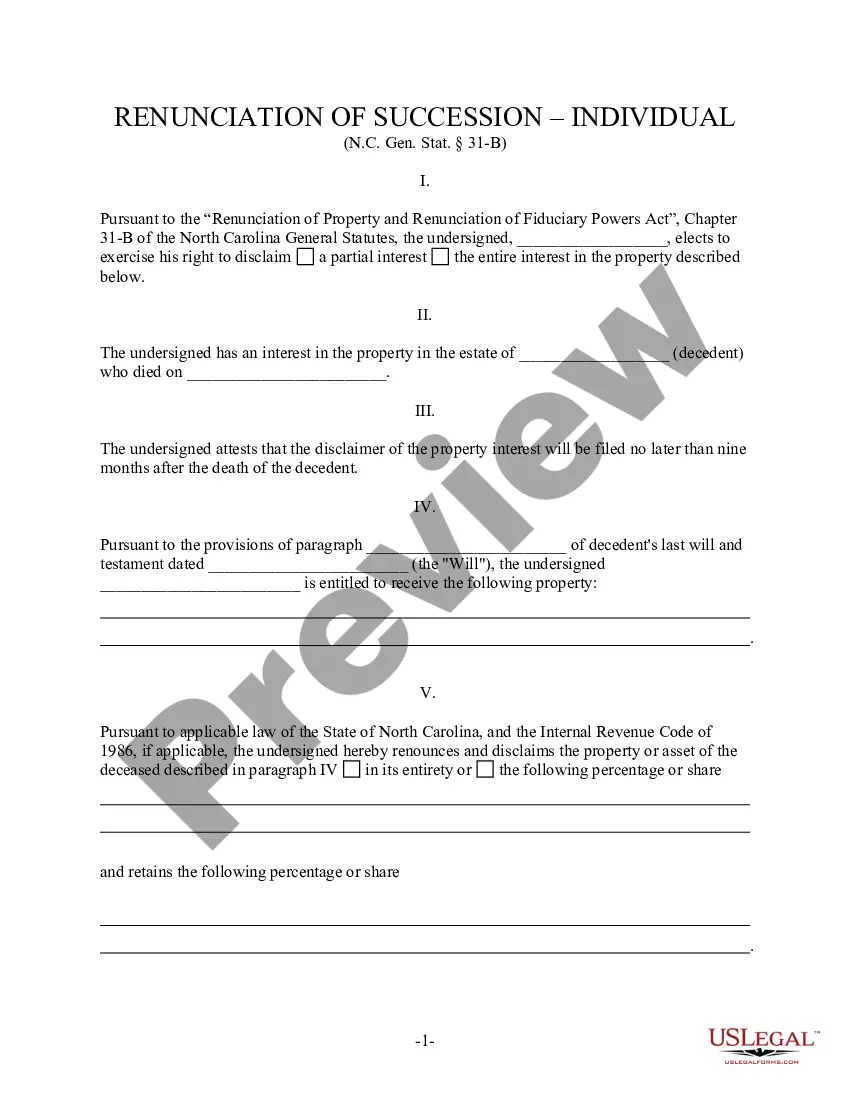

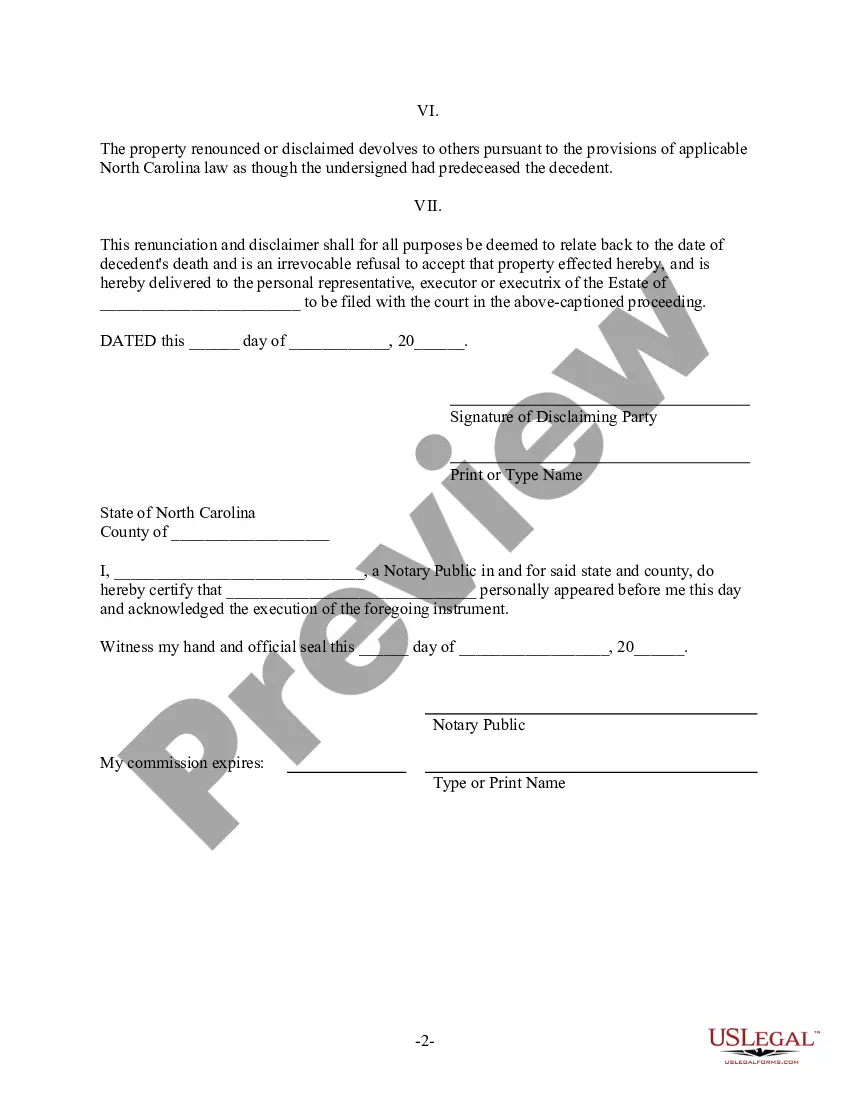

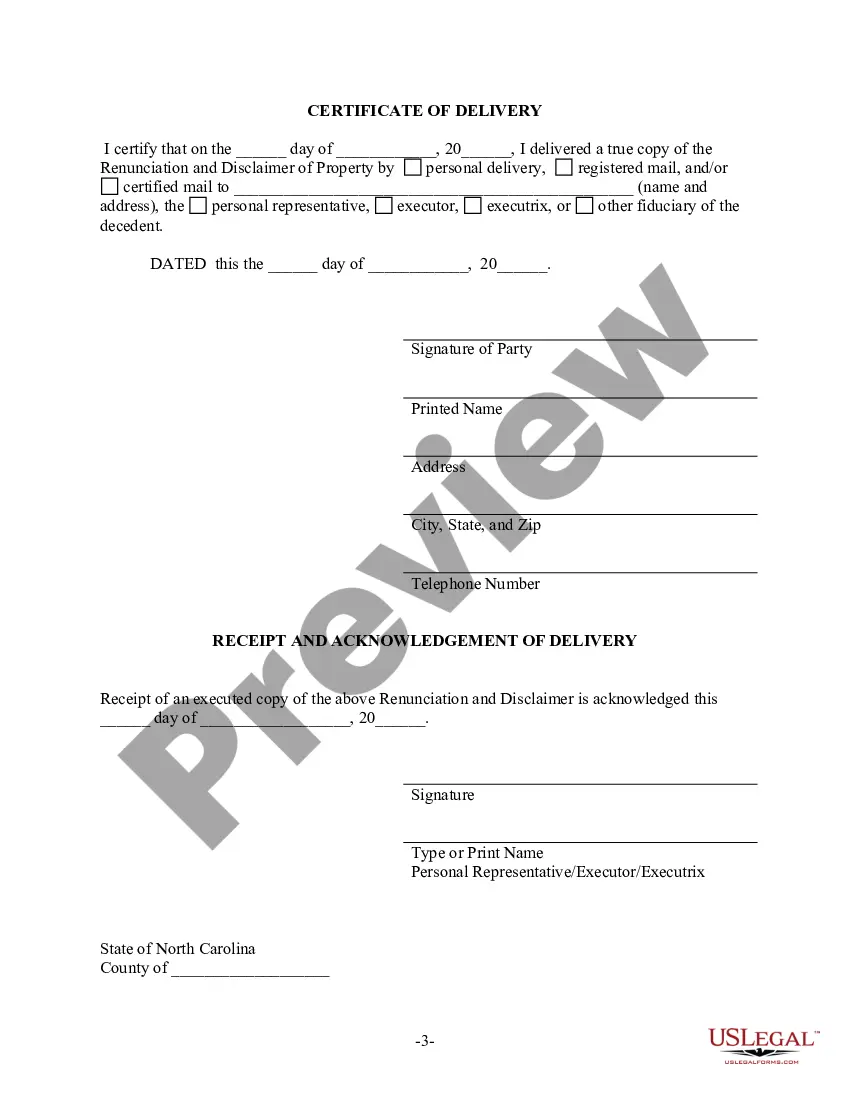

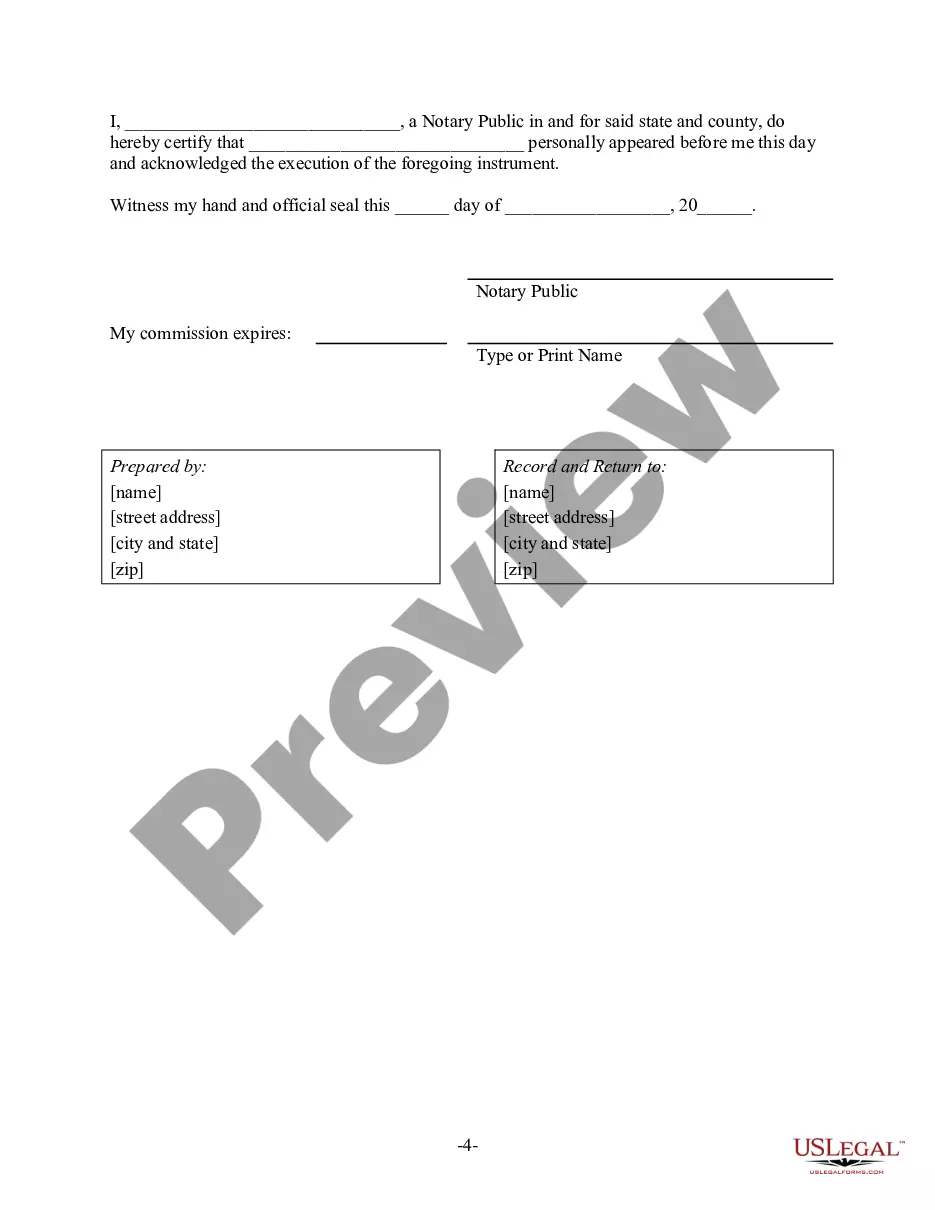

Raleigh North Carolina Renunciation And Disclaimer of Property from Will by Testate: A Comprehensive Guide Keywords: Raleigh, North Carolina, renunciation, disclaimer, property, will, testate Introduction: In Raleigh, North Carolina, when it comes to estate planning, individuals often designate beneficiaries through a Last Will and Testament. However, there may be situations where a named beneficiary decides to renounce or disclaim their right to inherit property from the will. This act is known as the "Renunciation and Disclaimer of Property from Will by Testate." This comprehensive guide will explore the process, types, and legal implications of renouncing or disclaiming property in Raleigh, North Carolina. 1. What is a Renunciation and Disclaimer of Property from Will by Testate? Renunciation and Disclaimer in the context of a will refer to the legal act of voluntarily giving up one's right to inherit property bequeathed through a will. It allows a beneficiary to disclaim their share of property, and the share then passes to the alternate beneficiaries or as per state laws of intestate succession. 2. Types of Renunciation and Disclaimer of Property from Will by Testate in Raleigh: a) Full Renunciation: In this type, the beneficiary fully renounces their right to inherit any part of the property mentioned in the will. Their share passes directly to the alternate beneficiaries or as per state laws. b) Partial Renunciation: A beneficiary may choose to renounce only a specific portion of the property mentioned in the will, allowing them to inherit other assets or items assigned to them. c) Conditional Disclaimer: This type of disclaimer occurs when a beneficiary renounces their right to inherit property but under certain conditions, such as if a particular debt is not paid from the estate or if certain liabilities are resolved. 