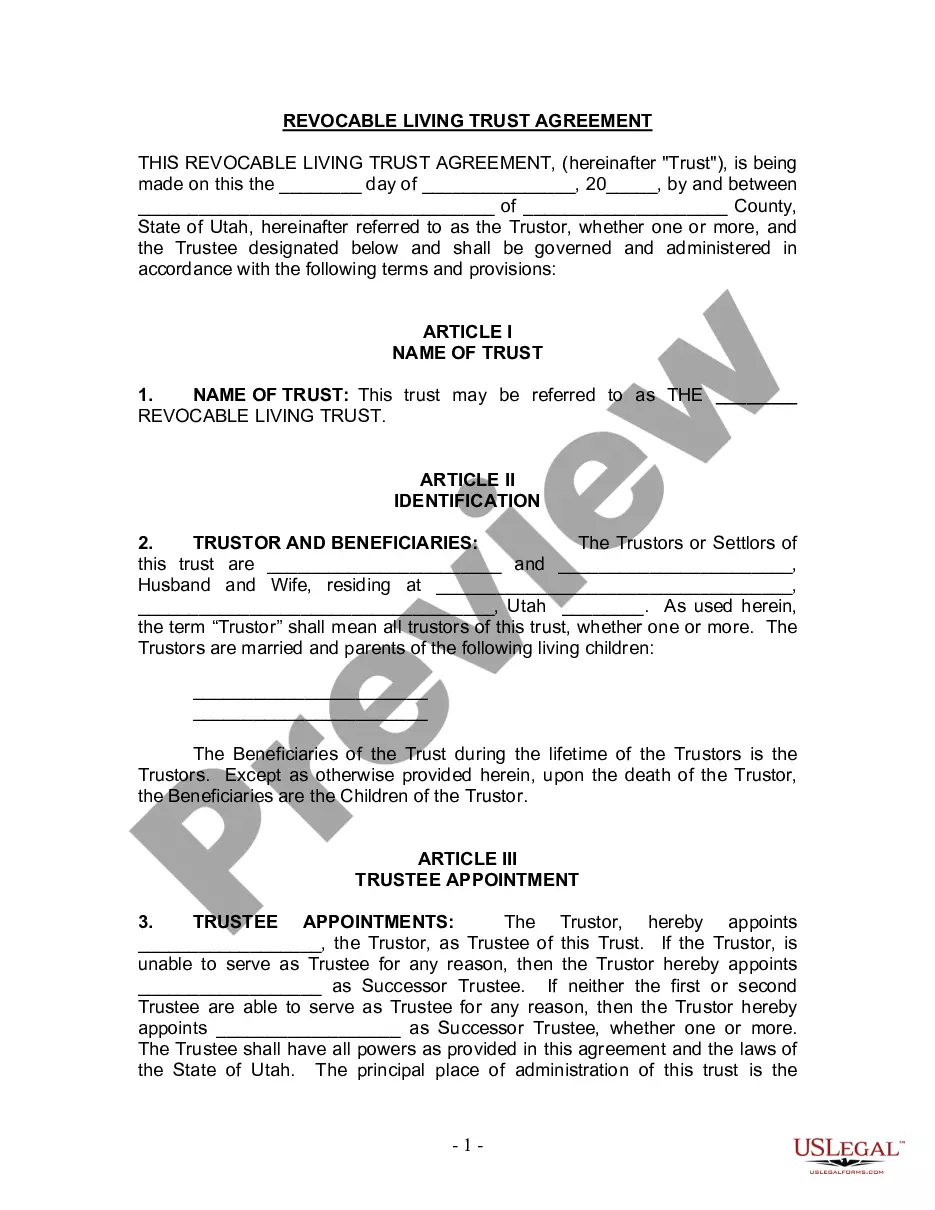

Raleigh North Carolina Quitclaim Deed from Individual to LLC

Description

How to fill out Raleigh North Carolina Quitclaim Deed From Individual To LLC?

If you've previously employed our service, Log In to your account and download the Raleigh North Carolina Quitclaim Deed from Individual to LLC onto your device by clicking the Download button. Ensure your subscription is current. If it isn’t, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your file.

You have permanent access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to use it again. Utilize the US Legal Forms service to effortlessly locate and download any template for your personal or business requirements!

- Ensure you have located the correct document. Review the description and use the Preview option, if available, to determine if it fits your requirements. If it does not suit you, use the Search tab above to find the right one.

