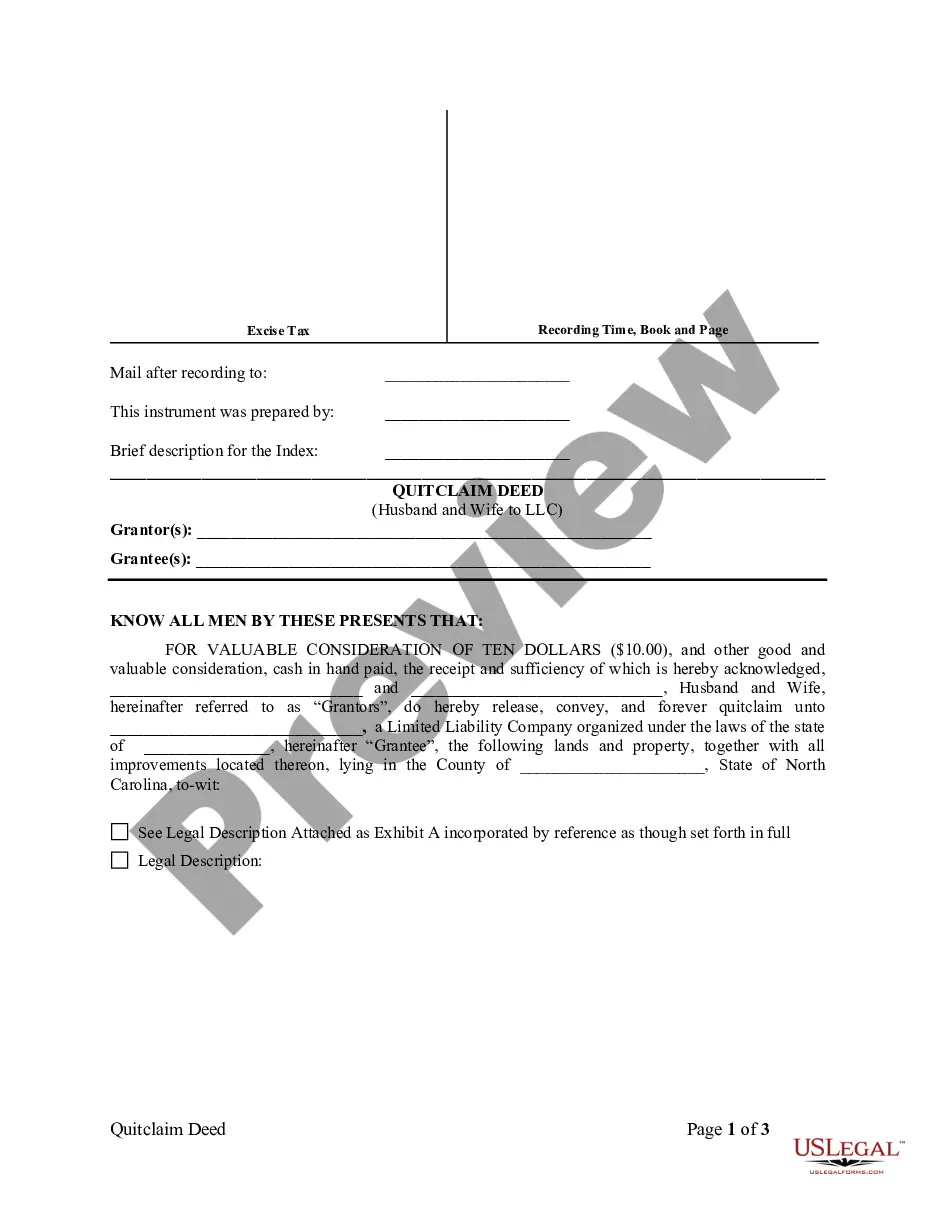

A Quitclaim Deed is a legal document used to transfer ownership of a property from one person or entity to another. In the specific scenario of a Quitclaim Deed from Husband and Wife to LLC in Charlotte, North Carolina, the deed serves to transfer the ownership of a property jointly owned by a married couple to a Limited Liability Company (LLC) that they either own or are establishing. This type of transfer may be necessary when the husband and wife want to protect the property or business assets by establishing an LLC, which provides liability protection and separates personal and business assets. By deeding the property to the LLC, they effectively transfer ownership and control to the company. Three common types of Quitclaim Deeds from Husband and Wife to LLC in Charlotte, North Carolina include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed, wherein the husband and wife sign and transfer their interests in the property to the LLC. This deed does not provide any warranties or guarantees about the property's title — it simply transfers whatever ownership and rights the couple had to the LLC. 2. Special Warranty Quitclaim Deed: This type of quitclaim deed includes limited warranties or guarantees from the husband and wife regarding the title of the property. They warrant that they have not done anything to negatively affect or encumber the title during their ownership, but they do not guarantee against any issues that may have existed before they acquired the property. 3. Other specific types: It's also worth noting that there could be other specific types of Quitclaim Deeds from Husband and Wife to LLC based on the unique circumstances or requirements of the parties involved. This might include variations in the wording or additional clauses to address specific concerns or conditions. Overall, a Charlotte North Carolina Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers the joint ownership of a property from a married couple to an LLC they own or establish, allowing them to protect their assets and separate personal and business interests. It's important to consult with a real estate attorney or legal professional to ensure the deed is prepared accurately and meets all legal requirements.

Charlotte North Carolina Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out North Carolina Quitclaim Deed From Husband And Wife To LLC?

Regardless of social or professional standing, finalizing law-related paperwork is a regrettable requirement in the contemporary professional landscape.

Frequently, it’s nearly unfeasible for someone lacking legal background to generate such documentation from the ground up, primarily due to the intricate vocabulary and legal nuances that accompany them.

This is where US Legal Forms can be a game-changer. Our platform provides an extensive library with over 85,000 ready-made state-specific forms that are applicable for nearly every legal circumstance.

If the form you chose does not fulfill your criteria, you can restart the process and search for the necessary document.