3. Requirements and Process of Renunciation and Disclaimer: To effectively renounce or disclaim property mentioned in a will, the following requirements must be met: a) The renunciation must be in writing and signed by the beneficiary. Electronic signatures may also be accepted under specific circumstances. b) The renunciation must be filed with the Clerk of Court in the county where the probate proceedings are taking place. c) The renunciation must be filed within the required timeframe, usually within a specified number of days after receiving notice about the will or the property inheritance. 4. Legal Implications and Considerations: a) Once a renunciation or disclaimer is filed, it is irrevocable. The renouncing party cannot change their decision afterward. b) The renunciation does not automatically pass the property to the next beneficiary; it depends on the terms of the will or state laws of intestacy. c) Tax implications might arise, and it is advisable to consult an experienced attorney or tax professional to understand the potential consequences. d) If a minor or incapacitated person is involved, additional legal steps and court approval may be required. Conclusion: Renouncing or disclaiming property from a will buy testate is a significant decision that allows beneficiaries in Raleigh, North Carolina, to refuse inheritance. The process involves specific legal requirements and implications. Understanding the types, process, and legal considerations associated with renunciation or disclaiming property is crucial for those considering exercising their right to decline a share of the estate. Seek guidance from a knowledgeable attorney to ensure compliance with the law and protect your interests.