- Acquire the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Raleigh North Carolina Quitclaim Deed from Individual to LLC. Choose the file format for your document and save it to your device.

- Complete your document. Print it or utilize online professional editors to fill it out and sign it electronically.

Form popularity

FAQ

A deed is a legal instrument that evidences legal ownership of a parcel of real property, which includes land and any buildings on the land. To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

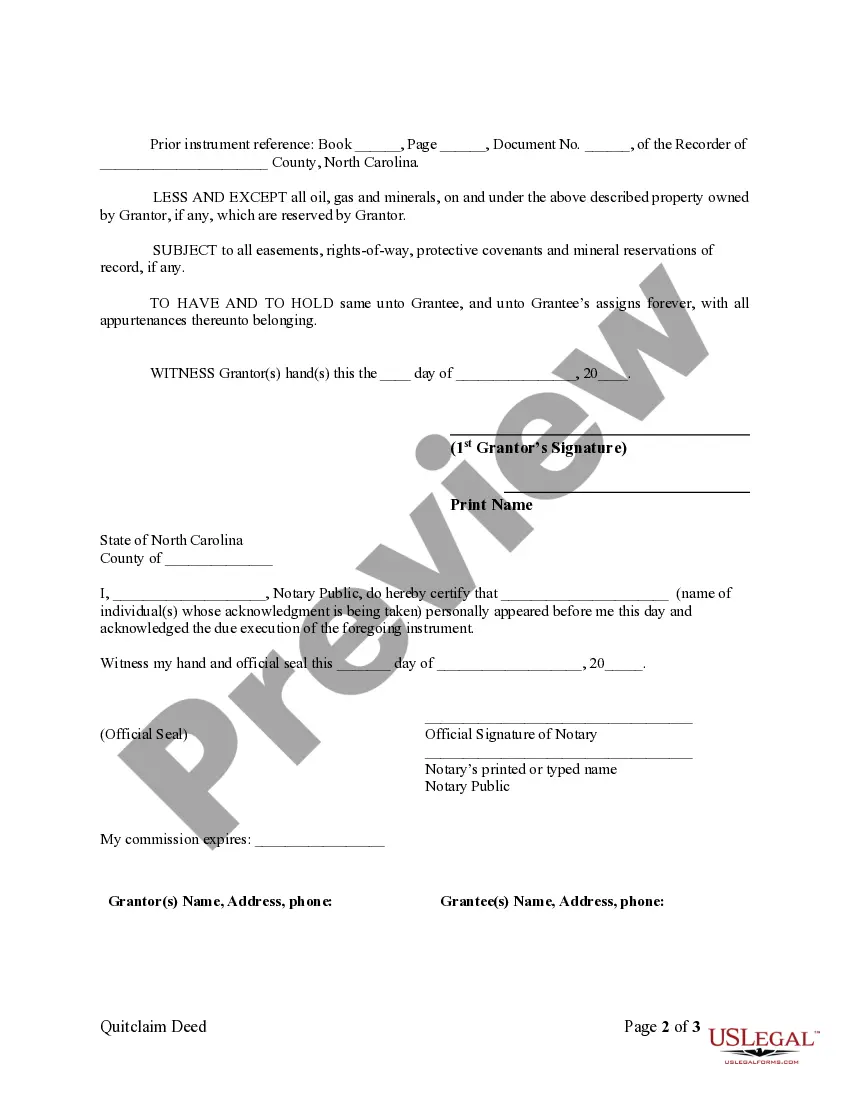

Signing - For a quitclaim deed to be accepted by the state of North Carolina, it must be signed by the seller of the property in the presence of a Notary Public (§ 47-38). Recording - After being notarized, this legal form should be filed with the Register of Deeds in the county where the property is located.

A quitclaim deed is likely the fastest, easiest, and most convenient way to transfer your ownership interest in a property or asset to a family member. Unlike other kinds of deeds, such as general and special warranty deeds, quitclaim deeds make no warranties or promises about what is being transferred.

To transfer ownership of land in North Carolina, the owner must execute and file a new deed with the register of deeds for the North Carolina county where the property is located.

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

Almost all instruments presented for recordation first must be acknowledged (notarized) before the Register of Deeds can record the instrument. Notary Publics are authorized by North Carolina law to perform this duty.

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.