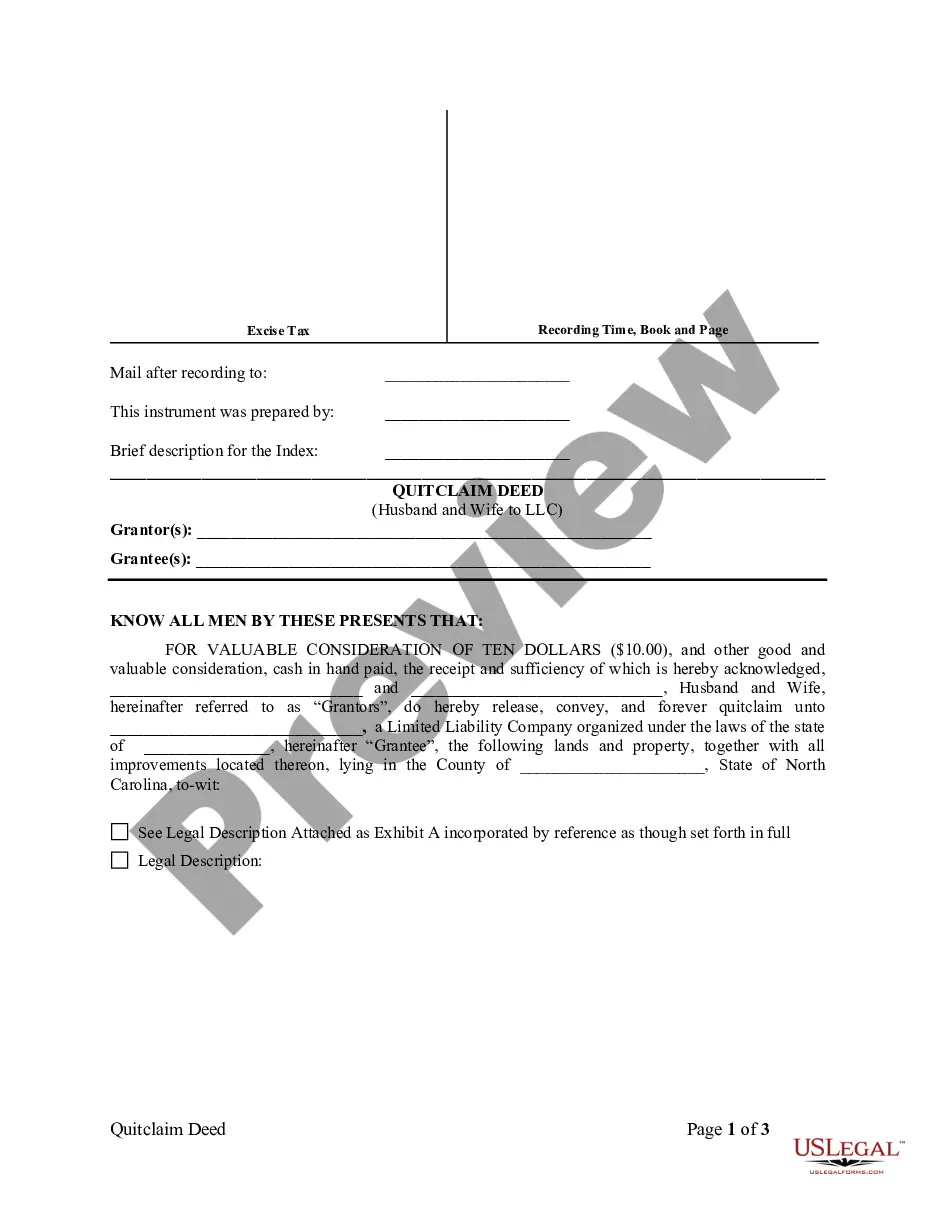

Raleigh North Carolina Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Raleigh North Carolina Quitclaim Deed From Husband And Wife To LLC?

If you are looking for an authentic form, it’s remarkably difficult to locate a superior source than the US Legal Forms website – likely the most extensive collections online.

With this collection, you can discover a multitude of document examples for commercial and personal objectives by categories and locations, or by keywords.

Utilizing our sophisticated search capability, finding the latest Raleigh North Carolina Quitclaim Deed from Husband and Wife to LLC is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Receive the template. Specify the file format and download it to your device.Edit the document. Fill out, modify, print, and sign the acquired Raleigh North Carolina Quitclaim Deed from Husband and Wife to LLC.

- Furthermore, the pertinence of each document is verified by a team of experienced lawyers who consistently review the templates on our platform and refresh them according to the latest state and county requirements.

- If you are already familiar with our service and possess an account, all you need to obtain the Raleigh North Carolina Quitclaim Deed from Husband and Wife to LLC is to Log In to your user account and click the Download button.