Raleigh North Carolina Renunciation And Disclaimer of Property from Will by Testate: A Comprehensive Guide Keywords: Raleigh, North Carolina, renunciation, disclaimer, property, will, testate Introduction: In Raleigh, North Carolina, when it comes to estate planning, individuals often designate beneficiaries through a Last Will and Testament. However, there may be situations where a named beneficiary decides to renounce or disclaim their right to inherit property from the will. This act is known as the "Renunciation and Disclaimer of Property from Will by Testate." This comprehensive guide will explore the process, types, and legal implications of renouncing or disclaiming property in Raleigh, North Carolina. 1. What is a Renunciation and Disclaimer of Property from Will by Testate? Renunciation and Disclaimer in the context of a will refer to the legal act of voluntarily giving up one's right to inherit property bequeathed through a will. It allows a beneficiary to disclaim their share of property, and the share then passes to the alternate beneficiaries or as per state laws of intestate succession. 2. Types of Renunciation and Disclaimer of Property from Will by Testate in Raleigh: a) Full Renunciation: In this type, the beneficiary fully renounces their right to inherit any part of the property mentioned in the will. Their share passes directly to the alternate beneficiaries or as per state laws. b) Partial Renunciation: A beneficiary may choose to renounce only a specific portion of the property mentioned in the will, allowing them to inherit other assets or items assigned to them. c) Conditional Disclaimer: This type of disclaimer occurs when a beneficiary renounces their right to inherit property but under certain conditions, such as if a particular debt is not paid from the estate or if certain liabilities are resolved. 