Click Buy now and select the subscription plan that works best for you.

- If you need the Charlotte North Carolina Quitclaim Deed from Husband and Wife to LLC or any other document that will be accepted in your jurisdiction, with US Legal Forms, everything is readily available.

- Here’s how to quickly obtain the Charlotte North Carolina Quitclaim Deed from Husband and Wife to LLC using our dependable service.

- If you are already a member, you can proceed to Log In to your account to acquire the required form.

- However, if you are unfamiliar with our platform, be sure to follow these steps before acquiring the Charlotte North Carolina Quitclaim Deed from Husband and Wife to LLC.

- Ensure the template you’ve located is appropriate for your locality, as the laws of one state or area do not apply to another.

- Examine the document and review a brief description (if available) of the scenarios for which the document can be utilized.

Form popularity

FAQ

The alternative spellings quit claim deed and quit-claim deed are generally acceptable?though used less frequently. Oklahoma legal professionals also use the word quitclaim as a verb indicating that an owner is transferring an interest without warranty. Release deed can be a synonym for quitclaim deed in some contexts.

Both spouses owning property ? Both parties must sign documents in purchase, sale, or refinance transactions. A married person buying property individually ? The owner needs to sign, but their spouse may not be required to sign documents at closing.

The quitclaim deed would transfer title from the community or joint property to separate property. A quitclaim deed is legally binding. The transferring spouse eliminates his rights to the property after signing it.

A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The title is transferred without any amendments or additions.

Keep in mind that if you sign the Quitclaim Deed giving him your legal rights in the home, you no longer have any legal rights to the home but you can still be financially responsible for the mortgage if your name is on the mortgage.

A quitclaim deed is likely the fastest, easiest, and most convenient way to transfer your ownership interest in a property or asset to a family member. Unlike other kinds of deeds, such as general and special warranty deeds, quitclaim deeds make no warranties or promises about what is being transferred.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

A North Carolina quit claim deed is a legal form used to convey real estate in North Carolina from one person to another. A quitclaim, unlike a warranty deed, does not come with a guarantee from the seller, or grantor, as to whether the grantor has clear title to the property or has the authority to sell the property.

In which of the following situations could a quitclaim deed NOT be used? c. The answer is to warrant that a title is valid.

Both spouses owning property ? Both parties must sign documents in purchase, sale, or refinance transactions. A married person buying property individually ? The owner needs to sign, but their spouse may not be required to sign documents at closing.