- If you're using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have located the example you desire. Review its description and utilize the Preview function to examine its contents. If it doesn’t fulfill your requirements, use the Search box at the top of the page to locate the suitable document.

- Confirm your choice. Select the Buy now option. Then, choose the desired subscription plan and enter your details to create an account.

Form popularity

FAQ

Average Title transfer service fee is ?20,000 for properties within Metro Manila and ?30,000 for properties outside of Metro Manila.

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

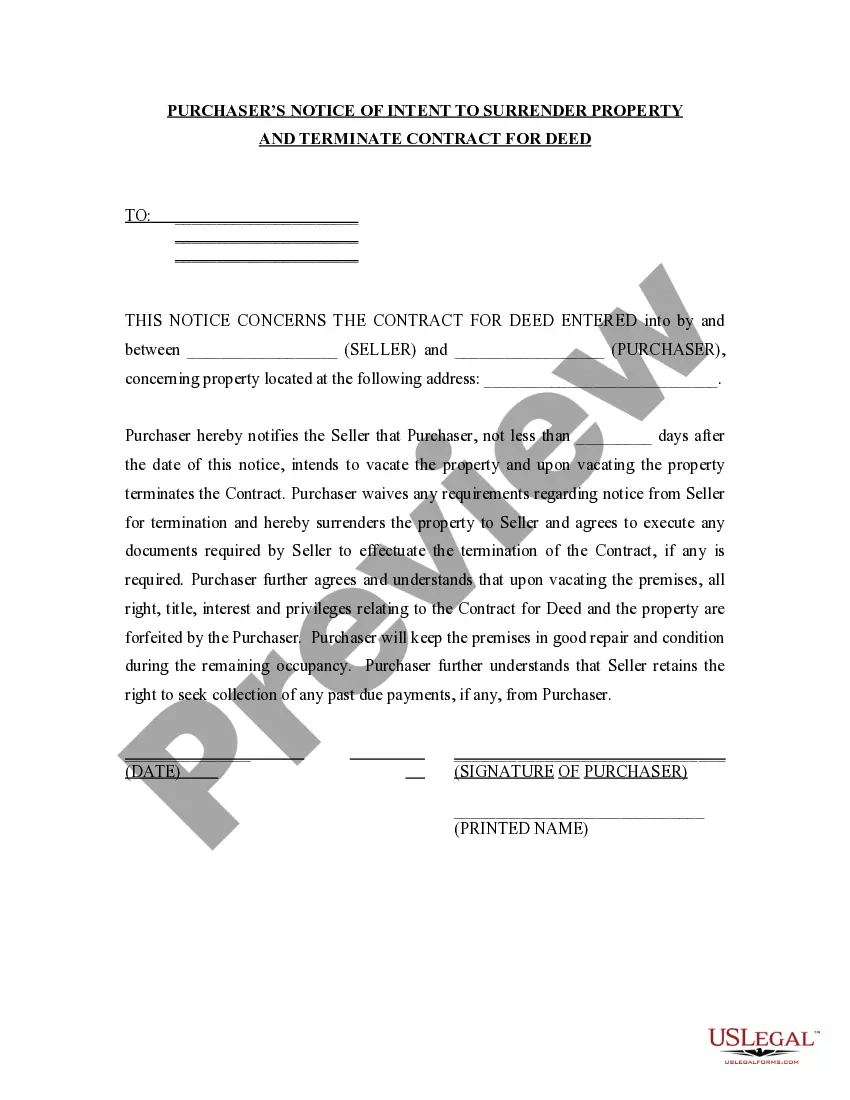

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

How to Write a North Carolina Quitclaim Deed Preparer's name and address. Name and mailing address of the person to whom the recorded deed should be returned. County where the real property is located. The consideration paid for the property. Grantor's name and address. Grantee's name and address.

The quitclaim deed would transfer title from the community or joint property to separate property. A quitclaim deed is legally binding. The transferring spouse eliminates his rights to the property after signing it.

A deed, of course, is a legal document representing property ownership. But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.

North Carolina's transfer tax rates are straightforward ? expect to pay $1 for every $500 of the sale price. For the state's average home value of $320,291, the transfer tax would amount to $640.58.

Keep in mind that if you sign the Quitclaim Deed giving him your legal rights in the home, you no longer have any legal rights to the home but you can still be financially responsible for the mortgage if your name is on the mortgage.

What Are the Steps to Transfer a Deed Yourself? Retrieve your original deed.Get the appropriate deed form.Draft the deed.Sign the deed before a notary.Record the deed with the county recorder.Obtain the new original deed.

Signing (N.C.G.S.A. § 47-38) ? All quit claim deeds are required to be signed with the Grantor(s) being witnessed by a Notary Public.