3. Requirements and Process of Renunciation and Disclaimer: To effectively renounce or disclaim property mentioned in a will, the following requirements must be met: a) The renunciation must be in writing and signed by the beneficiary. Electronic signatures may also be accepted under specific circumstances. b) The renunciation must be filed with the Clerk of Court in the county where the probate proceedings are taking place. c) The renunciation must be filed within the required timeframe, usually within a specified number of days after receiving notice about the will or the property inheritance. 4. Legal Implications and Considerations: a) Once a renunciation or disclaimer is filed, it is irrevocable. The renouncing party cannot change their decision afterward. b) The renunciation does not automatically pass the property to the next beneficiary; it depends on the terms of the will or state laws of intestacy. c) Tax implications might arise, and it is advisable to consult an experienced attorney or tax professional to understand the potential consequences. d) If a minor or incapacitated person is involved, additional legal steps and court approval may be required. Conclusion: Renouncing or disclaiming property from a will buy testate is a significant decision that allows beneficiaries in Raleigh, North Carolina, to refuse inheritance. The process involves specific legal requirements and implications. Understanding the types, process, and legal considerations associated with renunciation or disclaiming property is crucial for those considering exercising their right to decline a share of the estate. Seek guidance from a knowledgeable attorney to ensure compliance with the law and protect your interests.